4.9

- Personalised bonus offer

- Provably Fair Games

- Sportsbook with eSports

- VPN allowed

- Anonymous Gambling

- No fees

4.9

- Personalised bonus offer

- Provably Fair Games

- Low House Edge

- Popular casino

- Sportsbook with eSports

- Some of the best odds

- Top Bonus

- Large selection of games

- Sportsbook

- No KYC needed

- VPN friendly

- Instant withdrawal

- Generous welcome bonus

- Popular games

- Easy site navigation

Bonus Code: DAPPJACK

- Many cryptos available

- Quality Casino Games

- Esports

- 24/7 Live Chat

- Sportsbook

- Great mobile app

- Provably Fair Games

- Many cryptos available

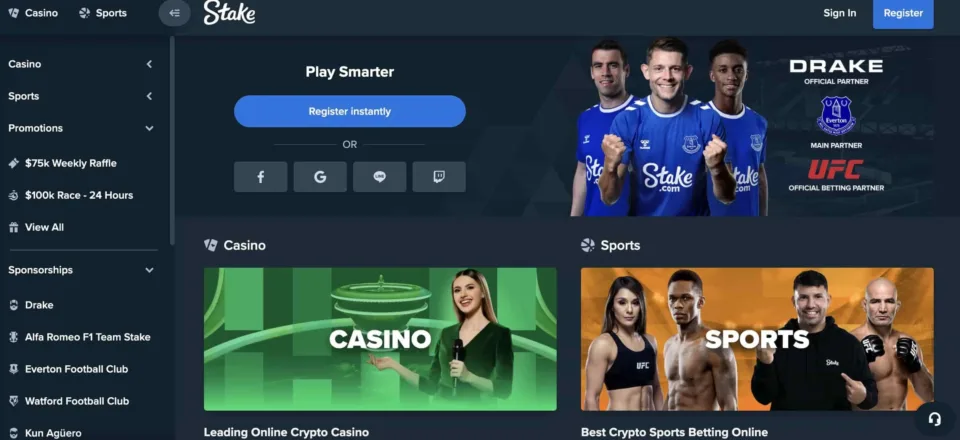

1. Stake – Best for Exclusive Bonus

Stake is stealing the show for Litecoin fans since players can deposit and gamble using LTC tokens, access a unique dappGambl promotion, deposit multiple cryptocurrencies, and play Stake original provably fair games with a verifiable result. By default, Stake doesn’t offer new players a welcome or first deposit bonus. However, dappGambl users can get an exclusive offer of 200% up to $1,000. Aside from the exclusive offer, other promotions on the platform include weekly slot prizes, daily race events with prizes of up to $100,000, Stake original promo, race multiplier with $10,000 prizes, level-up prizes, and Telegram shitcodes that can be used to redeem prizes.

A VIP program is also accessible for players on an invite-only basis on a platform that accepts 20 crypto tokens, including LTC or BTC. The minimum deposit on stake is the equivalent of $10, and players can’t deposit only using crypto. At the same time, there’s no minimum withdrawal, but a small fee depends on the token. In the game section, Stake has a collection of 5,000 games that include slots, live casino games, table games, unique provably fair games developed by Stake with known odds, and a sports betting section with regular sports as well as eSports options.

Stake’s reputation is of the highest caliber as the casino sponsors global sporting events like the UFC or is the main sponsor of the Alfa Romeo F1 Team. As a Curacao-licensed casino that launched in 2017, Stake doesn’t allow anonymous gambling, and players can contact customer support through a 24/7 live chat, customer email, or an FAQ section.

| Crypto Bonus | Wagering Requirements | Minimum Deposit | Available Currencies |

|---|---|---|---|

| Exclusive 200% up to $1000 | 40x | $100 | BTC, ETH, LTC, USDT, DOGE, BCH, XRP, ROS, TRX, BNB, USDC, APE, BUSD, CRO, DAI, LINK, SAND, SHIB, UNI, MATIC |

- Pros

- Great Reputation

- Provably fair + crypto games

- Transparent operator

- Cons

- Small withdrawal fee

- KYC required

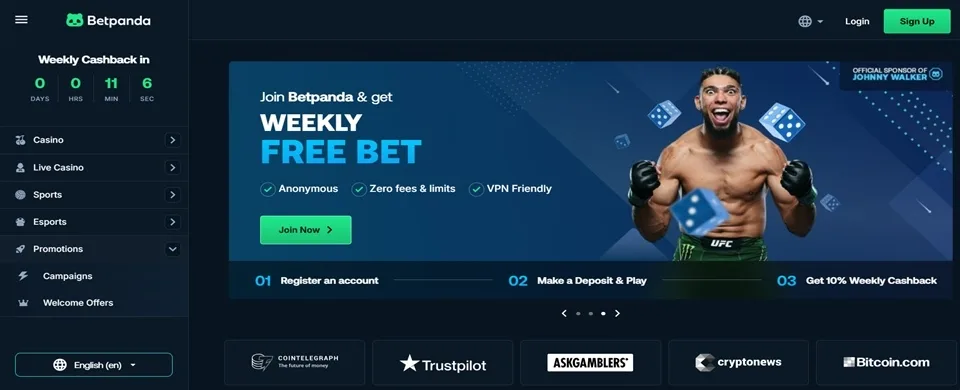

2. Betpanda – No KYC & VPN-friendly Casino

Betpanda offers an excellent casino experience with an extensive game library, including slots, live dealers, and table games, supported by top industry providers. It welcomes new players with a whopping 100% matched deposit bonus of up to 1 BTC, and it’s accessible via VPN, so if you choose anonymous play, you have a whole section explaining, in detail, how to use it. Payments, both deposits and withdrawals, are quick, and the casino does not charge any payment fees. All popular cryptocurrencies are accepted, including Litecoin.

There are many promotions available, and the exceptional XP Club.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 100% Bonus Up To 1 BTC | 80x | N/A | BTC, BCH, LTC, ETH, DOGE, USDT, TRX, USDC |

- Pros

- Provably fair games

- Fast withdrawals

- Great promotions

- Cons

- Lacking in RG tools

- High wagering requirements on welcome bonus

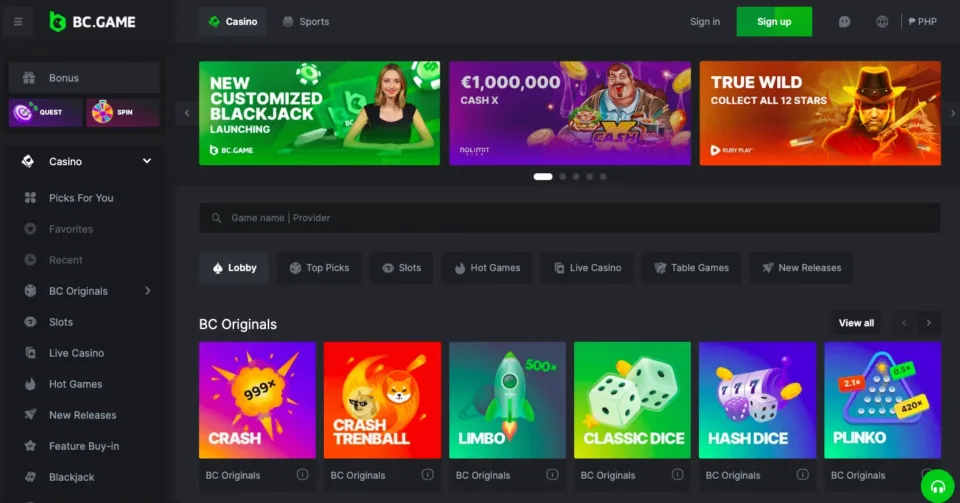

3. BC.Game – Best Casino with a Limited Welcome Bonus

Ranking second in our list of Litecoin-approved casinos in BC.Game that offers one of the highest welcome bonuses on the market supports over 60 total cryptocurrency payments and doesn’t have a wagering requirement, which is different than other platforms. As a welcome bonus, players can get a May exclusive of 270% up to 1 BTC or a minimum of $400 in deposits for the first deposit, while offering a welcome package of 1080% over four total deposits since launching in 2017, BC.GAME has gathered over 10,000 games on the platform that range from slots, live casinos, table games, and provably fair games, as well as offering sports betting and eSports tournament betting with great odds.

On the promotion level, players can get slot-specific promos such as casino battles, Play & Earn Bonanza with $10,000 prizes, free round bonuses, or double XP on sports betting. The VIP club grants players free withdrawals and a rakeback of up to 20%, while the affiliate offer pays out a commission of 25% of players’ winnings. Deposits and withdrawals can be made using 66 of the approved tokens, including LTC, BTC, or BCH, with no minimum deposit requirement and withdrawals having a small fee of 0.01% of the amount. The casino has held a gambling license since 2021, sponsoring known teams such as Cloud9 and the Argentina Football Team. Customer support is provided through live chat or email contact.

| Crypto Bonus | Wagering Requirements | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 270% Deposit bonus up to 1 BTC | No Wagering | $10 | 66 Tokens |

- Pros

- High welcome bonus

- 58 providers

- 24/7 support

- No wagering

- Cons

- Uses its own native token for bonuses

4. Cloudbet – Best for High Welcome Bonus

Cloudbet is our third option for gambling using Litecoin on RTP fixed, provably fair games, secure ways of deposit using fiat and crypto, and a high welcome offer. For new players, users can get a bonus of 100% up to 5 BTC, with no wagering requirement and a low minimum deposit. However, the remainder of the bonus offer is scarce, with only Tuesday free spins and a VIP program offered to existing players. KYC is implemented strictly on Cloudbet, which must be completed during early sign-up.

So, anonymous gambling is impossible as the casino holds a Curacao gambling license and has been operating since 2013. 3000 games are accessible on Cloudbet, including slots, provably fair games with a fixed and visible RTP, table games like blackjack or roulette, a live casino with games shows and known providers, and also a sportsbook section with traditional and eSports betting options. For deposits, players have access to 12 total tokens, including Litecoin and BTC, with deposits and withdrawals starting from as low as 0.0001 BTC. In addition, the casino provides great customer support services through live chat, access to email, and an FAQ help section with quality answers.

| Crypto Bonus | Wagering Requirements | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 100% up to 5 BTC | No Wagering | 0.001 BTC | BTC, ETH, LTC, XRP, DASH, XML, BCH, TRX, BNB, USDC, XMR, DOGE |

- Pros

- Sportsbook

- High deposit bonus

- Lots of crypto deposits

- Cons

- KYC required

- Withdrawal limits

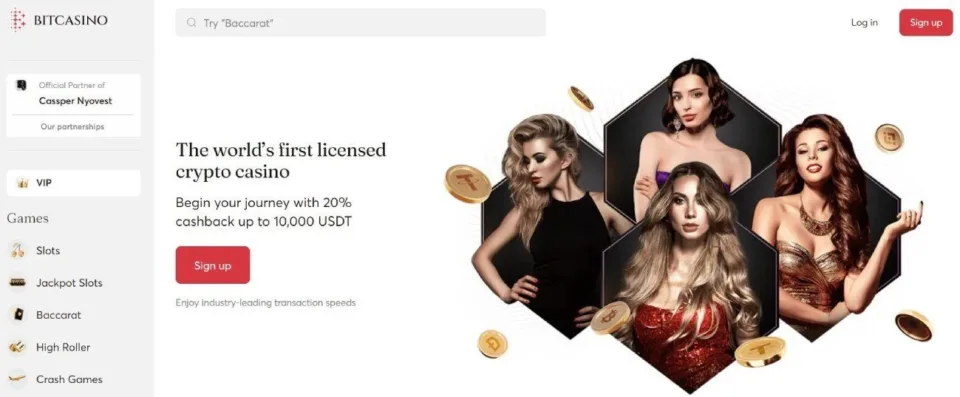

5. Bitcasino – Best for a High Rakeback

As our fourth option, Bitcasino offers a different casino experience for Litecoin token holders with a highly reputable casino, a big rakeback bonus, and the ability to gamble and interact with streamers to make the gameplay more immersive. The welcome offer on Bitcasino doesn’t offer any percentage bonus; instead has a cashback bonus of 20% up to $10,000 with no wagering requirement, making it ideal for players who hate wagering requirements. Other bonuses are also available, including gem races, start-of-the-week bonuses, loyalty club offers, and casino boosters.

In addition, the platform has an immersive gambling experience through the Livespins partnership, as players can place bets with casino streamers to make the interaction more engaging. With a mobile app available for players, Bitcaisno offers crypto deposits such as BNB, XRP, BTC, or LTC, with amounts starting from as low as 0.00025 BTC. There are over 5000 games available, including live casino games and game shows, provably fair games, slots, and table games like blackjack or baccarat. As the first licensed crypto casino, Bitcasino offers high trust, offering support through live chat and a casino help center.

| Crypto Bonus | Wagering Requirements | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 20% Cashback up to $10,000 | No Wagering | 0.00025 BTC | BTC, ETH, LTC, DOGE, ADA, USDT, TRX, XRP |

- Pros

- No wagering requirement

- Bet with streamers

- eSports gambling

- Cons

- Cashback bonus

- KYC and verification

6. Metaspins – Best for Easy User Navigation

Metaspins takes the fifth spot as a casino that offers LTC crypto deposits, includes a high rakeback, provides a captivating UI, and uses branded, provably fair games to make matters more engaging. KYC is mandatory for every player that signs up to Metaspins, leading to not allowing players to gamble anonymously. With that, the casino can offer a high welcome bonus of 100% up to 1 BTC with a minimum wagering requirement of 25x the wagering and a seven-day completion limit.

Other promotions are accessible for each player with crash gaming leaderboards, meme prize events, weekly BTC price predictions, and level-up events. Moreso, a rakeback of 57% is available on Metaspins as players continue to rank up their levels. With a futuristic UX design, the platform has a total of 4,000 games that range from slots to jackpot games and live casinos with no access to a sportsbook. Deposits can be made using cryptos like Litecoin, Bitcoin, or Ethereum, and players can also acquire and deposit tokens in seconds through traditional fiat means on third-party platforms. As a licensed casino, Metaspins allows players to contact support through a live chat or an FAQ section.

| Crypto Bonus | Wagering Requirements | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 100% up to 1 BTC | 25x | 0.0001 BTC | BTC, BCH, LTC, ETH, DOGE, USDT, TRX, ADA, USDC |

- Pros

- 1 BTC welcome bonus

- Low minimum deposit limit

- Cons

- KYC Required

7. Fortune Jack – Best for Getting Two Welcome Bonuses

Fortune Jack allows LTC deposits as the casino has a unique bonus structure, has provably fair games along with other games, and has a great reputation by operating for over a decade in the gambling industry. The welcome package includes a bonus of up to 6 BTC and 350 free spins that are redeemable over 4 total deposits, with the first deposit offering a 110% bonus and 250 free spins at a wagering requirement of 30x the amount deposited. As a second option, and this is valid across all 4 deposits, players can get a 20% cashback bonus with no wagering.

Other bonuses include a 50% bonus of up to 3.5 BTC or 100 no-deposit free spins upon registration. Tokens that are supported include BTC, ETH, and LTC, with no minimum deposits. Withdrawals are also processed instantly if players earn from playing the over 1500 games that range from regular slots, jackpots, a live casino, table games, and a sportsbook option with eSprots attached. With a gambling license, players can contact customer support through live chat or get their questions answered through the English-speaking community.

| Crypto Bonus | Wagering Requirements | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 110% up to 1.5 BTC + 250 Free Spins | 30x | $10 | BTC, LTC, DOGE, ETH, ZCASH, TRX, DASH, BCH, XMR |

- Pros

- High welcome bonus

- More cryptocurrencies accepted

- No minimum withdrawal

- Cons

- Two languages accepted

- Only 1500 games

8. Bitsler – Best for Gambling Using a Mobile App

Bitsler ranks seventh for using LTC to deposit and play on the casino, as the platform includes a welcome bonus and accepts unique cryptocurrencies aside from Litecoin while also offering mobile app gambling to let players gamble from anywhere. The welcome bonus offered by Bitsler gives players a 100% bonus of up to $700 with no wagering requirement set in place. This is because funds are released based on points. Other bonuses on Bitlser include tournament leaderboard bonuses, eSports free bets, affiliate access, or a VIP program for existing users. The standard rake back on Bitselr is a boosted number of up to 30%, allowing you to earn more while players can also get access to cash drops – rain events, and chest openings.

The casino also includes the BTSLR token that can be used in the Bitsler Coin Challenge. Over 17 different tokens are available on the casino, including LTC, BTC, or the ZEC privacy token, with no minimum deposit or withdrawals. The casino offering has only 1000 games to choose from, including a live casino, table games, jackpots, megaway slots, and provably fair games. The sportsbook offers both traditional sports and virtual sports like eSports, which is accessible through the licensed Bitsler casino, which offers only a few ways of support – through email and a help desk.

| Crypto Bonus | Wagering Requirements | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 100% up to $700 | $1 per 200XP | 0.0001 BTC | BTC, ETH, XRP, LTC, USDT, DOGE, BNB, BUSD, ADA, ETC, BCH, ZEC, DGB, EOS, XLM, TRX, DASH, BTG, NEO & QTUM |

- Pros

- Welcome bonus

- eSports and sportsbook

- KYC required

- Cons

- 1000 Games

- No live chat

9. Sporstbet.io – Best to Place Bets on Sports

Sportsbet.io is a premier online sports betting and casino platform that offers an exhilarating and immersive experience for sports enthusiasts and gamers alike. Founded in 2016, Sportsbet.io has quickly risen to prominence and has established itself as a trusted and reputable platform in the industry. With a user-friendly interface and support for multiple languages, including English, Spanish, Portuguese, German, and Russian, Sportsbet.io caters to a diverse global audience.

Sportsbet.io understands the importance of bonuses and rewards but does not offer a welcome bonus to new players. Sportsbet.io takes the security and privacy of its users seriously, employing state-of-the-art encryption technology and robust security measures. When it comes to anonymity, Sportsbet.io understands the importance of privacy for its users. For the first deposit and withdrawals, only basic documentation is required, ensuring a hassle-free experience while maintaining the privacy of its users.

| Crypto Bonus | Wagering Requirements | Minimum Deposit | Available Currencies |

|---|---|---|---|

| No bonus | No bonus | $10 | BTC, ETH, LTC, DOGE, ADA, USDT, TRX, XRP |

- Pros

- eSports gambling

- Many game providers

- Cons

- Cashback bonus

- KYC and verification

10. Crashino – Best for Anonymous Gambling

Crashino ranks eighth in our list of casinos where players can deposit and withdraw Litecoin offers anonymous gambling, access to a large number of games for an unlicensed casino, and active promotions. For new players, the casino doesn’t provide an advantageous welcome offer offering only 300 free spins that can be redeemed over three total deposits and accessed on only a few slots. Other promotions are available on Crashino, including a 100% multi bonus for sports bets, 3+1 NBA bets, betting on Premier League with no risk, and 100% insurance bets.

Casino bonuses are also available, including slots tournaments and Twitter and Telegram community bonuses. Over 5,000 games are available on the platform with various options, including slots, jackpots, a sportsbook section with both traditional and eSports games, and a live casino with game shows and baccarat. Crashino deposits start at a minimum of $10, accepting tokens like BTC or LTC, while deposits start only from $50 with weekly price caps. As an unlicensed casino, Crashino provides support through live chat and a large social media presence, but still, players should exercise some form of caution when depositing.

| Crypto Bonus | Wagering Requirements | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 300 Free Spins | 15x | $10 | BTC, ETH, LTC, DOGE, SHIB, USDT, BCH, BNB, DAI, TRX, USDC |

- Pros

- Active support

- Anonymous gambling

- Cons

- Min withdrawal of $50

- Bad welcome bonus

Top Litecoin Casinos Compared

| Litecoin Casino | Welcome Bonus | Available Games | Live Games (Yes or No) | Minimum Deposit | Withdrawal Time | Accepts US players? (Yes or No) |

| Stake | 200% up to 1,000 | Slots, provably fair games, table games, jackpots, live casino, sportsbook | Yes | $10 | Instant | No |

| BC.GAME | 270% Deposit bonus up to 1 BTC | Slots, provably fair games, table games, jackpots, live casino, sportsbook | Yes | N/A | Instant | No |

| Cloudbet | 100% up to 5 BTC | Slots, provably fair games, table games, jackpots, live casino, sportsbook | Yes | 0.001 BTC | 24 hours | No |

| Bitcasino | N/A | Slots, provably fair games, table games, jackpots, live casino, sportsbook | Yes | 0.00025 BTC | Instant | No |

| Metaspins | 100% up to 1 BTC | Slots, provably fair games, table games, jackpots, live casino | Yes | 0.0001 BTC | Instant | No |

| Fortune Jack | 100% up to 6 BTC | Slots, provably fair games, table games, jackpots, live casino, sportsbook | Yes | N/A | Instant | No |

| Bitsler | 100% up to $700 | Slots, provably fair games, table games, jackpots, live casino, | Yes | N/A | 12 hours | No |

| Sportsbet.io | N/A | Slots, provably fair games, table games, jackpots, live casino, sportsbook | Yes | 0.00025 BTC | Instant | No |

| Crashino | 300 Free Spins | Slots, provably fair games, table games, jackpots, live casino, sportsbook | Yes | $10 | 24 hours | No |

| Thunderpick | 100% up to $500 | Slots, provably fair games, table games, jackpots, live casino, sportsbook | Yes | $1 | 24 hours | No |

What is Litecoin?

Launched on October 13th, 2011, Litecoin is one of the oldest altcoins in existence and is often dubbed as the ‘silver’ to Bitcoin’s gold.

It is a decentralized cryptocurrency designed for instant transactions and low transaction fees. Created in 2011 by Charlie Lee, the LTC token quickly gained popularity in the early days as it would be a faster and cheaper alternative to Bitcoin. Due to its fast and secure transactions, Litecoin has become a crypto gambling favorite as it’s been integrated into best crypto casinos, and the trend keeps growing.

Because Litecoin uses decentralized computing to conduct network transactions, every transaction on the network is approved by network validators instead of being approved by a governmental or centralized authority. This allows gamblers to keep part of their financial transactions secure. In addition, blockchain transactions are transparent and private, and Litecoin gambling is beneficial for players since it provides better fees than traditional fiat gambling currency. As such, LTC gamblers can rapidly access all popular crypto games from their favorite online casino.

Best Litecoin Gambling dApps

Several gambling dApps now offer Litecoin as a payment option to bettors on their platform. The Litecoin gambling dApps offer a wide array of betting options to gamblers who join their platform. Some of these betting options include casino games, sports betting, and dice games.

In addition to offering Litecoin as a payment option, Litecoin gambling dApps also offer several other cryptocurrencies as payment options for gamblers. Some of these payment options include crypto assets like Bitcoin, Ethereum, and Tether, to name a few.

Our recommended Litecoin dApps offer gamblers to enjoy fast payment options and excellent game selection. To find out the best Litecoin Gambling dApps, check out our Litecoin gambling dApps ranking.

Mobile Litecoin Casinos

Many crypto casinos are developing mobile gambling apps to increase the user experience of gamblers on their sites. As a result, many Litecoin casinos on our list offer mobile apps to gamblers on their platform.

You can find the mobile app of your favorite Litecoin casino on the Apple Store or Google Play Store. Litecoin casinos also offer downloads of the apps via their official websites. These mobile apps are generally compatible with Android and iOS devices.

If you decide to play on mobile, you’ll benefit from having your crypto wallet on the same device as your app. Thus, when you connect your wallet to your casino account, you can easily fund it before you start playing.

Advantages of Gambling with Litecoin

Gambling with Litecoin has several advantages, making it an appealing option for many players. Firstly, the transaction times are much faster than Bitcoin, which is particularly beneficial for in-game bets and withdrawing winnings since you can quickly get your funds out of the casino, resulting in seamless and fast gameplay without waiting for funds to appear in your wallet.

Another advantage of gambling with Litecoin is that it is one of the most secure networks available for transactions, and players don’t have to worry about a 51% attack on the network since the current hashrate is similar to Bitcoins. Additionally, players who deposit LTC have low transaction fees making the protocol more cost-effective by allowing players not to pay high fees and keep more of their winnings. This is especially advantageous for those who make frequent deposits and withdrawals.

Gambling with Litecoin also offers more anonymity compared to traditional payment methods. Transactions are processed with intermediaries, such as banks, making it easier for third parties to track and monitor transactions. This offers privacy and anonymity, which many crypto gamblers value regarding online gambling.

Downsides of Gambling with Litecoin

While Litecoin transactions are fast, secure, and provide anonymity for users, a few downsides should be considered. One downside of depositing and withdrawing LTC tokens is the associated volatility of Litecoin and the entire cryptocurrency market. For example, a player’s winnings could drop significantly by even 20% or 30% in hours if Litecoin experiences a sudden price drop. However, the same can be said when volatility goes to the upside and the price of LTC increases by 20% or more.

Additionally, governmental institutions only partially regulate crypto casinos that accept Litecoins and other cryptocurrencies. While they do have some form of license, Litecoin gamblers run the risk of having their funds stolen or encountering problems when trying to withdraw their winnings without the possibility of making any claims. Another downside is the additional fees players might have to pay when making conversions. While casino withdrawals have minimum fees, players could pay a higher premium when converting their LTC to fiat or vice versa. This can be frustrating for players who are trying to maximize their profits.

1. Understand LTC Price, Marketcap, and Charts

Anyone trying to buy LTC must have done a bit of research before deciding to go for it. You must spend time researching whether Litecoin is a worthy investment. You need to answer important questions, such as – “do I plan to trade or hold?” “will the digital asset be a short-term or long-term investment?” “does it match my financial goals?”

If you’ve answered these questions, you can check out the price online to see if it will be a good time to buy. Resource materials and charts online will point you in the right direction on whether to buy – or, better still, if it is the right choice. Several cryptocurrencies are competing, and the smart decision for any investor is to put money into one with the highest potential or value.

2. Decide a Purchase Method

The next step is to decide how you would like to buy an amount’s worth of LTC. Usually, there are different methods to buy this asset. However, two of them are;

- Crypto Exchange Platforms: The most common method to get Litecoin is to visit crypto exchanges like Coinbase, Binance, etc. They are reliable and even offer additional services to investors or traders.

- P2P Trading Platforms: Peer-to-peer trading is the next most common method. It is a framework where people are connected on a platform to buy and sell digital assets online. You can buy LTC with cash or another digital asset on P2P Trading platforms. Unfortunately, it isn’t the most reliable method because cases of scam users or platforms have been reported.

3. Start Trade for Litecoin

If you’ve decided how to buy an LTC asset, the next part is to start the trade. There is no other way to do that than to register/create an account or sign in to an exchange or P2P trading platform. If you are new to crypto, signing up to Coinbase, for instance, will be a good idea.

You will be asked to provide basic information, including your email address. A verification procedure comes next to confirm your identity. Eventually, you’d get an account on the exchange platform.

Once you are signed in, search for Litecoin or LTC. Tap on the crypto and click the (+) or “Buy” button.

4. Choose a Payment Method and Get Your Litecoin Asset

After tapping the “Buy” button, you will be asked to enter the amount of LTC you want to buy. With your previous knowledge of Litecoin price, you can determine how much value’ worth you want. Enter the amount and choose a payment method.

Ideally, deciding how you want to pay before getting this asset would be best. There are two ways to go about it: pay with cash (or card) or another cryptocurrency.

For the former, you can pay via bank transfer or credit/debit card. You will be charged fees for this transaction.

For the latter, if you have another cryptocurrency in your wallet, you can exchange it for an amount of Litecoin.

5. Store the LTC in a Wallet

The final part is submitting your order and waiting for the exchange platform to confirm payments. Most times, the exchange platform holds the digital asset. However, that only allows you to share control with the exchange platform. You may have to store Litecoin in a reliable crypto or digital wallet to have full control.

Generally, two types of wallets exist:

- The hot wallet holds cryptocurrencies that can only be accessed through an internet connection. Unfortunately, it poses more risk.

- The cold wallet holds cryptocurrencies that can be accessed offline. It is a low-risk wallet but, unfortunately, expensive.

Step-by-Step Guide to Playing with LTC

To play live dealer games, table games, or slots in any of our listed online gambling platforms with the LTC token, players must first possess the cryptocurrency and deposit it in their betting account. This section of the guide will describe how players can bet and wager on casino games using Litecoin.

The best way to buy LTC is on a trustworthy exchange since most of the top crypto exchanges offer traders opportunities to buy LTC. However, before buying Litecoin, traders must first open a Litecoin wallet to store their Litecoin effectively. Generally, crypto traders are urged to store their Litecoins in a secure Litecoin wallet.

First, users who wish to purchase Litecoin on a crypto exchange must create an account with that particular exchange. Users are usually required to submit their personal information to crypto exchanges. In such cases, gamblers must first register with the platform before making any purchases. Registered users can begin buying LTC as soon as they have completed registration.

1. Create A Litecoin Wallet

As previously stated, crypto traders and gamblers need to create a Litecoin wallet before creating a trading account on a crypto exchange. Litecoin tokens are usually stored in crypto wallets by crypto traders.

Nevertheless, some gamblers can purchase LTC directly from their crypto wallets. Those who wish to buy LTC tokens in their crypto wallet are strongly encouraged to carefully follow the instructions for making token purchases.

2. Buy Litecoin

Once users have set up their crypto account and crypto wallet, they can purchase LTC. You can buy Litecoin by going to the purchase section of your crypto exchange and selecting the LTC coin.

Once you have provided your wallet address, click on the buy button and select your payment method. Verify receipt of your LTC coins by checking your crypto wallet once the transaction is complete. Currently, the LTC token is available on crypto exchanges like Binance, Coinbase, Mandala, OKEx, to name a few.

3. Create an account at the Best Litecoin Casino

Gamblers who wish to bet with the LTC token must first select and register in a LTC casino. Our review team has created a list of the best LTC casinos available today, and new gamblers can select any of these gambling platforms to enjoy gameplay. After completing the registration process in their preferred Litecoin casino, casino players must make deposits for gameplay.

4. Deposit Litecoin Into Your Gambling Account

After you create your gambling account, you will need to make the first deposit to play online casino games at the casino of your choice. Casino players who wish to make a deposit should go to the cashier section of their gambling site.

As your preferred deposit method, choose Litecoin. A casino wallet address is usually given to gamblers, and it is their responsibility to transfer LTC to the address. Casinos instantly credit your casino account with your Litecoin deposit after confirmation.

5. Begin Gameplay

Almost all online casinos and gambling dApps offer welcome bonuses to new players. Among these offers are deposit bonuses, no-deposit bonuses, and free spins. You can begin playing as soon as you claim your bonus offer by selecting the casino game of your choice.

You can choose from a variety of casino games at our recommended LTC casinos. Roulette, baccarat, poker, and blackjack are among the table games available. In addition, there are live dealer games and video slots. Sportsbooks and esports betting options may be available on some sites.

How to Withdraw Funds from Litecoin Gambling Sites?

Withdrawing funds from Litecoin gambling sites is straightforward, but it is important to follow certain steps to ensure the process goes smoothly.

Step 1: Log into your account on the Litecoin gambling site

To withdraw funds from a crypto casino, you will need to log in to your account using your username and password.

Step 2: Navigate to the cashier or withdrawal section

Once you are logged in, navigate to the cashier or withdrawal section. This is where you will find the available cryptocurrencies, including LTC.

Step 3: Select Litecoin as your withdrawal method

From the drop-down menu, select Litecoin (LTC) as your withdrawal method in the withdrawal section.

Step 4: Enter the amount you wish to withdraw

Type in the amount you want to withdraw from your account. You can type the max button to withdraw all your LTC tokens if available. Ensure that the amount is within the limits set by the gambling site.

Step 5: Add your wallet address

Copy your LTC address from your wallet and paste it into the designated spot in the cashier section. Make sure to double-check your address since transfers are irreversible, especially when they are done on-chain.

Step 6: Confirm and wait for the funds to be processed

After confirming the withdrawal request, you must wait for the funds to be processed and deposited into your Litecoin wallet. Depending on how the casino processes LTC transactions, this can take a couple of minutes or 24-48 hours.

Step 7: Check your Litecoin wallet to ensure the funds have been received

Once the funds have been processed and deposited into your Litecoin wallet, check your wallet to ensure that the funds have been received.

Key Factors to Keep in Mind Before Choosing Any Litecoin Online Casinos

As a popular cryptocurrency with a market capitalization of over $5 million, LTC tokens have become a favorite gambling token, with almost all major crypto gambling platforms integrating the token. That said, not all Litecoin online casinos are created equal, and it’s important to know how to spot a good casino from a bad one. Here are some of the key elements you need to know before depositing LTC.

GEO Restrictions

You must check the casino’s terms and conditions and look for regional and local restrictions by checking where and if the casino is banned in your country. Depending on the license, some casinos restrict players from certain countries from using their platform, and even if players use a VPN, this can be risky since casinos can block access to the account entirely. Always verify that the Litecoin online casino you select is allowed to operate in your country.

Crypto Reputation

Before making a deposit, always research the casino by checking user reviews and reading up on any news and updates about the casino. You must ensure that if you’re gambling on a decentralized platform, your wallet won’t be attacked. To check the casino’s reputation, you can see the number of tokens it supports and if it processes transactions on-chain or requires manual approval.

Deposit & Withdrawal Speed

One of the main advantages of using LTC for deposits is the fast deposit and withdrawal speeds. A reliable crypto-gambling platform will deposit your funds into your account almost instantly and take a short time to process withdrawals. Make sure to read the terms and conditions to see how fast withdrawals take place – in case they require processing away from that casino.

Deposit Bonuses & Promotions

Crypto casinos offer large bonuses to keep players happy and increase retention. There are several reasons why Casinos can offer high bonuses – including asset volatility; however, make sure that the casino offers welcome bonuses while also including a VIP program to reward player loyalty, daily or weekly promotions, and slot or sports-specific bonuses, which can add more to your bankroll. Always check the wagering requirement, and you should keep an eye out for two essential bonus types:

Welcome Match Bonus

A welcome match-up bonus is a prize given to new payers when they deposit LTC. Typically, the casino will award players a 100% match-up bonus, up to a specific amount of 1 BTC or more. These bonuses come with limitations of having to be wagered 30 or 40 times, and wagering must be completed within 14 days or 30 days.

Reload Bonuses

A reload bonus is a reward for players that make a subsequent (second) deposit. Typically, the same restrictions applied by the reload bonus are regularly smaller in the match-up. The most frequent reload bonus we see is a 50% reload bonus, but it still helps your bankroll get a quick boost.

Protection & Security

Crypto wallets allow users to receive, store and send LTC. Crypto wallets not only store LTC, they also protect the cryptographic information of crypto holders. Different types of crypto wallets are available for storing Litecoin.

Hardware wallets are the most secure way to store cryptocurrency. Due to their ease of use and quick application, web and online wallets are more popular. To prevent token theft, ensure that your private keys are protected regardless of which wallet you use.

The following are simple steps that crypto gamblers can follow to secure their crypto assets and winnings:

- Create a strong password and store them in a safe location.

- Do not use a web wallet or hardware wallet that you are not sure of.

- Your internet connection and device should be secure.

- Be sure the casino uses SSL encryption to safeguard its site.

How We Rate Litecoin Casinos?

Before listing any gambling site on our platform, our review team carefully examines several essential features. Our guide will look at some of the vital features we consider before listing Litecoin casinos on our platform.

Licensed and Provably Fair

We ensure that all Litecoin casinos featured on our website are licensed and regulated by leading gambling regulatory bodies like Malta or Curacao. Additionally, these casinos must deliver fair business practices, security and provably fair games to users before we rank them.

Bonuses

Our list of LTC casinos offers cool bonuses for new and existing players. You should check out welcome bonuses and free spins if you are a new player. Other casino bonuses include deposit bonuses, cashback, no deposit bonuses, and more. Players can earn winnings from jackpots and play in special tournaments at our Litecoin casinos.

Customer Support

Our rankings also take into account the quality of customer support offered by each site. As a result, all listed gambling sites on our platform deliver fast and responsive customer service to their users.

Game Selection

Our best casinos list also showcases Litecoin gambling sites that offer a wide variety of excellent casino games. Gamblers can expect to find live dealer games such as roulette, blackjack, baccarat, table games, poker, and video poker games on our list of Litecoin casinos. Also available to gamblers are slot games, esports, and sportsbooks. All of these games are delivered by the best casino game providers in the gambling industry

Payment Option

Casinos on the list of the best Litecoin casinos also accept a variety of other payment methods in addition to Litecoin. Among these options are Bitcoin, Bitcoin Cash, Tether, Ethereum, credit cards, bank transfers, and e-wallets.

Conclusion

Litecoin is the second most used cryptocurrency to deposit on crypto casinos, and its reputation as the second digital token will help Litecoin offer players the ability to deposit faster and cheaper than Bitcoin. In this article, we’ve seen what you need to look out for when choosing a crypto casino, including geo-restrictions, available bonuses, and speed of payouts. Additionally, LTC tokens come with inherited risk or volatility, but that’s the case for almost every digital token – aside from Stablecoins, for players who want partly anonymous crypto gambling and still benefit from a highly secure LTC casino, BC.GAME is our top recommendation since players can deposit using over 66 tokens; it offers a high welcome bonus and includes over 10,000 games. LTC gambling has changed how players interact with casinos and how quickly they can withdraw their winnings while still keeping their wallets private.

How do I choose the top Litecoin casinos?

To choose the top Litecoin casinos, players should look for certain qualities such as licensing and regulation, accreditation from trusted third-party agencies, a wide variety of games, fast and secure payment and withdrawal options, responsive customer support, and positive user feedback.

What are Litecoin casino games?

Litecoin casino games are games that can be played with Litecoin as the betting currency. These games include slots, table games, live dealer games, and sports betting. Some popular Litecoin casino games include blackjack, roulette, craps, baccarat, and video poker.

Are Litecoin casinos safe?

Yes, as long as you play at reputable and licensed Litecoin casinos. These sites use advanced encryption and security protocols to protect players’ personal and financial information, and they are audited regularly by third-party agencies to ensure fairness and legitimacy.

Can I play Litecoin slots online?

Yes, many online casinos offer slots of games playable with Litecoin.

Can I use Litecoin for online gambling?

Several online casinos and betting sites allow players to deposit, wager, and withdraw in Litecoin.

How is Litecoin different from Bitcoin?

Litecoin was created as a lighter and faster-spinning alternative to Bitcoin, with a shorter block time and a different hashing algorithm. This makes Litecoin transactions faster and cheaper than Bitcoin transactions.

Other Cryptocurrency Casinos

Facts Checked by Josip Putarek, Senior Author

julien@contentbydesign.ca

julien@contentbydesign.ca