4.9

- Personalised bonus offer

- Provably Fair Games

- Low House Edge

- Popular casino

- Sportsbook with eSports

- Some of the best odds

4.6

- Wager Free Bonus

- Shared House Profits

- Free Faucets

4.6

- Live Casino

- Generous welcome bonus

- Large selection of games

- Many cryptos available

- Quality Casino Games

- Esports

- Fast payouts

- Provably Fair Games

- Free Spins

4.5

- Daily Cashback

- 89 live casino titles

- crypto rewards

- Live Casino

- Great Welcome Offer

- Large selection of games

- Great Welcome Offer

- Crypto Games

- VIP Programme

- No KYC needed

- VPN friendly

- Instant withdrawal

Ranked: Our Bitcoin Cash Gambling Site Picks

- BC.Game: Best Overall Bitcoin Cash Casino

- Cloudbet: BCH Gambling Site with long Standing Reputation

- BetFury: Best Upcoming Bitcoin Cash Casino

- BitStarz: BCH Gaming SIte with 5BTC Welcome Bonus and 180 Free Spins

- Bitsler: Best BCH Casino with Mobile App

- Winz.io: Bitcoin Cash Casino with 5,000+ Titles

- Bets.io: Beginner Friendly Bitcoin Cash Gambling Website

- mBit: Best Long Standing Casino with High Security Features

- Mirax: Best Latest Bitcoin Cash Gaming Platform

- Metaspins: Multilingual Gambling Site with Competent Customer Care

Bitcoin Cash Casino Sites Reviewed

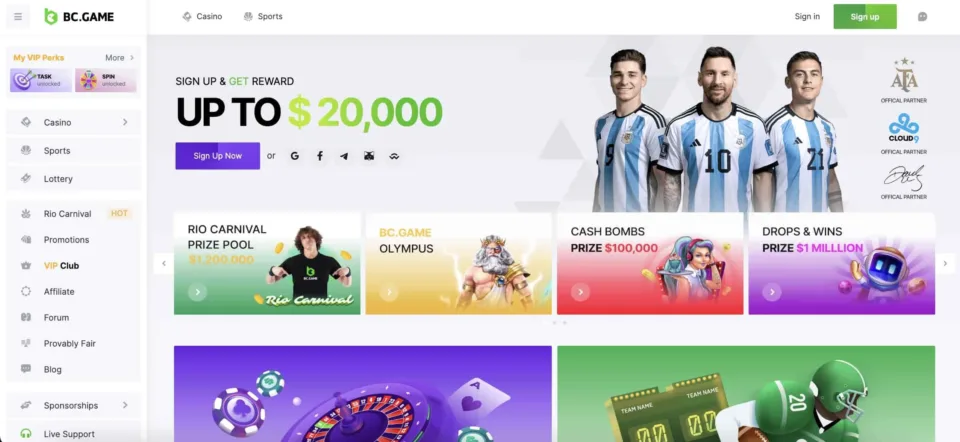

1. BC.Game: Best Overall Bitcoin Cash Casino

BC.Game is our number one BCH gambling site. It’s a one-of-a-kind website providing crypto casino gambling and sports betting since its establishment in 2017. Owned and operated by BlockDance B.V. under the Curaçao License #5536/JAZ, BC.Game offers 6,000+ games, including popular slots, table games, provably fair games, and a live casino. You can gamble with BCH, BTC, ETC, USDT, SOL, and more. If you don’t already have your desired crypto, you purchase it on the website using fiat. Anyone can get started on this platform thanks to its easy sign-up process requiring only an email address and a strong password to create an account. There are no KYC requirements during sign-up. To start playing, you only need to deposit a minimum of 0.001 BTC or equivalent in a crypto of your choice. There are no maximum withdrawals at BC.Game. Although payments are approved instantly, the time taken to access your funds may vary depending on the blockchain verification process of your selected crypto. The support team is competent, responsive, and kind. If English is not your first language, you can use the website in any of the other 16 supported languages, including French, Portuguese, Spanish, Turkish, Russian, Polish, Vietnamese, Chinese, German, and Hindi. In terms of security, BC.Game is safe and reliable. It’s licensed in Curacao and offers a stable gambling platform protected by SSL encryption technology

| Crypto Welcome Bonus | Wagering Requirement | Minimum Deposit | Supported Cryptos |

|---|---|---|---|

| 220,000 USDT for casino only | 25x | 10 USDT | AVAX, BTC, ETH, DOGE, XRP, ADA, DOT, TRX, BNB, AVAX, SOL, MATIC, CRO, FTM, RUNE, ATOM, NEAR |

- Pros

- Good reputation

- Multiple bonuses

- Provably fair games

- Casino and sportsbook

- Cons

- Restricted in many countries

2. Cloudbet: BCH Gambling Site with Long-Standing Reputation

Cloudbet.com is a renowned online gambling site that has been operating since 2013. It’s licensed in Curacao under license number 1668/JAZ and is owned by Halcyon Super Holdings. With a focus on cryptocurrency gambling, Cloudbet offers a wide range of betting options, including casino games, live dealer games, and an extensive sportsbook. The casino section features a diverse selection of games, such as slots, table games, video poker, and progressive jackpots. Leading software suppliers, including Microgaming, Betsoft, and Evolution Gaming, supply the games, guaranteeing excellent visuals and smooth gameplay. The live dealer games add an immersive touch, allowing players to experience the thrill of a real casino without leaving their homes. Crypto enthusiasts can wager with a wide selection of over 30 digital coins and tokens. While it allows users to purchase virtual money on its website, keep in mind that a 5% conversion and processing fee may apply. The platform does not charge any fees to gamers who deposit and withdraw via Bitcoin Cash and other cryptos. All payments are instant, and you won’t be subjected to minimum and maximum withdrawal limits. If you are planning to sign up, don’t hesitate because the website offers a 100% welcome bonus of up to 5 BTC to new members. Across the year, it continues offering more bonuses amounting to millions of dollars. We found it secure and reliable during this review. No wonder it enjoys a 4.9/5 dappGambl rating.

| Crypto Welcome Bonus | Wagering Requirement | Minimum Deposit | Supported Cryptos |

|---|---|---|---|

| 100% up to 5BTC | Point system 0.001 BTC released per 150 points | 0.001 BTC | BTC, PAXG,stETH, BCH, BNB, DASH, LTC, SOL, AVAX, ZCASH, DOT, LINK, UNI, FTM, MATIC, EOS, ADA, ALGO, BUSD, DAI, USDP, USDC, USDT, UST, DOGE, XLM, TRON, LUNC, SHIB |

- Pros

- Many payment options

- Casino and sportsbook

- Great welcome bonus

- Long standing reputation

- Cons

- Restricted in some countries

3. BetFury: Best Upcoming Bitcoin Cash Casino

BetFury is a 2019 established online crypto-gambling platform operating with a Curacao gaming license. Players can enjoy various categories of more than 5,000 games, including slots, table games, live casino games, and virtual games. The platform collaborates with renowned software providers such as Pragmatic Play, BGaming, and Evolution Gaming, ensuring a diverse and high-quality gaming experience. In addition to its impressive game collection, BetFury stands out for its unique feature called “in-house games.” These exclusive games add an extra element of excitement and allow players to participate in special events and challenges for additional rewards. It also has an excellent sportsbook with over 80 sports and thousands of daily events. Football, basketball, baseball, hockey, rugby, and tennis are among the major sports offered. The Bitcoin Cash casino also allows players to wager using over 35 other cryptocurrencies ranging from major coins like BTC, ETH, and LTC to less-known tokens such as BSW, MKR, GLM, and LINK. Users enjoy rewarding bonuses from the moment they sign up. New players get up to 1000 free spins and $3,500 worth of prizes upon successfully funding their accounts for the first time. The platform also runs numerous ongoing promos in cashbacks, free spins, coin drops, and more. In addition, users can take part in simple daily activities for a chance to earn free BTC and the casino’s native coin BFG. You may engage in staking and farming to earn passive income when not gambling.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Other Cryptos Available |

|---|---|---|---|

| No Crypto Bonus | N/A | 0.00015 BTC | BTC, BFG, 1INCH, AAVE, ADA, AIRT, AXAX, BABY, BANANA, BAT, BCH, BNB, BSW, CHZ, COMP, DAI, DASH, ENJ, ETC, ETH, FTM, GLM, ONT, PORTO, REEF, SHIB, SNX, USDT, YFI, ZIL, ZRX, SOL, STORJ, SUSHI, TRX, UMA, UNI, USDC, WIN, XLM, XRP, MATIC, MKR, OMG, LINK, CAKE, BUSD, BTT (Old), BTT (New), |

- Pros

- Fast payouts

- Highly intuitive

- Interesting promos and rewards

- Many payment options

- Cons

- Unclear information about owners

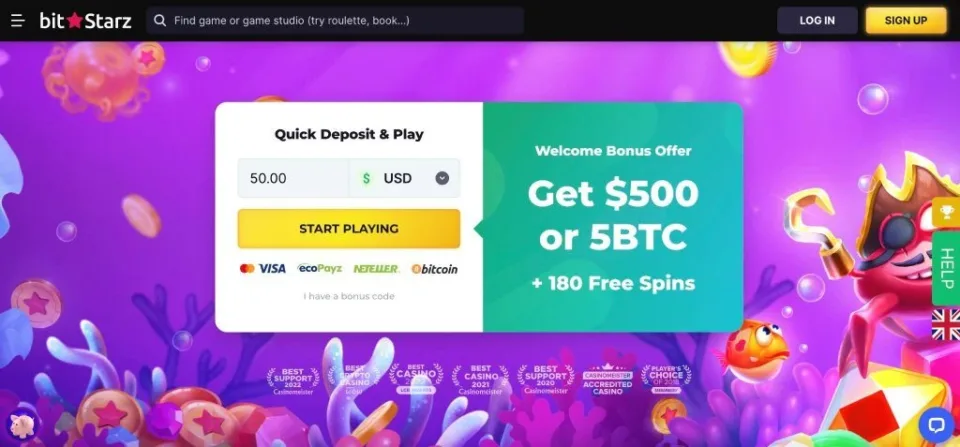

4. BitStarz: BCH Gaming Site with 5BTC Welcome Bonus and 180 Free Spins

BitStarz Casino is another well-known BCH online gaming site providing a large selection of casino games and a smooth cryptocurrency gambling environment. It was started in 2014 and has since gained popularity among players all over the world. BitStarz is owned by Direx N.V. Casinos and is governed by Curacao law. With over 4,000 games available, players can enjoy a diverse selection of slots, table games, live casinos, and more. The casino collaborates with leading game developers like Pragmatic Play, Evolution, BGaming, NetEnt, Kalamba, and EndoPlay, ensuring high-quality graphics, smooth gameplay, and immersive audio. Apart from BCH, it supports multiple cryptocurrencies, including Bitcoin, Ethereum, and Litecoin, making it a preferred choice for crypto enthusiasts. Though you can only wager in digital money, the platform allows in-house virtual coins purchase using traditional fiat currencies, offering flexibility to players. Deposits and withdrawals are quick and secure, with various payment options available. It offers free play for some games, allowing you to test its game mechanics and get a feel of the user experience before depositing funds. On signing up, new users are welcomed by a whopping 300% bonus up to 5BTC and 180 free spins. Support is available in English, Russian, Chinese, Japanese, and Portuguese, perfectly catering to a diverse user community.

| Crypto Bonus | Wagering Requirements | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 300% deposit match up to 5 BTC | 40x | 0.0001 BTC | BTC, BCH, LTC, ETH, DOGE, ADA, XRP, USDT, TRX, BNB |

- Pros

- Long standing reputation

- Attractive welcome bonus

- Reputable owners

- 4,000+ games

- Cons

- Restricted in some countries

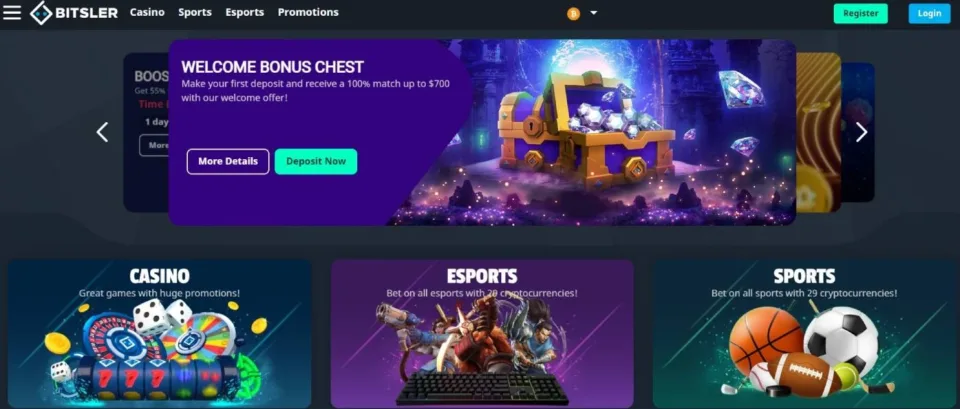

5. Bitsler: Best BCH Casino with Mobile App

Bitsler is an established online gambling site that has been in business since 2015. It has a diverse selection of 3,000+ games and also offers attractive sports betting opportunities, making it a popular choice for Bitcoin Cash gamblers. You may also wager using XRP, BUSD, ZEC, LTC, BTC, ETH, XLM, and more. There are no minimum or maximum transaction limits on this website. Transactions also happen at near-instant speed at zero platform charges. Transparency builds trust and ensures a fair gaming experience. The games are provably fair, which means that players can use cryptographic procedures to validate the fairness of each outcome. Bitsler’s user interface is straightforward, making it simple for both new and expert gamers to browse the site. The registration process is easy, and players can begin playing with just a few mouse clicks. Furthermore, the site is fully optimized for mobile devices, allowing gamers to play their favorite games while on the go. You may engage in mobile gambling via the mobile web browser or downloadable application for Android and iOS devices. Unlike BC.Game or BitStarz, this website isn’t multi-lingua. It only caters to English and Spanish speakers. We gave an overall rating of 4.1/5 at dappGambl.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Other Cryptos Available |

|---|---|---|---|

| None | N/A | No Limits | BTC, ETH, XRP, LTC, USDT, DOGE, BUSD, ADA, ETC, BCH, ZEC, DGB, EOS, XLM, TRX, and DASH |

- Pros

- Long standing reputation

- Licensed and trustworthy

- Multiple crypto options

- Cons

- No crypto welcome bonus

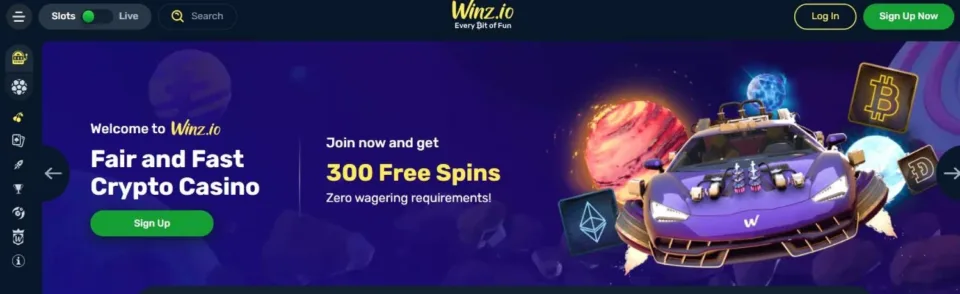

6. Winz.io: Bitcoin Cash Casino with 5,000+ Titles

Winz.io, the self-proclaimed king of crypto casinos, was established in 2020. It’s owned and operated by Dama N.V. under a Curacao license. With a remarkable library of over 5,000 titles, players can indulge in various categories such as slots, provably fair games, bonus buys, drops & wins, table games, mega ways, and jackpot games. Sports lovers can bet on 1300+ soccer matches, 250+ basketball games, and at least 110 tennis tournaments. The bookmaker section also offers sports like ice hockey, handball, badminton, volleyball, cricket, darts, cycling, boxing, formula 1, and more. Winz.io caters to different player preferences with its support for diverse payment methods. Crypto enthusiasts can deposit funds using BCH and ten other virtual currencies, including USDC, USDT, ADA, TRX, and DOGE. There is a minimum deposit requirement of 0.0001 BTC or equivalent and a maximum monthly cash-out cap of 400,000 USDT or equivalent. All payments are processed instantly. The website is user-friendly with an intuitive feel. Navigation is easy even for first-timers. Whenever you need help, do not hesitate to contact the support department via live chat, email, or contact form. The customer care team is patient, understanding, and highly knowledgeable. Winz.io uses SSL encryption to offer security and enhance data privacy. You may also activate the 2FA security layer to neutralize any threats of compromised credentials.

| Crypto Bonus | Wagering Requirements | Minimum Deposit | Available Currencies |

|---|---|---|---|

| None | N/A | 0.0001 BTC | BTC, ETH, XRP, LTC, USDT, DOGE, BNB, BUSD, ADA, ETC, BCH, ZEC, DGB, EOS, XLM, TRX, DASH |

- Pros

- Crypto friendly

- High transaction limits

- 24/7 live support

- Cons

- Bonuses geo-restricted

7. Bets.io: Beginner-Friendly Bitcoin Cash Gambling Website

Bets.io is a reputable Curacao-licensed crypto casino that offers a wide selection of games, convenient payment options, and exciting bonuses. With its commitment to providing a top-notch gambling experience, it has become a popular choice for players seeking an immersive and rewarding online betting platform. The 2021 established website has everything you need to enjoy a thrilling and enjoyable gaming journey. Players can indulge in over 3,000 games, including slots, table games, live dealer games, and more. Every sort of gambler is catered to. To protect users’ personal and financial information, the casino implements industry-standard security measures such as SSL encryption techniques. This contributes to a safe and secure environment in which players can enjoy their gaming experience. It further employs certified and audited random number generators (RNGs) to ensure that the game results are fair and unpredictable. What’s more, it offers provably fair titles that come with high RTPs. So you can rest assured that you have a reasonable possibility of winning. In terms of payments, you may play with at least ten other coins in addition to BCH. There is a minimum deposit requirement of 0.001 BTC or equivalent and a maximum cashout limit of 30,000 USDT or equivalent per day. Bets.io also has a user-friendly interface, making it easy for players to navigate and find their preferred games. The website is designed to provide a seamless and enjoyable experience, whether accessed on a desktop or mobile device.

| Crypto Bonus | Wagering Requirements | Minimum Deposit | Available Currencies |

|---|---|---|---|

| Up to 1BTC | 40x | 0.0001 BTC | BTC, BCH, ETH, LTC, DOGE, USDT, XRP, ADA, BNB, TRX, USDC, BUSD |

- Pros

- Responsive mobile browser terminal

- 3000+ games

- Welcome bonus up to 1BTC

- Multiple ongoing offers

- Multi-lingual operator

- Cons

- No sportsbook

8. mBit: Best Long Standing Casino with High Security Features

At number eight comes mBit, a renowned online gambling platform catering to cryptocurrency enthusiasts. Established in 2014, mBit Casino has gained a strong reputation in the industry for its extensive game selection, generous bonuses, and reliable customer support. It is owned and run by Direx N.V., a reputable eGaming firm with a Curacao license that oversees more than ten prosperous online gambling sites. Regarding game variety, mBit Casino offers an impressive collection of over 2,000 games from leading software providers like Endorphina, Habanero, Spinomenal, Evolution, Wazdan, and Kalamba. Players can explore various options, including slots, table games, live dealer games, and progressive jackpots. The platform constantly updates its game library to ensure players have access to the industry’s latest and most popular titles. Additionally, the games featured on the site undergo regular testing for fairness by independent auditors, ensuring players have a fair chance of winning. In terms of bonuses and promotions, mBit Casino doesn’t disappoint. New players are greeted with a generous welcome package of a 300% deposit match up to 4 BTC. The casino also runs regular promotions and tournaments and has a VIP program to reward loyal players and enhance their gaming experience. A 256-bit SSL encryption secures the website to protect user data from hackers. Additionally, mBit offers a 2FA security feature for enhanced account safety.

| Crypto Bonus | Wagering Requirements | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 300% up to 4 BTC | 40x in 7 days | 0.00035 BTC | BTC, ETH, LTC, DOGE, USDT, BCH, XRP |

- Pros

- Speedy transactions

- Wide game selection

- Generous welcome bonus

- Cons

- High wagering requirements

9. Mirax: Best Latest Bitcoin Cash Gaming Platform

Mirax Casino is one of the newest BCH casinos. It was established in 2022 under a Curacao license and is owned and operated by Hollycorn N.V. Apart from Bitcoin Cash. The platform supports other digital currencies like ETH, XRP, DOG, USDT, and BNB. All payments are processed instantly. However, there is a minimum deposit requirement of 0.0001 BTC for deposit and a transaction fee of 0.00002 BTC when cashing out. There was no maximum withdrawal limit as of writing this. Users are spoilt for choice, with over 7,000 games available. You can choose from different varieties of Live casinos, Slots, Table Games, and the latest trending crypto games like Plinko, Hi-Lo, Mines, and Crash games. NoLimit City, Playtech, NetEnt, Kalamba Games, Evolution Gaming, Red Tiger Gaming, Pragmatic Play, ELK Studios, Betsoft, 1x2gaming, Avatar UX, and Belatra Games are among the leading software publishers. Rewards offered range from welcome bonuses to ongoing promos. New users start their journey with up to 5 BTC +150 free spins in sign-up rewards. This amount must be wagered 45 times within 14 days before cashing out. Existing players access multiple seasonal and ongoing cashback and free spins offers. There is also a ten-tier VIP program with prestigious rewards in bonuses. You may feel left out if you’re not fluent in English, as the website is unavailable in any other language. Security-wise, there is no question as Mirax is safe and has zero histories of fraud and or successful hacking.

| Crypto Bonus | Wagering Requirements | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 325% up to 5 BTC | 45x in 14 days | 0.0001 BTC | BTC, BCH, LTC, ETH, XRP, DOG, USDT, BNB, TRX & ADA |

- Pros

- Instant payments

- Favorable deposit limit

- Attractive welcome bonus

- Cons

- Only available in English

10. Metaspins: Multilingual Gambling Site with Competent Customer Care

Like Mirax, Metaspins is a relatively new online casino operating since 2022. As a platform regulated under Curacao, it’s safe and reliable, complying with the highest industry standards. The site is encrypted with SSL technology, safeguarding sensitive information and transactions. Additionally, user accounts are equipped with two-factor authentication (2FA) for an extra layer of protection. Regarding responsible gambling, it offers cooling-off periods and self-exclusion and does not allow underage gaming. Enjoy over 2,500 games ranging from classic slots, table games, and crypto games. Players can make payments using BCH, BTCH, LTC, ETH, and more. There is a minimum deposit limit of 0.0001BTC or equivalent. However, when it comes to withdrawals, you are not limited. The operator also allows zero-fee transactions. Of course, you still have to settle network fees. The customer care team was friendly to us during this review. We found the team highly skilled and competent in matters of gambling and cryptocurrencies. The casino offers language options for non-English speakers, including French, German, Norwegian, Portuguese, Finnish, and Spanish, ensuring a more inclusive and accessible experience for players from various backgrounds. Overall, Metaspins has a dappGambl expert rating of 4.3/5.

| Crypto Bonus | Wagering Requirements | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 100% deposit match up to 1BTC | 25x | 0.0001BTC or equivalent | BTC, BCH, DOGE, ADA, USDT, TRX, USDC |

- Pros

- Low wagering requirements

- Multi-lingual support

- Low minimum deposit limit

- 2,500+ games

- Cons

- Few cryptos supported

Top Bitcoin Cash Casinos Compared

| Welcome Bonus | Available Games | Live Games (Yes or No) | Minimum Deposit | Withdrawal Time | Accepts US players? (Yes or No) | |

|---|---|---|---|---|---|---|

| BC.Game | 220,000 USDT | 6,000+ | Yes | 10 USDT | Instant | Yes |

| Cloudbet | 100% up to 5BTC | Yes | 0.001 BTC | Instant | No | |

| BetFury | None | 5,000+ | Yes | 0.00015 BTC | Instant | Yes |

| BitStarz | 300% deposit match up to 5 BTC | 4,000+ | Yes | 0.0001 BTC | Instant | No |

| Bitsler | None | 3,000+ | Yes | No limits | Instant | No |

| Winz.io | None | 5,000+ | Yes | 0.0001 BTC | Variable | Yes |

| Bets.io | Up to 1 BTC | 3,000+ | Yes | 0.0001 BTC | Instant | No |

| mBit | 300% up to 4 BTC | 2,000+ | Yes | 0.00035 BTC | Instant | Yes |

| Mirax | 325% up to 5 BTC | 7,000+ | Yes | 0.0001 BTC | Variable | No |

| Metaspins | 100% deposit match up to 1BTC | 2,500+ | Yes | 0.0001BTC or equivalent | Instant after approval | No |

What is Bitcoin Cash?

Bitcoin Cash (BCH) is a fast-growing peer-to-peer electronic cash launched in August 2017 as a hard fork of the original Bitcoin (BTC) network. It was developed to address some of the scalability issues and transaction speed limitations of Bitcoin. It places a strong emphasis on being a medium of exchange and facilitating everyday transactions.

Bitcoin Cash (BCH) is a fast-growing peer-to-peer electronic cash launched in August 2017 as a hard fork of the original Bitcoin (BTC) network. It was developed to address some of the scalability issues and transaction speed limitations of Bitcoin. It places a strong emphasis on being a medium of exchange and facilitating everyday transactions.

Bitcoin Cash proponents argue that its larger block size and lower transaction fees are essential for any cryptocurrency aiming to serve as a daily use digital currency. It was built with a block size of 8MB, allowing more transactions to be processed in each block, ultimately reducing congestion and guaranteeing lower transaction fees. Like BTC, it’s reliable, simple to use, stable, and highly secure. Despite running on slightly different concepts, there are certain technological commonalities between Bitcoin and Bitcoin Cash.

For example, they both use the proof of work consensus mechanism. Bitcoin Cash also maintains a maximum coin supply cap of 21 million. In the shortest time it has been available, BCH has quickly grown into one of the most transacted cryptocurrencies, as it has found use cases in many industries, including gambling. It is also more affordable than BTC, attracting a huge market base.

As of writing this, BCH had a total coin supply of about 19 million and a market cap of $2,247,296,641. A single coin was going for $115.25. This is way lower than its highest price of about $3,900, achieved in December 2001, shortly after launch. You can purchase it in most crypto exchanges, including Binance, Kraken, Coinbase, Gemini, and Bittrex.

How to Find the Best Bitcoin Cash Casino?

Now that many gambling sites accept BCH, finding the best Bitcoin Cash casino may be tough. Here are some steps to follow:

- Research and Reviews: Look for rankings and reviews of Bitcoin Cash casinos online. This will give you an understanding of various platforms’ reputations, trustworthiness, and user experiences. In addition, pay close attention to user feedback on the selection of games, customer service, withdrawal procedures, and general satisfaction.

- Check Licensing: Check if the Bitcoin Cash casinos you are considering are authorized and governed by a recognized body like UK Gambling Commission, Curacao Gaming Authority, and Malta Gaming Authority. This promotes fair games, financial security, and compliance with rules and guidelines. You may want to steer clear of unlicensed platforms for your safety.

- Consider Payment Options: Check if the Bitcoin Cash casino supports convenient and secure payment options for deposits and withdrawals. Look for casinos that offer seamless transactions with Bitcoin Cash and other popular cryptocurrencies like BTC, ETH, USDT, and more. You may also consider a site that allows in-house crypto purchases with fiat if you don’t already have BCH in your cryptocurrency wallet. Finally, don’t forget to check if the casino has proper security measures to protect your funds.

- RNGs and Provably Fair Gaming: Consider if the Bitcoin Cash casino employs provably fair technology. Provably fair algorithms provide verifiable evidence that the games are fair and unbiased, offering transparency to players. While some games may not be provably fair, they should use verified random number generators (RNGs) to offer randomness of game outcomes.

- User Experience: Lastly, ask yourself how you generally feel about the casinos you are considering after assessing all the above factors. You want a certain sense of fulfillment when gaming. Evaluate the user interface taking into account the overall design, ease of use, intuitiveness, and navigation. Accessibility of both PC and mobile platforms may matter too. A user-friendly interface, smooth navigation, and responsive design contribute to a better gambling experience.

- Pros

- Absolutely fantastic security due to blockchain protection

- Extremely fast payment processing

- Low transaction fees

- Is increasing in popularity amongst users

- Cons

- BCH isn’t as well known as BTC, so it’s harder to find casinos that accept it

- It isn’t always used to play the games and will be exchanged to other cryptos or fiat

Are Bitcoin Cash Casinos Popular?

Bitcoin Cash casinos are becoming increasingly popular among cryptocurrency aficionados and online gamblers. While they have not yet become as common as traditional online casinos, they have acquired a sizable user base because of the coin’s benefits. Bitcoin Cash casinos provide various advantages to players, including fast and secure transactions, fewer fees compared to traditional payment methods, and the chance to remain anonymous when wagering.

Most gaming sites supporting major coins like BTC and ETH also accept BCH. It’s becoming rare to find an online crypto casino that doesn’t support it, even if the site only offers as little as five cryptocurrencies. The coin’s high market cap of over $2 billion is indicative of the high user demand behind it. If you have read this review from the start, you may have noticed that some of the world’s best online digital wagering sites dominate our top list. So, yes, Bitcoin Casinos are popular. As the adoption of cryptocurrencies continues to grow and more people become familiar with the virtual currency and its advantages, we expect to see increased popularity of Bitcoin Cash casinos.

However, it’s important to note that the popularity of individual websites may vary depending on factors such as their reputation, game selection, and user experience. It’s always essential to conduct thorough research and choose a reputable and well-established gaming site to ensure a safe and enjoyable gambling environment.

How do Bitcoin Cash Casinos Work?

It depends on the provider you choose to play at. Some will purely allow for crypto payments to be made. This means that when you make your deposit with your Bitcoin Cash wallet, that balance will then be used to play the different games that are in place. It means that you will both win and lose BCH when you play a game. For cryptocurrency enthusiasts, this is without a doubt the best way to play.

There are also hybrid casinos available to players. These can work in two different ways. The first way is that deposits can be made using both crypto and fiat currency and that will then be used to play the different games. So, if you deposited 1 BCH, you would then use that to play games, but if you deposited $50 then you would use that instead. This is the best scenario for crypto players because it means that your crypto is treated as such when a deposit is made.

Other hybrid casinos will change the crypto deposit into fiat after it has been made. So, you might deposit BCH but that will then be converted into dollars in order to play the games. This is not something that crypto players will find appealing as it means any price rises from crypto inherent volatility will be lost. There is also the possibility that withdrawals with crypto aren’t possible, so this is something else to look out for before signing up to play.

It’s also important to understand that BCH gambling platforms operate just like any other crypto casino out there. So, the games are all registered and work legally. On top of this sites that feature provably fair games have the instant ability to prove if a game is behaving in a statistically fair manner.

How to Sign up for a Bitcoin Cash Casino?

Signing up with a BCH casino is easy and should take under five minutes. While the process might vary from one website to another, we present to you a general guide below:

- Pick your preference: First, research and choose a reputable Bitcoin Cash casino considering the factors we discussed earlier, like safety, reputation, customer care, and game selection.

- Create an account: Go to the Bitcoin Cash casino’s website and look for the “Sign Up” or “Register” button. Click on it to begin the registration process. You will be redirected to the sign-up page to fill out a registration form. This typically involves submitting your username, password, and email address. You may also be asked for personal information such as your name and date of birth. Double-check to confirm the accuracy of the information, then submit it.

- Account verification: Depending on the casino you selected, you may be required to complete a form of account verification before proceeding. This might be as simple as confirming your email address by clicking a link sent to your inbox or providing documentation, such as proof of identity or address. However, some of our best BCH casinos may not ask for such info during sign-up.

- Deposit Bitcoin Cash: You are now good to go. However, you must fund your account to start gambling. Select Bitcoin Cash as your chosen payment option in the deposit area. The casino will provide a unique deposit address to send your Bitcoin Cash. Copy the address and use your Bitcoin Cash wallet to send the desired amount of funds to that address.

- Start playing: The funds will be credited to your casino account once your deposit is validated. Depending on the operator’s payment policies and network status, this should take anywhere from ten minutes. Then you may browse the available games, pick your favorites, and begin playing.

How to Make Deposits and Withdrawals in Bitcoin Cash Casino?

Cashing out from a BCH casino is easy. Once ready, follow these steps. Remember, they may vary slightly across different sites.

Making a Deposit with Bitcoin Cash

Step 1: Create a Bitcoin Cash Wallet

Step 2: Buy Bitcoin Cash

Step 3: Sign Up for your Casino of Choice

Step 4: Select Bitcoin Cash for Deposit

Step 5: Get the Casino Bitcoin Cash Wallet Address

Step 6: Send Bitcoin Cash

Step 7: Start Playing

Making a Withdrawal with Bitcoin Cash

Step 1: Open your Wallet and Acquire your Withdrawal Address

Step 2: Open the Profile Part of your Casino Account

Step 3: Select the Withdrawal Option

Step 4: Wait for your BCH to be Sent

Key Factors to Keep in Mind Before Choosing Any Bitcoin Cash Online Casinos

Here are the main elements we evaluate while choosing a Bitcoin Cash gaming platform.

BCH Bonus Availability

There aren’t any specific bonuses that are related to Bitcoin Cash at the moment. This doesn’t mean that you won’t be able to get access to any though. There are a lot of excellent cryptocurrency bonuses on the market at the moment. So, while they aren’t directly geared towards BCH, they can still be claimed from BCH deposits as long as the casino supports the use of Bitcoin Cash.

It’s vital to check out the terms and conditions before making your deposit though. Some sites might not offer a BCH bonus, so if you want to get access to one, you’ll have to find the right site to do so.

GEO Restrictions

Different regulatory requirements define the territories within which casinos can operate. That means while a website might be accessible to you, it may not permit players from your region to create an account. While you may be lucky to successfully sign up and even start gambling, you risk losing your account and money if caught. To avoid such complications, it’s essential to ensure you only wager on sites where you are not restricted. You can always check the terms and conditions of a casino for signing up to get this information. If still unsure, send an email to the support team for clarity.

Crypto Reputation

Reputation is a key element to consider when selecting a platform for wagering. You want to avoid manipulative sites that may hold your money and refuse to pay your winnings. For the best user experience, always stick with legitimate and highly reputable websites. Apart from checking licensing information, you also want to read user reviews on platforms like TrustPilot. Professional reviews websites like dappGambl could be another place to learn about crypto casino reputation.

Deposit & Withdrawal Speed

Deposit and withdrawal times are critical components of the overall gambling experience. Faster deposit and withdrawal times allow you to fund accounts instantly and begin playing without any extra delays. Similarly, quick withdrawals ensure that players may access their profits as soon as possible, increasing overall satisfaction and enjoyment of the gambling experience. In addition, quick deposit speeds enable players to seize favorable betting opportunities and capitalize on real-time events. Similarly, high withdrawal rates will allow you to withdraw funds quickly to take advantage of other investment possibilities or utilize earnings elsewhere.

Fees & Limits

The limits and fees for Bitcoin Cash casinos vary depending on the site that you’re playing at. In terms of the fees for sending Bitcoin Cash to other crypto wallets, they are typically much lower than other cryptos on the market. It means that it’s generally cheaper to send Bitcoin Cash than if you played with different crypto.

Any fees on top of this will be applied by the specific casino. They are not related to Bitcoin Cash itself. So, the terms and conditions will have to be checked in order to make sure you’re aware of any extra costs. Limits are also under the same restrictions. Bitcoin Cash itself won’t impose them, but the casino you play at, or in some rare cases the wallet that you use, may have some deposit and withdrawal limits.

Security

Online gambling may involve transmitting sensitive personal and financial information to the casino. Therefore, robust security measures, such as encryption protocols and secure payment gateways, are essential to protect players’ data from unauthorized access, fraud, and identity theft. Security measures are crucial for preventing cheating and fraud in online gambling. Assess your preferred site to ensure it has proper tools like SSL encryption, 2FA, and support for provably fair games.

Deposit Bonuses & Promotions

Having a larger capital might give you a strong edge in your gambling. Consider the bonuses and promotions offered by the Bitcoin Cash casino. Look for welcome bonuses, deposit bonuses, free spins, and loyalty programs that can enhance your gambling experience. Pay attention to the terms and conditions associated with these bonuses, including wagering requirements and withdrawal restrictions.

Customer Support

Evaluate the responsiveness and accessibility of customer support. Look for casinos providing various support options, including live chat, email, and phone, and make sure their staff members are competent and polite when you have any questions or concerns. They should respond fast and accurately to your needs.

Game Selection

The number and variety of games offered are key determinants when selecting the best Bitcoin Cash casinos. Check the game selection offered by the casino. Look for a diverse range of Bitcoin Cash casino games, including popular options like slots, table games (such as blackjack and roulette), poker, and live dealer games. Remember to check the reputation of game providers. A wider selection gives you more options and caters to your preferences

Where to Buy Bitcoin Cash for Gambling?

You can buy BCH at a number of crypto exchanges. It’s up to you to choose the best exchange for your requirements. It depends on the country that you live in as well as not all exchanges are available worldwide. Once you have the funds you will be able to send them to your casino account and begin playing.

It’s always important to understand that exchange reviews are the best way to get up to speed with which exchange is the best one for you. This will ensure that you are fully aware of everything that is available at the exchange as well as what it can offer to you.

Bitcoin Cash Gambling vs Other Cryptocurrencies

Gambling with crypto offers some benefits when compared to other cryptocurrencies. One of the biggest benefits is that transaction fees are a lot lower than other cryptos on the market. This, obviously, means that it will cost a lot less to transfer funds when making either a deposit or a withdrawal.

Transaction times are also much faster. So, you won’t have to wait as long when you withdraw your funds after a big win. This is excellent for players who want instant access to winnings.

There are some negatives though. Bitcoin Cash isn’t one of the most mainstream cryptos out there. So, not all online casinos will have it available for use. It means that some of the top sites on the market might not be available to players who use Bitcoin Cash solely.

Future of Bitcoin Cash Casinos

Bitcoin has proven resilient by successfully navigating the last crypto winter, where some coins and tokens almost became defunct. Though it has a healthy market cap and seems to attract more users over time, its future is subject to various factors and trends in the cryptocurrency and online gambling industry.

Its low fees and quick transaction times may make it an appealing solution for different merchants and businesses. As it gains more recognition and acceptance as a digital currency, the number of Bitcoin Cash casinos may increase. In addition, the demand for cryptocurrency gambling, including Bitcoin Cash casinos, may grow as more individuals become interested in decentralized and anonymous forms of online betting.

We may also see days when BCH gaming may be integrated with smart contracts as blockchain technology continues to evolve. This may lead to increased fairness, security, speed, and generally enhanced user experience. Legally, the future of BCH is quite unpredictable, as the regulatory environment is still evolving in many jurisdictions.

However, based on the current positive trends of crypto acceptance by some leading governments and bodies like the European Union, BCH is likely to find more use cases and experience a significant price explosion in the future. Having said all that, it’s necessary always to exercise caution while gambling with any virtual currency, as this comes with inherent risks like high volatility.

Expert Conclusion

Gambling with Bitcoin Cash is a wise decision. It is faster than Bitcoin and also has lower transaction costs. Volatility exists in all cryptocurrencies. However, BCH has successfully traversed the most difficult times in crypto history, such as the 2022 winter, indicating that it is dependable and quite stable. Furthermore, it is backed by the world’s leading digital coin casinos. If you’re not sure where to begin, BC.Game is our top Bitcoin Cash operator. It’s secure, easy to use, and has over 6,000 games and a sports book. New members begin their journey on the website with a massive welcome bonus of up to 220,000USDT. You may also select any of the top 10 websites discussed in this article.

How fast are payouts processed at a BCH operators?

Payouts are processed at a much faster rate with BCH than other cryptos. It means that you will get access to your withdrawals very quickly. Obviously, if the network is busy then it does mean it will take a little bit longer than usual.

Is there a minimum deposit amount required to play at a Bitcoin Cash casino?

It depends on the site that you’re playing at. Some sites will have lower minimum deposit amounts than others. It means that you will need to research the site you want to play at before you sign up.

What is the house edge at a Bitcoin Cash casino?

This is another aspect that varies from casino to casino. Some sites will have higher house edges than others. On top of this, each different game has its own house edge, so the overall casino house edge may be irrelevant if you’re playing a game with a very low house edge.

Are there any special promotions or bonuses offered at Bitcoin Cash casinos?

Yes there are. Pretty much all online casinos have promotions available to players. While there aren’t any specific Bitcoin Cash bonuses offered at the moment, there are bonuses that are catered specifically to cryptocurrency. If the site you choose to play at features Bitcoin Cash, then it means you will be able to claim this bonus with a BCH deposit.

Facts Checked by Josip Putarek, Senior Author

will.wood.9964@googlemail.com

will.wood.9964@googlemail.com