- Popular casino

- Sportsbook with eSports

- Some of the best odds

4.9

- Personalised bonus offer

- Provably Fair Games

- Low House Edge

- No KYC needed

- VPN friendly

- Instant withdrawal

4.6

- Live Casino

- Generous welcome bonus

- Large selection of games

3.9

- Instant Deposits & Withdrawals

- Provably Fair Games

- Many cryptos available

- Generous welcome bonus

- VIP

- Fast Withdrawals

- Many cryptos available

- Quality Casino Games

- Esports

- Top Bonus

- Large selection of games

- Sportsbook

Ranked: Our ADA Gambling Site Picks

- Cloudbet – Best for a High Welcome Bonus

- BC.Game – Best for Exclusive dappGambl Bonus

- Metaspins – Best for Interactive UI

- BitStarz – Best for Instant Withdrawals

- DuckDice – Best for Playing Dice

- BetOnline – Best for Playing in the US

- Playfina – Best for Huge Games Selection

- Bitsler – Best for Gambling on a Mobile App

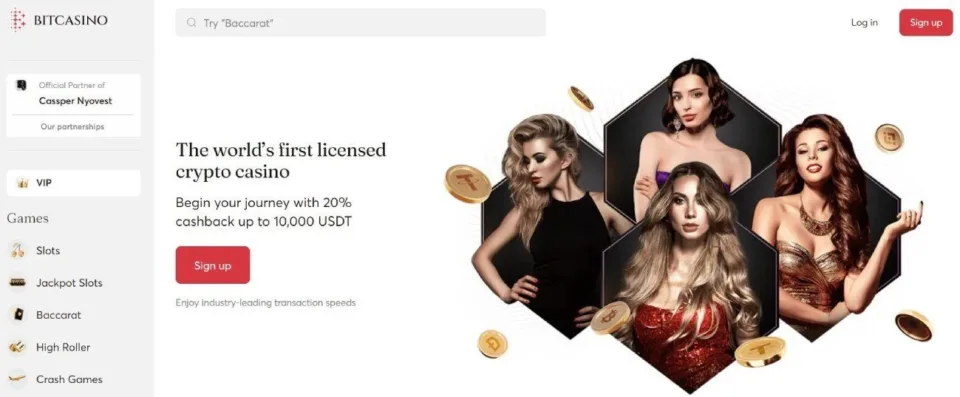

- Bitcasino – Best for Gambling Along with Streamers

ADA Casino Sites Reviewed

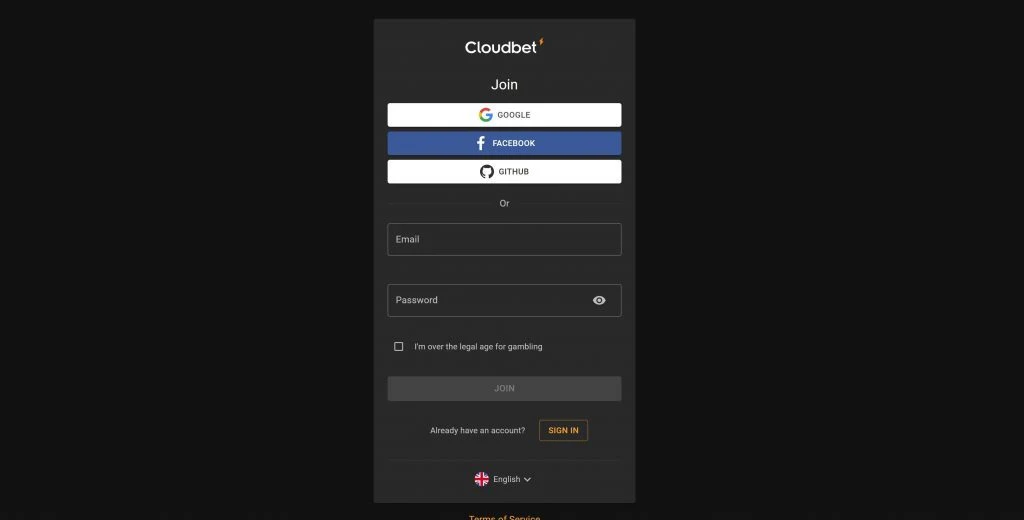

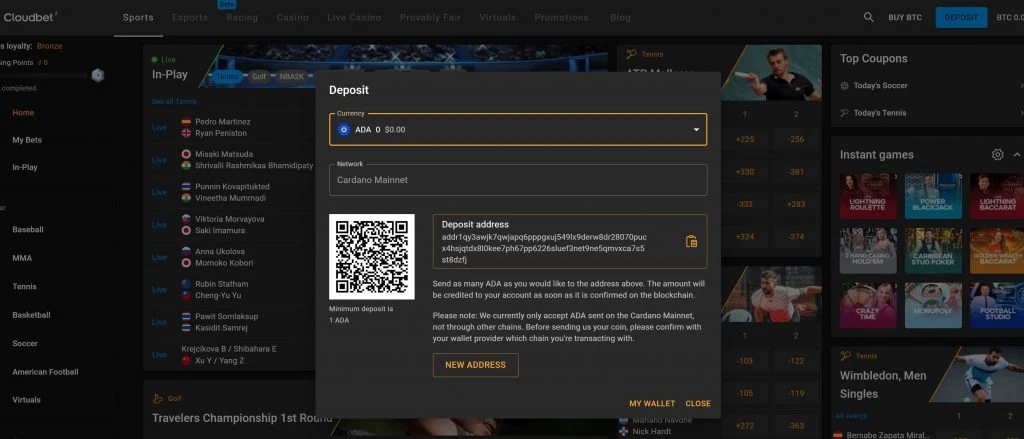

1. Cloudbet – Best for a High Welcome Bonus

First on our list of Cardano-approved casinos is Cloudbet, a sportsbook and casino operator with a strong focus on provably fair and accurate gambling with real-time RTP and offering players a high welcome bonus to get started. The welcome bonus offered is one of the best in the market, with a 100% up to 5 BTC without a wagering requirement and funds released based on XP points earned. There are only a few other bonuses on Cloudbet, including free spins on Tuesday, game reward competitions, and a VIP program with six levels where Cloudbet offers deposit bonuses, preferred customer support, and exclusive game promos.

The game selection offers 3,000 titles to choose from, ranging from slots, table games, a sportsbook, live casino games like live blackjack or dealer roulette, and crypto games with a fixed 97% RTP. Also, the house edge and RTP are visible in every game, and players can deposit using fiat payments and cryptos like ADA or BTC starting from 0.001 BTC. For customer support, Cloudbet is active 24/7 through live chat while providing email access and a FAQ page.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 100% up to 5 BTC | Bonus released in every 150 points earned | 0.001 BTC | BTC, ETH, LTC, XRP, DASH, XML, BCH, TRX, BNB, USDC, XMR, DOGE, ADA |

- Pros

- High deposit bonus

- Sportsbook

- Lots of crypto deposits

- Cons

- KYC required

- Withdrawal limits

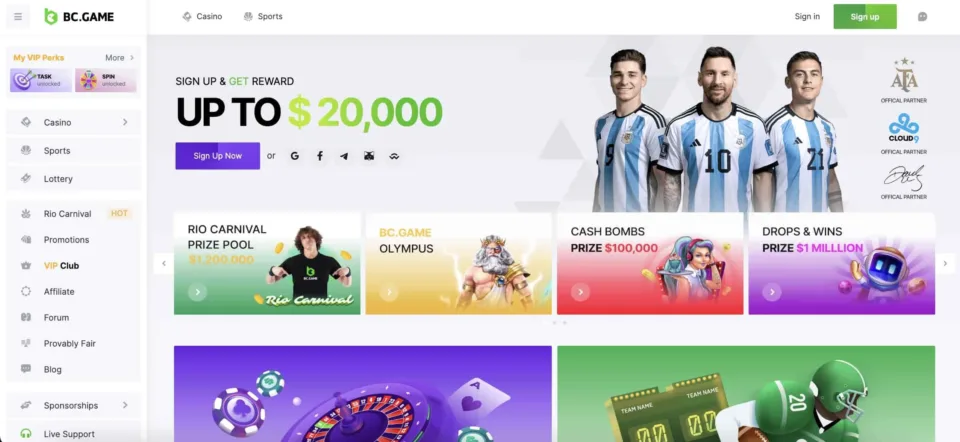

2. BC.Game – Best for Exclusive dappGambl Bonus

The second ADA casino that makes our list is BC.Game, which boasts a robust online reputation, has a large welcome bonus with high rewards and a heap of games of all ranges. The welcome bonus is special and features a boost for dappGambl users who can get a 270% up to 1 BTC bonus with a minimum spend of $400 and no wagering requirement. On top of that, the welcome package is extremely high, with a four-deposit bonus of up to 1080% while having additional ongoing promotions. Players can access game battles, slot prizes, tournaments, free bonus rounds, and events with boosted XP on sports bets, with over 66 different tokens from multiple chains BC.GAME includes stablecoins and tokens like ADA or BTC, which can be deposited starting at a minimum of $10.

The casino option features 10,000 games, including jackpots, megaways, table games, a sportsbook with multiple sports and great odds, and typical slots and live casino games. A VIP program is also provided with a rakeback of 20% and an affiliate system that offers 25% of all earned winnings. Launched in 2017, BC.Game has generated a reputation for sponsoring Argentina’s Football Team and Cloud9 while getting their Curacao gambling license. Anonymous gambling is partly possible, and the casino offers support through live chat and email, having common questions added in their FAQ section.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 270% Deposit bonus up to 1 BTC | 500% – Unlocks with wagering | $10 | 66 tokens |

- Pros

- High welcome bonus

- 24/7 support

- 58 providers

- Cons

- Uses its own native token for bonuses

3. Metaspins – Best for Interactive UI

Metaspins positions itself as the third option to deposit using ADA. as it’s known for features like a secure gambling experience, a rakeback tiered approach with a high boosted rakeback, and provably fair games that make for an engaging player experience. Metaspins welcomes new players with a generous welcome package of a 100% match bonus of up to 1 BTC, with a minimum of 25x wagering. As a licensed casino, there’s a mandatory KYC in place as players can access various promotions, including crash gaming leaderboards, meme prize events, BTC price predictions, and level-up events.

As players rank up their levels, they can enjoy a rakeback of up to 57%. The sleek UI and UX make the casino stand out as it offers over 4,000 games that cater to all gaming preferences, from classic slots to live casino games and jackpot games. It doesn’t offer sportsbook games but provides crypto deposit options with ADA or BTC and the chance to acquire tokens quickly and efficiently using traditional fiat methods. In addition, Metaspins has a live chat section and FAQ support for players to contact the casino.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 100% up to 1 BTC | 25x | 0.0001 BTC | BTC, BCH, LTC, ETH, DOGE, USDT, TRX, ADA, USDC |

- Pros

- 1 BTC welcome bonus

- Low minimum deposit limit

- Cons

- KYC Required

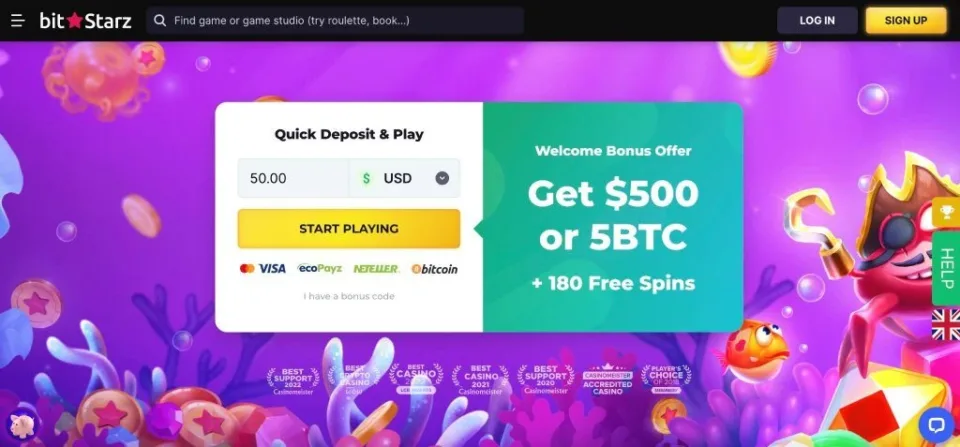

4. BitStarz – Best for Instant Withdrawals

Fourth on our list of ADA casinos is Bitstarz which is highly regulated and includes country-specific restrictions, accepts crypto and fiat payments and deposits while offering unique, provably fair games. For new players, an incredible bonus offer is available. Players can receive up to 5 BTC and 180 free spins redeemable over four deposits, with a minimum deposit of 0.2 BTC. There’s a 40x wagering requirement for players to fulfill, and the operator includes bonus offers such as 50% Monday add-ons and 50% Wednesday free spins.

Thus, players can deposit using both fiat and cryptos like ETH, BTC, or ADA tokens. With over 3,700 games, Bitstarz has something for everyone, including slots, jackpots, and a live casino with no sportsbook but access to known game providers. Since launching in 2014, Bitstarz has completed registration through a Curacao gambling platform, which provides verified gameplay and customer support through live chat and email.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 5 BTC + 180 Free Spins | 40x | $10 | BTC, ETH, DOGE, LTC, TRX, USDT, XRP, BNB, ADA, BCH, BNB |

- Pros

- Bonus of up to 5 BTC

- Instant withdrawals

- 8000 games

- Cons

- Min withdrawal of $20

5. DuckDice – Best for Playing Dice

DuckDice is in the middle of the pack as a decentralized casino with a single-game feature – dice! There’s a 100% welcome bonus of up to 2 BTC on DuckDice, and it also includes a progressive jackpot, daily rakeback, casino races, staking opportunities, lottery tickets, and a Duck Faucet. The affiliate program on DuckDice offers rewards up to 25 for players, and the casino accepts multiple tokens, including BTC or ADA or less popular options like ETC, or ZEC. Deposits and withdrawals are instant and are paid out depending on the token, with deposits starting from 0.0001858 BTC. The only available game is dice which is a provably fair crypto game. With that, the platform launched in 2016 and holds a valid gambling license in Curacao with a 5/5 user review score while offering customer support through FAQ and live support.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 100% up to 2 BTC | N/A | 0.0001858 BTC | BTC, BCH, LTC, DASH, DOGE, ETH, XMR, XRP, ETC, XLM, ZEC, ADA |

- Pros

- Accepts different tokens

- On-chain withdrawals

- High reputation

- Cons

- Only one game offered

6. BetOnline – Best for Playing in the US

BetOnline, the sixth casino and sports betting platform to accept Cardano deposits as the operator, stands out by ensuring gambling trust has unique bonuses for each game department and includes all payment methods. For the welcome bonus, players can choose between a 50% Sports Bonus of up to $1,000 using BET1000, a 100% Crypto Deposit of up to $1,000, and a 14x wager using CRYPTO100 code, a 100% bonus of up to $1,000 on casino or poker bonus of 100% up to $1,000 using code POKER1000. Reload bonuses are also available, and BetOnline strives at game-specific promotions, casino cash races, weekly battles, risk-free sports bets, poker leaderboards, casino referrals of 200%, and racehorse or eSports promos.

Depositing on BetOnline starts from a minimum of $20, while there’s a maximum cap of $10,000 per week, with deposits available through fiat and crypto. There are over 1,000 games, including slots, table games, poker, race horses, crash races, video poker, poker, live casino, and a sportsbook with eSports access. With a valid license and registered in Panama City, players can’t gamble anonymously since KYC is required, and support is provided through a helpline, email, and live chat.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 100% up to $1,000 | 30x | 0.0001858 BTC | BTC, BCH, LTC, DASH, DOGE, ETH, XMR, XRP, ETC, XLM, ZEC, ADA, SOL, SHIB |

- Pros

- Sportsbook

- High deposit bonus

- Lots of crypto deposits

- Cons

- KYC required

- Withdrawal limits

7. Playfina – Best for Huge Games Selection

Ranked number eight on our top ADA gaming platforms is Playfina – a reputable casino that offers a secure gambling experience and a vast collection of casino games developed by renowned providers. New players are welcomed with a generous bonus of up to $1000 and 200 free spins available only on specific slots. The minimum bonus deposit is $20 and requires a 40x wagering as Playfina boasts an impressive range of bonuses for its existing players, including an opportunity for free spins every Wednesday, a reload bonus of 50%, and 150 free spins every weekend. To boast competition, the operator features monthly tournaments on select games and a VIP program rewarding its members with cashback, priority cashouts, and physical gifts.

Deposits and withdrawals have a minimum of $20 and a weekly withdrawal limit of $10,000. Players can use cryptocurrencies like ETH, ADA, or BTC and fiat currencies such as EUR or USD to make deposits. The game section has an impressive number of over 9,000 games, including provably fair crypto games, table games, megaways, bonus buys, and jackpots. In addition, players can enjoy real-time gaming with the live casino feature but no sports betting. As a fully licensed and registered casino in Curacao, it provides a secure and trustworthy platform for gaming enthusiasts. Playfina’s customer support is accessible via live chat, social media DMs, or email contact, ensuring all players’ queries are resolved promptly and efficiently.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| $1,000 + 200 Free Spins | 40x | $20 | BNB, ADA, XRP, LTC, DOGE, TRX,ETH, BCH, BTC |

- Pros

- Free spin bonus

- 9,000 games

- Trusted platform

- Cons

- High wagering requirement

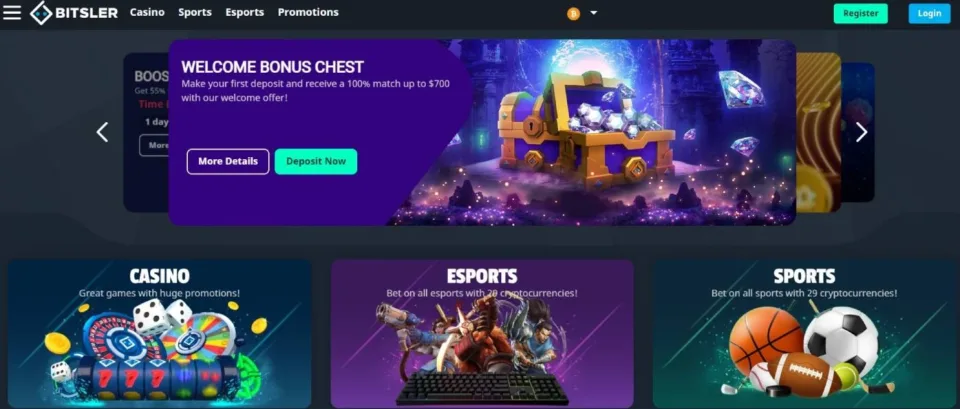

8. Bitsler – Best for Gambling on a Mobile App

Bitsler enters the list of ADA-approved casinos as it includes a distinct pool of accepted cryptocurrencies, has an intuitive mobile app, and includes several casino bonuses. Bitsler has a welcome package, which offers a remarkable 100% bonus of up to $700 with no required wagering, and winnings are subject to a point-based release scheduling which sees players unlock their bonus much faster. In addition, Bitsler offers a range of exciting features, including casino tournaments, free sports bets, an affiliate and referral program, and a VIP club for loyal users that grants exclusive benefits such as rakeback and chest openings on XP points.

Players can also earn additional bonuses through cash drops, and the operator’s BTSLR tokens can be used for gambling purposes. The operator accepts tokens like BTC, ZEC, and ADA with no minimum withdrawal or deposit as players can choose from over 1,000 games ranging from slots and mega ways, table games like blackjack and roulette, and a live casino and provably fair games. In addition to traditional casino games, players can bet on regular and eSports matches. As a licensed and registered gambling platform, Bitsler doesn’t allow anonymous betting and offers customer support through a reliable Help Desk and email support system.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 100% up to $700 | $1 per 200XP | $20 | BTC, ETH, XRP, LTC, USDT, DOGE, BNB, BUSD, ADA, ETC, BCH, ZEC, DGB, EOS, XLM, TRX, DASH, BTG, NEO & QTUM |

- Pros

- Welcome bonus

- eSports and sportsbook

- Cons

- KYC required

- No live chat

9. Bitcasino – Best for Gambling Along with Streamers

Bitcasino caters to the Cardano community and offers a highly trustworthy, distinctive gambling experience, thanks to its reputation as a secure casino. It also has a wide game selection with crypto games, includes immersive gaming options, and includes consistent cashback. Players can get a cashback bonus of 20% up to $10,000, along with providing other bonuses such as slot bonuses, VIP program offers, casino boosters, and slot tournaments.

Bitcasino has partnered with Livespins, which allows players to gamble along verified casino streamers and make similar bets while depositing crypto starting from 0.00025 BTC. The casino offers include crypto games, live casino with blackjack or games shows from known providers, and access to slots and table games. The 2014 launched casino, which holds a Curacao gambling license, doesn’t include sports betting but does provide support through live chat and a casino help center to get questions answered quickly.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 20% cashback up to 10,000 USDT | No wagering | $10 | BTC, ETH, LTC, DOGE, ADA, USDT, TRX, XRP |

- Pros

- No wagering requirement

- Bet with streamers

- eSports gambling

- Cons

- Cashback bonus

- KYC and verification

What is Cardano / ADA?

Developers were motivated to explore new crypto possibilities when Bitcoin started going mainstream. Vitalik Buterin, the founder of Ethereum, was among the first people who saw an opportunity to build a new blockchain network. Being the brains behind the Bitcoin Magazine, he had spent enough time studying the bitcoin blockchain’s network and established weaknesses that he wanted to handle in his eliminate in his project. And that was the birth of the Ethereum blockchain network, known to some people as the “World Computer.”

Charles Hoskinson, an early co-founder of Ethereum, broke away to develop what he termed an improved version of Ethereum after disagreeing with other partners on the future of Ethereum. And that is how Cardano came into existence in 2017. It’s a blockchain network supporting decentralized finance through dApps, just like Ethereum. The main goal is to improve on all the functionalities missing in Ethereum and ultimately become a “World Computer.” Hoskinson argues that Cardano is more scalable and interoperable than Bitcoin and Ethereum. Cardano’s blockchain network’s native coin is called “ADA,” named after Ada Lovelace, the first known computer programmer from the 19th century. Like BTC or ETH, ADA is a utility token used for making payments and rewarding miners who validate transactions on the Cardano blockchain network.

- Pros

- Fast payment processing

- Privacy

- Anonymous gambling

- High security

- Lucrative bonuses and promotions

- Low transaction fees

- Get paid in crypto

- Cons

- Uncertain legal status

- Volatility risk

- A new form of betting

- Reduced government supervision

How To Find The Best Cardano Casino?

Finding the best Cardano Casino can be an uphill task if you don’t have a good guide. Maybe you are asking yourself, what makes a casino good? There is no standard answer to this question; the right casino should meet all your needs and, above all, guarantee safety. Here are the factors we considered to find the best Cardano casinos while preparing this guide. Even though you may have additional factors you look at, these should never be ignored.

Licensing and Regulation

The Cardano casinos in this guide have at least one license from a recognized regulatory body like Curacao or Malta gaming authorities. Licensed operators undergo regular audits from authorities to ensure they adhere to crucial policies for your protection. Therefore, regulatory compliance shows that a crypto gambling platform is safe. In addition, other certifications such as membership in professional bodies should be a plus. eCOGRA, an international accredited testing and certification agency, is one of gambling operators’ most trusted professional bodies. Members undergo scrutiny and must maintain a fair and safe gambling environment for their clients.

Banking Options

Payment can be a big issue when it comes to Cardano casinos. Some key factors are minimum and maximum transaction limit, payment speed, available options, and fees charged—casinos with a low minimum deposit and withdrawal amount rank high on our list. Even if you’re a high roller, low payment minimums come in handy when you want to make small transactions. Withdrawal limits, however, should be high enough. You want to be able to cash out your big wins fast enough. Most crypto transactions process payments instantly, but that does not cut across the industry. The faster transactions take, the better. Don’t forget that you might incur transaction charges whenever you wager, deposit, or withdraw money. Every cost will count towards your losses or profits, so steer clear of expensive casinos. Lastly, give more priority to operators with vast payment options for your own convenience. Some casinos accept only crypto, while others allow you to deposit in fiat and convert your money to ADA. Choose what works for you better.

Game Selection

Gone are the days of dull and monotonous gambling when there were just a few games to pick from. Today’s casinos offer a plethora of exciting games. So don’t limit yourself to operators with few games because you will surely get bored within no time. Top gambling providers offer a wide selection of betting products, from classic to modern themes. A casino should have a mix of slots, live casino, table games, crash, and more to qualify as one of the best providers. You should also look at the software providers as this directly affects your gaming experience. Your operator of choice should have at least 20 different providers. This assures you that you will experience various angles of creative gambling from multiple providers.

Software Providers

Unless a casino is provably fair, it’s practically impossible to verify fairness in a casino. That’s why the choice of software providers in an operator matters. Top providers are well licensed by reputable authorities and have gained trust in the industry for providing safe and fair games. Their products are tested by authorities annually to ensure that players are not being cheated. The most trusted developers include Programmatic Play, Play n’ Go, NetEnt, Evolution Gaming, Micrograming, Real Time Gaming, Playtech, Amaya Gaming, William’s Interactive, Betsoft, NextGen Gaming, and Realistic Games.

Bonuses and Promos

Bonuses and promos are not as important as the factors we have already discussed, but they still improve your gambling experience. Operators issue casino bonuses to lure new gamblers to their platform and retain existing clients. Therefore, casinos with generous bonuses are attractive. From our user experience, bonuses can increase your potential win and cushion your capital from losses if things don’t work out. You may look for casinos with no-deposit bonuses if you’re new to gambling. How they work is that the casino funds your account with its money as soon as you sign up, hoping you will deposit more funds after experiencing their platform for free. You can also find exclusive bonuses and use them to learn gambling without spending a dime from your pocket. Pro traders also need bonuses to bankroll their capital further.

Wagering Requirements

Most people accept terms and conditions without trying to skim through them. There are specific rules you should be aware of before signing up with any gambling provider. One of them is the wagering requirement. Wagering requirements indicate how many times you must bet your capital or bonus before you can start cashing out profits. The higher it is, the longer you wait to cash out.

Getting Started at Cardano Casinos

Signing up with Cardano casinos may seem easy, but getting confused along the way is not uncommon. Registration processes differ across different operators. However, the variation isn’t so wide, so if you have ever signed up with any casino, you will probably find it relatively easy doing the same with a different operator. In this section, you will learn how to get started with Cardano casinos step by step.

Step 1: Pick the best Cardano Casino

The first step involves researching to find the best casino for your needs. As discussed under “How to Find the Best Cardano Casino,” you must scrutinize your potential options to select a safe, fair platform. Don’t forget to read different user reviews of your casino choices. You want to know what the current customers feel about the providers you are considering. However, the easiest way to find the best Cardano gambling provider is through professional reviews like dappGambl. Unlike ordinary reviews, our site will give you a comprehensive analysis of different casinos, which is what you need to choose. For purposes of this guide, we will use Cloudbet casino for illustration. Cloudbet is our top pick from the list of best Cardano casinos, so feel free to register with them.

Step 2: Account Opening

Visit Cloudbet.com and hit the “JOIN” button on the far top right of the site. Most crypto casinos have more than one signup method. When it comes to Cloudbet, you can sign up using Google, Facebook, GitHub, or Email. If, for example, you pick the Google Account option, you will be redirected to your google account home page, where you will be required to log in. Cloudbet will pick your details from the Google Account and sign you up automatically. You will use your google account username and password to log in to your Cloudbet casino account. This is a straightforward process that takes less than two minutes to complete.

Once you’re in, the site will ask you to create a nickname. Does your mind ring ‘”Anonymous gambling?” Oh yes! This is how we do it. Pick your best nickname because it can’t be changed later. Next, share your date of birth. The casino has a responsibility to keep away underage gamblers from its platform. So this step is necessary. Next, pick your odds. Don’t worry about these steps. Cloudbet casino website directs you on what to do as soon as you sign in for the first time. You will be presented wit different types of odds type to pick. These can be altered anytime in the future. The site will also require you to enable 2FA login.

Step 3: Account Verification

Cloudbet is a 100% compliant gambling provider and requires clients to follow strict verification procedures before they can get into gambling using their platform. Check your email for a verification link and click it to confirm that you are the rightful owner of the email. You might lose your account in the future if you ignore this step. KYC procedures are not necessary since this is a crypto casino. However, you may be required to verify them in accordance to Cloudbet AML procedures in the future. So we recommend doing so during registration to avoid delays in cashing out profits in the coming days. How this works is that you simply visit your profile and click on “Account Verification.” Next, upload a copy of your government-issued identification documents, such as your passport or driving license, and submit it. The page will refresh and bring you a new page with a physical address form. Fill it out and save it to update your address. Lastly, verify your physical address to complete this stage. Uploading and submitting a recent bank statement or copy of a utility bill indicating the physical address you provided works. You will receive an email indicating receipt of your verification documents. The support team will physically check the submitted documents and verify your account. Your profile is now 100% complete.

Step 4: Fund your Account

Cloudbet does not support FIAT payments. That means you can only fund your account using a crypto wallet. We recommend Coinbase.com for beginners and Binance.com for pro gamblers. Read more about cryptocurrency wallets if you’re new to this. The minimum deposit at Cloudbet is 0.1 ADA or equivalent, so any amount above that works. There are two main ways to do this. The first one involves connecting your wallet and initiating the transaction from the Cloudbet payment page. This is forthright and less prone to errors. The alternative is to copy the Cardano crypto address on your Cloudbet dashboard and use it to send money directly from a crypto exchange like Coinbase. Be careful if you opt for the second method. Any mistake in the address info could permanently lose your funds. Those who prefer card payments should open a Moonpay account and link it with Cloudbet. Your ADA will be automatically transferred to your Cloudbet account as soon as you make card payments on Moonpay.

Step 5: Claim Bonus

Most casinos offer different types of welcome bonuses. Cloudbet casino has an incredible welcome bonus of up to 180% on your first deposit, up to a value of 1BTC. So if you deposit $100, you earn an extra $180 in deposits, bringing your total capital to a whopping $380. Who wouldn’t want that? What’s more, the platform will reward you a similar bonus on your second and third deposits before assimilating you with a 240% bonus the fourth time you fund your account. This is already 780% in bonuses. Such philanthropic offers are rare, so don’t let this chance slide. You can register with Cloudbet casino now to claim your bonus.

Step 6: Start Betting

You’re ready to go with a complete profile and funded account. It’s time to bet Cardano. Browse through the different game categories to get familiar with the casino. Cloudbet casino has a user-friendly interface, so it shouldn’t take long to figure out things. Don’t hesitate to contact the live chat agent in case you have any pressing issues. You can start wagering with small stakes and improve later as you accumulate more wins than losses.

Buy ADA: How Does it Work?

The most effective way to buy ADA is through a crypto exchange. Crypto exchanges are very similar to the stock exchange, except that they are 100% online, decentralized, and run 24/7. We recommend Binance and Coinbase as the best crypto exchanges to buy ADA. Registration procedures are simple, and you can set up your account in under five minutes. You will need:

- Your full names

- Strong Password

- Email address

- Passport/ ID/ Driving License

- Utility Bill with your physical address

Once signed up, verify your account using your I.D. and physical address, then add a debit or credit card to your crypto exchange Binance and start buying cryptocurrencies. It’s that easy. If you’re using the Coinbase platform, use the search bar to find ADA, then click buy. Specify the amount of money you want to spend, and hit the “Confirm” button. Coinbase will credit your account with ADA instantly.

How to Withdraw Funds from Cardano Gambling Sites?

If you’ve won money while gambling on a Cardano-based platform and you’re wondering how to withdraw your funds, we’ve got you covered. Here are the steps you need to follow:

Step 1: Ensure you have an ADA wallet

Before receiving any funds from the Cardano gambling site, you need to have an ADA wallet. An ADA wallet is a digital wallet that stores your ADA funds. There are various types of ADA wallets, from hardware to software wallets.

Step 2: Log in to your Cardano gambling site account

To withdraw your winnings, log in to your online gambling account using your email address and password. If you’ve set up extra precautions, you may be required to complete a two-factor authentication process.

Step 3: Navigate to the withdrawal section

Navigate to the withdrawal section once you’re logged in to your account. This section will be located in your account dashboard or the site’s cashier section.

Step 4: Enter the amount you want to withdraw

Enter the amount of funds you wish to withdraw. Keep in mind that some sites may have minimum and maximum withdrawal amounts that you need to adhere to.

Step 5: Choose your withdrawal method

Choose the Cardano token from the list of available cryptocurrencies and, if needed, select the ADA network to process the transaction.

Step 6: Confirm your transaction

Once you’ve chosen your withdrawal method, add your address by copying from your ADA wallet and pasting it into the cashier section.

Step 7: Wait for your funds to transfer

After confirming your transaction, you must wait for your funds to transfer to your ADA wallet.

Best Exchange For Cardano Casinos

No 1: Binance: Best Overall Exchange for Cardano Casinos

Binance is the number 1 crypto exchange in the world by market capitalization and number of users. It’s not the most user-friendly but has some of the lowest trading fees and offers the highest number of digital coins in the entire crypto market. The exchange was launched in 2017 by software developer Changpeng Zhao targeting advanced crypto users. Therefore we do not recommend it for total newbies as they may experience a steep learning curve.

The platform offers a wide array of blockchain products, including major cryptos, altcoins, tokens, and NFTs. Users can access Binance through a web browser, desktop app, or iOS and Android apps. Binance.com is banned in the U.S., so clients from that region can only use Binance. U.S. Apart from crypto, Binance also offers additional assets such as futures, options, and other types of derivatives. U.S. users, however, have limited access to only 65 assets that the government regulator has approved.

When it comes to safety, the website is highly secure. Users log in using a 2FA feature, meaning a third party can’t steal your money unless they have access to your authenticator app. In addition, U.S. clients enjoy FDIC insurance for all their U.S. dollar balances.

- Pros

- Over 65 tradable cryptocurrencies for U.S. customers

- Low fees

- Large coin selection

- Wide selection of trading options and order types

- Cons

- The platform is complex and may be confusing

- Non-transparent corporate structure

- Binance has run into regulatory trouble in several countries

No 2: Coinbase: Beginner Friendly Exchange for Cardano Casinos

Coinbase is our second-best Cardano casino exchange and the top recommendation for beginners. Unlike Binance, the exchange is user-friendly and easy to use, even for newbies. No wonder it has quickly become one of the leading crypto exchanges in the entire world. It’s natively U.S., meaning it’s one of the most reliable and safest crypto exchanges ever. You can buy and sell more than 150 coins on this platform using a credit/debit card, wire transfer, or eWallets like PayPal and Skrill. Transaction fees are, however, much higher than most of its competitors, but we still find that reasonable compared to the safety and all the other unique features that this exchange brings to the table. Fees range from 0.5% to 0.4.5% depending on the transaction type.

Coinbase users can access the platform from a web browser, desktop app, or mobile app. There is also an option to use Coinbase’s non-custodial wallet if you need extra security for your crypto. The website is SSL secured, so you can rest assured that your data is safe. Apart from that, there are very few security concerns considering that the exchange is licensed in the U.S., which is probably the toughest crypto regulatory region in the world.

- Pros

- U.S. license

- Multiple crypto options

- Low account funding minimum

- Option to use non-custodial wallet

- Highly secure

- Client funds are insured

- Cons

- Higher transaction fee compared to competitors

- Restricted in some regions

Cardano (ADA) in Crypto Casino Games

- Cardano Slots: Are you a slots lover? You’ll find Cardano slots in most Cardano casinos. The gameplay is not different from regular slots, except you play and win in ADA. From our Cardano casino recommendations, B.C.Game and True Flip are our go-to platforms for the best Cardano slots. Both of them offer a low house edge and attractive bonuses on slots. In terms of ranking, Cloudbet is our top pick, followed by True Flip casino.

- Cardano Blackjack: You have not had a blast in gambling if you have never played a blackjack game. It’s among the most popular casino table games as it has straightforward rules making it a simple game. You can play Cardano blackjack in any Cardano casino anytime. Your main goal is to beat the dealer standing in for the house. The game has a strategy aspect, making it a good fit for witty gamblers as it’s not purely based on luck. True Flip is our top pick for Cardano blackjack gambling.

- Cardano Roulette: Roulette was less popular a few years ago, but it sits on the throne today. Cardano roulette is easy to learn and fun to play; wheels make it more engaging and add an aspect of drama due to their highly unpredictable nature. Just like blackjack, you play against the house. So, your main goal is to beat the dealer. If time and convenience are important to you, sign up with B.C.Game and enjoy playing Cardano roulette from the comfort of your home. Rest assured, you’ll rake in high payouts and original games from leading industry names.

- Cardano Crash: Cardano crash is a pretty simple game designed to test your intuitive sense. It consists of a floating object or line rising until it reaches a crashing point. You aim to cash out before it crashes and take home a prize in ADA. However, you lose the money you had staked if the game crashes. Cardano crash is not as old as slots, blackjack, or roulette. Therefore some major game studios like Microgaming and NetEnt don’t have crash games yet. Cloudbet is the best Cardano crash game provider out of our top three list of the best Cardano casinos.

- Cardano Poker: Cardano poker is played in Cardano online casinos. Players bet and win in ADA. Poker is among the most preferred games by pro gamblers as it’s not a game of pure luck. Winning takes a combination of strategy, proper gameplay, concentration, memory, and luck. You can either play against the house or other players. Sign up with Cloudbet today to enjoy Cardano poker, including live table casino poker. You can also create an account at our favorite operator, BC.Game to play Texas Hold ’em Poker and Oasis Poker with RTPs of 97.96 and 98.96, respectively.

Why is Using Cardano on Casinos the Right Call?

Ethereum is one of the most secure blockchain networks, and that’s why dApp developers trust it worldwide. On the other hand, Cardano was built to improve on all Ethereum weaknesses. It’s more scalable and one of the most secure digital coins due to the Ouroboros algo. Like other cryptos, the digital coin is getting a lot of attention from the crypto community, which means demand is also rising. With all that in mind, using Cardano casinos assures you of a safe, fast, and reliable betting environment. Furthermore, ADA is decently priced, and its value could appreciate both in the short term and long term.

What Can You Expect to Find on Cardano Casinos?

- Speed: Cardano has one of the fastest blockchain technology. As a result, you can expect lightning-speed transactions on Cardano casinos, with deposits and withdrawals taking about 45 seconds to complete. This is incomparable to traditional banking methods like eWallets and bank wire transfers which can take 3 to 5 business days.

- Anonymity: Anonymous betting is the hottest thing in gambling now, and you can only find it in crypto casinos. Most Cardano casinos will not ask you for more than your username, email address, and password during account registration. Keep in mind, though, that for security, you may still be required to verify your KYC in case the casinos suspect fraud.

- Capital Growth: Much purchasing power is lost when players use FIAT to gamble, unlike crypto. It’s an open fact that Cardano is one of the fastest-growing digital currencies and is likely to take on a steady uptrend as it gains popularity among dApp developers. Gambling with Cardano hence allows you to grow your capital as the digital coin’s value rises.

- Innovation: The Cardano project is the work of top scientists and has undergone several peer reviews in the past. The company also hires the best academic brains to make Cardano an innovative problem solver in the crypto world. So you can expect new updates from time to time, and of course, they don’t come without innovations.

Cardano Casino Trustworthiness

There’s no question of trust when it comes to Cardano casinos. These operators ensure safety, openness, and, consequently, fairness through a smart contract system. Smart contracts are transaction protocols that automatically execute instructions immutable upon fulfillment of the terms of the contract or agreement. They hence lock-in trust by ensuring agreements are executed on the blockchain with zero third-party interventions. They can’t be hacked or manipulated. Execution doesn’t happen if the terms of the agreement are not met. This technology makes it possible for gamblers to verify the fairness of game outcomes hence eliminating the distrust between players and the casino.

Differences Between ADA and Other Crypto Coins

Several factors differentiate Cardano from other cryptos. The main one, however, is in the consensus mechanism of Cardano. Digital coins like Bitcoin and Litecoin use the proof of work (PoW) consensus mechanism, which is expensive and energy-consuming. This cost is added to the transaction fees making payments expensive. Ethereum is also using the PoW, although the company is currently working on transiting to the Proof of Stake system. Cardano’s Proof of Stake is very different from what is being used by cryptos like Solana or what Ethereum is trying to adopt. It uses a variation of the existing Proof of Stake called Ouroboros. Charles Hoskinson, the founder, describes this system as incomparably efficient. The method picks random leaders to validate blocks and can complete over 250 transactions per second compared to Ethereum, which only handles about 30 successful transactions per second. As of writing this, ADA is held in over 3.5 million wallets, and the blockchain has remained stable with zero downtime in over 1500 days so far.

The Future of Cardano Gambling

We expect to see a steady rise in Cardano gambling as more crypto gamblers move away from expensive networks with pricey network fees and slow processing times. Cardano and its novel proof of stake consensus mechanism allow transactions to be processed much faster and at a fraction of the costs, which keeps network security high. With the new Cardano updates that saw the blockchain release and update its smart contract functions, Cardano has become even more helpful in traditional and decentralized gambling scenarios. We’ve already seen ADA tokens being added on almost if not all, major crypto casinos, and as network fees continue to decrease, removing financial frictions from gamblers’ deposits, players will seek to use the Cardano network for its reliable blockchain and fast deposits.

Final Thoughts

Crypto gambling is the hip thing right now. Whether you’re just getting started in the industry or already a pro, you should try ADA gambling. What matters is finding the best Cardano casino, as there are many fraudsters on the hunt for their next victim. Consider starting your Cardano gambling with our recommended casinos if you haven’t figured out which provider to choose. We thoroughly review crypto operators and only select the best to list on our website. What’s more, we negotiate attractive deals from crypto gambling providers. Sign up with any operator using the links on our website to enjoy exclusive offers and bonuses.

What are the fees for an ADA payment at the casino?

The best Cardano casinos don’t charge zero fees for deposits and withdrawals. However, cryptocurrencies have network fees that you must foot every time you make a transaction. Nevertheless, Cardano’s Ouroboros consensus mechanism makes transaction fees insignificant, so your cost may be less than a dollar in most cases.

Is there a Cardano bonus in the casino?

All the Cardano casinos on dappGambl offer a form of bonuses and promos. The most common bonuses are welcome bonuses, which could be a deposit or no deposit bonuses.

Is ADA accepted everywhere?

ADA is relatively new crypto, so it’s not accepted everywhere. Unlike Bitcoin, which is supported in almost every crypto casino, only specific online gambling providers like the ones listed on this page accept ADA.

How secure are Cardano deposits?

Cardano deposits are 100% secure if you use a safe provider. A rule of thumb is to avoid sites that are not SSL secured. An SSL certificate is the only indication that all information you share with a website is encrypted and safe from hackers.

Who invented Cardano?

American entrepreneur Charles Hoskinson invented Cardano in 2017 after breaking away from the Ethereum project. Buterin removed his co-founder Hoskinson from the Ethereum project after a heated dispute on whether Ethereum would be commercialized or not.

Is Cardano the Same as Ethereum?

Although Ethereum and Cardano support dApps and smart contracts, they are not the same. Cardano is not the same as Ethereum. Ethereum was launched on 30th July 2015 as an advanced crypto that addressed the challenges of Bitcoin, mainly scalability. Cardano, on the other hand, was officially rolled out in September 2017 as a more scalable and energy-efficient blockchain network.

How to deposit at a Cardano Casino?

You need a crypto wallet to deposit at a Cardano casino. The quickest way is to link your wallet to the casino’s dashboard and execute a transaction. You can also send directly from your wallet to the casino using the operator’s Cardano casino address linked to your gambling dashboard.

How long does a Deposit Take in Cardano Casinos?

Cardano transactions take an average of 40 seconds to complete. So you can be sure to look forward to experiencing fast deposits and withdrawals, averaging 45 to 50 seconds.

Can Cardano be withdrawn from Cardano Online Casinos?

Yes. You can withdraw Cardano from a Cardano casino seamlessly. However, some operators may require you to meet wagering requirements before your ADA can be eligible for withdrawal. So don’t forget to read the terms and conditions before signing up.

Can You Use Cardano on Casinos?

You can only use Cardano in a specific casino that supports Cardano gambling. B.C.Game, True Flip, and Cloudbet are some of the best Cardano gambling platforms.

Is fiat involved in the Cardano Casino?

Crypto-only casinos do not accept any form of FIAT on their platform. However, some operators accept both FIAT and crypto. These are mostly traditional online casinos that have recently included crypto betting on their platform.

Other Recommended Cryptocurrency Casinos

Facts Checked by Josip Putarek, Senior Author