4.9

- Personalised bonus offer

- Provably Fair Games

- Low House Edge

- VPN allowed

- Anonymous Gambling

- No fees

- Provably Fair Games

- Many cryptos available

- No KYC needed

- VPN friendly

- Instant withdrawal

- Top Bonus

- Large selection of games

- Sportsbook

- Popular casino

- Sportsbook with eSports

- Some of the best odds

4.3

- Cashback Bonus

- Excellent on mobile

- Easy & quick withdrawals

4.5

- Daily Cashback

- 89 live casino titles

- crypto rewards

- 1000 Games

- Cashback Bonus

- Fast payouts

4.6

- Wager Free Bonus

- Shared House Profits

- Free Faucets

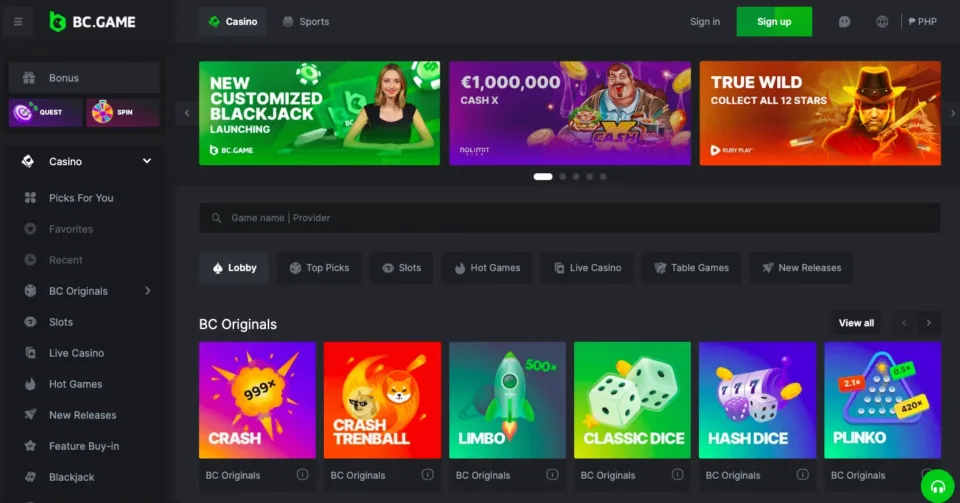

1. BC.Game – Best Overall Casino

BC.Game distinguishes itself as a prime option for depositing and wagering with USDT, providing an exclusive dappGambl promotion, the highest number of supported tokens, and promotions totaling up to 1 BTC. New players get a dappGambl exclusive bonus of 270% up to 1 BTC. However, the grand welcome package includes a 1080% bonus over four total deposits, allowing users to make deposits using 66 tokens. Other bonuses fill the casino with promotions such as game battles, tournaments, slots, cash prizes worth $10,000, and bonus rounds at no extra cost. Sports fans can also benefit from bonus activation and increased XP allocation.

Deposits start from $10 in stablecoin and levy a nominal 0.01% fee on crypto withdrawals. Also, when introducing new players to BC.Game, the platform grants you 25% of all casino earnings, while players can secure a rakeback of up to 20%. Ten thousand games are included on the platform, including slots, jackpots, megaways, table games, crypto games, live casino experiences like game shows and blackjack, and a sports betting section covering traditional sports and eSports. Since 2017, BC.Game has enjoyed growing popularity due to its presence in the sports sector and obtaining a gambling license in 2021. Anonymous gambling is not possible, and players can contact the casino through live chat, email, or the FAQ section.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| Up to $500 + 100FS | 500x – Unlocks with wagering | $10 |

- Pros

- High welcome bonus

- 24/7 support

- 58 providers

- Cons

- Welcome bonus dispensed in platform tokens

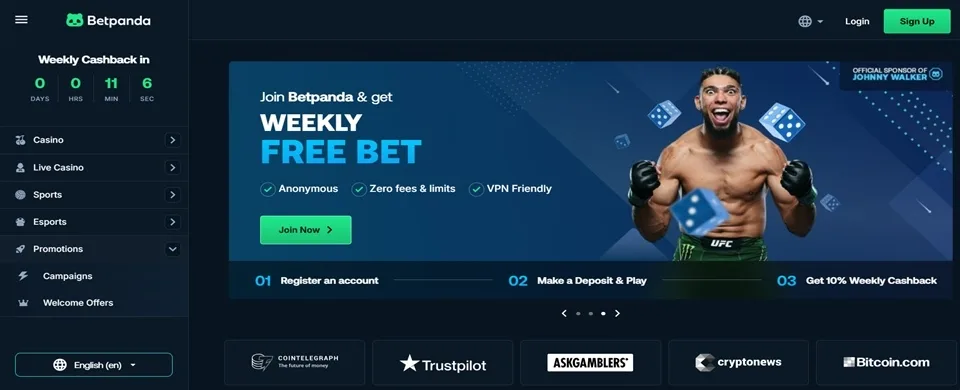

2. Betpanda – Best VPN-friendly Site

Betpanda opened its virtual doors in 2023 under Costa Rican legislation and made a good impression in the crypto industry, with fair operations and good player reviews found across the web. It has a massive 4000+ game library provided by major software companies. Playing at the casino is anonymous because no KYC is necessary, and virtual private networks are permitted if you are playing from the countries listed as restricted. Payments are quick, with over ten supported cryptocurrencies, some of which are listed below.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 100% Bonus Up To 1 BTC | 80x | N/A | BTC, BCH, LTC, ETH, DOGE, USDT, TRX, USDC |

- Pros

- Offers up to 1 BTC welcome bonus

- VPN-friendly casino

- No KYC required

- Cons

- Lacking Responsible Gambling tools

- Not standard license regulator

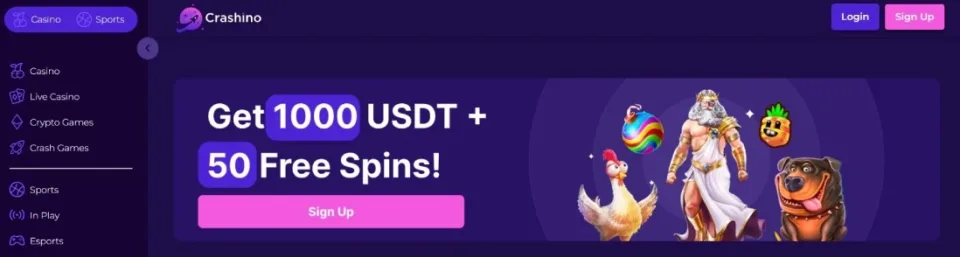

3. Crashino – Best for Betting Anonymously

Crashino has secured second place in our USDT favorites listing for its anonymous gambling feature on multiple games. Despite being an unlicensed casino, it offers access to a vast number of games and live casino bonuses. However, the welcome offer provided by the casino is not advantageous, with only 300 free spins redeemable over three deposits and limited to just a few slots. Moreover, Crashino’s promotions include a 100% multi-bonus for sports bets, 3+1 NBA bets, betting on Pthe remier League with no risk, 100% insurance bets, and casino bonuses, such as slots tournaments and Twitter and Telegram community bonuses.

With over 5,000 games, slots, jackpots, crypt games, a live casino, and a sportsbook are all accessible to everyone. USDT deposits start from $10, with other tokens like BTC, ETH, or LTC following suit; deposits start at $50 with a limit of weekly withdrawals. The casino has no valid license, so anonymous gambling is possible, with country-related restrictions. Still, there is a live chat and a large social media presence that players can contact in case of any issues.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 300 Free Spins | 15x | $10 | BTC, ETH, LTC, DOGE, SHIB, USDT, BCH, BNB, DAI, TRX, USDC |

- Pros

- Active support

- Anonymous gambling

- Cons

- Min withdrawal of $50

- Bad welcome bonus

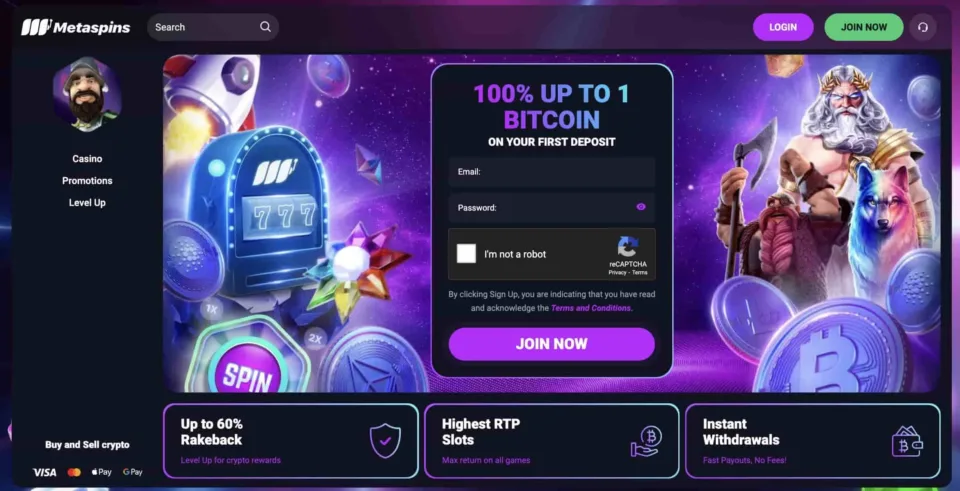

4. Metaspins – Best for a High Rakeback Program

Metaspins is placed third on our list of USDT casinos due to its unique features, such as a booster rakeback, a distinctive UI design, and mandatory user KYC. The casino’s welcome bonus offers a 100% match on deposits up to 1 BTC, provided a wagering requirement of 25x is met. In addition, Metaspins provides unique bonuses such as crash game tournaments, meme drawing contests, crypto price predictions, and leveling-up events via the VIP program. The rakeback system is based on tiers, with the highest possible amount reaching 57%. However, players must go through the ranking to reach the highest amount.

The game selection is impressive, with over 4,000 titles, including jackpot games, slots, MetaLotto, crypto games, and a live casino, albeit with no sportsbook and there’s a mandatory KYC verification as the casino holds a Curacao gambling license with country restrictions. Players can deposit on Metaspins using Bitcoin, Ethereum, or USDT while also having the option to purchase tokens from third-party applications. The customer support team is accessible via live chat, social media contact, and email.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 100% up to 1 BTC | 25x | 0.0001 BTC | BTC, BCH, LTC, ETH, DOGE, USDT, TRX, ADA, USDC |

- Pros

- 1 BTC welcome bonus

- Low minimum deposit limit

- Cons

- KYC Required

5. Bitcasino – Best for Betting Along Live Casino Streamers

As a fourth favorite, Bitcasino allows USDT deposits and crypto wagering as the operator has a reputation as the first licensed casino with a stellar reputation. This achievement has continued with a unique welcome offer, which comes in the form of a 20% cashback bonus of up to $10,000, with no wagering attached. Aside from the cashback bonus, players can also participate in casino bonuses such as gem races, week’s start bonuses, a loyalty club, bankroll boosters, and a loyalty club with cashback and free spins attached.

In addition, there’s a mobile application available that offers seamless crypto deposits and access to betting along casino streamers through the Livespins partnership. Still, as payment, Bitcasino accepts cryptocurrencies such as ETH, USDT, or BTC, with deposits starting as low as 0.00025 BTC, which can access over 5000 games. In addition, there are live casino games with game shows, crypto games, bonus buys, slots with jackpots, and various table games like blackjack or roulette. As the first licensed crypto casino launched in 2014 – meaning anonymous gambling is impossible- Bitcasino offers high trust through its support teams, easily accessed through the platform’s live chat and casino help center.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 20% Cashback up to 10,000 USDT | No wagering | 0.00025 BTC | BTC, ETH, LTC, DOGE, ADA, USDT, TRX, XRP |

- Pros

- Bet with streamers

- eSports gambling

- Cons

- Cashback bonus

- KYC and verification

6. Cloudbet – Best for Getting a High Welcome Bonus

Cloudbet is a well-known online casino that ranks fifth on the USDT casino list, offering an array of both sports betting and casino games, which boast positive RTP and an edgy welcome bonus. Players can also view the games’ real-time RTP and house edge, possibly receiving a crypto-only BTC bonus. One unique aspect of Cloudbet is its high level of trust, as described by its reputation for being a secure casino. To register, players must undergo a KYC process, and the casino does not support anonymous gambling.

Established in 2013, Cloudbet offers a welcome bonus of 100% up to 5 BTC with tier bonus releases on every 150 points gained. Additionally, the casino offers a VIP loyalty club with six tiers that provide exclusive promotions, deposit bonuses, and priority customer support. Other bonuses include free spins, and in terms of games, players can access a selection of over 3,000 games that allow for crypto, stablecoins, and fiat payments with minimum deposits of 0.001 BTC. The casino offers slots, table games, a sportsbook, a live casino, and crypto games with a fixed RTP of 97%. Cloudbet provides 24/7 customer support through live chat, email contact, as well as a comprehensive FAQ page section.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 100% up to 5 BTC | No wagering | 0.001 BTC | BTC, ETH, LTC, XRP, DASH, XML, BCH, TRX, BNB, USDC, XMR, DOGE |

- Pros

- Sportsbook

- High deposit bonus

- Lots of crypto deposits

- Cons

- KYC required

- Withdrawal limits

7. Justbit – Best for App Gambling

Justbit has made the USDT list by having a welcoming starter package but compensating through its immersive and responsive UI design, sportsbook option, and Android mobile app. When considering the welcome bonus, Justbit offers both sports and casino welcome bonuses, with the latter giving players 100% up to $250 for their first deposit or 1 Free Bet + 50 free spins for the sports option. There are a total of 3 deposit stages totaling 125% up to $750 and 75 free spins. Other promotions include 10% game cashback using the native casino token, slot drop & wins, Telegram special bonuses, competitions, and guaranteed rakeback.

The minimum deposit amount on Justbit is $20 with a minimum withdrawal of 0.00018 BTC using tokens such as BTC, ADA, or USDT. Crypto can be purchased directly through the casino with max daily withdrawals of $20,000. The casino section features 4,000 games, including instant crypto games, slots, jackpots, a live casino, and a live casino. In addition, a VIP program on Justbit offers money bonuses and VIP cashback. As a licensed casino in 2022, Justbit has a KYC policy in place and offers customer support through live chat, social media, and email.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| $100 up to $250 | 40x | $20 | BTC, LTC, ADA, BCH, DOGE, XRP, NEO, USDT, BNB, TRX, ETH, CSC |

- Pros

- Sports and casino welcome bonuses

- Crypto games

- Android mobile app

- Cons

- High wagering

- No anonymous gambling

- Minimum withdrawals

8. Bets.io – Best for Using Bonus Codes

Bets.io, a reputable online casino, has made it to the USDT casino list thanks to its top-notch features that provide players with a memorable gaming experience while offering instant withdrawals and cashback deals and boasts of an exceptional reputation. Bets.io offers a generous welcome package of 100% up to 1 BTC with 100 free spins on Buffalo Dale to new players using the code BETSFTD and a wagering of 40x the deposit. Moreso, other bonuses are claimable through the operator, including mystery boxes, weekly and daily cashback of 20%, and tournaments.

Deposits start at a low of 0.00006 BTC, with withdrawals processed within five minutes, and players can deposit crypto like BTC or stablecoins like USDT. Gamers have over 3,000 games, including table games, slots, feature buys, and a live casino with no sports betting options. Launched in 2021, the Curacao-licensed casino offers customer support through a live chat feature, email options, and an FAQ page to cater to inquiries or concerns.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 100% up to 1 BTC + 100 Free Spins | 40x | 0.00006 BTC | BTC, BCH, DOGE, ETH, LTC, USDT, XRP |

- Pros

- 3000 games

- Welcome bonus

- Rated best crypto casino

- Cons

- High wagering

9. Wildcoins – Best for Winning a BTC Jackpot

Wildcoins Casino is a blockchain casino offering high-quality BTC games, access to thousands of games, and game quests to keep players entertained. For the welcome bonus, Wildcoins has a welcome package of 3.5 BTC and 400 free spins with strict wagering. On top of that, a high roller bonus is available, a cashback program, game tournaments with prizes, and loyalty quests with CP points.

The cashier department has a minimum deposit of 0.0001 BTC, while withdrawals start from 0.0002 BTC, with the casino accepting multiple tokens including ETH or USDT. The casino hosts over 3000 games that can be accessed using BTC or other cryptos, including slots, a live casino with active table games and regular table games, and jackpots but no sportsbook. Boasting a gambling license, Wildcoins doesn’t mention anything about their KYC policy, but they do provide customer support through email contact and live chat.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| Up to 3.5 BTC and 400 Free Spins | 40x | 0.0001 BTC | BTC, ETH, DOGE, USDT, LTC, BCH |

- Pros

- Huge welcome bonus

- Loyalty rewards

- Accepts US players

- Cons

- Low maximum withdrawal limits

- Fiat not accepted

10. Betfury – Best for Accessing a Casino Faucet

Betfury is last on our list, where players can deposit using USDT, offering various unique features such as casino faucets, provably fair games, and free spins promotions. The platform offers a welcome bonus of 1000 free spins up to $3500 for new users, which can be utilized over three total deposits. To fully redeem the amount, players must complete a 35x wagering. Other promotions include 100 no-deposit free spins when signing up, social media sharing promotions, or casino game battles.

In addition, there’s a FuryWheel in place on the casino, which has a bonus of up to 1 BTC, and BetFury offers players a casino faucet or a cashback system of up to 25%. With over 1000 game options, including live casino games, slots, provably fair games, and table games, Betfury offers a minimum deposit of 0.00015 BTC, and players can utilize various tokens such as USDT, BTC, and ETH. Live casino is available, as well as a sportsbook; however, players must complete a KYC process and can contact customer support through a 24/7 live casino feature. Established in 2019, BetFury offers support in eight different languages.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 1000 Free Spins + $3500 | 35x | 0.00015 BTC | BTC, ENJ, USDC, LTC, DOGE, BCH, OX, USDT, LINK, BNB, BTT |

- Pros

- Casino faucet

- Lage token selection

- Cons

- Weak game selection

- KYC required

Top Tether Casinos Compared

| Tether Casino | Welcome Bonus | Available Games | Live Games (Yes or No) | Minimum Deposit | Withdrawal Time | Accepts US players? (Yes or No) |

| BC.GAME | 270% Deposit bonus up to 1 BTC | Slots, provably fair games, table games, jackpots, live casino, sportsbook | Yes | N/A | Instant | No |

| Crashino | 300 Free Spins | Slots, provably fair games, table games, jackpots, live casino, sportsbook | Yes | $10 | 24 hours | No |

| Metaspins | 100% up to 1 BTC | Slots, provably fair games, table games, jackpots, live casino | Yes | 0.0001 BTC | Instant | No |

| Bitcasino | 20% Cashback up to 10,000 USDT | Slots, provably fair games, table games, jackpots, live casino, sportsbook | Yes | 0.00025 BTC | Instant | No |

| Cloudbet | 100% up to 5 BTC | Slots, provably fair games, table games, jackpots, live casino, sportsbook | Yes | 0.001 BTC | 24 hours | No |

| JustBit | $100 up to $250 | Slots, live casino, sportsbook, blackjack, roulette, provably fair games | Yes | $20 | Instant | No |

| LTC Casino | N/A | Slots, bonus buys, jackpot, provably fair games, live casino | Yes | 1 mETH | Instant | No |

| WildCoins | Up to 3.5 BTC and 400 Free Spins | Slots, table games, live casino | Yes | 0.0001 BTC | 1 hour | No |

| Betfury | 1000 Free Spins + $3500 | Slots, provably fair games, live casino, sportsbook, special games | Yes | 0.00015 BTC | Instant | No |

What is Tether (USDT)?

By definition, a stablecoin is a digital currency backed by a fiat currency. Since fiat currencies back all stablecoins, their value corresponds with that of the underlying fiat currency.

Tether was the first stablecoin to be released in the crypto market. This cryptocurrency was launched in 2014 and has been used to control volatility in the crypto market. Essentially, Tether is a stable crypto asset that is backed by the US dollar. As a result of its affiliation with the US dollar, the value of each Tether coin always corresponds to $1.

The purpose of stablecoins is to control the price volatility of digital assets on the crypto market, and Tether excels at this primary function. Additionally, Tether can also be used to make payments. The result is that many gambling dApps and crypto casinos now accept Tether as a payment option for gamblers on their platforms. Similarly, bettors can request withdrawals using the Tether coin.

Tether is becoming increasingly popular as a payment option on gambling sites due to its many features. For example, Tether gives its users stability due to its lack of price volatility. Similarly, user transactions involving Tether are extremely fast due to the fast transaction speed of the coin.

Furthermore, USDT transactions have low transaction fees, so bettors will keep more of their winnings when they make withdrawals. Tether makes the perfect payment method for gambling dApps and top crypto casinos due to all of these excellent features.

How does Tether Work?

Tether operates on a 1-to-1 ratio with the US dollar, meaning that for every Tether token in circulation, an equivalent amount of US dollars is held in reserve. This is meant to ensure that the value of Tether remains stable relative to the US dollar. Tether Limited claims to hold enough US dollars in reserve to fully back all Tether tokens in circulation and has undergone periodic audits to confirm this.

To provide transparency and increase confidence in the asset, Tether Limited has undergone periodic audits (though not independent) to confirm that it holds enough US dollars in reserve to fully back all Tether tokens in circulation. The company has also published the results of these audits on its website.

To use Tether, individuals or businesses can purchase the digital asset using US dollars, and then use it for transactions or hold onto it as a store of value. Tether can be transferred between parties using a cryptocurrency wallet, and can also be converted back into US dollars at any time.

Gambling with USDT

Adopting stablecoins as a payment option in the online gambling scene has helped crypto gamblers significantly manage the volatility attached to trading regular cryptocurrencies like Bitcoin, Ethereum, and Bitcoin Cash, to name a few. For this reason, many crypto casinos and gambling dApps have begun to offer and accept Tether (USDT) as a payment option on their gambling platforms.

Tether gambling dApps offer Tether as a payment option to bettors on their platforms. These gambling dApps, like other online casinos, offer players a variety of betting options. Among these betting options are sports betting, casino games, and dice games.

Along with Tether, Tether gambling dApps offer a range of other top cryptocurrencies as payment options. Among these options are crypto assets, including Bitcoin, Ethereum, and Litecoin.

We recommend Tether dApps which offer gamblers excellent gaming options and fast payment options. Check out our ranking of the best Tether gambling dApps for more information.

Mobile Casino Apps

Similar to many online casinos, crypto casinos now offer users mobile gambling apps. Currently, many of our listed Tether casinos offer users the opportunity to enjoy gameplay through a mobile app.

You can find the mobile app of your preferred Tether casino in the Google Play store or Apple Store. You can also download these apps from the official website of your favourite Tether casino. In most cases, these mobile apps are usually accessible from Android and iOS devices.

Having your crypto wallet on the same device as your mobile app will be beneficial if you decide to play on mobile. Therefore, you can easily fund your casino account before gambling by connecting your wallet.

Step-by-Step Guide to Playing with USDT

1. Create An Account With A Crypto Exchange

USDT is available on most crypto exchanges, so your best option is to buy USDT on a reputable exchange. However, gamblers are encouraged to use crypto exchanges that offer the Ether coin (ETH) for USDT purchases. Moreover, the exchange must be within the gambler’s jurisdiction.

Users who want to purchase Tether in a crypto exchange must first set up an account in their preferred crypto exchange. In some cases, crypto exchanges require their users to provide personal information. In such cases, gamblers need to complete the registration process before making any purchases on the platform. Upon completing the registration process, registered users can begin to make USDT purchases.

2. Setup A Crypto Wallet

When setting up their crypto exchange accounts, gamblers also need to create a personal crypto wallet. A crypto wallet is similar to a bank account, and it is convenient for safely storing digital currencies.

Usually, crypto traders can use their crypto wallets to store their Tether tokens. However, in some cases, gamblers can also purchase USDT directly from their crypto wallets. In such cases, users are encouraged to follow the instructions for buying the USDT token carefully.

3. Buy Tether

After setting up their crypto account and crypto wallet, users can now make their USDT purchases. To buy some Tether coins, head to the purchase section of your crypto exchange and select the USDT coin.

Next, input your wallet address, click on the buy button and provide a means of payment. Once the transaction is complete, check your crypto wallet to confirm receipt of your USdt coins.

4. Create an account at the Best Tether Casino

Choose a Tether casino that works best for you from our recommended list of best Tether casinos. Our review team has carefully selected the best USDT online casinos and have created a list of the best USDT online casinos and gambling dApps. This guide has a section on how our review team evaluates the best Tether casinos.

5. Deposit Money Into Your Gambling Account

To play online casino games at your desired casino, you need to make the first deposit after creating your gambling account. Gamblers who wish to make a deposit need to head to the cashier section of the online casino.

Next, choose Tether as your preferred payment option for deposits. Usually, gamblers are given a casino wallet address, and they must transfer USDT to the casino USDT wallet. After confirmation of your deposit, the casino instantly credits your casino account with your deposit for gameplay.

6. Begin Gameplay

Most online casinos and gambling dApps reward new players with welcome bonuses for joining their sites. These bonus offers often include deposit bonuses, no deposit bonus offers, and free spins. After you claim your bonus offer, you can immediately begin gameplay by selecting your preferred casino game.

Our recommended Tether casinos offer a wide variety of casino games. They include table games such as roulette, baccarat, poker, and blackjack. They also provide live dealer games, video slots, and other best casino games. Some sites offer esports betting options and sportsbooks to gamblers on their platform.

How to Withdraw Funds from Tether Gambling Sites?

Here are the key points you need to know about withdrawing funds from tether gambling sites:

Step 1: Verify your account

Before withdrawing funds, you need to verify your account. This process is pretty straightforward and involves submitting your identification documents. Once your account is verified, you can proceed with the withdrawal process.

Step 2: Choose your withdrawal method

Tether gambling sites usually offer several withdrawal options. Choose the one that works best for you. Common withdrawal methods include cryptocurrency wallets, bank transfers, and PayPal.

Step 3: Check for withdrawal fees

Some sites charge withdrawal fees, so it’s always good to check for this before proceeding. Withdrawal fees can vary depending on the method used and the amount of money withdrawn.

Step 4: Check for minimum withdrawal amounts

Most tether gambling sites have a minimum withdrawal amount. This is the minimum amount of money you can withdraw from your account. Make sure you meet this requirement before attempting to withdraw your funds.

Step 5: Enter the amount you want to withdraw

Once you have chosen your withdrawal method, enter the amount of money you want to withdraw. Make sure it doesn’t exceed your available balance.

Step 6: Add your wallet address

Add the wallet address you want to withdraw to and make sure you send it to the correct network.

Step 7: Confirm your withdrawal

After entering the amount, confirm your withdrawal request. You will usually receive an email confirmation once your withdrawal request has been processed.

Key Factors to Keep in Mind Before Choosing Any Tether Online Casinos

With the rise in popularity of online gambling and the increasing acceptance of cryptocurrencies like Tether, there are now many online casinos that offer Tether as a payment option. As a player, it is important to keep certain factors in mind before choosing any Tether online casinos. This article will outline key considerations that can help you make the best decision and avoid any unpleasant surprises.

GEO Restrictions

One of the first things to consider when choosing a Tether online casino is whether it is available in your region. Many online casinos have geo-restrictions that may prevent players from certain countries or regions from accessing their services. Before depositing funds or signing up for an account, it is essential to check if the online casino accepts players from your region.

Crypto Reputation

Another important factor to consider when choosing a Tether online casino is the crypto reputation of the casino. In today’s world, cryptocurrencies are becoming more popular and it is important to choose a casino that has a good reputation in terms of handling cryptocurrencies. You should research the reviews and ratings of the casino in various online forums and communities. Additionally, you should check whether any previous customers have reported any issues with depositing or withdrawing with Tether.

Deposit & Withdrawal Speed

The speed of deposits and withdrawals can also play a vital role when selecting a Tether online casino. Ideally, the chosen casino should offer quick deposits and withdrawals, allowing players to receive their winnings as soon as possible. A slow deposit or withdrawal process can be frustrating, and can even affect your overall enjoyment of the casino experience. Therefore, it is important to read reviews and check the casino’s policy on Tether withdrawals.

Deposit Bonuses & Promotions

Deposit bonuses and other promotions can also make a significant difference when choosing a Tether online casino. It is worth comparing the various promotions and bonuses offered by different casinos to see which ones are most suitable for your requirements. You should be wary of casinos that are too generous with their bonus offers. Often, these casinos have hidden terms and conditions that can prove to be detrimental to your gaming experience.

Customer Support

Another key consideration is customer support. The best Tether online casinos should provide good customer support, preferably with 24/7 availability, should you ever encounter issues or have concerns. You can find out more about the quality of customer support by checking reviews and feedback or by contacting the support team directly and asking them some questions.

Game Selection

Finally, the game selection should not be overlooked. Different Tether online casinos offer different games, so it’s important to choose one that suits your taste. Whether you prefer slots, card games or table games, it’s worth examining the casino’s selection before making a decision.

Security

Crypto wallets are used to store, send, and receive USDT. In addition to storing USDT, crypto wallets also protect the cryptographic information of crypto holders. There are different types of crypto wallets available for storing Tether.

Hardware wallets offer the best level of security for any cryptocurrency wallet. Web and online wallets, however, are more popular due to their ease of use and quick application. Whichever wallet you end up using, make sure you protect your wallet private keys to prevent the theft of your tokens.

Crypto gamblers can also safeguard their crypto assets and winnings by following these simple steps:

- Be sure to use strong passwords and do not write them down anywhere.

- Use a trusted web wallet or hardware wallet.

- Make sure your internet and device are secure.

- You should be wary of voice phishing.

- Use an SSL-encrypted online casino that is reputable.

How We Rate USDT Casinos?

Our review team gives serious consideration to several important features before listing any gambling site on our platform. In this section of our guide will take a look at some of the essential features we consider before listing Tether casinos on our platform.

1. Licensed and Provably Fair

One of our first steps is to ensure that our listed Tether casinos are licensed and regulated by leading gambling regulatory bodies such as Curacao or Malta. Additionally, the casinos must be able to prove they are fair and ensure that the privacy of gamblers on their platform is protected.

2. Customer Support

We also consider the quality of customer service available to games on each site we rank. All of our listed gambling sites offer fast and responsive customer support to their users.

3. Bonuses

Our Tether casinos also offer cool bonuses to new and existing casino players. If you are a new player, you’ll want to look out for welcome bonuses and free spins. There are also casino bonuses such as deposit bonuses, cashback, no deposit bonuses, and more. Our Tether casinos also offer gamblers jackpots and special tournaments.

4. Game Selection

We also ensured that the Tether gambling sites on our list of best casinos offer a wide range of excellent casino games. Generally, gamblers will find live casino games like blackjack, roulette, poker, baccarat, table games, and video poker games on our listed Tether casinos. Our sites also offer slot games, esports, and sportsbooks to gamblers.

5. Payment Option

In addition to offering USDT as a payment option, Tether casinos also accept a wide range of other payment options for gamblers on their platform. These options often include Bitcoin, Ethereum, Bitcoin Cash, Litecoin, credit cards, bank transfer, and e-wallets.

The Future of Tether Gambling

Stablecoins like Tether have their own place in crypto gambling, and that’s because they remove some price uncertainty. Because tokens like Tether are pegged at the price of $1, then they are less prone to Bitcoin’s volatility and make players feel more secure with their balance. When looking at how Tether belongs to crypto casino interactions, we can see that many casinos are finding stablecoins as a necessity and continue to allow players to use them as a deposit method. Of course, other stablecoins are also added to the casino mix. Still, Tether’s stability and current market share make the token one of the preferred means of deposing a cryptocurrency with low volatility.

Additionally, the stablecoin can be integrated with most EVM-compatible chains, so it’s extremely easy for casinos and players to deposit, use and withdraw the token while choosing which network to conduct the transaction on. That said, the use of Tether will continue to grow; even though it doesn’t allow for high anonymity, it does help gamblers, especially those who want to withdraw quickly during periods of high market volatility, to protect their cashier balance. On that, Tether and other stablecoins make it easy for gamblers to withdraw a currency they know and deposit it back without having to do many conversions.

Conclusion

USDT is the alternative to digital cash, as players who use it for deposits or gambling can better manage their finances. Despite the low deposit threshold and the convenience of using digital dollars with Tether, players still need to make sure the casino they choose is safe and secure. When depositing Tether, it’s essential to check what games are available, how secure the platform is, and what bonuses are offered. Our top list includes the best casinos for depositing and withdrawing USDT, and for those who want to maximize their crypto gambling experience, we can recommend opting for BC.Game as it offers the best overall casino experience with a high welcome bonus while offering fast withdrawals on more than just USDT.

However, for an anonymous gambling casino, we recommend using Crashino as the casino allowing players to sign-up and deposit stables without having to share any personal details.

With that, USDT Gambling has changed how easy it is to make crypto deposits without constantly making token conversions. More importantly, the stability and reluctance to be affected by Bitcoin’s volatility help players manage their crypto gambling risks.

Where can I gamble USDT?

Several reputable online casinos accept USDT, and they’re all included in our dappGambl top list and a review.

What are Tether casinos?

Tether casinos are gambling sites that accept stablecoins like Tether as payment options.

Are Tether casinos safe?

Overall, Tether Casinos are safe. However, as with any online casino, you should do your due diligence by checking customer reviews, reading the dappGambl score, and checking if they have a valid license.

Can you gamble with Tether?

Yes, you can gamble with Tether, and known casinos accept USDT or Tether as a payment option.

Other Cryptocurrency Casinos

Facts Checked by Josip Putarek, Senior Author

julien@contentbydesign.ca

julien@contentbydesign.ca