NFT Meaning

Cryptocurrencies such as BTC and Ether are fungible tokens – it does not matter which Bitcoin you have, as they are all the same and of the same value. An NFT, on the other hand, is fully unique and cannot be traded like-for-like, and that is where the term “non-fungible” comes into play. The file contains additional data that raises it above the domain of pure currency and into the realm of, well, anything.

Any easily copied digital file, such as photography, art, films, tweets, music, and even memes, can be saved as an NFT to authenticate the original copy.

Despite the fact that they’ve been there since 2014, NFTs are gaining popularity currently as a popular means to buy and sell digital works of art.

NFTs are one-of-a-kind, or at the very least one of a very small run, and contain unique identifying codes.

While NFTs are currently mostly used for trading digital art, there are many more use cases.

Difference Between NFTs and Traditional Digital Assets:

Unlike traditional digital assets, NFTs have unique characteristics that make them stand out. Here are some key differences:

Ownership

With traditional digital assets, ownership is often difficult to prove because it’s easy to make copies of the original file. For example, if you take a picture on your phone and share it on social media, anyone can download it, and share it with others. Thus, the original owner of the picture has no control over who sees it or how it’s used.

NFTs, on the other hand, use blockchain technology to verify ownership of a digital asset. When an artist creates it to represent their artwork, they can include information about the ownership of their artwork in the token. This information is then recorded on the blockchain, which is a decentralized ledger maintained by a network of computers around the world. Since the blockchain is decentralized, it’s difficult to alter the ownership information once it has been recorded. Thus, such tokens provide a way for artists and other creators to prove ownership of their digital assets and control how they are used.

Unique Identification

The unique identification is possible due to their use of blockchain technology. Blockchain technology is a decentralized ledger that maintains a secure and tamper-proof record of transactions. In the case of non-fungible tokens, each digital asset is assigned a unique identifier or “token,” which is recorded on the blockchain. This token includes metadata that describes the digital asset, such as its title, description, and creator.

The token can be verified by anyone on the blockchain, ensuring that it is authentic and not a copy. This unique identification is important because it allows the tokens to be bought, sold, and traded as unique assets. It also provides a way to track ownership and its value over time. It can also be traced back to its original creation and verified as a unique asset. In contrast, traditional digital assets may be easily duplicated and distributed without a way to verify their authenticity or ownership.

Transferability

In the past, transferring ownership of a digital asset required a complicated and often lengthy process that involved intermediaries such as lawyers or agents to verify the transfer of ownership. With blockchain, the transfer of ownership is much simpler and more streamlined. NFTs are stored on a blockchain, and their transfer can be verified without the need for a third-party intermediary. Moreover, the transfer process can be completed quickly and with less friction. Additionally, the absence of intermediaries can lower transaction costs, making buying and selling more accessible to a wider range of investors and collectors.

Valuation

The difference in valuation between NFTs and traditional digital assets lies in the fact that the former is unique and non-fungible, while the latter are often easily replicated. Since traditional digital assets can be copied and shared freely, the value of the original asset may be difficult to determine. On the other hand, the uniqueness of non-fungible tokens makes them more valuable as they have a distinct identity that is verifiable on the blockchain.

This uniqueness implies their value is largely dependent on supply and demand. If there is high demand for a particular digital asset, its value may increase significantly, and vice versa.

Valuation is determined by various factors, including the scarcity of the asset, the popularity of the creator or artist, the historical significance of the asset, and the level of interest from buyers. Additionally, the value may change over time based on market trends, cultural shifts, or changes in the overall popularity of the asset.

Interoperability

Since NFTs are built on blockchain technology, they can be used across different platforms and ecosystems, regardless of the specific blockchain that is being used. This allows them to be used in a variety of ways, such as in games, social media, and e-commerce.

For example, a token that represents a piece of artwork can be used in a game, sold on an e-commerce platform, or shared on social media, all without losing its unique identity or its value. This makes them more versatile than traditional digital assets, which are often tied to specific platforms or ecosystems, and cannot be easily used in other contexts.

Overall, the interoperability makes them a powerful tool for creators, collectors, and investors, as it allows them to use and transfer their assets across a wide range of applications and use cases.

Security

NFTs are secured by the same cryptography and decentralized ledger technology that underpins blockchain networks like Bitcoin and Ethereum. When a digital asset is turned into a token, it is recorded on the blockchain with a unique digital signature that verifies the ownership of the asset. This signature ensures that the crypto cannot be altered or replicated, making it virtually impossible to commit fraud or manipulate ownership. Additionally, smart contracts associated with the tokens can also include conditions and rules for transferring or selling digital assets, providing an extra layer of security and reducing the risk of scams or fraudulent transactions. Overall, the security makes it a valuable option for those looking to protect their digital assets and ensure their ownership.

Creativity and Expression

They offer a new level of creative expression for digital artists and creators. They allow artists to monetize their work in a more direct and transparent way. Artists can sell unique digital artworks to collectors, and every time the artwork is resold, the artist can receive a percentage of the sale price. This creates a new revenue stream for artists and allows them to profit from their work in a way that was not possible before.

Non-fungible tokens also allow creators to explore new forms of expression that were not previously possible with traditional digital assets. For example, an artist can create interactive digital artwork that can be owned and displayed by collectors. The collector can interact with the artwork in unique ways, such as by changing the color or composition of the artwork. These changes will be recorded on the blockchain, making them a part of the artwork’s history.

Additionally, these tokens can also be used to represent other forms of creative work, such as music, videos, and even virtual real estate. Thus, it opens up new possibilities for the creative industry.

Applications and Use Cases

They have numerous applications and use cases in a variety of industries. In the art world, they have revolutionized the way art is sold and collected. Artists can now sell their unique digital artworks directly to collectors, without the need for intermediaries such as galleries and auction houses. The tokens have also been used in the music industry to sell limited edition tracks or albums, providing an alternative revenue stream for artists.

In the gaming industry, they are being used to represent in-game items, allowing players to truly own and trade their virtual assets. They are also being used to create a unique virtual real estate, which can be bought and sold digitally. This has the potential to create a whole new market for virtual land and property.

They have also been used in the sports industry to sell digital collectibles such as trading cards and other memorabilia. In the fashion industry, they have been used to sell limited-edition clothing and accessories.

Technological Infrastructure

NFTs are built on top of blockchain technology, which provides a decentralized and secure way to verify ownership and transactions of digital assets. Blockchain technology is tamper-proof, transparent, and verifiable, which is important for proving the authenticity and ownership of unique digital assets. The underlying infrastructure of blockchain technology is also allowing for new developments and innovations, such as the use of smart contracts to automate transactions and the creation of decentralized marketplaces.

To further elaborate on the technological infrastructure, it’s worth noting that most tokens are currently built on top of the Ethereum blockchain, which allows for the creation of smart contracts. Smart contracts are self-executing contracts that can automatically enforce the terms and conditions of an agreement, making them ideal for use in the creation and transfer of tokens.

In addition to Ethereum, other blockchain platforms such as Binance Smart Chain, Flow, and Solana are also being used to create and trade tokens. These platforms offer different features and capabilities, such as faster transaction speeds or lower fees, which can make them more suitable for certain types of use cases.

The technological infrastructure is constantly evolving and improving. For example, there are ongoing efforts to make tokens more environmentally friendly, as the energy consumption required to mint and trade has been a point of concern. Some blockchain platforms are exploring new consensus mechanisms and scaling solutions to reduce energy consumption.

Regulation

As non-fungible tokens gain popularity and become more mainstream, regulators around the world are beginning to take notice and explore how to regulate this new asset class. Some of the regulatory considerations include taxation, securities laws, intellectual property rights, and anti-money laundering regulations.

For example, in the United States, the IRS has issued guidance on how to report transactions for tax purposes. Additionally, the SEC is closely monitoring tokens to determine if they qualify as securities and should be subject to securities laws.

In other countries, such as China, there have been more stringent regulations put in place to curb speculation and protect investors. The Chinese government has banned financial institutions from providing services related to cryptocurrencies.

As the regulatory landscape continues to evolve, it is important for creators, investors, and users to stay informed and comply with any applicable laws and regulations to avoid legal issues or penalties.

What is NFTs’ Uniqueness?

Their uniqueness comes from the fact that each token is one-of-a-kind, and cannot be replicated, making them valuable to collectors and investors. Here are some key features that make them unique:

Non-fungibility

The term “non-fungible” means that an asset cannot be exchanged or replaced on a one-to-one basis with another asset because it possesses unique characteristics that differentiate it from all other assets.

For example, a bitcoin is fungible because every unit of bitcoin is interchangeable and equal in value to other units of bitcoin. On the other hand, an NFT is non-fungible because it is unique and one-of-a-kind, so it cannot be exchanged in a one-to-one.

This non-fungibility creates scarcity, which is a critical factor in the value of these tokens. Since it is unique and cannot be replicated or replaced, it can have considerable value to collectors and investors who are willing to pay a premium for ownership. Additionally, non-fungibility is a critical aspect of the proof of authenticity for such assets, as it ensures that the owner is the only one with unique rights to that asset.

Immutable Ownership

Once an NFT is created and recorded on a blockchain, it cannot be modified or tampered with. This feature is made possible by the decentralized and distributed nature of blockchain technology, where information is recorded in a transparent and verifiable manner across a network of computers.

Thus, the owner can prove their ownership with certainty, and the record of ownership is publicly accessible for anyone to verify. This is a significant advantage over traditional ownership structures, where ownership is often established through intermediaries such as banks or other financial institutions.

Proof of Authenticity

Proof of authenticity ensures their uniqueness and value. In the digital world, it can be challenging to verify the authenticity of a digital asset. However, NFTs provide a solution to this problem. When a creator mints a token, they are effectively creating a digital certificate of ownership and authenticity, which is stored on the blockchain. The blockchain acts as a digital ledger that records every transaction, from creation to ownership transfers.

By using blockchain technology, it offers an unalterable and transparent record of the asset’s ownership history.

Unique Identifiers

A Unique Identifier, also known as a UUID (Universally Unique Identifier), is a code used to uniquely identify an object or entity. In this context, this identifier is used to differentiate one token from another.

Each NFT is assigned a unique identifier or token ID, that is generated when it is created. This identifier is a long string of characters, usually expressed as a hexadecimal number, and is stored on the blockchain.

Direct Connection to Creators

They enable a direct connection between the creator of a digital asset and the buyer. Since they are typically sold on decentralized marketplaces, it allows creators to sell their work directly to their fans and collectors, without the need for intermediaries such as galleries, auction houses, or agents.

This direct connection can provide a personal and rewarding experience for both the creator and the buyer. For creators, it means they can sell their work on their own terms, without having to relinquish control or a portion of their profits to middlemen. It also allows them to interact with their fans and collectors in a more intimate way, by offering exclusive perks, such as limited edition releases, behind-the-scenes content, and even virtual meet-and-greets.

For buyers, the direct connection to the creator can provide a more meaningful and authentic experience. By purchasing it directly from the creator, buyers can feel a deeper connection to the work, knowing that they are supporting the artist directly and contributing to their success. They can also gain access to exclusive content and experiences that they wouldn’t have access to otherwise.

Limitless Potential

NFTs have limitless potential because they can represent any type of digital asset. While the most well-known use cases are in the fields of art and collectibles, they can be used to represent a wide variety of digital assets, including music, videos, virtual real estate, in-game items, and even intellectual property rights.

One of the key benefits is that they provide a way to establish ownership and authenticity for digital assets, which were previously difficult to monetize or protect.

For example, musicians and other artists can sell their music, videos, and other creative content, allowing them to monetize their work more effectively and giving fans a new way to support their favorite artists. Similarly, gamers can use them to represent in-game items, skins, and other virtual assets, allowing them to trade, sell, and collect these items in a secure and transparent way.

Another area of tremendous potential is in the field of virtual real estate. As more and more people spend time in virtual worlds and metaverses, the demand for virtual real estate is growing. NFTs can be used to represent virtual land, buildings, and other assets, allowing creators to monetize their work and buyers to invest in virtual real estate.

Finally, they can also be used to represent intellectual property rights, such as patents, trademarks, and copyrights. By creating a verifiable record of ownership on the blockchain, they can help to protect the intellectual property of creators and innovators, ensuring that they are properly compensated for their work.

Access to Exclusive Experiences

They can provide access to a range of exclusive experiences, which can add significant value to the ownership of the digital asset. These experiences can range from special events and limited edition content to access to private communities and VIP perks.

One of the main advantages is that they can be customized to include additional perks and benefits for the owners. For example, a musician might offer a limited edition vinyl record as a token, and owners of that token might also gain access to exclusive backstage passes or meet-and-greet events.

In addition to physical experiences, owners can also gain access to exclusive digital content, such as rare or unreleased music tracks, videos, or other digital assets.

Token owners can also gain access to exclusive communities and networks, where they can interact with other owners. For example, a gaming company might offer an NFT that includes membership in an exclusive online community, where owners can interact with each other and the developers of the game.

Enabling New Business Models

They are enabling new business models that have the potential to fundamentally change the way we interact with digital assets.

This decentralized ownership structure enables new business models, such as decentralized marketplaces and ownership structures. Decentralized marketplaces allow creators to sell their digital assets directly to buyers, without the need for intermediaries such as art galleries, record labels, or auction houses.

Additionally, they allow for new ownership structures, such as fractional ownership and community ownership. Fractional ownership allows multiple owners to own a share of a token, which can be used to fund the creation of the digital asset or to provide investors with a new asset class. This can democratize ownership of digital assets and provide more opportunities for investment and participation. Moreover, community ownership structures can also be created. For example, a group of fans or supporters can pool their resources to purchase a digital asset, such as a piece of art or a music album. The group can then collectively own and manage the asset, with decisions on how to monetize or display the asset made through a decentralized decision-making process.

Tokenized Value

They can be used to represent the value of a digital asset, which can make it easier to buy, sell, and trade. The tokenized value is based on the unique attributes and characteristics of the digital asset it represents, as well as the demand for that asset.

One of the key advantages of tokenized value is that it provides a standardized way to value and exchange digital assets. Unlike traditional physical assets, which can have a wide range of values and can be difficult to evaluate, digital assets are easy to quantify and tokenize.

Digital artwork can be tokenized, with the value based on factors like the artist’s reputation, the rarity of the work, and the demand for the particular artwork in the market. An example could be “Everyday: The First 5000 Days” by the artist Beeple. This artwork was sold at auction by Christie’s in March 2021 for a record-breaking price of $69.3 million, making it one of the most expensive tokenized pieces ever sold. The token for this artwork represents ownership of a unique and original digital file, and its value is based on factors such as the artwork’s historical significance, the reputation of the artist, and the high demand for the artwork in the market.

Open Market

They can be bought and sold on an open market, which provides liquidity and a fair market value for digital assets. This market operates in a similar way to traditional financial markets, with buyers and sellers coming together to exchange assets at a negotiated price.

One of the key advantages of an open market is that it provides liquidity for digital assets. Unlike physical assets, which can be difficult to sell or transfer, digital assets can be easily bought and sold on an open market. This can provide creators and investors with a more efficient way to monetize and realize the value of their digital assets.

Additionally, an open market can provide a fair market value for digital assets as the price is determined by supply and demand, with buyers and sellers negotiating a price that reflects the value of the underlying digital asset. This can provide a more transparent and objective way to value and exchange digital assets, and can also help to establish a broader market for these assets.

Another advantage of an open market is that it can enable new business models and revenue streams. For example, creators can sell tokens that represent access to exclusive content, such as a virtual concert or a limited-edition video game item. Buyers can then resell these tokens on an open market, providing a new revenue stream for both creators and investors.

How to Use NFTs?

Beyond the representation of digital items, NFTs can be used to represent real-world items like real estate, art, fashion, and more. So you may buy an NFT to own part of an apartment and earn passive income or purchase a sneaker NFT from one of your favorite brands to get it delivered right to your door while also owning it in the metaverse.

By tokenizing physical assets, they can be bought, sold, and traded in a more efficient way, while reducing or even eliminating the risk of fraud.

Another use case for NFTs is the representation of individuals’ identities, contracts and more.

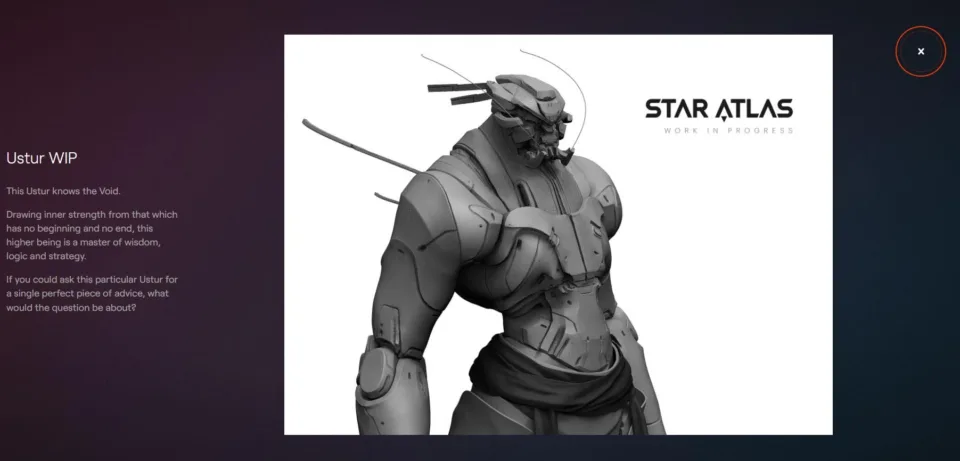

Mostly though, NFTs are still seen as digital assets and have become very popular in the use for gaming and the representation of in-game items in Metaverse Worlds. One of the most famous NFT games is Axie but we do expect much more sophisticated NFT games and Metaverses to launch in the following years, such as Star Atlas and Illuvium.

How Does it Work?

They use blockchain technology, which allows for secure and transparent transactions through smart contracts. These contracts are self-executing and are encoded on the blockchain. They can be created and transferred through a variety of blockchain platforms and marketplaces.

Blockchain technology

Blockchain technology is a key component as it provides a secure and transparent way to record ownership and transfer of digital assets. Blockchains are distributed ledgers that record transactions in a transparent and immutable way. Thus, once a transaction is recorded on a blockchain, it cannot be altered or deleted.

One example is the Ethereum blockchain, which is the most widely used for creating and trading NFTs.

Smart contracts

Smart contracts are another key component as they provide a way to automate transactions and ensure that the terms of the contract are securely enforced on the blockchain. Smart contracts are self-executing agreements that are coded on blockchain networks and can be used to automate the buying, selling, and transfer of digital tokens.

One example is the OpenSea marketplace, which is one of the largest marketplaces for buying and selling non-fungible tokens.

When a buyer makes a purchase on OpenSea, the transaction is executed through a smart contract on the Ethereum blockchain. The smart contract automatically transfers ownership of the asset from the seller to the buyer and ensures that the payment is made in a secure and transparent way. The smart contract is transparent and verifiable, which ensures that all parties involved in the transaction can trust that the contract will execute as intended.

Creation and Transfer of NFTs

Step 1: The creator must choose a digital asset to represent, such as a piece of art, a video, or a piece of music. The digital asset can be created or purchased from another creator.

Step 2: The creator must select a blockchain platform to mint the token. Popular blockchain platforms include Ethereum, Binance Smart Chain, and Flow. The creator must create the token on the selected platform, and include details about the digital asset, such as the title, description, and any relevant metadata.

Step 3: Once the token is created, the creator must set up a digital wallet to store it. The wallet must be compatible with the selected blockchain platform, and should be secure to protect the asset from theft or loss.

Step 4: After the token is minted and the wallet is set up, the creator can list it on a marketplace for sale. Popular marketplaces include OpenSea, Nifty Gateway, and SuperRare. The creator can set a price for it or auction it to the highest bidder.

Step 5: Transferring involves sending it from one digital wallet to another. To transfer, the owner must initiate the transfer through their digital wallet by entering the recipient’s wallet address and confirming the transfer. The transfer is recorded and is visible to anyone with access to the blockchain. Once the transfer is complete, the recipient will have ownership of the digital asset, and can store it in their own digital wallet or list it for sale on a marketplace.

Marketplaces for NFTs

Marketplaces are similar to traditional online stores but are specifically designed for buying and selling tokens. These marketplaces enable artists and creators to showcase their digital works, and buyers to browse and purchase them using cryptocurrency.

Some of the most popular marketplaces are OpenSea and Rarible, which allows creators to easily create and sell tokens without needing any coding skills. Rarible also has a social element, allowing creators to build a following and engage with their audience.

What is a NFT Game?

DApp games may also be referred to as NFT games and are any type of game hosted on a blockchain platform. These games provide players with a chance to earn real money while playing, also known as play-to-earn gaming.

As the name suggests, dApps games make use of NFTs. With the use of NFTs, players can actually own their in-game items, such as a spaceship or your nice sword, and resell them to other players. Why would they want it? Well, it’s an NFT, it’s limited and non-fungible.

How do You Make Money in NFT Games?

This aspect is why even dApp games might also be more interesting to casino gamblers: you can play and actually earn money doing so – either by winning or reselling your items. More and more, such gaming applications also include other features, such as DeFi. This means that you may be able to stake one of your weapons or lease your avatar and earn a profit on it.

Additionally more and more gambling dApps are also making use of NFTs and play-to-earn Functions. There are NFT Poker dApps for example Polker.

The whole entertainment industry will undergo a paradigm shift as a result of NFTs. When compared to other blockchain dapp platforms, Ethereum, EOS, and Tron are currently the most popular platforms to build dApp games.

NFTs in Gambling

NFT games are gaining more and more attention and there are more and more options that are quite interesting from a gambling perspective.

NFTs in gambling bring with them the opportunity of

- “play to earn”,

- innovative new gambling experiences,

- shared house profits,

- casinos owned by the players,

- owning slots and other casino games and earn passive revenue,

- gaining exclusive holder benefits.

- access to Special Metaverse Games and Casinos

- special tournament prize

- access to staking and benefits

Step 1: Choose the Asset

Firstly, the creator needs to choose the asset that they want to tokenize. This could be a digital artwork, a video game asset, or any other unique digital item.

Step 2: Select a Blockchain

Next, the creator needs to select a blockchain platform. Popular options include Ethereum, Binance Smart Chain, and Flow.

Step 3: Set up a Digital Wallet

The creator will also need to set up a digital wallet to store the tokens, and any associated cryptocurrency. Many blockchain platforms offer their own wallet, but the creator can also use a third-party wallet such as Metamask or Trust Wallet.

Step 4: Select a Marketplace

The creator can list it for sale on a marketplace such as OpenSea, Rarible, or SuperRare. These platforms allow buyers to browse and purchase non-fungible tokens using cryptocurrency.

Step 5: Upload Your File

The creator will need to upload their digital asset to the blockchain platform. This is typically done through a smart contract, which defines the rules and attributes.

Step 6: Determine Selling Strategy

Finally, the creator needs to determine their selling strategy. This includes setting a price for the token, deciding whether to sell it at auction or as a fixed-price listing and promoting it through social media and other channels.

Advantages of NFTs

They offer several advantages over traditional physical assets and cryptocurrencies, including:

Proof of Ownership

One of the biggest advantages is that they provide proof of ownership. This is because they are stored on the blockchain, which is a decentralized and tamper-proof ledger. Once it is purchased, the buyer can prove that they own it through the blockchain, which cannot be altered or manipulated.

Proof of Originality

This is important for artists and creators who want to protect their work. Each NFT is unique and contains metadata that can verify its authenticity and prove that it is an original piece.

Transferability

They are highly transferable and can be bought and sold on various marketplaces. This makes it easier for investors and collectors to trade their assets and access a wider audience.

Disadvantages of NFTs

While they have gained popularity in recent years, there are some disadvantages associated with this new technology.

Can’t replace physical art

While they can provide a way for artists to monetize their digital creations, they do not offer the same sensory experience as physical art. Some argue that the value of art lies in its ability to evoke an emotional response from viewers, which cannot be replicated through a digital medium.

Value Uncertainty

Another challenge is the uncertainty around their value. Unlike physical art, which has a history of sales and auctions that can help establish a benchmark for pricing, NFTs are a relatively new and untested market. Thus, the value is largely determined by market demand, which can be highly volatile and unpredictable. This makes it difficult for artists and collectors to accurately price their work, and there is always the risk of overvaluation or undervaluation.

High Expense

They can be expensive to purchase and create. The process of minting can require a significant amount of computing power and energy, which can be costly. Additionally, the cost of purchasing can be prohibitively high, especially for emerging artists or collectors. This can make it difficult for new entrants to the market to gain a foothold and can lead to a concentration of ownership among a small group of wealthy investors.

Step 1: Set up an Account on an Exchange

The first step is to set up an account on a cryptocurrency exchange. There are many exchanges to choose from, such as Coinbase, Binance, or Kraken. When setting up the account, be sure to provide accurate information and complete all required verification steps, which may include providing identification documents and other personal information.

Step 2: Buy Cryptocurrency

Once the buyer has set up their account, they will need to purchase a cryptocurrency, such as Bitcoin or Ethereum, which are commonly used to buy NFTs.

Step 3: Set up a Digital Wallet

To hold the cryptocurrency and other tokens, the buyer needs to set up a digital wallet. Though there are many options for digital wallets, such as MetaMask or MyEtherWallet, make sure to choose a reputable wallet that is compatible with the blockchain that the buyer’s asset is minted on.

Step 4: Select an NFT Marketplace

Next, the buyer will need to select a marketplace to buy from. Some popular marketplaces include OpenSea, SuperRare, and Rarible. A buyer must do their research to find a reputable marketplace that has a good selection of tokens.

Step 5: Purchase the NFT

The buyer will need to use their cryptocurrency to buy the NFT. Make sure to carefully review the details of the asset, including its price, authenticity, and any associated fees before making the purchase. Once the buyer has completed the transaction, the NFT will be transferred to the digital wallet.

Step 1: List your NFT for sale

The first step to selling is to list it for sale. The seller can list their token on various marketplaces, including OpenSea, Rarible, SuperRare, and Nifty Gateway. Each marketplace has its own set of rules and guidelines, so it’s important to read the terms carefully before listing. Some marketplaces charge a fee for listing, while others take a commission on the sale.

When listing an asset, the seller will need to provide some basic information, such as the name of the token, a description, and any relevant metadata. The seller will also need to set a price, either in ETH or another cryptocurrency.

Step 2: Promote and manage your listing

Once it is listed for sale, it’s important to promote it to potential buyers. The seller can share the link to the listing on social media, online forums, and other platforms to increase visibility. The seller can also consider reaching out to collectors and investors directly to gauge their interest.

It’s important to stay on top of the listing and respond to any inquiries from potential buyers promptly. The seller may also need to adjust the price or explore other marketing options.

The first NFT X Gambling dApps:

Decentral.Games

Decentral-Games offers a play-to-earn mechanism for the owners of ICE NFT Wearables, basically NFT clothes for your Decentraland Avatar.

In order to participate in the play-to-earn mechanism, users need to acquire at least one ICE NFT Wearable, either through purchase or delegation. When holding such an NFT players are allocated a set amount of Poker Chips, which then can be used to play ICE Poker.

Owners of such ICE NFT Wearables can earn money in many ways. There are daily challenges waiting to be completed but if you are not much of a Poker player you can also delegate your NFT wearable to players for a revenue share of their winnings.

Moreover, you can also mint new NFT wearable and sell them on the marketplace or collect ultra-rare DG Diamond Hands wearable and hope to sell them for a fortune later on.

Gambling Apes

Gambling Apes is another Metaverse Casino in Decentraland but also offers static online casinos for those, who are not quite ready for the Metaverse yet.

When you hold one of their NFTs you are eligible for a share of the profits. As a fact, 70% of the profit share will go to holders. Each NFT is eligible for the same amount of profit, you can increase your profit, by owning more NFTs.

We are excited by the spirit of Gambling Apes and we see them bringing even more innovative benefits to NFT holders.

Slotie

Slotie is another interesting NFT Casino project that presents itself as the one to bring DeFi to Gambling.

Slotie NFTs provide real-world benefits in over 150 casinos worldwide.

Owning a Slotie will give you the opportunity to become the house.

You can for example stake your Sloties in the slots of the partnered casinos.

Furthermore, holders will earn 12% of the NFT slots profits. And besides this passive income, owners also become VIPs in the partnered casinos, which will give them a benefit of 20% takeback on their lost bets.

But this is not enough – Slotie owners can take part in a weekly lottery game, by buying a ticket that costs 50 WATTs.

Polker

Polker.Games is an innovative Poker dApp utilizing NFTs to deliver the first NFT Play to Earn Poker Game.

Zed.Run

It´s not only pure NFT casinos that are of interest regarding NFT gambling. There are other projects like Zed Run.

Players can buy an NFT racehorse on Opensea and put it onto the race track on Zed.Run.

You can earn money by selling your horse, by breeding your horse, or by winning races.

Factors Affecting NFTs Prices:

Supply and Demand: The balance between supply and demand can significantly impact their prices. If the demand for a particular asset increases, while the supply remains limited, the price will likely increase, and vice versa.

The popularity of the Creator: If the creator has a strong following and reputation in the industry, their creations are likely to command higher prices.

Rarity: Rare or one-of-a-kind items, such as limited editions, can have an impact on prices. The more unique an asset is, the more valuable it can be.

Market Trends: Market trends play a vital role in the demand for an asset. If a particular type of token becomes trendy or popular, the demand for it will increase, which in turn can affect its price.

Utility and Functionality: The utility and functionality, such as access to exclusive content or experiences, can affect their prices. Tokens that offer real-world utility or functionality may have a higher value than those that do not.

Liquidity: The liquidity, or the ease with which they can be bought and sold, can affect their prices. The more liquid an asset is, the more accessible it becomes, which can increase its demand and value.

Public Perception: Public perception and sentiment about an asset, and the overall market, can have a significant impact on its prices. Positive public perception can drive up demand, while negative public sentiment can have the opposite effect.

Regulation: Government regulations and laws can impact prices significantly. The introduction of regulations or laws that impact the use or sale of NFTs can affect their demand and value.

Technological Advancements: Advancements in blockchain technology can impact the prices of tokens. New features and improvements in technology can make them more valuable and appealing to buyers.

Macroeconomic Conditions: Global macroeconomic conditions, such as inflation and currency fluctuations, can also affect prices. If the economy is doing well, people are more likely to invest, which can drive up their prices.

How NFTs Change Our World?

Creating Value for various Tokenized Assets

NFTs provide a means through which real goods such as art pieces can be tokenized, preventing duplication and granting sole ownership to the artist. This will in turn produce scarcity and increase the value of the art work.

It Increases Liquidity for Investors

Tokenizing assets allows investors to have more control over their commodities when they need it. A virtual landowner, for example, might opt to rent out his or her virtual property to advertising or influencers for a charge while still owning the land. In this example, the virtual land remains for the owner, but a portion of it has been liquified as rent.

Growth and development possibilities

NFTs have the ability to grow and develop the land sector. In real estate, for example, owning and managing virtual lands gives you the authority to select what you want to do on your land, and tying NFTs to land pieces has shown significant promise for growth and development. You have the option of renting it out, establishing a stable and secure business for advertising, or selling it online.

Conclusion

In conclusion, NFTs are unique digital assets that use blockchain technology to provide authenticity, scarcity, and ownership verification. They have become increasingly popular in various industries such as art, music, sports, and gaming. They have the potential to revolutionize the way we value and trade digital assets, but there are also disadvantages to consider, such as their environmental impact and the uncertainty of their value.

For players looking to buy them, it is essential to do research and understand the factors that affect their prices, such as supply and demand, rarity, and market trends. Players should also ensure they use reputable marketplaces, set up a digital wallet, and understand the potential risks involved.

For investors, these can be a good option, but it is important to understand the risks involved, and only invest what you can afford to lose.

For creators, they offer a new way to monetize their digital assets and connect with fans. It is essential to consider the potential benefits and drawbacks and to carefully consider the impact on their brand and reputation.

FAQs

Are NFTs a good investment?

We can not give a general answer to this question, as NFTs can represent almost anything and it very much depends on the NFT and the NFT project.

Generally NFTs that have utility are a much safer bet than speculating on artworks.

For example: Owners of a Gambling Ape NFT co-own a casino in the metaverse and will receive part of the casinos profits. If the Gambling Ape Metaverse Casino is a success you might earn a respective steady income. Though, as always you need to do your own research, as we are no financial advisors.

What is an example of a NFT?

The domain of NFT is still relatively new. In theory, as said, NFTs can be used for anything that is unique and requires verifiable ownership. Here are some current examples of NFTs to give you a clear picture:

- An in-game item

- A unique limited-edition sneaker

- A unique digital artwork

- A digital collectible

Are NFTs secure and safe to use?

They are based on blockchain technology, which provides a high level of security and immutability. However, buyers should always exercise caution when buying NFTs, as there is always the risk of scams, fraud, and theft.

What role do smart contracts play in NFTs?

Smart contracts are self-executing contracts that are coded on the blockchain and can automate the buying and selling process. They enable the automatic transfer of ownership from the seller to the buyer once the payment has been received, providing transparency and security to the transaction.

What are the legal and regulatory considerations for NFTs?

The legal and regulatory considerations vary depending on the jurisdiction. Some countries have already enacted laws and regulations governing the use and sale of NFTs, while others are still in the process of developing their legal framework. Buyers and sellers should always be aware of the legal and regulatory requirements in their respective jurisdictions to ensure compliance.

What is the potential for NFTs in the gaming industry?

They have the potential to revolutionize the gaming industry by enabling players to truly own their in-game assets and allowing game developers to create new revenue streams. NFTs can provide a way for players to monetize their gaming achievements, and create a new market for buying and selling virtual goods.

julien@contentbydesign.ca

julien@contentbydesign.ca