4.9

- Personalised bonus offer

- Provably Fair Games

- Low House Edge

4.9

- Personalised bonus offer

- Provably Fair Games

- Sportsbook with eSports

4.5

- Daily Cashback

- 89 live casino titles

- crypto rewards

- Low House Edge

- Provably Fair Games

- Shared House Profits

- Generous welcome bonus

- VIP

- Fast Withdrawals

4.5

- CSGO Site

- Accepts NFTs For Wagering

- Gaming-focused

- No KYC needed

- VPN friendly

- Instant withdrawal

- Many cryptos available

- Quality Casino Games

- Esports

Ranked: Our XRP Gambling Site Picks

- BC.Game – Best for an Exclusive dappGambl Bonus

- Stake – Best for Playing Stake Original Games

- Bets.io – Best for Accessing a Welcome Bonus with Codes

- Earnbet – Best for Getting a BTC Casino Bonus

- Playfina – Best for Playing Casino Challenges

- Duelbits – Best for Depositing Using Game Assets

- Thunderpick – Best for Betting on eSports Events

- Metaspins – Best for Rakeback Bonus

- Bitsler – Best for VIP Rewards

Ripple Casinos Sites Reviewed

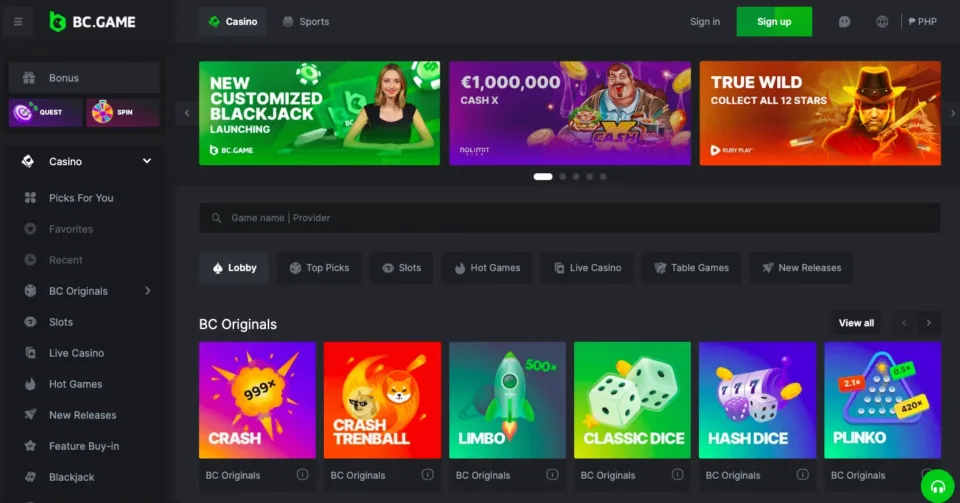

1. BC.Game – Best for an Exclusive dappGambl Bonus

First on our list of casinos for XRP betting is BC.Game which includes a unique dappGambl special promo, access to tens of thousands of casino games, and a VIP package where players get invited and can obtain better bonuses from BC.Game. If you seek a distinctive gaming experience with exclusive bonuses while using XRP, then this casino is tailored for you.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 270% Deposit bonus up to 1 BTC | 500x – Unlocks with wagering | $10 | 66 tokens |

- Pros

- High welcome bonus

- 58 providers

- 24/7 support

- Cons

- Uses its own native token for bonuses

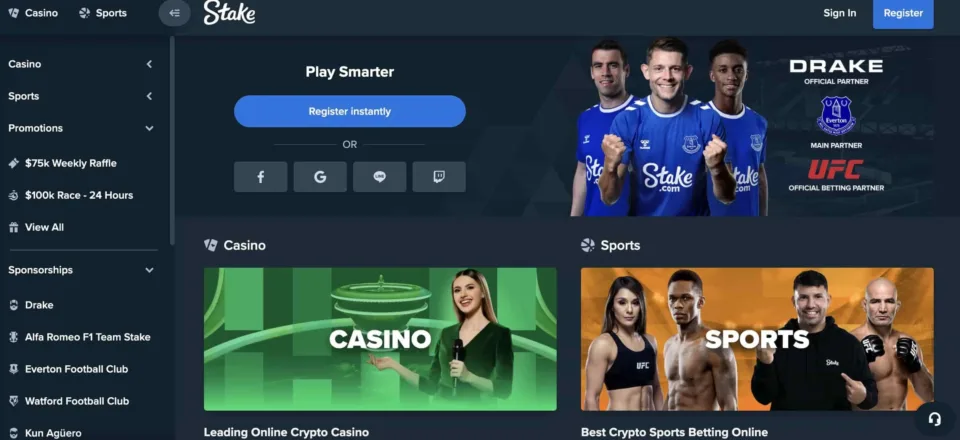

2. Stake – Best for Playing Stake Original Games

When it comes to depositing XRP and engaging in Ripple token gambling, Stake takes the second spot as our preferred platform. The casino features special, provably fair games, boasts a stellar online reputation, and offers access to a diverse array of betting options. If you’re considering Stake, dappGambl users are fortunate as they can avail of an exclusive welcome package, offering a 200% bonus up to $1,000.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| Exclusive 200% up to $1000 | 40x | $100 | BTC, ETH, LTC, USDT, DOGE, BCH, XRP, ROS, TRX, BNB, USDC, APE, BUSD, CRO, DAI, LINK, SAND, SHIB, UNI, MATIC |

- Pros

- Great reputation

- Provably fair + crypto games

- Transparent operator

- Cons

- Small withdrawal fee

- KYC required

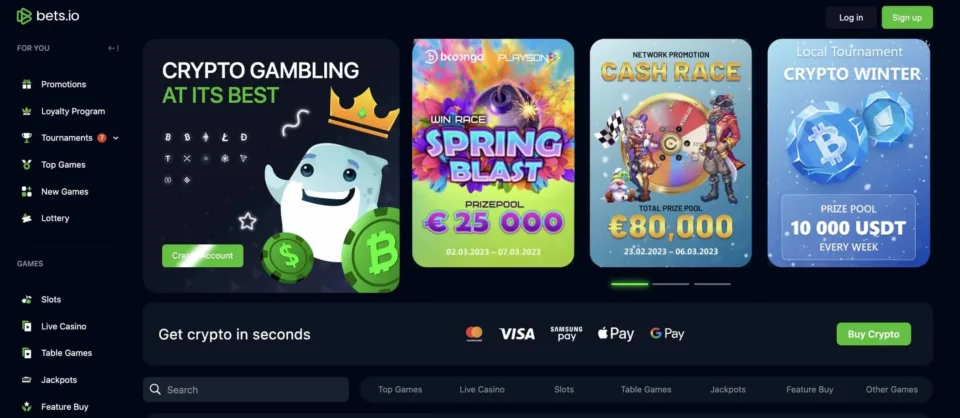

3. Bets.io – Best for Accessing a Welcome Bonus with Codes

Ranked fourth on our list of casinos supporting XRP tokens is Bets.io, it features weekly cashback, facilitates instant crypto and XRP withdrawals, and maintains a top-tier reputation. If you’re seeking an extensive gaming selection, Bets.io provides over 3,000 games, encompassing slots, jackpots, feature buys, table games, and a live casino with offerings such as blackjack, roulette, and baccarat.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| Up to 1 BTC + 100 Free Spins | 40x | 0.00006 BTC | BTC, BCH, DOGE, ETH, LTC, USDT, XRP |

- Pros

- 3000 games

- Welcome bonus

- Rated best crypto casino

- Cons

- High wagering

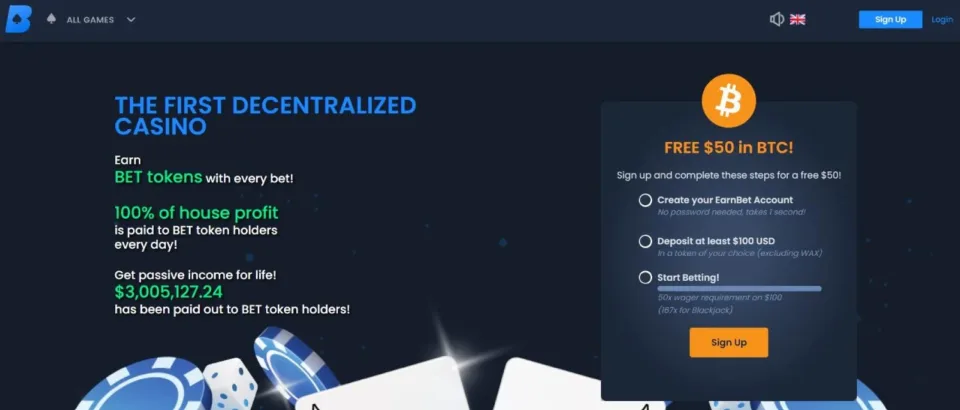

4. Earnbet – Best for Getting a BTC Casino Bonus

Earnbet has earned its place among crypto casinos that accept XRP tokens by offering a welcome bonus, providing shares of casino profits, and being the first fully decentralized gambling platform. If you’re intrigued by provably fair games, Earnbet specializes in them, so take the chance and join the platform to explore further.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| $50 in BTC | 50x | $100 | BNB, BTC, BCH, EOS, ETH, LTC, XRP, XLM |

- Pros

- dApp focused

- Low house edge

- Shared profits on BET

- Cons

- $50 welcome bonus

- 6 games available

5. Playfina – Best for Playing Casino Challenges

Playfina ranks as our sixth choice for XRP gamblers, being one of the most reputable platforms in the market, offering a wide array of casino games alongside challenges and renowned providers. If you’re looking for an online casino where players can enjoy a diverse range of games, from video slots and table games to a live dealer room, consider this platform.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| $1,000 + 200 Free Spins | 40x | $20 | BNB, ADA, XRP, LTC, DOGE, TRX,ETH, BCH, BTC |

- Pros

- 9,000 games

- Trusted platform

- Cons

- High wager requirement

6. Duelbits – Best for Depositing Using Game Assets

Duelbits is our seventh choice for depositing XRP tokens, given its acceptance of both crypto and fiat options, streamlined deposits, and early game access. If desiring both casino and sportsbook bonuses, Duelbits offers a variety, spanning from live casino or slots cash prizes to provably fair games with continuous drops on slots.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 50% Rakeback | N/A | $10 | BTC, ETH, LTC, SOL, DOGE, XRP, TRX, USDT |

- Pros

- CSGO Skins deposit

- Easy registration

- Strong reputation

- Cons

- Country restrictions

- No anonymous gambling

7. Thunderpick – Best for Betting on eSports Events

Thunderpick is a sportsbook that accepts cryptocurrency payments, including XRP, is focused on eSports betting, and includes provably fair games. There is a single welcome bonus available that offers 100% up to $500 for new players (with the WELCOME bonus), which can be used in both a casino or sportsbook, with various waterings of 10x or 30x the amount. Other bonuses on Thunderpick include slot tournaments, daily giveaways, Pragmatic Play operations slot drops, and eSports betting offers. The VIP offer extends into the casino giving players priority withdrawals, better sports odds, and access to unique bonuses.

Crypto deposits include BTC, LTC, or XRP tokens with no minimum deposits. However, withdrawals start from $10, with a weekly withdrawal cap of $50,000. With a focus on sports, Thunderpick offers both traditional sports and sports betting while also having a large offer of slots, live casinos, provably fair games, table games, poker, and casual games. Thunderpick holds a Curacao gambling license and offers great customer support through a 24/7 live chat, an FAQ section, and email contact support.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| $500 Welcome Bonus | 30x | $1 | BTC, ETH, DOGE, LTC, TRX, USDT, XRP, BNB |

- Pros

- Fast withdrawals

- KYC on-demand

- Cons

- eSports focused

8. Metaspins – Best for Rakeback Bonus

Metaspins is an XRP favorite casino as it includes boosted rakeback up to 60%, takes a different approach to casino design layout, and has a mandatory KYC set in place. Metaspins offers a 100% up to 1 BTC bonus for the welcome bonus while requiring a small wagering of 25x the bet amount. Other bonuses available on Metaspins include crash game tournaments, meme drawing contests, crypto price predictions, and leveling-up events for the VIP program. The rakeback system set into place gives players 57% back on their bets, with players required to go up the ranks to get the boosted amount.

KYC is mandatory on Metaspins as the casino holds a Curacao gambling license allowing players to deposit using tokens like BTC, ETH, or XRP and allowing crypto purchases directly from the website. The game selection covers 4,000 titles, including slots, jackpot games, MetaLotto, crypto games, and a live casino with no sportsbook. When contacting customer support, players can get access to the operator through a live chat, social media contact, and an email option.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 100% up to 1 BTC | 25x | 0.0001 BTC | BTC, BCH, LTC, ETH, DOGE, USDT, TRX, ADA, USDC |

- Pros

- 1 BTC welcome bonus

- Low minimum deposit limit

- Cons

- KYC Required

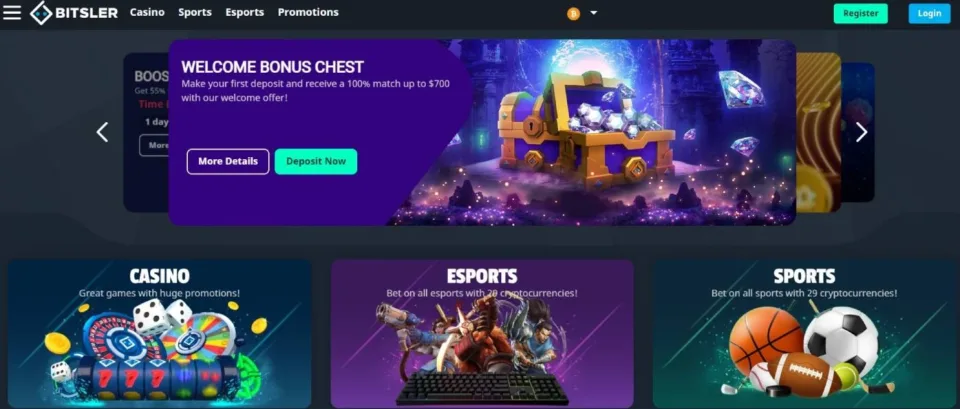

9. Bitsler – Best for VIP Rewards

Last on our list of XRP casinos is Bitsler, which has a distinct pool of accepted cryptocurrencies, includes a welcome bonus, and offers mobile app gambling. The welcome package on Bitsler includes a 100% bonus of up to $700 with no required wagering – a feature not many casinos offer. However, bonus winnings are released on a point base system, and the operator also features casino tournaments, sports free bets, an affiliate and referral program, and a VIP club for loyal users with rakeback and chest openings on XP points. In addition, there’s a boosted rakeback of 30%, and players can earn additional bonuses through cash drops.

The operator’s BTSLR tokens have wagering utility but nothing more, and Bitsler accepts multiple tokens, including BTC, XRP, or more private tokens like zCash, with no minimum on deposits and withdrawals. The game selection includes 1,000 games such as slots, megaways, table games with poker, blackjack, roulette, a live casino, and provably fair games. Regular and eSports betting is available as the casino has a valid gambling license – so anonymous wagering is not possible. Still, support is provided through email or a help desk.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 100% up to $700 | $1 per 200XP | 0.0001 BTC | BTC, ETH, XRP, LTC, USDT, DOGE, BNB, BUSD, ADA, ETC, BCH, ZEC, DGB, EOS, XLM, TRX, DASH, BTG, NEO & QTUM |

- Pros

- Welcome bonus

- eSports and sportsbook

- Kyc required

- Cons

- 1000 Games

- No live chat

Top Ripple Casinos Compared

| Ripple Casino | Welcome Bonus | Available Games | Live Games (Yes or No) | Minimum Deposit | Withdrawal Time | Accepts US players? (Yes or No) |

| BC.GAME | 270% Deposit bonus up to 1 BTC | Slots, provably fair games, table games, jackpots, live casino, sportsbook | Yes | $10 | Instant | No |

| Stake | 200% up to 1,000 | Slots, provably fair games, table games, jackpots, live casino, sportsbook | Yes | $100 | Instant | No |

| Earnbet | $50 in BTC | Provably fair games, blackjack, baccarat, dice, hilo, crash | No | $100 | Instant | No |

| Playfina | $1000 bonus + 200 Free Spins | Provably fair, live casino, table games, megaways, | Yes | $20 | 24 hours | No |

| Duelbits | N/A | Provably fair, blackjack, sportsbook, dice duels, | Yes | $10 | 12 hours | No |

| Thunderpick | 100% up to $500 | Slots, provably fair games, table games, jackpots, live casino, sportsbook | Yes | $1 | 24 hours | No |

| Metaspins | 100% up to 1 BTC | Slots, provably fair games, table games, jackpots, live casino | Yes | 0.0001 BTC | Instant | No |

| Bitsler | 100% up to $700 | Slots, provably fair games, table games, jackpots, live casino, | Yes | 0.0001 BTC | 12 hours | No |

What is Ripple?

Ripple, or XRP, is a digital currency created to provide a fast, secure, and cost-effective way to transfer funds globally or to make transactions between different parties. It’s one of the leading cryptocurrencies in the world, with a market capitalization of over $40 million.

Ripple’s lightning-fast DLT can process transactions faster than most PoW networks, with an average completion time of 4 seconds to process. For gambling purposes, this helps players interact seamlessly with the casino in both gambling and cashing-out situations, giving them more time to enjoy their favorite casino games. In addition, by removing any central authority, players can sometimes deposit and gamble anonymously while keeping transactions safe from cyber-attacks or fraud. XRP’s market reputation – which has been on a downtrend in the past two years due to an ongoing lawsuit, has positioned the token to be one of the most used digital assets because it’s convenient to use and deposit.

The pros and cons of using each crypto differ and below are notable advantages and disadvantages of using ripple.

The Benefits of Using Ripple

- Fast transactions: In terms of transaction processing, ripple is now the fastest cryptocurrency network. With this method, bankroll funding and online payments can be completed in less than a second.

- Anonymity: When it comes to gamers that prefer to keep their personal information private, the adoption of XRP is essential. Even though the platform’s ledger is private, it is nonetheless centralized in its structure. Because it does not collect any personal information about the gamblers, it is an excellent choice for those who value their privacy.

- Low fees: Transaction fees on ripple are among the lowest in the crypto market, arguably the lowest. At this point in time, you may get it for as little as $0.00001.

- Recognized by several banks: Unlike other blockchain projects that are at loggerheads with mainstream institutions, the Ripple network is recognized by banks globally.

- No exchange fees: Ripple is an exchange platform that makes it easy for users to exchange cryptocurrency. The fact that it doesn’t charge any fees is what makes it genuinely exceptional and distinctive.

- Legitimate: Ripple’s credibility has been bolstered by the fact that over 100 major financial institutions have accepted it. It works with some of the most well-known firms in the financial world and is unlikely to disappear, leaving you with useless tokens in your possession.

The Drawbacks of Using Ripple

- Lack of widespread casino support: In comparison to Cryptocurrencies such as bitcoin, XRP isn’t supported by as many casinos yet.

XRP Casino Bonuses

Welcome Bonus:

Bonuses are available at Ripple casinos when you deposit money. Depending on the wagering conditions, the welcome incentives can be incredibly beneficial, covering up to four deposits.

Loyalty Rewards:

Loyal casino players may be eligible for a wide range of bonuses as well. Comp points that may be redeemed for gifts or VIP schemes that offer a variety of perks are just one example.

Seasonal Bonuses:

Best Bonuses are offered weekly, monthly, or even daily at some casinos. There are a variety of perks available, including free spins, cashback, and crypto. There might also be a range of seasonal promos to keep the pleasure continuing.

High Roller Bonuses:

Crypto casinos frequently award their most loyal customers as a way of encouraging them to keep playing and spending. Crypto, trips, gadgets, and membership in exclusive clubs are all examples of this.

Game-Specific Bonuses:

You may be encouraged to play featured or new crypto games at a Ripple casino by special promotions. There are various ways to receive these bonuses, including free spins, bonus points, and additional tokens for play.

Best Ripple Casino dApps

Currently, no casino dApps on the market run on the Ripple Ledger. Since XRP is a currency with its own blockchain, that also supports smart contracts, the first casino dApps are expected to be released in the foreseeable future.

How Ripple Casinos Work?

XRP gambling establishments The Ripple laboratories have integrated a payment processing mechanism into XRP. XRP casinos primarily accept cryptocurrency payments, but the games are also played with XRP tokens.

The casino customer will need to deposit a particular amount of XRP to his casino account to play top crypto games including table games, slots, poker, and all in the casinos. Before depositing, the user must first create an account or register and wait for the site to validate the user. Deposits can be made when the account has been set up and validated.

Also, buying currency from an exchange is necessary before depositing it into an individual’s XRP gambling account.

Mobile Ripple Casinos

Mobile Ripple Casinos are online gambling platforms that allow players to access crypto casinos on their Android or iOS devices, eliminating the need for them to be tied to a particular location to partake in their favorite games of chance.

Most casinos are accessible on a mobile device through the phone’s browser. However, some of the casinos in our list also include mobile apps that can be downloaded from app stores with a straightforward installation process.

Thus, mobile Ripple casinos can be accessed from anywhere, at any time, making them highly convenient for players who want to enjoy gambling on the go while offering the same range of games compatible with any mobile device or operating system.

To take full advantage of the benefits of the casino, make sure you have a crypto wallet on your phone to make XRP transfers instantly.

Step by Step Guide to Playing with XRP

XRP is no different than any other cryptocurrency, and here’s how to get started with playing with Ripple:

Step 1: Create an Account

You need to create an account at a reputable crypto casino that accepts XRP as a payment method. You must provide your email address and create a strong password to secure your account, and make sure to check the payment section to see if the casino includes XRP tokens.

Step 2: Verify Your Account

Verification is not mandatory on crypto casinos to start playing, but if they do, you need to fill in additional details to get the account approved. This quick and straightforward process involves submitting a form of identification, such as a passport or driver’s license.

Step 3: Fund Your Account with XRP

To fund your account, you need to navigate to the deposit section and select XRP as your preferred payment method. You will then be provided with the casino’s XRP wallet address, which you can use to transfer funds from your wallet.

Step 4: Send XRP Tokens

To send XRP tokens, you must open your XRP wallet, paste the wallet address, add the mnemonic phrase if required, and complete the transfer by clicking OK. Transaction will be completed in a few minutes and will be added to your casino account once verification is complete.

Step 5: Choose Your Game

With your account funded, it’s time to choose the game you want to play. Most crypto casinos offer a wide range of games, from classic table games like blackjack and baccarat to more modern offerings like video slots and live dealer games.

Step 6: Place Your Bets

Once you’ve selected a game, it’s time to place your bets, and this depends on the game you choose, but most casinos make it easy to select your bet size and place your wager. Make sure to stay within your budget and only bet what you can afford to lose.

How to Withdraw Funds from Ripple Gambling Sites?

The process of withdrawing tokens from Ripple casinos is easy if you follow these steps:

Step 1: Access Your Casino

The first step in withdrawing funds from a Ripple gambling site is to log in to your account. Ensure that you enter the correct login details for your account to avoid any complications during the withdrawal process.

Step 2: Open The Cashier

Once you have accessed your account, locate the cashier section and click on it. This will take you to the withdrawal page to withdraw your funds.

Step 3: Select Ripple

Scroll through the available withdrawal methods until you find Ripple. Then, click on Ripple to initiate the withdrawal process.

Step 4: Enter Amount

The next step is to enter the amount of funds you wish to withdraw. Again, ensure you enter the correct amount to avoid any issues during the transaction.

Step 5: Confirm Transaction

Before you submit your withdrawal request, always take the time to review your details to ensure that everything is correct. Once satisfied with your withdrawal information, hit confirm to complete the transaction.

Step 6: Wait for Transaction

After you submit your withdrawal request, you must wait for the transaction to process. The length of time that it takes for the transaction to clear will vary depending on the Ripple gambling site’s policies and the amount of funds being withdrawn.

Step 7: Receive Funds

Once the transaction has been processed, you should receive your funds in your Ripple wallet. From here, you can keep your funds in Ripple or convert them into another currency.

Key Factors to Keep in Mind Before Choosing Any Ripple Online Casinos

If you are looking for a trustworthy and reliable Ripple online casino to play, there are a few factors you need to know before choosing a crypto casino:

GEO Restriction

Before registering with any Ripple online casino, you must check if the platform accepts players from your jurisdiction. Some online casinos restrict players from specific regions from playing and depositing in the casino. Therefore, you must ensure the online casino accepts players from your country to avoid your deposits being blocked or your account being disabled.

Crypto Reputation

Another crucial factor to consider is the cryptocurrency’s reputation that the online casino accepts. Make sure the casino handles the most known cryptocurrencies, including Bitcoin, Ethereum, and Ripple, and avoid opting to deposit tokens with low market capitalization and no solid utility for the network.

Deposit & Withdrawal Speed

When you deposit funds into your Ripple online casino account, you want to start playing your favorite games immediately. Therefore, it is essential to read the terms and conditions to see what limits the online casino imposes and whether it enables instant processing of withdrawals. Some casinos only allow you to withdraw a limited number of tokens, so selecting a casino with instant withdrawals is beneficial.

Deposit Bonuses & Promotions

Crypto bonuses and promotions make a crypto casino stand out from traditional operators, and Ripple casinos are no different. As crypto casinos have lower operations costs, they can provide better promotions for their players. So always check the welcome package and the ongoing promotions before making a deposit to help boost your bankroll and provide new incentives.

Welcome Match Bonus

One of the most significant bonuses Ripple online casinos offer is a welcome match bonus. This bonus type significantly boosts players when signing up and matches your first deposit, typically with a 100% or 200% bonus. Always check the wagering requirements for the bonus to avoid being caught off-guard.

Reload Bonuses

In addition to the welcome bonus, online casinos offer reload bonuses to keep the bankroll moving. These bonuses provide extra benefits to the players and have similar requirements in terms of wagering; however, they have a lower bonus percentage and offer free spins as compensation. Choose a casino that adds both match-up and welcome bonuses.

Bitcoin Vs XRP

A distributed ledger is at the heart of Ripple’s XRP cryptocurrency, which functions in a similar fashion to Bitcoin’s ledger. There is no single point of failure on the network, and the history of the ledger is agreed upon by consensus because there are many thousands of nodes. Because ripple’s blockchain is governed by a “consortium,” it has a distinct advantage over Bitcoin.

Trusted nodes are chosen to verify the network in a consortium chain. It is possible for any node to join and validate (or attack) the blockchain in a public chain (such as Bitcoin’s). This reduces the amount of effort spent on protecting consumers from harmful conduct by operating as a consortium (or “private” blockchain). On top of that, the whole supply of the XRP coin was allocated at its birth, therefore there is no way to mine it.

Blocks are not “mined,” but rather packaged and confirmed by other nodes on the network, allowing settlement to occur more quickly and efficiently.

The transaction speeds and system scalability of XRP make it a superior cryptocurrency for online gambling than any other.

In exchange for the increased speed, there is some degree of centralization, but as more consortium nodes come up, this centralization is rapidly decreasing. XRP is also designed so that even if Ripple Labs went bankrupt, the blockchain’s open source technology would continue to function.

The Future of Ripple Gambling

The future of Ripple gambling is currently unknown since the company operating the XRP tokens has entered a legal battle with the S.E.C. We’re saying this because access to XRP tokens has been made difficult due to the pending lawsuit in which the U.S. government is considering XRP as a security. This leads to exchanges being afraid of operating security which can cause further issues for their company.

That said, the state of Ripple is not doomed worldwide, only the U.S. government has taken this stance, and Ripple has since expanded into other jurisdictions. Although the token can still be purchased and offers faster and more affordable transactions than Bitcoin or Ethereum, Ripple gambling could face some pushback in case the lawsuit doesn’t go their way. We can say that XRP gambling will continue outside of the U.S. as players will still be able to get XRP from exchanges or decentralized platforms.

Conclusion

As we’ve reviewed all XRP benefits and drawbacks, the Ripple network offers value for crypto gamblers since they can access high-profile welcome bonuses and instant withdrawals as the Ripple network facilitates rapid transactions. Finally, you have to understand how to eye the best XRP casino as players need to make sure the casino has their favorite games – and more, which can be accessed on the go through their mobile, and players can access it from anywhere in the world.

Our list of XRP casinos has a mixture of all benefits, and we strongly recommend BC.GAME since the platform has an exclusive welcome offer, includes provably fair games, and is a secure casino. In short, XRP has allowed gamblers to easily access their favorite games without having to worry about 10-minute deposits or pay high network fees due to network congestion, helping users get better game access at a fraction of their costs.

How do I choose the top Ripple casinos?

When looking for a top Ripple casino, consider factors such as licensing, security measures, game selection, and welcome bonus offer; read customer support to know the platform is reliable and check how customer support is offered. Finally, the game selection should fit your needs and must include provably fair games.

Are Ripple casinos safe?

Yes, casinos accepting XRP as payments are safe when they operate under a gambling license, regardless of whether it’s off-shore. However, a casino should include account protection technology such as SSL encryption or 2 Factor Authentication to be safe.

Can you gamble with Ripple?

Yes, several online casinos accept Ripple as a payment method for gambling and making deposits.

Other Cryptocurrency Casinos

Facts Checked by Josip Putarek, Senior Author

julien@contentbydesign.ca

julien@contentbydesign.ca