4.9

- Free Faucets

- Play to Earn

- Provably Fair Games

4.9

- Personalised bonus offer

- Provably Fair Games

- Low House Edge

- VPN allowed

- Anonymous Gambling

- No fees

4.9

- Personalised bonus offer

- Provably Fair Games

- Sportsbook with eSports

- 24/7 Live Chat

- Sportsbook

- Great mobile app

3.1

- Anonymous Gambling

- Instant withdrawal

- Crypto sportsbook

4.6

- Live Casino

- Generous welcome bonus

- Large selection of games

- Live chat 24/7

- Fast Withdrawals

- Crypto Games

- VIP Programme

- Anonymous Gambling

- Responsible Gaming Tools

4.2

- Fast payouts

- Low Deposit

- userfriendly

- Popular casino

- Sportsbook with eSports

- Some of the best odds

- Crypto Casino

- Fast payouts

- Poker tournaments

4.5

- Daily Cashback

- 89 live casino titles

- crypto rewards

- No KYC needed

- VPN friendly

- Instant withdrawal

1. Sportsbet.io – An Excellent Selection of Games

Sportsbet.io Casino is a popular operator founded in 2016 and known for its wide variety of games, including slots, table games, and live dealer options. It’s licensed by the Government of Curacao, which ensures a safe gambling environment. It also features a Mobile-friendly design for gaming on the go, 24/7 customer support, fantastic bonuses, and more.

Sportsbet.io Casino is a popular operator founded in 2016 and known for its wide variety of games, including slots, table games, and live dealer options. It’s licensed by the Government of Curacao, which ensures a safe gambling environment. It also features a Mobile-friendly design for gaming on the go, 24/7 customer support, fantastic bonuses, and more.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Cryptocurrencies |

|---|---|---|---|

| 100% 1st Deposit Bonus Up To 1,000 USDT + 100 FS | 40x | 20 USDT | BTC, ETH, USDT, XRP, LTC, TRX, ADA, BCH |

- Pros

- Great VIP Clubhouse for loyal players

- Offers native Mobile App for Android and IOS players

- Fast payment transactions

- Cons

- Doesn't focus on responsible gambling

- Big number of restricted countries

2. Vave – A Very Secure and Safe Site

Vave Casino is a relatively new top-tier operator offering a fantastic welcome bonus and free spins for newbies while regulars enjoy weekly reloads, tournaments, and a rewarding VIP program. With fast payment transactions, 24/7 live chat support, and an excellent user interface, you will have a seamless gaming experience. Licensed in Curacao, it ensures security with SSL encryption and 2FA.

Vave Casino is a relatively new top-tier operator offering a fantastic welcome bonus and free spins for newbies while regulars enjoy weekly reloads, tournaments, and a rewarding VIP program. With fast payment transactions, 24/7 live chat support, and an excellent user interface, you will have a seamless gaming experience. Licensed in Curacao, it ensures security with SSL encryption and 2FA.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Cryptocurrencies |

|---|---|---|---|

| 150% bonus up to 1.5 BTC + 100 FS | 40x | 20 USDT | ETH, USDT, XRP, LTC, TRX, DOGE, BCH |

- Pros

- Supports multiple digital coins for transactions

- Fast and secure payouts

- Extensive game library with over 6,000 games

- Cons

- Some table games may be difficult to locate

- Limited selection of niche specialty games like bingo

3. CryptoBetSports – A Very Secure and Safe Site

CryptoBetSports Casino, established in 2022 and licensed by the CGCB, is a cryptocurrency-friendly operator where you can find an excellent selection of games, from slots to live dealer options, from top providers like NetEnt and Evolution Gaming. It supports multiple digital currencies and offers fiat-to-digital coin conversion for added convenience.

CryptoBetSports Casino, established in 2022 and licensed by the CGCB, is a cryptocurrency-friendly operator where you can find an excellent selection of games, from slots to live dealer options, from top providers like NetEnt and Evolution Gaming. It supports multiple digital currencies and offers fiat-to-digital coin conversion for added convenience.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Cryptocurrencies |

|---|---|---|---|

| 150% Up To 1 BTC + 150 FS | 40x | $20 | BTC, XRP, LTC, ETH, USDT, TRX, DOGE, BCH, BNB |

- Pros

- Fast withdrawals processed within minutes

- High daily cashback (15%)

- Multi-channel around the clock customer support

- Cons

- No dedicated mobile app

- High wagering requirements

4. Bitstarz – A Reputable Casino

BitStarz Casino is an online gaming platform that was launched in 2014, known for being one of the first casinos to accept both traditional currencies and cryptocurrencies like Bitcoin. It offers a wide range of games, including slots, table games, and live dealer options, provided by top software developers such as NetEnt, Microgaming, and Evolution Gaming.

BitStarz Casino is an online gaming platform that was launched in 2014, known for being one of the first casinos to accept both traditional currencies and cryptocurrencies like Bitcoin. It offers a wide range of games, including slots, table games, and live dealer options, provided by top software developers such as NetEnt, Microgaming, and Evolution Gaming.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Cryptocurrencies |

|---|---|---|---|

| 25 No Deposit Free Spins | N/A | N/A | BTC, ETH, USDT, XRP, TRON, LTC, TRX, ADA, DOGE, BCH |

- Pros

- Free Spins

- VIP Club

- Cons

- Some bonuses are only for fiat currencies

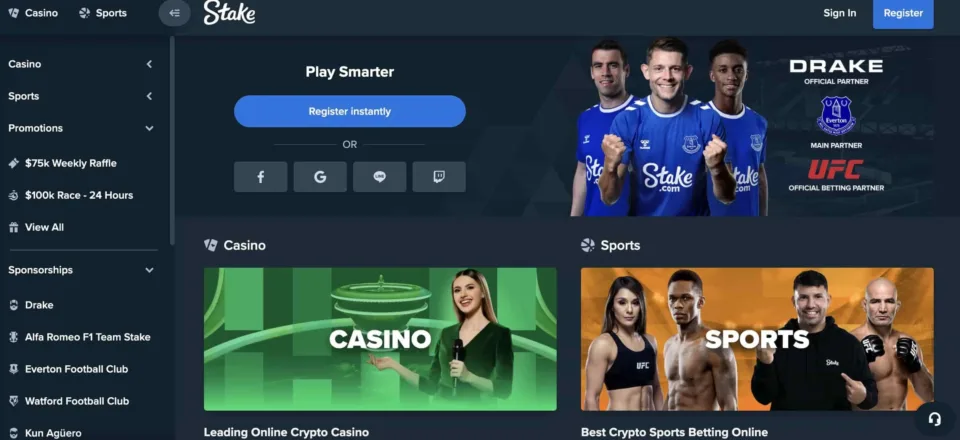

5. Stake – Best for Exclusive dappGambl Bonus of 200% up to $1000

Stake Casino is the most popular online crypto casino with millions of players worldwide. For that reason, we have prepared a special exclusive bonus for the new players. Casino supports many cryptocurrencies and card payments like Visa and Mastercard. Support is always ready to help especially if you become one of their VIP players.

Stake Casino is the most popular online crypto casino with millions of players worldwide. For that reason, we have prepared a special exclusive bonus for the new players. Casino supports many cryptocurrencies and card payments like Visa and Mastercard. Support is always ready to help especially if you become one of their VIP players.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Cryptocurrencies |

|---|---|---|---|

| 200% up to $1000 | 40x | $100 | BTC, ETH, USDT, XRP, TRON, LTC, TRX, ADA, DOGE, BCH |

- Pros

- Top notch VIP program including rakebacks and weekly promotions and rewards

- Very transparent operator

- Exclusive bonus

- Cons

- KYC required

- No fiat payments

6. BetRunner Casino – Best for Exclusive dappGambl Bonus of 200% up to $1000

BetRunner casino, which launched very recently, has three licenses: Curaçao, Anjouan, and Costa Rica. It offers a games lobby with over 5,000 games from top providers like Pragmatic Play, Hacksaw Gaming, and Evolution. The site supports multiple cryptocurrencies, including ETH, LTC, and DOGE, with an exchange for convenient fiat-to-coin conversion.

BetRunner casino, which launched very recently, has three licenses: Curaçao, Anjouan, and Costa Rica. It offers a games lobby with over 5,000 games from top providers like Pragmatic Play, Hacksaw Gaming, and Evolution. The site supports multiple cryptocurrencies, including ETH, LTC, and DOGE, with an exchange for convenient fiat-to-coin conversion.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Cryptocurrencies |

|---|---|---|---|

| 200% Bonus up to 10,000 USDT + 50 FS | 40x | 20 USDT | ETH, USDT, XRP, LTC, TRX, SOL, DOGE, BNB |

- Pros

- Welcomes players with a massive bonus

- Has more than one license

- Withdrawals can be done without KYC

- Cons

- The sites interface is not modern

- Limited responsible gambling features

7. Playbet: Welcome Bonus up to 4 BTCs

Playbet is our top casino that accepts cryptocurrency. It has a beautiful and easy design. New players can get a big welcome bonus on the first 4 deposits. It supports many popular cryptocurrencies and Credit cards.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Cryptocurrencies |

|---|---|---|---|

| Up to 4 BTC and 800 free spins | 40x | $30 | BTC, ETH, USDT, XRP, LTC, TRX, ADA, DOGE, BCH, DOG |

- Pros

- Huge welcome bonus

- Many provides

- Many cryptocurrencies supported

- Cons

- Above average minimal deposit

8. Gamix – Free Cash VIP Program

Gamix is a relatively new crypto casino that accepts many popular cryptocurrencies. Players can benefit from great bonuses, promotions, and VIP program. Sportsbook and many games from popular providers are available to choose from.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Cryptocurrencies |

|---|---|---|---|

| Up to 225% and $1500 + Free Bets and Spins | 40x | $10 | BTC, ETH, USDT, XRP, TRON, LTC, DOGE, BCH, AVAX |

- Pros

- Decent bonus terms

- Free cash and free spins

- Great VIP program

- Cons

- New casino on the market

9. Cloudbet: Trending Variety Casino

Cloudbet offers a crypto gaming platform where you can transact with over 25 digital currencies. If you don’t have coins, you can easily purchase some via Moonpay using bank cards and eWallets. While testing the site, we confirmed that Cloudbet doesn’t set minimum deposit limits. However, you must fund your account with at least 0.001 BTC to qualify for the welcome bonus.

Cloudbet offers a crypto gaming platform where you can transact with over 25 digital currencies. If you don’t have coins, you can easily purchase some via Moonpay using bank cards and eWallets. While testing the site, we confirmed that Cloudbet doesn’t set minimum deposit limits. However, you must fund your account with at least 0.001 BTC to qualify for the welcome bonus.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Cryptocurrencies |

|---|---|---|---|

| 100% up to 5 BTC | Bonus conversion is based on a points system, which varies depending on the game and RTP | 0.001 BTC | ADA, ALGO, AVAX, BCH, BNB, BTC, DAI, DASH, DOGE, DOT, EOS, ETH, FTM, stETH, LINK, LTC, MATIC, PAXG, SHIB, SOL, TRON, UNI, USDC, USDP, USDT, XLM, XRP, Zcash |

- Pros

- High-value welcome bonus offer

- Supports up to 25 crypto coins

- Valid license from Curacao eGaming

- Allows purchase of crypto with fiat

- Cons

- Unclear wagering requirements

- No Android or iOS app

10. Betplay – Bitcoin Lightning Network

Betplay.io is a crypto casino that supports Bitcoin lighting network for fast deposits and withdrawals. It is also popular with its Poker client. It supports many popular cryptocurrencies and there’s a generous welcome bonus that you can find more about below.

Betplay.io is a crypto casino that supports Bitcoin lighting network for fast deposits and withdrawals. It is also popular with its Poker client. It supports many popular cryptocurrencies and there’s a generous welcome bonus that you can find more about below.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Cryptocurrencies |

|---|---|---|---|

| 200% Bonuss | 80x | $10 | BTC, ETH, USDT, XRP, TRON, LTC, TRX, ADA, DOGE, BCH, USDC |

- Pros

- No KYC required

- Poker client

- Bitcoin lightning network

- Cons

- No visible license

11. Thunderpick: All-in-one Casino with Betting on eSports

If you want to experience the thrill of Provably Fair gaming, Thunderpick Casino is our top recommendation. The website has an extensive array of titles that support the category, especially crash games. You can choose from close to 30 crash games on the site while using 10 different digital currencies.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Cryptocurrencies |

|---|---|---|---|

| 100% up to $500 worth of cryptocurrency | 30x | $20 | BTC, ETH, USDT, XRP, LTC, TRX, ADA, DOGE, BCH, USDC |

- Pros

- Up to 30 crash casino games

- Dedicated Provably Fair page

- Supports deposits using gift cards

- Features 2FA for added security

- Cons

- High minimum deposit

- The website is somewhat cluttered

12. BC.Game: Best for Huge Welcome Bonus

If you want to play thrilling games at a crypto casino, BC.Game provides an exceptional selection. You get 790+ slots, 38+ table games, and 603+ live casino games on the site. What’s more interesting is the 40+ BC Originals; games you won’t find at any other crypto casino. As a dedicated crypto casino, BC.Game supports 18+ digital currencies. You can claim an attractive welcome package on the website with your first four deposits.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Accepted Cryptocurrencies |

|---|---|---|---|

| Up to $220,000 worth of crypto on your first four deposits. | *1%*20% | $10 / $50 / $100 / $200, respectively for the first four deposits | BTC, ETH, DOGE, ADA, DOT, TRX, BNB, AVAX, SOL, MATIC, USDT, LTC, LINK, BCH, XLM, EOS, DAI, UNI, MANA, BAT, SHIB, ENJ |

- Pros

- Welcome bonus across the first four deposits

- Exclusive original games

- 18+ crypto coins supported

- Accepts fiat payments

- Cons

- Complex wagering requirements

- High minimum deposits on the welcome offer

13. Bets.io – Great Sportsbook & Casino

Bets.io is an online cryptocurrency casino that offers a variety of gaming options, including slots, table games, and live dealer games. It primarily caters to players who prefer using cryptocurrencies like Bitcoin, Ethereum, and other popular digital currencies for their gaming transactions.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Accepted Cryptocurrencies |

|---|---|---|---|

| Up to 1 BTC + 100 Free Spins | 40x | 0.0005 BTC | BTC, ETH, DOGE, ADA, TRX, BNB, AVAX, SOL, MATIC, USDT, LTC |

- Pros

- Daily cashback rewards

- Many bonuses

- Cons

- No VIP Program

14. Metaspins – Casino with Lotto

Metaspins is a cryptocurrency-focused online casino that offers a diverse range of games, including slots, table games, and live dealer options. The casino features a modern, user-friendly interface and partners with top software providers to deliver high-quality gaming experiences. Metaspins is known for its emphasis on decentralized finance (DeFi) elements and blockchain integration, which adds a layer of transparency and security to its operations.

Metaspins is a cryptocurrency-focused online casino that offers a diverse range of games, including slots, table games, and live dealer options. The casino features a modern, user-friendly interface and partners with top software providers to deliver high-quality gaming experiences. Metaspins is known for its emphasis on decentralized finance (DeFi) elements and blockchain integration, which adds a layer of transparency and security to its operations.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 100% bonus up to 1 BTC | 40x | N/A | BTC, BCH, ADA, LTC, USDT, XRP, ETH, DOGE, TRX, USDC |

- Pros

- Interesting and unique bonus system

- No transaction fees

- Players chat

- Cons

- No fiat withdrawal options

15. Betfury – Top Community-Based DeFi-Focused Site

Betfury is on our list as the platform includes free casino faucets, provably fair games, and free spins promotions. uryWheel lets signed-up players get a chance to win 1 BTC while the free casino faucet awards players in tokens. In the game department, there are 1000 available options, including slots, live casinos, provably fair games, specials, and table games where minimum deposits start from 0.00015 BTC and include tokens like BTC, BCH, or ETH.

Betfury is on our list as the platform includes free casino faucets, provably fair games, and free spins promotions. uryWheel lets signed-up players get a chance to win 1 BTC while the free casino faucet awards players in tokens. In the game department, there are 1000 available options, including slots, live casinos, provably fair games, specials, and table games where minimum deposits start from 0.00015 BTC and include tokens like BTC, BCH, or ETH.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currency |

|---|---|---|---|

| 100 no deposit free spins | N/A | 0.00015 BTC | BTC, ENJ, USDC, LTC, DOGE, BCH, OX, USDT, LINK, BNB, BTT |

- Pros

- Casino faucet

- Operating since 2019

- Lage token selection

- Cons

- KYC required

16. Coins Game – Free Jet Box

Coins Game is a fully licensed crypto casino that offers many popular providers. New players can get 100% bonus + 100 free spins for registration and it supports more than 30 cryptocurrencies. Customer support is available 24/7 if you need any help.

Coins Game is a fully licensed crypto casino that offers many popular providers. New players can get 100% bonus + 100 free spins for registration and it supports more than 30 cryptocurrencies. Customer support is available 24/7 if you need any help.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 100% bonus + 100 free spins | 30x | $20 | BTC, LTE, USDT, XRP, ETH, DOGE + 25 cryptos |

- Pros

- Quick registration

- Many cryptocurrencies supported

- Cons

- New casino

- Not all terms and conditions are translated

17. Betfoxx: Crypto Casino and Sportsbook in One

Betfoxx is a new crypto casino on the market that offers casino games and sports betting all in one. You can get a great welcome bonus pack for your 3 deposits. It accepts the most popular cryptocurrencies. If you have any questions, customer support is available via Whatsapp or email.

| Crypto Bonus | Wager Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 100% up to $250 + 20 Free Spins | 5x | $20 | BTC, BCH, LTC, ETH, DOGE, USDT, TRX, USDC |

- Pros

- Interesting welcome bonus

- Many cryptocurrencies supported

- Sportsbook

- Cons

- New crypto casino

18. Joya Casino – 50 Registration Free Spins

Joya Casino is a fully licensed crypto casino launched in 2023 and licensed by the Government of Curacao. Operated by Provably Fair Gaming B.V., it holds a valid Curacao eGaming license, providing access to the casino with two-stage registration.

Joya Casino is a fully licensed crypto casino launched in 2023 and licensed by the Government of Curacao. Operated by Provably Fair Gaming B.V., it holds a valid Curacao eGaming license, providing access to the casino with two-stage registration.

Joya provides access to a global market with few local restrictions and provides multi-lingual access for German or Chinese users – making the site easily accessible for any user type.

Following registration, Joya will require more personal details to access the casino features fully. With over 7,00 different games to pick from, the promo bonus section rewards users with welcome bonuses, a VIP package, cashback, and daily campaigns to choose from.

| Crypto Bonus | Wager Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 50 No Deposit Free Spins | 40x | Not required | BTC, BCH, LTC, ETH, DOGE, XRP, USDT, TRX, DASH, MONERO |

- Pros

- Game library with 7,000 games

- Generous welcome bonus

- Casinos reality checks

- Cons

- High wagering

- No FAQ page

19. RakeBit Casino – Best New Crypto Casino

RakeBit casino is a new online casino that accepts major cryptocurrencies like BTC, BCH, ETH, DOGE, USDT, and more. It offers an excellent gaming experience with over 7,000 games from leading developers. It is licensed in Costa Rica, the casino also accommodates VPN users. Players can enjoy attractive bonuses, promotions, and a VIP program to enhance their gaming experience.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Cryptocurrencies |

|---|---|---|---|

| Welcome Bonus of Up to 200 Free Spins | All deposits must be wagered 1x | 1 USDT | BTC, BCH, ETH, LTC, DOGE, XRP, SOL, BNB, USDT, TRX, & more |

- Pros

- Good bonuses and promotions

- 7,000+ game library

- Instant crypto payments

- Cons

- Lacking in responsible gambling tools

20. Winz.io: Popular VIP Club Crypto Casino

At Winz.io, you have a choice of 11 crypto coins for deposits and withdrawals. However, the site’s main attraction is the exclusive VIP club with many special rewards to leverage. You instantly qualify for the program if you deposit 2,500 USDT. The perks of being a VIP at the casino include tailored bonuses, higher bet limits, cashback & rakebacks, fast withdrawals, dedicated customer support, and no wagering bonuses.

At Winz.io, you have a choice of 11 crypto coins for deposits and withdrawals. However, the site’s main attraction is the exclusive VIP club with many special rewards to leverage. You instantly qualify for the program if you deposit 2,500 USDT. The perks of being a VIP at the casino include tailored bonuses, higher bet limits, cashback & rakebacks, fast withdrawals, dedicated customer support, and no wagering bonuses.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Cryptocurrencies |

|---|---|---|---|

| Up to $5,000 worth of crypto | None | $25 | BTC, USDT, ETH, LTC, BCH, DOGE, USDC, BNB, ADA, TRX, XRP |

- Pros

- VIP club with extensive rewards

- Spin-the-wheel welcome bonus with no wagering requirements

- Supports up to 11 crypto coins

- Intuitive website interface

- Cons

- No mobile application

- No regular deposit match bonuses

21. Bombastic: Up to 30,000 USDT Bonus

Bombastic Casino is a new crypto casino on the market offering a huge welcome bonus for new players. It has a game selection with over 3,500 titles and accepts the majority of popular cryptocurrencies. The minimum deposit to start playing is 10 USDT. The operator has many restricted countries but offers great customer support.

Bombastic Casino is a new crypto casino on the market offering a huge welcome bonus for new players. It has a game selection with over 3,500 titles and accepts the majority of popular cryptocurrencies. The minimum deposit to start playing is 10 USDT. The operator has many restricted countries but offers great customer support.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| Up to 30,000 USDT + 100 FS | 30x | 10 USDT | Bitcoin, Ethereum, Dogecoin, Cardano, Tether, USD Coin, Litecoin, Bitcoin cash, Ripple, Binance Coin, Tron |

- Pros

- Huge welcome bonus with decent terms

- Great customer support

- VIP program

- Cons

- New casino

22. LuckyBlock: Overall Best Casino with 200% Bonus and 50 Free Spins

From our review of Lucky Block, the website features one of the most valuable welcome bonuses for crypto players. You can claim a 200% match up to $25,000 worth of crypto plus 50 free spins. Regarding payments, the platform accepts 20+ coins, including popular and lesser-known options. While you can’t transact with fiat, there’s a feature to display your balance in USD.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Accepted Cryptocurrencies |

|---|---|---|---|

| 200% up to $25,000 worth of crypto and 50 free spins | 35x | $20 | BTC, ETH, LTC, USDT, USDC, SOL, TRX, ADA, LBLOCK, PEPE, SHIB, BNB, TAMA, XRP, BCH, MATIC, BONK, AVAX, FLOK, DOGE |

- Pros

- Deposit match welcome bonus and free spins

- Over 20 supported coins

- Allows balance display in USD

- Features a sportsbook

- Cons

- High minimum deposit

- No mobile application

23. Coinkings: Best No Cap Welcome Bonus

Coinkings is a new casino launched in 2024. It is owned and operated by Mibs N.V. and has a Curacao license. As a welcome bonus you will get 100% matched bonus with no cap + 100 free spins. The game choice is solid with over 2,500+ titles.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Cryptocurrencies |

|---|---|---|---|

| 100% bonus with no cap + 100 Free Spins | 40x | $20 | BTC, ETH, USDT, XRP, LTC, TRX, BNB, ADA. TRX, USDC, DOGE |

- Pros

- Excellent choice of games

- No maximum on the welcome bonus

- VIP scheme

- Cons

- Low maximum monthly withdrawal

24. Mega Dice: Innovative Telegram Crypto Casino

MegaDice is a new crypto casino that is accessible via Telegram. Mibs NV operates the site, providing players access to an impressive range of crypto games. Players can claim a 200% matched bonus on their first deposit at MegaDice. The minimum deposit is $20 worth of BTC, and the maximum bonus is 1 BTC. In addition to the matched deposit, MegaDice Casino provides 50 free spins on Dead or a Wild.

MegaDice is a new crypto casino that is accessible via Telegram. Mibs NV operates the site, providing players access to an impressive range of crypto games. Players can claim a 200% matched bonus on their first deposit at MegaDice. The minimum deposit is $20 worth of BTC, and the maximum bonus is 1 BTC. In addition to the matched deposit, MegaDice Casino provides 50 free spins on Dead or a Wild.

The minimum deposit amount is 0.0001 BTC, with limits varying by VIP level. MegaDice confirms deposits instantly, but each crypto has its own confirmation times. MegaDice has a minimum withdrawal of 0.0002 BTC. The processing of withdrawals is instant, but confirmation times for different cryptos will vary. The maximum limit changes depending on VIP levels, meaning higher-level players can withdraw more at once.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Cryptocurrencies |

|---|---|---|---|

| 200% up to 1 BTC + 50 FS | 200% bonus | €20 | BTC,BCH,LTC,DOGE,TRX,XRP,ADA,BNB,BSC,SOL, BONK,USDC,FLOK,ETH,USDT,TAMA,PEPE,SHIB |

- Pros

- Has an innovative approach to bonus wagering

- Players can claim a welcome bonus in BTC

- Excellent customer support is available 24/7

- Provably fair games are part of the game selection

- Cons

- Responsible gaming tools are missing

What is Bitcoin?

Bitcoin is a digital currency, often referred to as cryptocurrency, created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto. It operates on a decentralized network called blockchain, which is a distributed ledger that records all transactions across a network of computers.

Unlike traditional currencies, such as the US dollar or Euro, bitcoin is not controlled by any central authority like a government or financial institution. Instead, it relies on cryptographic techniques to secure transactions and control the creation of new units.

What are the Problems of Bitcoin?

- Unstable Value: As a currency, Bitcoin fails to be a reliable store of value and means of deferred payments. The value of the coin changes by about 1-3% almost daily, and occasionally by up to 5%. This value easily goes to as high as 10% a month several times in a year. Such volatility is advantageous when the price of an asset is rising, but poses serious threats when the value is declining. As of writing this, the price of BTC was $38, 537. This is about $27,000 less than the price of the same digital currency a year ago. If you were trading in futures and you sold commodities at two Bitcoins, valued at $65,000 each, and you got paid today, we would be counting more than $50,000 in losses due to the volatility of BTC.

- Government Criticism: If it’s not China cracking down on Bitcoin mining rigs, it’s the US that’s coming up with new policies to regulate the digital coin. Governments across the world are concerned that Bitcoin poses severe security threats. It’s the most ideal form of funding terrorism and promoting money laundering activities as it offers anonymity. Some governments still look at BTC investments as gambling, especially after their citizens lost millions of dollars in crypto-related scams. Additionally, tax authorities are concerned that virtual currencies could be used by their citizens to try and evade taxation. Of course, these are genuine issues that need to be addressed, but the flip side of it is that they fuel not only objections from regulatory bodies, but also create a hostile environment for the adoption of Bitcoin.

- Energy Requirements: Away from criticism and instability, BTC’s cost of mining is absurd due to its energy requirements. Cambridge University estimates that energy spent in mining Bitcoin every hour at over 100 terawatt, which is equivalent to a third of the energy consumed in the whole of the United Kingdom. The future of this kind of technology might not be so bright in this era where global warming is a key concern.

Expert Tips for Choosing the Best Crypto Gambling Site

To choose the best, we recommend paying attention to the following factors:

1. Wide Range of Casino Games

To begin with, ensure the casino you pick has a diverse selection of games. We recommend checking for slots, table games, live casino, and Provably Fair options. That way, you’ll have a variety of titles to go with.

2. Accepted Coins

It’s essential to consider the range of digital coins available at a crypto online casino. The best sites will feature multiple coins, but it is most important to confirm whether you have active wallets for the supported options.

3. Swift Transactions

No one likes waiting hours and days to receive payouts. As a result, opt for crypto-gambling platforms that accommodate rapid withdrawals. This criterion is relatively easy to meet since most crypto facilitates swift payments by default.

4. Bonuses and Promotions

Your gaming experience will be more enjoyable if there are regular promotions to claim. Based on our industry expertise, we advise using sites with valuable bitcoin casino bonuses. Look out for offers like reloads, cashbacks, and free spins.

5. Reasonable Limits

You should always choose a crypto and bitcoin casino that accommodates your budget. Check the deposit and withdrawal limits to ensure you can perform transactions without constraints.

6. Restricted Countries

Mentioned casinos have licenses in different jurisdictions, so some are limited to particular countries. You’ll want to confirm that the gaming website you’re considering is available in your region. That’ll ensure you’re not going against the operator’s policies.

7. Security, Reputation, & Trust

Look for BTC casinos with a positive reputation and trust among players. One way to do this is by researching the company behind the website and reading reviews from existing users. In terms of security, it’s a good idea to check the platform for reliable measures like SSL encryption and 2FA before you sign up.

8. Customer Support

If you have questions when using a gaming site, it always helps when support is prompt and professional. We recommend choosing operators with 24/7 customer service, reachable via multiple channels, like live chat, email, and phone.

9. Anonymity

Some players are particular about staying private while gaming. Based on our experience, you can find a number of anonymous crypto gambling sites that won’t request you to complete KYC before receiving payouts.

Pros & Cons of Crypto Casinos

Deciding whether to use a crypto casino involves considering the upsides and downsides. We’ve outlined them below so you get balanced insights on what to expect:

- Pros

- Fast transactions: With BTC and other digital coins, you can deposit and withdraw almost instantly, thanks to blockchain technology.

- High anonymity: You use only a wallet address when transacting with crypto. So, you stay anonymous without revealing sensitive payment details online.

- Global availability: Cryptocurrency is decentralized, meaning you can use it anywhere. You won’t need to worry about currency conversions, regardless of the location of the crypto casino.

- Low transaction fees: Most Bitcoin gaming platforms won’t charge for deposits and withdrawals. Likewise, blockchain network fees are usually minimal.

- Cons

- Volatility: The value of Bitcoin and other cryptocurrencies regularly fluctuates due to market conditions. This can impact your bankroll as you play games.

- Requires a learning curve: Transacting with crypto involves using exchanges and wallet providers, which some players may find technical to handle.

How Bitcoin Casinos Operate in Practice?

They work by facilitating transactions via the blockchain. Payments are decentralized, which introduces higher security and anonymity. They feature innovative technologies, like Provably Fair, which allows you to verify the transparency of gaming results.

Differences Between Crypto Casinos and Traditional Casinos

If you’re wondering what sets them apart, we’ve highlighted the core differences in the table below:

| Features | Cryptocurrency Casinos | Traditional Casinos |

|---|---|---|

| Currency type | BTC, USDT, ETH, LTC, DOGE, and more | USD, EUR, GBP, NZD, CAD, and more |

| Anonymity | High thanks to blockchain | Low due to extensive verification |

| Deposit speed | Instant | Instant but can take up to 24 hours |

| Withdrawal speed | Usually instant or within a few minutes | Can take multiple business days, depending on the method |

| Transaction fees | Minimal | High if it involves currency conversions |

| Regulatory landscape | Limited | Well-established |

Are Bitcoin Casinos Safe?

Yes, they are safe if you use reputable platforms. We noted that the best crypto casinos have SSL technology to encrypt users’ data, keeping it safe from third parties. When you create and log into your account, you can find options like 2FA to protect your account further. Since the sites use blockchain, you can rest assured that payments are highly secure as the network is said to be “unhackable.”

Are Bitcoin Casinos Legal?

Discussions around the legality always vary from country to country. Some regions permit playing games on crypto sites, while others have staunch restrictions. If your country allows online gambling and the use of cryptocurrency, you should be able to use BTC casinos without any issues.

In the US, for instance, they are permitted in some states where online gambling is legal. It’s similar in the UK, as the government is working towards regulating digital currency. If you’re in Britain, you can play at them so long as they’re licensed and regulated by the UKGC.

What Types Of Games Are Available at a BTC Casino?

Signing up at the best BTC casinos from our top list gives you access to exciting games, like:

This is arguably the most popular card game, where you aim to get a hand close to 21 to beat the dealer. As you play blackjack, you can employ skills and strategies rather than rely only on luck.

Online slots always dominate casino game collections, and the same is true for crypto sites. With this category, you have diverse options, from classic variants to video slots and jackpots. They’re easy to play, as all you have to do is spin the reels.

With roulette, the target is to predict where the ball lands after the dealer spins the wheel. It’s a table game where outcomes depend solely on chance. The appeal is that you get several gaming options.

If you don’t want to play cards against the dealer, you’ll appreciate poker. In this table game, you compete against other crypto casino players to form the strongest hand before the showdown. Variants like Texas Hold’em and Omaha are the most popular to check out.

Baccarat is a premium casino card game where you bet on the Banker or Player's hand. Whoever gets closest to 9 without going over wins. This game is a constant on all top crypto and Bitcoin casino sites.

Online casino fans choose live dealer games for a real-life gaming experience. If you play these games at a crypto casino, you interact with a human dealer via a high-quality live stream. The options available are usually classic table games and live game shows.

These games are particular to cryptocurrency casinos, as they rely on blockchain technology. They’re available as instant wins, slots, and even table games. What makes them different is that you can verify the fairness of each game round.

Bonuses and Promotions in 2025

Beyond games, you can anticipate the below bonuses and promotions at crypto and Bitcoin casinos:

1. Matched Bonuses

These bonuses give you a percentage of your deposit up to a particular amount. For instance, a 100% match bonus will reward you with an extra 100 USDT if you deposit 100 USDT. Most welcome offers are matched bonuses.

2. Free Spins

With these offers, you can play your favorite slot games for free. These casinos usually offer free spins promos as part of deposit match offers, but they can be standalone reloads.

3. No Deposit Bonuses

You claim no deposit bonuses without making any payment. They are free rewards usually available for new players and VIPs.

4. Cashback

A cashback bonus will return a percentage of your lost bet at crypto gambling sites. For instance, a 10% cashback will return 10 USDT if you lose 100 USDT while playing games.

How to Choose a Bitcoin Bonus?

Having identified the different promotions available, let’s look at some tips to help you claim the best ones:

Consider the maximum bonus cap and minimum deposit to confirm if the reward is worth the payment.

Check the wagering requirements and ensure they’re reasonable to meet.

Review the T&Cs of the Bitcoin gaming sites to know if the games that support the bonus meet your preferences.

Target combo offers, like those that reward deposit bonuses and free spins, for more value.

How Do I Select the Best Crypto Gambling Site?

You can quickly identify the best crypto gambling site by considering the criteria below:

1. Reputation and Licensing

Verify the history and reputation of the operator to confirm it’s positive. For this, check for valid licenses and feedback from existing players.

2. Geo-Restrictions

Ensure that the crypto gambling site you choose isn’t restricted to your region. You can check this from the platform’s terms of service page.

3. Cryptocurrencies Available

You’ll want to use a crypto gambling platform with coins you have in your portfolio. So, review the cryptocurrencies available while focusing on the top ones like BTC, ETH, and USDT.

4. Game Selection

The best crypto gambling site will have a variety of games in different categories. Besides quantity, ensure that the platform has quality titles from providers like NetEnt, Microgaming, Pragmatic Play, and Evolution.

5. Bonus and Promotions

Check the promotions page on the site to know what offers are available. It’s best when the operator lists multiple bonuses, so you get regular rewards for your gameplay.

6. Payment Options

Perhaps you want to transact in fiat from time to time or purchase coins using traditional money at the casino. In that case, we recommend reviewing the available payment methods.

7. Fair Gaming Conditions

The gambling platform you choose must have fair policies to avoid biased game results. One way to verify this is by checking the Provably Fair percentage for supported games.

8. Mobile Compatibility

Go for casinos that are highly compatible with mobile if you prefer gambling on your smartphone. An optimized and responsive mobile site is good, but an app is best.

9. Top Customer Support

The crypto gambling site you sign up with should have dependable customer support channels. That’ll ensure you can get help whenever needed.

Step-by-Step Guide on How to Sign Up at a Bitcoin Casino

After you choose your preferred casino to play at, follow the below steps to register your account:

Follow the link to the casino website and click the registration button.

Provide your email and personal details as required.

Create your username and password.

Accept the site’s terms and conditions and confirm that you’re over 18.

Submit the sign-up form and verify your email address.

How We Rate and Review Casino Sites

At DapplGambl, our expert team considers multiple factors when rating and reviewing the best crypto and Bitcoin casinos. You can check them out below:

- Bonuses: We confirm the site has valuable bonuses with friendly terms and conditions.

- Games: Our experts review the game collection to check their quantity, quality, and credibility.

- Sportsbook: We review various betting options, such as the emerging trend of crypto sports betting and traditional sports betting, to cater to all player preferences.

- Payment options: Our rating process includes testing and confirming that transactions are seamless and timely with various payment methods.

- Safety and security: We look at the measures in place to protect players at the crypto casino.

- Customer support: We confirm that users can get quick and professional help whenever needed.

- Interface and user experience: Our reviews analyze the ease of use of each crypto site to guarantee an enjoyable user experience.

VIP Programs

A notable upside of playing at the best Bitcoin casinos is the available VIP clubs. These exclusive programs usually require accumulating points as you play games. So, the more you engage with the crypto site, the higher your VIP status. Here are some of the benefits to expect when you join Bitcoin and crypto casino VIP programs:

- Special promotions: These usually include deposit match bonuses, cashback, and free spins. You get a much higher value than regular offers and sometimes more favorable bonus terms.

- Higher transaction limits: This advantage means you can deposit and withdraw larger amounts than other layers. You usually get faster payout times, too.

- Private account manager: The best crypto sites have dedicated staff to assist VIP casino players. You can expect faster support when needed, and even additional rewards and gifts from your account manager.

- Invitation to private events: Reaching the highest VIP tier usually gets you invitations to private events and parties. You may even get a fully paid trip to a luxurious location at some sites.

How To Make a Bitcoin Deposit at an Online Casino?

Making Bitcoin deposits at an online casino is straightforward, and you can get it done by following the steps below:

Log into your casino account and navigate to the deposit section.

Select BTC or any other cryptocurrency you want to use.

Copy the casino’s wallet address.

Switch to your crypto wallet and paste the casino’s address.

Enter the amount you wish to deposit and authorize the payment.

Return to your casino account and confirm the deposit.

Regulatory Compliance

The cryptocurrency casinos featured in our reviews adhere to regulatory standards. These sites have valid licenses from renowned authorities like Curaçao eGaming and the Malta Gaming Authority (MGA). As a result, they maintain a high level of transparency and security.

Social and Community Features

Crypto casino sites offer features like real-time chat rooms and forums to create a sense of community between players. You can use such social features to discuss games, exchange updates, and share strategies with other users. If you have questions, you can utilize the chat rooms and forums to find solutions from other players or even in-house experts.

It’s worth noting that some casinos host tournaments with live leaderboards. Participating in these tournaments allows you to compete with other players and claim rewards based on rank. You’ll be motivated to improve your gameplay and build better casino gaming skills.

Educational Resources

Top-notch crypto gaming sites feature resources to help you get the best out of your gameplay. We’ve listed the main options to look out for below:

1. Responsible Gambling

This idea here is to control your gambling activities and avoid spending more than you can afford. Hence, top crypto casinos feature responsible gambling tools for setting deposit limits, session limits, loss limits, time breaks, and self-exclusion. You’ll find contact details of professional responsible gaming organizations like GamCare, GamblingTherapy, and Gamblers Anonymous in the page footers and on dedicated responsible gambling pages.

2. Understanding Blockchain Technology

You may find crypto and blockchain gambling technical if you’re a new Bitcoin casino player. This is why leading casinos in the crypto space provide guides that explain how the whole thing works. These are usually available via FAQs and dedicated help centers on their websites.

What Are the Current Trends in the Crypto Gambling Market in 2025?

New ideas and technology mean that the Bitcoin gambling market is always undergoing exciting developments. We’ve been watching closely to see what 2024 will bring. Here are some of our trend predictions for this year:

- An increase in Provably Fair games: It’s becoming obvious that players trust casinos that are more transparent about their RTPs, terms and conditions, and overall operation. We’ll see a rise in Provably Fair games as Bitcoin gambling platforms respond to players’ wishes.

- TRON gaining popularity: This coin is being adopted by more casino players as it offers fast transfers and lower fees than other leading coins like ETH and BTC.

- A greater sense of community: Online gambling hasn’t always been seen as a social activity. However, it has become obvious that players enjoy an added element of competition and even being able to communicate with each other in the same way they would expect from online gaming. We expect to see more social elements appearing on Bitcoin gambling sites this year.

- Trading NFTs: The idea of using non-fungible tokens to reward players has been around for several years. With the wider adoption of blockchain technology, we expect to see NFTs becoming a more common feature on casinos this year, both as rewards and as tradable assets.

Transactions made with crypto are highly secure, as the blockchain is more or less hack-proof.

Players don’t need to worry about converting from one currency to another based on their location, as crypto is global.

Casinos with cryptocurrencies allow players to mitigate the risk of market volatility by supporting stablecoins. Users get the same stability as fiat currencies but with high security and anonymity.

Crypto Casino Apps

Based on our review, Sportsbet.io and BitCasino are the two best crypto casinos with mobile applications. You can install the apps on your Android device and play on the go. Note that the applications aren’t available for download via the Google Play Store. Instead, you can find them on the casinos’ official websites. The platforms currently do not have iOS versions, but you can still play seamlessly on Safari.

Final Thoughts

So far, we’ve covered all the essential aspects of crypto and best Bitcoin casinos. If you’re new to the industry, you’ll find it much easier to pick the best platform and register by following the information in this guide. Our top 10 list features high-quality and safe crypto gaming sites you can trust, with rewarding bonuses to claim. Browse the list, find a platform that suits you and start playing your favorite games.

Which is the best casino to gamble with cryptocurrency?

It varies depending on your preferences as a player. You can check the top list on this page for the ones we recommend.

What is the best casino welcome bonus?

Based on our review and our rating methodology, it is LuckyBlock. The website features a signup bonus that rewards you with a deposit match and free spins.

Which casino is legal for crypto in USA?

Many casinos are legal to gamble with crypto in the USA. To pick the best one, confirm that the site is reputable with a valid license. You can check our top list on this page for recommendations.

Are crypto casinos better than traditional online casinos?

Yes, they are better in multiple aspects. The sites allow faster and safer transactions via blockchain, which guarantees anonymity.

What cryptocurrency casinos pays out the most?

These casinos usually have high Return-to-Player rates with a low house edge. You can confirm the RTP percentages before you begin playing any game.

Casinos by Cryptocurrency

References

- Provably fair algorithm – Wikipedia-on-IPFS.org

- An introduction to the different types of gambling and casino games – Skrill.com

- VIP and loyalty programs – thegolfbusiness.co.uk

- The Social Aspect of Online Casinos – hnmagazine.co.uk

Facts Checked by Josip Putarek, Senior Author

julien@contentbydesign.ca

julien@contentbydesign.ca