4.9

- Free Faucets

- Play to Earn

- Provably Fair Games

4.9

- Personalised bonus offer

- Provably Fair Games

- Low House Edge

4.9

- Personalised bonus offer

- Provably Fair Games

- Sportsbook with eSports

- VPN allowed

- Anonymous Gambling

- No fees

3.1

- Anonymous Gambling

- Instant withdrawal

- Crypto sportsbook

- 24/7 Live Chat

- Sportsbook

- Great mobile app

4.6

- Live Casino

- Generous welcome bonus

- Large selection of games

- VIP Programme

- Anonymous Gambling

- Responsible Gaming Tools

- Live chat 24/7

- Fast Withdrawals

- Crypto Games

- Crypto Casino

- Fast payouts

- Poker tournaments

4.6

- Wager Free Bonus

- Shared House Profits

- Free Faucets

4.2

- Fast payouts

- Low Deposit

- userfriendly

- No KYC needed

- VPN friendly

- Instant withdrawal

- Popular casino

- Sportsbook with eSports

- Some of the best odds

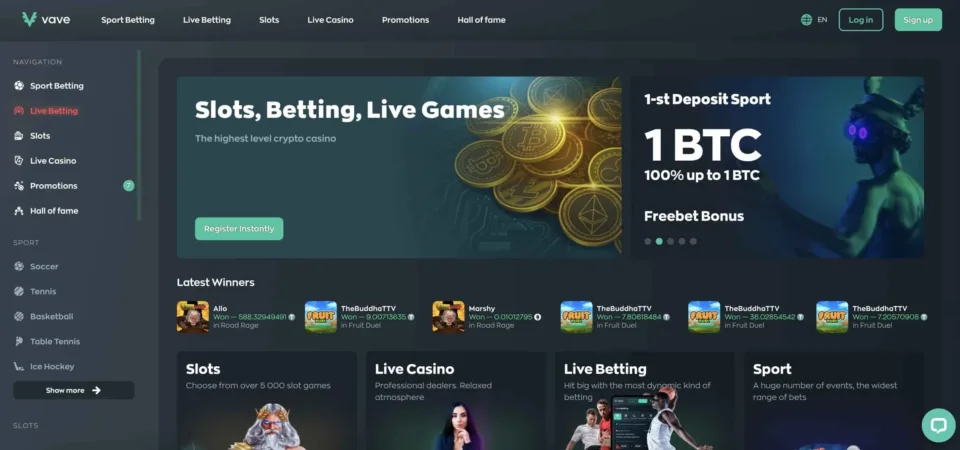

1. Vave: A Very Secure and Safe Site

Vave Casino is a relatively new top-tier operator offering a fantastic welcome bonus and free spins for newbies while regulars enjoy weekly reloads, tournaments, and a rewarding VIP program. With fast payment transactions, 24/7 live chat support, and an excellent user interface, you will have a seamless gaming experience. Licensed in Curacao, it ensures security with SSL encryption and 2FA.

Vave Casino is a relatively new top-tier operator offering a fantastic welcome bonus and free spins for newbies while regulars enjoy weekly reloads, tournaments, and a rewarding VIP program. With fast payment transactions, 24/7 live chat support, and an excellent user interface, you will have a seamless gaming experience. Licensed in Curacao, it ensures security with SSL encryption and 2FA.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Cryptocurrencies |

|---|---|---|---|

| 150% bonus up to 1.5 BTC + 100 FS | 40x | 20 USDT | ETH, USDT, XRP, LTC, TRX, DOGE, BCH |

- Pros

- Supports multiple digital coins for transactions

- Fast and secure payouts

- Extensive game library with over 6,000 games

- Cons

- Some table games may be difficult to locate

- Limited selection of niche specialty games like bingo

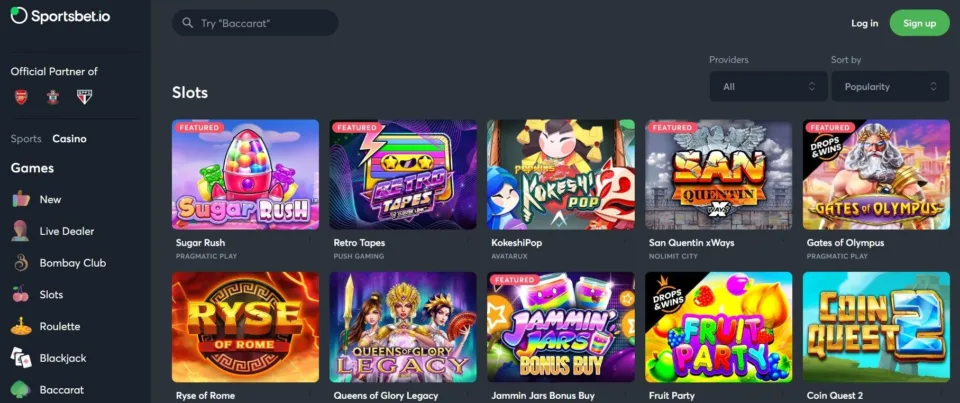

2. Sportsbet.io: An Excellent Selection of Games

Sportsbet.io Casino is a popular operator founded in 2016 and known for its wide variety of games, including slots, table games, and live dealer options. It’s licensed by the Government of Curacao, which ensures a safe gambling environment. It also features a Mobile-friendly design for gaming on the go, 24/7 customer support, fantastic bonuses, and more.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Cryptocurrencies |

|---|---|---|---|

| 100% 1st Deposit Bonus Up To 1,000 USDT + 100 FS | 40x | 20 USDT | BTC, ETH, USDT, XRP, LTC, TRX, ADA, BCH |

- Pros

- Great VIP Clubhouse for loyal players

- Offers native Mobile App for Android and IOS players

- Fast payment transactions

- Cons

- Doesn't focus on responsible gambling

- Big number of restricted countries

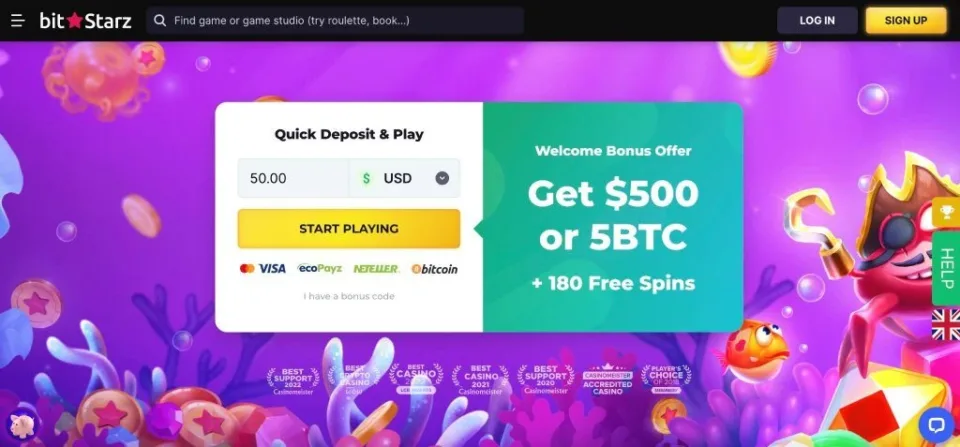

3. Bitstarz: A Reputable Casino

BitStarz Casino is an online gaming platform that was launched in 2014, known for being one of the first casinos to accept both traditional currencies and cryptocurrencies like Bitcoin. It offers a wide range of games, including slots, table games, and live dealer options, provided by top software developers such as NetEnt, Microgaming, and Evolution Gaming.

BitStarz Casino is an online gaming platform that was launched in 2014, known for being one of the first casinos to accept both traditional currencies and cryptocurrencies like Bitcoin. It offers a wide range of games, including slots, table games, and live dealer options, provided by top software developers such as NetEnt, Microgaming, and Evolution Gaming.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Cryptocurrencies |

|---|---|---|---|

| 25 No Deposit Free Spins | N/A | N/A | BTC, ETH, USDT, XRP, TRON, LTC, TRX, ADA, DOGE, BCH |

- Pros

- Free Spins

- VIP Club

- Cons

- Some bonuses are only for fiat currencies

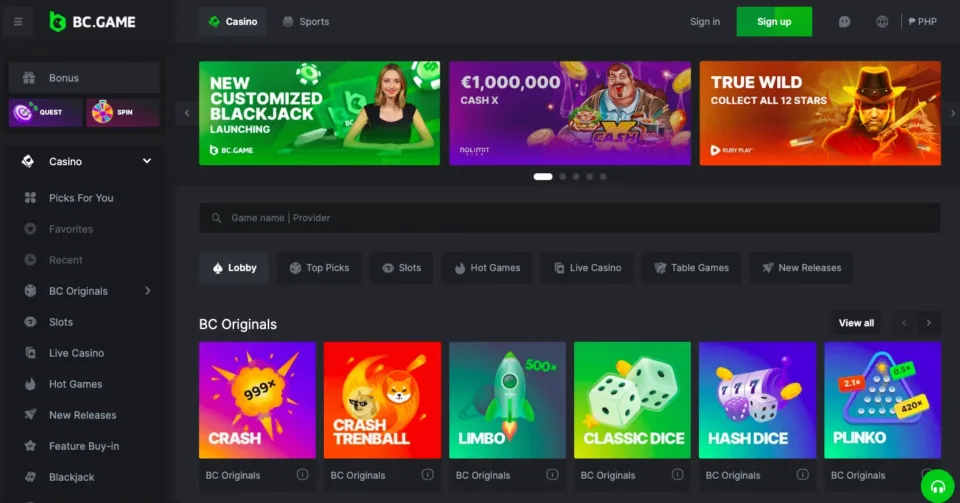

4. BC.Game: Best Ethereum Casino Overall

BC.GAME is one of the best-looking platforms on the market, offering the best overall crypto betting experience. It has a proprietary game currency named JB coins for trying games out and a special currency called BC Dollar. You can swap your BCD for Ethereum or any crypto and FIAT currency at the rate of BCD1=$1.

We found some of the best crypto games here, including provably fair crash games, BC original games, over 800 slot games, live casino titles, and table games, and even a range of lottery, bingo, and sports betting options. BC.GAME supports over 120 cryptocurrencies and over 43 FIAT currencies and belongs among the top Ethereum casinos with low deposits.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Cryptocurrencies |

|---|---|---|---|

| $1 every 200XP earned | $100 $200 | ETH, BTC, SOL, TRX, USDR, LTC, BNB, XRP, DOGE, ATOM, EOS, DAI, ADA, BTCB, ALGO and more |

- Pros

- Four deposit match bonuses

- Ethereum buy available

- Lucky spin up to 5BTC

- BC.Game unique currency BCD

- Cons

- Cannot use JB coins to play live casino games

- High 3rd and 4th Ethereum casino deposit

5. CryptoBetSports: A Very Secure and Safe Site

CryptoBetSports Casino, established in 2022 and licensed by the CGCB, is a cryptocurrency-friendly operator where you can find an excellent selection of games, from slots to live dealer options, from top providers like NetEnt and Evolution Gaming. It supports multiple digital currencies and offers fiat-to-digital coin conversion for added convenience.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Cryptocurrencies |

|---|---|---|---|

| 150% Up To 1 BTC + 150 FS | 40x | $20 | BTC, XRP, LTC, ETH, USDT, TRX, DOGE, BCH, BNB |

- Pros

- Fast withdrawals processed within minutes

- High daily cashback (15%)

- Multi-channel around the clock customer support

- Cons

- No dedicated mobile app

- High wagering requirements

6. Playbet: Welcome Bonus up to 4 BTCs

Playbet is our top casino that accepts cryptocurrency. It has a beautiful and easy design. New players can get a big welcome bonus on the first 4 deposits. It supports many popular cryptocurrencies and Credit cards.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Cryptocurrencies |

|---|---|---|---|

| Up to 4 BTC and 800 free spins | 40x | $30 | BTC, ETH, USDT, XRP, LTC, TRX, ADA, DOGE, BCH, DOG |

- Pros

- Huge welcome bonus

- Many provides

- Many cryptocurrencies supported

- Cons

- Above average minimal deposit

7. BetRunner Casino: Best for Exclusive dappGambl Bonus of 200% up to $1000

BetRunner, which launched very recently, has three licenses: Curaçao, Anjouan, and Costa Rica. It offers a games lobby with over 5,000 games from top providers like Pragmatic Play, Hacksaw Gaming, and Evolution. The site supports multiple cryptocurrencies, including ETH, LTC, and DOGE, with an exchange for convenient fiat-to-coin conversion.

BetRunner, which launched very recently, has three licenses: Curaçao, Anjouan, and Costa Rica. It offers a games lobby with over 5,000 games from top providers like Pragmatic Play, Hacksaw Gaming, and Evolution. The site supports multiple cryptocurrencies, including ETH, LTC, and DOGE, with an exchange for convenient fiat-to-coin conversion.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Cryptocurrencies |

|---|---|---|---|

| 200% Bonus up to 10,000 USDT + 50 FS | 40x | 20 USDT | ETH, USDT, XRP, LTC, TRX, SOL, DOGE, BNB |

- Pros

- Welcomes players with a massive bonus

- Has more than one license

- Withdrawals can be done without KYC

- Cons

- The sites interface is not modern

- Limited responsible gambling features

8. Betplay: Bitcoin Lightning Network

Betplay.io is a crypto casino that supports Bitcoin lighting network for fast deposits and withdrawals. It is also popular with its Poker client. It supports many popular cryptocurrencies and there’s a generous welcome bonus that you can find more about below.

Betplay.io is a crypto casino that supports Bitcoin lighting network for fast deposits and withdrawals. It is also popular with its Poker client. It supports many popular cryptocurrencies and there’s a generous welcome bonus that you can find more about below.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Cryptocurrencies |

|---|---|---|---|

| 200% Bonuss | 80x | $10 | BTC, ETH, USDT, XRP, TRON, LTC, TRX, ADA, DOGE, BCH, USDC |

- Pros

- No KYC required

- Poker client

- Bitcoin lightning network

- Cons

- No visible license

9. Betfury: Top Community-Based DeFi-Focused Site

Betfury is on our list as the platform includes free casino faucets, provably fair games, and free spins promotions. The welcome bonus on tap on Betfury is 1000 free spins up to $ 3500, which comes with a wagering of 35x that has to be completed over three total deposits. Free spins have restrictions on specific games, and the casino also has 100 no-deposit free spins for players.

FuryWheel lets signed-up players get a chance to win 1 BTC while the free casino faucet awards players in tokens. In the game department, there are 1000 available options, including slots, live casinos, provably fair games, specials, and table games where minimum deposits start from 0.00015 BTC and include tokens like BTC, BCH, or ETH. Launched in 2019, the casino supports 8 languages and offers customer support through social media and a live 24/7 live chat while requiring KYC to be completed.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currency |

|---|---|---|---|

| 100 no deposit free spins | N/A | 0.00015 BTC | BTC, ENJ, USDC, LTC, DOGE, BCH, OX, USDT, LINK, BNB, BTT |

- Pros

- Casino faucet

- Operating since 2019

- Lage token selection

- Cons

- KYC required

10. Gamix: Free Cash VIP Program

Gamix is a relatively new crypto casino that accepts many popular cryptocurrencies. Players can benefit from great bonuses, promotions, and VIP program. Sportsbook and many games from popular providers are available to choose from.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Cryptocurrencies |

|---|---|---|---|

| Up to 225% and $1500 + Free Bets and Spins | 40x | $10 | BTC, ETH, USDT, XRP, TRON, LTC, DOGE, BCH, AVAX |

- Pros

- Decent bonus terms

- Free cash and free spins

- Great VIP program

- Cons

- New casino on the market

11. Thunderpick: All-in-one Casino with Betting on eSports

If you want to experience the thrill of Provably Fair gaming, Thunderpick Casino is our top recommendation. The website has an extensive array of titles that support the category, especially crash games. You can choose from close to 30 crash games on the site while using 10 different digital currencies.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Cryptocurrencies |

|---|---|---|---|

| 100% up to $500 worth of cryptocurrency | 30x | $20 | BTC, ETH, USDT, XRP, LTC, TRX, ADA, DOGE, BCH, USDC |

- Pros

- Up to 30 crash casino games

- Dedicated Provably Fair page

- Supports deposits using gift cards

- Features 2FA for added security

- Cons

- High minimum deposit

- The website is somewhat cluttered

12. Stake: Best for Exclusive dappGambl Bonus of 200% up to $1000

Stake Casino is the most popular online crypto casino with millions of players worldwide. For that reason, we have prepared a special exclusive bonus for the new players. Casino supports many cryptocurrencies and card payments like Visa and Mastercard. Support is always ready to help especially if you become one of their VIP players.

Stake Casino is the most popular online crypto casino with millions of players worldwide. For that reason, we have prepared a special exclusive bonus for the new players. Casino supports many cryptocurrencies and card payments like Visa and Mastercard. Support is always ready to help especially if you become one of their VIP players.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Cryptocurrencies |

|---|---|---|---|

| 200% up to $1000 | 40x | $100 | BTC, ETH, USDT, XRP, TRON, LTC, TRX, ADA, DOGE, BCH |

- Pros

- Top notch VIP program including rakebacks and weekly promotions and rewards

- Very transparent operator

- Exclusive bonus

- Cons

- KYC required

- No fiat payments

13. Metaspins: Top Site With No Maximum Withdrawal Limits

Metaspins comes 2nd on the list. Like its counterparts, it boasts an expansive games selection of 2,500+, comprising at least 1,600 slots, 50+ live tables, jackpot games, and provably fair titles. With RTPs towering at 98%, players experience top-notch gameplay and handsome payouts. One thing we loved about it was the simplicity employed on the platform. Though not the most user-friendly site, it has minimal features allowing users to sport different functions easily. All it takes to sign up is an email address, and password, then solve a security puzzle and create your account. You can translate the platform into seven different languages apart from English, such as Spanish, German, French, Norwegian, and Portuguese. Everyone is eligible for a nine-tier VIP scheme starting with the first slot wager after registration. To level up, you must continue to play and earn points. The best part is that as you progress up the ladder, you will be rewarded with better perks, such as high cashback. Regarding security, all client data on the website is encrypted with a 256-bit SSL certificate that is impossible to crack. Fairness levels are outstanding, as all games use provably fair technology or regularly audited RNGs.

Metaspins comes 2nd on the list. Like its counterparts, it boasts an expansive games selection of 2,500+, comprising at least 1,600 slots, 50+ live tables, jackpot games, and provably fair titles. With RTPs towering at 98%, players experience top-notch gameplay and handsome payouts. One thing we loved about it was the simplicity employed on the platform. Though not the most user-friendly site, it has minimal features allowing users to sport different functions easily. All it takes to sign up is an email address, and password, then solve a security puzzle and create your account. You can translate the platform into seven different languages apart from English, such as Spanish, German, French, Norwegian, and Portuguese. Everyone is eligible for a nine-tier VIP scheme starting with the first slot wager after registration. To level up, you must continue to play and earn points. The best part is that as you progress up the ladder, you will be rewarded with better perks, such as high cashback. Regarding security, all client data on the website is encrypted with a 256-bit SSL certificate that is impossible to crack. Fairness levels are outstanding, as all games use provably fair technology or regularly audited RNGs.

| Crypto Bonus | Wager Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 100% deposit match up to 1BTC | 25x | $1 | BTC, BCH, LTC, ETH, DOGE, XRP, USDT, TRX |

- Pros

- Multiple payment methods

- Huge bonus

- Low wagering requirements

- Low minimum deposit

- Cons

- Slow support

14. Cloudbet: Trending Variety Casino

Cloudbet offers a crypto gaming platform where you can transact with over 25 digital currencies. If you don’t have coins, you can easily purchase some via Moonpay using bank cards and eWallets. While testing the site, we confirmed that Cloudbet doesn’t set minimum deposit limits. However, you must fund your account with at least 0.001 BTC to qualify for the welcome bonus.

Cloudbet offers a crypto gaming platform where you can transact with over 25 digital currencies. If you don’t have coins, you can easily purchase some via Moonpay using bank cards and eWallets. While testing the site, we confirmed that Cloudbet doesn’t set minimum deposit limits. However, you must fund your account with at least 0.001 BTC to qualify for the welcome bonus.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Cryptocurrencies |

|---|---|---|---|

| 100% up to 5 BTC | Bonus conversion is based on a points system, which varies depending on the game and RTP | 0.001 BTC | ADA, ALGO, AVAX, BCH, BNB, BTC, DAI, DASH, DOGE, DOT, EOS, ETH, FTM, stETH, LINK, LTC, MATIC, PAXG, SHIB, SOL, TRON, UNI, USDC, USDP, USDT, XLM, XRP, Zcash |

- Pros

- High-value welcome bonus offer

- Supports up to 25 crypto coins

- Valid license from Curacao eGaming

- Allows purchase of crypto with fiat

- Cons

- Unclear wagering requirements

- No Android or iOS app

15. Joya Casino: 50 Registration Free Spins

Joya Casino is a fully licensed crypto casino launched in 2023 and licensed by the Government of Curacao. Operated by Provably Fair Gaming B.V., it holds a valid Curacao eGaming license, providing access to the casino with two-stage registration.

Joya Casino is a fully licensed crypto casino launched in 2023 and licensed by the Government of Curacao. Operated by Provably Fair Gaming B.V., it holds a valid Curacao eGaming license, providing access to the casino with two-stage registration.

Joya provides access to a global market with few local restrictions and provides multi-lingual access for German or Chinese users – making the site easily accessible for any user type.

Following registration, Joya will require more personal details to access the casino features fully. With over 7,00 different games to pick from, the promo bonus section rewards users with welcome bonuses, a VIP package, cashback, and daily campaigns to choose from.

| Crypto Bonus | Wager Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 50 No Deposit Free Spins | 40x | Not required | BTC, BCH, LTC, ETH, DOGE, XRP, USDT, TRX, DASH, MONERO |

- Pros

- Game library with 7,000 games

- Generous welcome bonus

- Casinos reality checks

- Cons

- High wagering

- No FAQ page

What is Ethereum?

Ethereum is a decentralized global software platform that utilizes blockchain technology to enable the creation of decentralized applications (dApps) and crypto transactions. The Ethereum network, launched in 2015, was the first to expand the use cases of blockchain technology by introducing unique features such as smart contracts, which enable the automation of complex financial transactions and the creation of decentralized applications. Ethereum also introduced its own programming language, Solidity, which makes it more accessible for developers to build on top of the network.

What are Ethereum Casinos?

Ethereum casinos are crypto gambling sites that accept Ethereum currency for deposits, withdrawals, placing wagers, and much more. They take full advantage of blockchain and smart contract technology. The key features of the best ETH casinos are:

- Crypto Payments: They accept ETH and more cryptocurrencies, including BTC, LTH, USDT, USDC, BCH and BNB. Usually, Ethereum deposits and withdrawals are free of fees, and they’re instant.

- Decentralization: Since the blockchain network is decentralized, your casino deposits and withdrawals aren’t controlled by any authority.

- Anonymity: You don’t have to give your personal and bank information to deposit at an Ethereum casino. All Ethereum transactions are pseudonymous and don’t require revealing personal information.

- Provably Fair Gaming: Provably fair games bring an unbeatable level of fairness and transparency since you can compare the predetermined outcome with the result. There are many games available with provably fair technology, including crash games, slots, live casino games, and table games.

- Bonuses for Ethereum Depositors: The most substantial bonuses in casinos that accept cryptocurrency are intended for crypto depositors. Some casinos even give bonuses displayed in ETH currency.

Comparison of the Best Ethereum Casino Sites: Our Selection Criteria and How to Pick the Best One for You

Finding the best Ethereum casino for your needs is a process that requires deep research. In this section, we’ve laid out the most important criteria to consider before registering your account and making your first deposit.

All the listed casinos offer instant deposits and withdrawals. Due to the nature of blockchain technology, which is not controlled by banks or payment processors, Ethereum deposits and withdrawals can be processed quickly, often in minutes.

Casino games are the lifeblood of any Ethereum casino. We gave a higher ranking to casinos with the largest collection of crypto games from well-known providers such as Avatar UX, Ezugi, Microgaming, NetEnt, Spribe, Spinomenal and Bet Solutions. ETH casinos offer thousands of provably fair games, slots, instant win and crash games, live casino, and table games. We added casinos that boast games that are unique to Ethereum, such as Ethermon, Hytopia, Benji Bananas, and Champignons of Arborethia.

Top Ethereum casinos are vying for your attention, offering enticing bonuses that may allow you to start with a larger balance than anticipated. We assessed the wagering requirements, expiry dates, and bet limits to ensure transparency and guarantee that you have a fair chance of really taking advantage of the available bonuses.

We look at the techniques online casinos use to create a more engaging gaming experience for users. This includes real-time gaming, high-quality animations, complex algorithms to improve the fairness and transparency of the games. We choose Ethereum casinos with 24/7 customer support for our top list as we know that the best user experiences include being able to get help if something goes wrong. Ethereum casinos for mobile gaming have become increasingly popular as they enhance the user experience for players on the move, so we look at how well sites run on mobile devices and whether they have apps.

Ethereum gambling can offer a degree of anonymity, although it's not entirely anonymous. Transactions via the blockchain don’t contain your name or personal information and can be considered anonymous. However, the Ethereum casino where you play may require personal information and the completion of the KYC process. Nevertheless, many of the best Ethereum casinos with no KYC requirements allow you to play without sending a scan of your ID or utility bill.

Licensing is of the utmost importance when playing at a crypto casino. Always ensure to check if the crypto casino you’re playing at is licensed and regulated by the jurisdiction where it operates and adheres to regulatory standards. Verify if the casino is committed to responsible gaming and has implemented AML policies to protect players' funds. The best Ethereum gambling sites must have implemented security measures and encryption technology, such as 128-bit SSL encryption, as a minimum level of protection. Two-factor authentication adds an additional layer of security to protect users' accounts.

Privacy in crypto gambling can vary depending on the site and the coin you choose. While Ethereum offers a degree of anonymity since information is recorded on a public ledger without revealing your personal details, your privacy at Ethereum casinos isn’t always 100% protected. Some casinos may ask you to complete the KYC process to make deposits and withdrawals. Before committing to any Ethereum casino, ensure it meets all the criteria listed in this section.

Before engaging with an Ethereum casino, it's recommended to read reviews, assess the casino's reputation, familiarize yourself with its terms and conditions, and evaluate the quality of its customer support. Ensure you clearly understand the legal regulations concerning online gambling and cryptocurrencies in your area and remember that it's crucial to exercise caution and adhere to responsible gambling practices at all times.

Types of Games Offered

Signing up for the best Ethereum gambling sites will give you access to the most exciting casino games:

Ethereum slots, popular for their simplicity of access and easy checking of game outcomes, are the go-to for many casino enthusiasts. Using your Ethereum deposit, you can play classic 3-reelers, Megaways, Bonus Buy games, and jackpot titles without boundaries. Among our top picks that offer the best variety of slot games are Cloudbet Casino and Bitstarz Casino.

Players continue to love Ethereum blackjack because it combines Ethereum's benefits with the excitement of classic blackjack. We prefer playing blackjack with Ethereum since it adds a level of anonymity and is a more cost-effective gaming experience. Therefore, we chose Ethereum casino sites that offer a wide variety of blackjack for you.

As with traditional payment methods, Ethereum gambling sites allow you to play roulette in different variations using Ethereum deposits, such as European, American, and Lightning Roulette from top-notch developers, including Playtech, Evolution Gaming, and Pragmatic Play.

For poker enthusiasts, Ethereum poker games offer the thrill of the traditional game along with the advantages of cryptocurrency transactions. In contrast to traditional poker, which is subject to fees from banks and credit card transactions, as well as taxes from local governments, Ethereum poker rooms operate under different regulations. Consequently, there are fewer fees for gamblers, particularly for poker winnings.

For strategic Ethereum gamblers, we picked Ethereum casino sites with a wide variety of table games. We hand-picked sites that offer baccarat, dice games, Sic Bo, and the classics such as roulette, blackjack, and Texas Hold’em poker.

Part of what makes a casino experience memorable is the social aspect, and casinos offering live games nail this. Depending on the game, you can interact with the dealer or croupier and chat with other players. Moreover, Ethereum casinos with live dealer games from our list offer promotions and bonuses for crypto players intended for live casino games.

Best Ethereum Casino Bonuses

Nearly all Ethereum casino sites come stacked with generous crypto gambling bonuses and promotions – and you’d be wise to take full advantage of them to increase your winning chances.

Below, we will outline the most popular offers available at Ethereum casinos and elaborate on which ones are worth getting.

Welcome Bonuses

First things first – the welcome bonus.

First things first – the welcome bonus.

Every single Ethereum casino out there will give you a starting bonus as a new player, either in the form of a matched deposit, free spins, or a combination of both.

The way these bonuses work is that you need to make a qualifying deposit and opt-in (or use a bonus code) to claim the bonus. Note that all welcome bonuses have terms and conditions attached, and you should always read them.

Getting bonuses with wagering requirements above 40x is not a good idea, which is why you should stick to the lowest wagering requirement Ethereum casinos, that’ll give you the best chance of cashing out your bonus winnings.

Free Spins

Free spins bonuses are some of the most popular promos at casinos accepting Ethereum. You can get them as a new player, as an existing player through a reload promotion, or by unlocking a new level in a VIP program, etc.

Free spins bonuses are some of the most popular promos at casinos accepting Ethereum. You can get them as a new player, as an existing player through a reload promotion, or by unlocking a new level in a VIP program, etc.

It’s worth noting that the free spins you get will almost always be available to use on a pre-selected game by the online casino; you won’t be able to play any game you wish to.

They come with wagering requirements and maximum cashout limits, so it’s paramount that you read the terms and conditions.

No Deposit Bonuses

No deposit bonuses – as the name suggests – don’t require you to make a qualifying deposit in order to get the bonus.

No deposit bonuses – as the name suggests – don’t require you to make a qualifying deposit in order to get the bonus.

All you have to do is sign up and use a bonus code to either get free spins or bonus cash. Keep in mind, though, that no deposit offers are quite rare, and even if you do find one, it’ll most likely come with higher wagering requirements.

Reload Bonuses

All bonuses that you get as an existing player are called reload bonuses. When you “reload” your account with another deposit, Ethereum casino sites will usually give you a bonus that you can use to play casino games.

All bonuses that you get as an existing player are called reload bonuses. When you “reload” your account with another deposit, Ethereum casino sites will usually give you a bonus that you can use to play casino games.

Reload promos come in the form of matched deposits, free spins, cash giveaways, cashback, and more. Most of these offers are tied to specific days of the week. For example, on Monday, you can get free spins, while on Tuesday, you can get a match deposit bonus.

Cashbacks

The one bonus to rule them all (ask any experienced gambler, and they’ll tell you) is cashback.

The one bonus to rule them all (ask any experienced gambler, and they’ll tell you) is cashback.

Most Ethereum casinos offer VIP programs through which loyal players can get cashback on their losses. The higher your level in those VIP programs, the higher the cashback percentage will get – usually capped at 20% as the maximum amount.

The great thing about cashback is that the wagering requirements are usually much lower, or there are none at all, making it one of the most valuable bonuses for players.

Loyalty Bonuses

Loyalty Bonuses

Besides cashback, there are plenty of other loyalty bonuses that Ethereum casino players can get, including free spins, cash giveaways, exotic trips – and even super-car giveaways.

These bonuses are designed to turn new players into loyal customers, and most casinos will have a generous loyalty program that makes it worth your while.

VIP Programs

We’ve touched a bit on new Ethereum casinos with VIP programs in the previous section, but since there’s much more to talk about, we’ll explain further all the benefits that you can get from them.

Exclusive Rewards

By exclusive rewards, we mean exotic trips, cashback with no wagering requirements, luxury giveaways, cash prizes, and more.

Every good Ethereum casino will have a VIP program filled with rewards like these, and the best of them are typically reserved for players who reach the highest level in the program.

Personalized Services

On joining the VIP program, you’ll receive your very own account manager, who’ll be available 24/7 to instantly help you with whatever issue you encounter.

Simply put, you’ll be getting an elite treatment unavailable to all other casino players.

Plus, you can receive tailored rewards specific to your account, such as free spins on your favorite slot game or a birthday bonus.

Enhanced Gaming Experience

Last but not least is an overall more enjoyable gambling experience with expedited payouts, higher deposit and withdrawal limits, and access to high-limit games.

Once you reach a high tier in the VIP program, you will typically get prioritized payouts, which means that any payout request you make will go right at the top of the queue – allowing you to get paid out almost instantly.

Plus, being a VIP player comes with other perks, such as higher withdrawal limits. If you’re lucky enough to win a jackpot at high payout Ethereum casinos, you could potentially withdraw the full amount in just one transaction – as opposed to withdrawing it in a few increments as a regular player because of the tight limits.

Differences Between Ethereum Casinos and Traditional Casinos

If you want to find out what sets Ethereum casinos apart from traditional casinos, we’ve highlighted the main differences between the two for your better view:

| Options | Crypto Casinos | Traditional Casinos |

| Range of Currencies Available | ETH, BTC, LTC, USDT, USDC, SOL, DOGE, XRP, TRON, BNB, ADA | USD, EUR, NZD, AUD, GBP, CAD and more |

| Deposit Speed | Instant | Up to 24 hours |

| Withdrawal Speed | Up to 24 hours | Up to 3-7 days |

| Included Fees | Minimal | High if you convert currencies |

| Anonymity | Guaranteed | Low due to extensive verification |

| Regulatory Environment | Limited only to a few jurisdictions | Well established |

Step-by-Step Guide: Registering and Playing at an Ethereum Casino

Registering your account at an Ethereum casino doesn’t require any special skills, as it’s no different from creating an account at a traditional casino. Below, we’ve picked the best Ethereum casinos for beginners, so just follow the steps I’ve outlined, and you won’t encounter any issues during the registration process.

Launch the website of your best Ethereum casino and click on the “Register” button.

Provide your personal information, such as name, surname, pseudonym, and email address.

Verify your email address by clicking the activation link in your inbox.

Once you’re a verified member, log into your account.

Visit the “Cashier” section and choose Ethereum as your preferred payment method.

Copy the Ethereum address from your wallet into the transaction window.

Confirm your Ethereum transaction.

Start playing games using your Ethereum deposit.

What is the Best Ethereum Wallet for Gambling?

You’ll need an Ethereum wallet to engage with the Ethereum ecosystem and safely manage transactions involving Ethereum. Many top-tier Ethereum wallets offer the capability to interact with Ethereum decentralized applications (dApps) by linking your wallet to their smart contracts.

Our team has chosen the best Ethereum wallets that we have personally tried to use. Below is the rundown:

Metamask 4.4/5 |  Trust 4.3/5 |  Exodus 4.4/5 | |

| Wallet Type |

|

|

|

| Price |

|

|

|

| Fees |

|

|

|

| Currencies |

|

|

|

| Read Review | Learn More | Learn More | Learn More |

Can You Gamble with Ethereum?

Ethereum is a decentralized digital currency operating on a blockchain network that operates independently of banks and governmental oversight. The legality of Ethereum, as well as other cryptocurrencies, varies from one jurisdiction to another. For example, there are secure Ethereum casinos for US players in states where gambling is legalized. Some countries have legalized cryptocurrencies as a payment option, allowing individuals to buy, sell, and engage in gambling activities using Ethereum and other cryptocurrencies.

Before diving into Ethereum crypto betting, it’s crucial to verify its legality in your country of residence. For instance, while licensed Ethereum casinos in Europe operate in most countries, cryptocurrency gambling remains prohibited in the UK. Nonetheless, staying updated on Ethereum’s legal status is essential, as many countries are actively shaping regulations to oversee the cryptocurrency market.

Payment Options

We believe that payments should be easily made with various methods, and our selection of top Ethereum casinos accepting multiple cryptocurrencies reflects that belief. Below, we outlined the most used payment options in online casinos:

- Credit / Debit Cards: If you’re a traditional player who hasn’t joined the crypto train, you’ll like to find credit and debit card payment options at an online casino. The options include Visa, Mastercard, American Express, Discover, and more country-related payment options.

- E-wallets: The most used and popular e-wallets at online casinos are PayPal, Neteller, Skrill, and eZeeWallet. Be careful before depositing since many online casinos restrict claiming bonuses with e-wallet payments.

- Vouchers: E-vouchers are used at many crypto casinos; the most popular are Paysafecard, AstroPay and Neosurf.

- Bitcoin (BTC): Bitcoin is today’s most valuable and popular crypto. You can find Bitcoin and other variants from the Bitcoin network, such as Lightning Bitcoin and Bitcoin Cash, in almost every crypto casino you choose.

- Litecoin: It belongs among the most used cryptocurrencies in online casinos. Its network generates a new block every two and a half minutes, which makes it up to four times faster than Bitcoin.

- USDT: This crypto is pegged to the US dollar, and its price fluctuates with the US dollar prize. USDT is issued by Tether and is among the most used cryptocurrencies in online casinos.

Customer Service

You should always check the quality of customer support a casino offers before signing up, especially a new one without an established reputation. Having access to a live chat representative will make it easier and faster to get help when issues arise. It’s a good idea to check email responsiveness and whether the Ethereum casino has social media channels on Twitter, Facebook, Instagram, or Telegram, so you have other options for getting in touch, too.

Conclusion

In conclusion, all Ethereum casinos on our list provide bespoke gambling options: the best provably fair games, live casino, and table games, as well as new trends – crash and instant win games.

You can wager your Ethereum with peace of mind, as all casinos are licensed and trusted and pass our strict criteria tests. Anonymity, security, and privacy are guaranteed due to the protection provided by transactions via the blockchain.

There are no wrong answers regarding the Ethereum gambling sites on this page, as they are all thoroughly vetted and tested by our dappGambl team.

Wherever you end up playing games using Ethereum, make sure to gamble responsibly.

How do I know if an Ethereum casino is reputable and safe?

There are several ways to establish an operator’s reputation and safety level. Reputation starts with compliance. Even though virtual currencies are decentralized and enable players to wager without restrictions, many fraudulent sites have used crypto to scam players. So, any good platform with the best intention wouldn’t hesitate to get regulated as a sign of good faith. That’s not all. Not all licensed sites will give you the best experience. Go further to read reviews and check rating sites such as TrustPilot to find out what experts and other players say about the casinos you are considering. Lastly, confirm the casino website is SSL-certified. This type of encryption protects all communication, including any payment information and personal data you may share on a website.

Are Ethereum casinos legal and regulated?

You will encounter licensed and unlicensed ETH betting sites like in any other industry. Sticking to regulated platforms for your safety and a general good user experience is best. Since crypto still needs to be widely legalized, only a few countries offer ETH casino licenses. The best part is they allow their operators to provide services globally. So far, Curacao and Malta have issued the highest number of cryptocurrency gambling licenses.

How do I ensure my security and privacy when using an Ethereum casino?

Security starts with selecting a licensed and reputable casino. Read reviews like the ones offered by dappGambl to compare different operators and select the most appropriate ones per your needs. Once signed up, create a strong password to ensure no one can access your account. Next, activate any extra safety layers, such as 2FA. For privacy, you want to ensure you fund your account using a crypto wallet rather than buying ETH using fiat on the casino, even if it offers exchange services. Avoiding public WiFi is also another step you can take for maximum privacy and security.

How does using Ethereum at a casino differ from using traditional currency?

Using ETH for gambling differs from traditional currencies in several ways. First, every transaction is recorded on the blockchain. Second, the safety of payments is guaranteed. Distributed nodes and smart contracts secure the Ethereum network. You also experience fast transactions at unbelievably low fees. You will need an Ethereum wallet, such as Metamask, to get started.

References:

Tether (USDT): Meaning and Uses for Tethering Crypto – Investopedia.com

History of ETH: The rise of the Ethereum blockchain – Cointelegraph.com

Facts Checked by Josip Putarek, Senior Author

julien@contentbydesign.ca

julien@contentbydesign.ca