In the vibrant world of cryptocurrencies, Non-Fungible Tokens (NFTs) have emerged as the stars of recent years.

The hype around NFTs peaked in the 2021/22 bull run that saw nearly $2.8 billion in monthly trading volume recorded in August 2021. From this, NFTs captured the collective imagination worldwide with multiple news reports of million-dollar deals for sales of certain NFT assets.

People were excited about this new type of online asset and something of a goldrush appeared to start. Fast forward to today… and the NFT market is starkly different.

Data from the Block reveals a weekly traded value of around $80 million in July 2023, just 3% of its peak back in August 2021. So what happened?

NFTs had a bull run then crashed. Hard. We now find ourselves in the midst of a bear market for NFTs, with numerous projects now struggling to find buyers following a pessimistic market outlook on their future value.

So what does the current NFT market situation look like, are there still ‘white whales’ that can command million-dollar-deals, and do NFTs have a future? We’re here to outline all three and hopefully end on a high note that will leave you feeling optimistic.

After all, that unrealistic hype could never be sustained, but the future of NFTs is still very much in play.

The Current State of the Overall NFT Market

As previously mentioned, things have slowed down dramatically within the NFT market as the hype has come to a crashing halt. We know this. We hear about it often. But just how bad is the problem?

The team here at dappGambl, who are used to covering diverse crypto topics such as crypto casinos and exchanges, have decided to investigate the problem and we’re here to outline it all for you below.

Using data provided by NFT Scan, we have compiled a comprehensive analysis of over 73 thousand NFT collections (73,257, to be exact) in order to identify key trends, assess the health of the market, determine the factors contributing to successful projects, and hopefully gain insights into the potential future trajectory of the NFT ecosystem.

The results were shocking, to say the least.

The Vast Majority of NFTs are Worthless

Of the 73,257 NFT collections we identified, an eye-watering 69,795 of them have a market cap of 0 Ether (ETH).

This statistic effectively means that 95% of people holding NFT collections are currently holding onto worthless investments. Having looked into those figures, we would estimate that 95% include over 23 million people whose investments are now worthless.

This highlights the incredibly high-risk nature of the NFT market and underscores the need for careful due diligence before making any purchases, especially ones of high value.

This daunting reality should serve as a sobering check on the euphoria that has often surrounded the NFT space. Amid stories of digital art pieces selling for millions and overnight success stories, it is easy to overlook the fact that the market is fraught with pitfalls and potential losses.

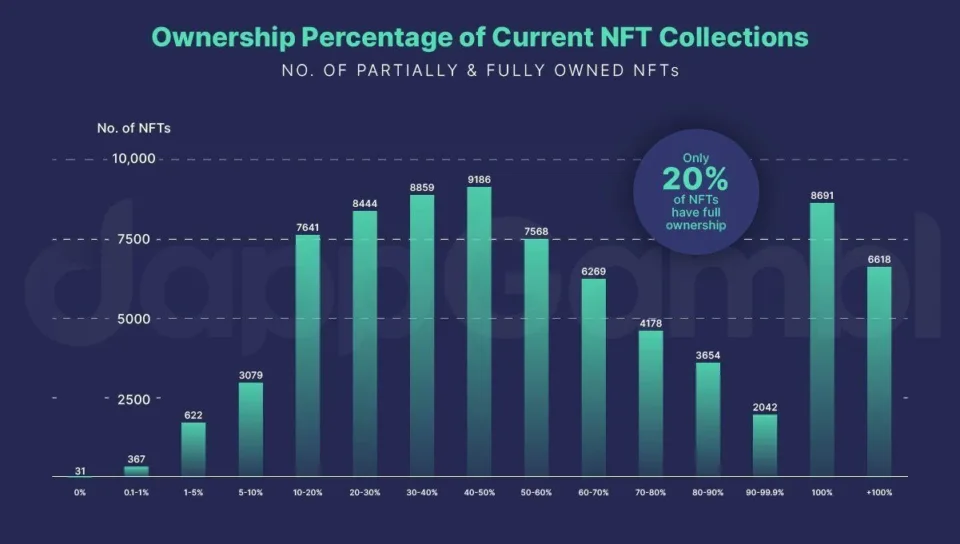

There Isn’t Enough Demand to Keep Up with Supply

Of the collections we identified, only 21% were fully spoken-for, in terms of having 100%+ ownership. This means that 79% of all NFT collections – otherwise known as almost 4 out of every 5 – have remained unsold.

This situation is telling of a significant imbalance between the creation of new Non Fungible Tokens (NFTs) and the actual demand for these digital assets in the current market landscape.

This surplus of supply over demand is creating a buyer’s market where potential investors are becoming more discerning, carefully evaluating the style, uniqueness, and potential value of NFTs before making a purchase.

As a result, projects that lack clear use cases, compelling narratives, or genuine artistic value are finding it increasingly difficult to attract attention and sales.

It is a stark reminder that, while the NFT space has introduced a revolutionary new model for ownership and the monetization of digital assets, it remains a highly speculative and volatile market.

As such, both creators and investors should approach with caution, a clear strategy, and a thorough understanding of the risks involved.

The Impact on the Environment

It’s essential to approach the subject of NFTs and the environment with a well-rounded perspective. Like many other digital technologies before it, the creation of NFTs consumes energy.

The minting process of NFTs involves certifying a digital asset as unique by making a transaction on the blockchain. Each minting consumes energy, just as any other operation in the digital realm does, though the amount of energy consumed by minting NFTs with little to no use case might be cause for alarm.

To give a sense of scale, our study identified 195,699 NFT collections with no apparent owners or market share. The energy required to mint these NFTs is comparable to 27,789,258 kWh, resulting in an emission of approximately 16,243 metric tons of CO2.

Those are some big numbers, so let’s contextualize that… 16,243,017kg of CO2 is 16,243 metric tons, which is equivalent to:

- The yearly emissions of 2048 homes – it’s 7.93 per home according to the EPA.

- The yearly emissions of 3531 cars – it’s 4.6 per car according to the EPA.

- The carbon footprint of 4061 passengers flying from London (England) to Wellington (New Zealand) – it’s 4 tons of CO2 per person according to Air New Zealand.

To put this in a broader context: Many daily activities and industries have energy footprints. Banking transactions, daily electronic usage like watching movies or charging devices, and urban areas lit up throughout the night all contribute to our overall energy consumption and carbon footprint. It’s essential to view the energy usage of NFTs within this larger picture of consumption.

However, it’s worth noting that the responsibility rests with NFT creators to ensure meaningful and genuine contributions to the NFT ecosystem. Those primarily looking for quick gains without adding real value might end up incurring unnecessary environmental costs, all for the sake of a quick buck.

As with any industry, thoughtful and responsible creation and consumption are vital to balance benefits with any potential drawbacks.

The Current State of the Top NFT Assets

Analyzing the market as a whole might be seen as somewhat unfair, after all, the stock market is full of dud investments that might not perhaps tell the whole story.

Just as the S&P 500 serves as a reliable indicator of the overall health of the US stock market, analyzing the top NFT collections provides a better snapshot of the NFT market’s condition.

By filtering out the noise of lower-value and less significant projects you can reveal key trends and the patterns that emerge from this dynamic digital ecosystem.

To that end, we have decided to look at the top 8850 NFT collections according to CoinMarketCap, and here’s what we found…

Value Remains a Big Problem

Even when looking at the top NFTs, the value was still hard to find.

A startling 18% of these top collections have a floor price of zero, indicating that a significant portion of even the most prominent collections are struggling to maintain demand.

Furthermore, 41% of the top NFTs are modestly priced between $5 and $100, which may signal a lack of perceived value among these digital assets.

Astonishingly, less than 1% of these NFTs boast a price tag of over $6,000, shedding light on the rarity of high-value assets even within the cream of the crop.

This is a complete departure from the million-dollar deals that were heavily reported during their boom.

These statistics not only underline the disparity within the top echelons of the NFT world but also serve as a stark reminder that, despite all the glitter and allure, genuine value in this market can be elusive.

The Number of Dead NFTs Could be Even Higher

The Number of Dead NFTs Could be Even Higher

The situation may even be bleaker than these numbers suggest.

For example, MacContract on Ethereum has a floor price of $13,234,204.2, but its all-time sales is only $18. This stark discrepancy between listed floor prices and actual sales data exposes a significant issue in the NFT market – inflated valuations that don’t reflect genuine buyer interest or real-world transactions.

Such disparities reveal a speculative nature in parts of the NFT market, where exorbitant prices can be set by sellers without any bearing on tangible, real demand.

This can be particularly concerning for new or uninformed investors who might view these listed prices as a sign of inherent value, rather than speculative positioning.

It becomes clear that a significant portion of the NFT market is characterized by speculative and hopeful pricing strategies that are far removed from the actual trading history of these assets.

Additionally, this apparent disconnect between listed prices and actual sales could suggest that many sellers are waiting for another massive surge in NFT interest akin to the boom witnessed in 2021, which may not ever occur again.

This also raises questions about the sustainability and stability of the NFT market, as relying on cyclical or sporadic surges of interest is not a dependable long-term strategy for any market, let alone one as volatile as NFTs.

The key question arises: How many of these NFTs lacked a genuine use case and are now redundant? Without utility, they may be considered “dead”.

What Does the Future of NFTs Look Like?

While the situation does look bleak, many armchair commentators have referred to this crash as “the death of the NFT”.

In our opinion, however, NFTs still have a place in our future.

The 2021 hype was bound to fail, as all overhyped things often are. At dappGambl, we still maintain that once the dust has settled, we will start to see an evolution within NFTs.

Beyond Digital Collectibles

While collectibles like Bored Ape Yacht Club (BAYC) and their subsequent Mutant Ape Yacht Club NFT collections have gained immense popularity, they may lose relevance if they only serve as a profile picture or a ‘flex’ to the have-nots on how much you’re willing to spend on one.

To weather market downturns and have lasting value, NFTs need to either be historically relevant (akin to first-edition Pokémon cards), true art or provide genuine utility.

Though how you define art as having ‘substance’ is debatable, it stands to reason that plenty believe a large crop of NFTs on the market has none, otherwise, there would be demand there to meet it.

NFTs with Real Use Cases

While we’re not one to talk down on art for art’s sake, it stands to reason that NFTs can also be so much more than something pretty to look at.

Here are just some of the many examples of practical uses for NFTs:

Preserving cultural heritage:

NFTs can be used to digitize and protect cultural artifacts, giving them a unique, immutable status on a blockchain.

Gaming:

Unique in-game assets, represented as NFTs, can be bought, sold, and used across different game environments.

Token-gated access:

NFTs can grant holders special access to events, content, or services.

Fractional ownership:

Basically, when an NFT, representing a singular asset, can be split into multiple fractions… or shares, if you think about it like stocks. This allows multiple owners to have a stake in the NFT, making the asset/art far more accessible to the average person.

Real estate:

Owned properties can be tokenized as NFTs, allowing for the sale of the property on blockchain platforms, which would provide a pathway to much easier selling.

Digital identity:

Anonymity online can have its risks, and NFTs can be used to ensure that online personas, credentials, or qualifications are both verifiable and unique.

Data Insight and Future Prediction

Top NFTs with such use cases generally exhibit greater resilience in the data. They retain value due to their utility rather than speculative buying. For example, NFTs like Etheria, which were among the first to arrive on the scene, might see renewed interest and potential appreciation in value in subsequent crypto bull runs, due to their first-mover status and historical significance.

The NFT landscape has undeniably experienced a seismic shift from its 2021 highs. Yet, this evolving space is far from dead. As the market matures, NFTs are likely to increasingly pivot from mere collectibles to assets with tangible utility and significance.

In this ever evolving space, the future of NFTs will be shaped not by speculation, but by genuine value and utility that they bring to their holders.

About dappGambl

dappGambl is a team of Crypto and Crypto Gambling Experts that set out on the mission of revolutionizing the Crypto iGaming sector, providing trustworthy reviews and information to players worldwide and educating them about the Web 3 World of Fun.

dappGambl is a team of Crypto and Crypto Gambling Experts that set out on the mission of revolutionizing the Crypto iGaming sector, providing trustworthy reviews and information to players worldwide and educating them about the Web 3 World of Fun.

We hold strong values and all of our content adheres to high standards like honesty, accuracy, reliability, and transparency.

Our integrity allows us to play big.

Our ultimate vision is to build a robust community where crypto gamblers can find support and learn to make better decisions for free: a home for like-minded crypto lovers to interact, learn about digital assets, gambling, crypto casinos, and much more – and have fun!

Facts Checked by Josip Putarek, Senior Author