UniSwap Exchange Review

3.6

Main Selling Points

Huge selection of cryptos

Huge selection of cryptos  No KYC needed

No KYC needed  Fast transactions

Fast transactions UniSwap Basic Information

Uniswap is the largest decentralized marketplace on the Ethereum network. This means it is not owned by any single entity and poses no risk of censorship. It is open-source and allows users to list their own tokens. Unlike traditional decentralized exchanges (DExs), Uniswap operates on a unique model known as automated market making (AMM), which it pioneered.Introducing UniSwap

Uniswap exchange is the most significant decentralized marketplace on the Ethereum network. That means it’s not owned by anyone and carries zero risk of censorship. It’s open source and even permits users to list their own tokens. Unlike normal DExs, this one operates on a unique model called automated market making (AMM), which it pioneered. Instead of an order book, AMMs use smart contracts to set asset prices and execute trades automatically. It has two smart contracts: exchange and factory smart contracts. The Factory smart contract is responsible for adding new tokens to the platform. The exchange, on the other hand, allows trade and swap execution. Therefore, you can swap any ERC-20 token with another on the updated Uniswap v2 platform.

Uniswap exchange allows you to trade ERC20 tokens (crypto assets built on the Ethereum blockchain). Users can also swap crypto assets and earn interest through liquidity mining. Interestingly, you don’t need to sign up for an account to use this platform. Simply connect your crypto wallet, load funds and get started. The exchange has a user-friendly design that makes it easy to use, especially for beginners. More than two versions have been rolled out so far, as the developers strive to offer quality. The first upgrade, Uniswap V2 was rolled out in May 2020. It enabled users to swap crypto assets on the Ethereum blockchain directly. One year later, in May 2021, the AMM released Uniswap v3 on the L1 Ethereum Mainnet.

Unlike the previous versions, Uniswap V3 has a flexible fee structure that is pretty accurate and efficient. Also, V3 offers liquidity and provides better interest rates than V2. Uniswap v3 strives to surpass all centralized exchanges and stable coin-based AMMS by facilitating low-slippage trade execution. The platform is currently the largest in terms of volume and total value locked. See “Market Share” information below. Let’s deep dive into this Uniswap crypto exchange review and learn more about what it offers.

Pros & Cons

- Pros

- It has a user-friendly design

- Users can earn interest through liquidity mining

- No signup required

- Several crypto wallets are supported

- Supports swapping of NFTs

- No KYC requirements

- Cons

- Fiat currencies aren't supported

- High gas fees

- Risk of impermanent loss

Company Overview

Team – Who founded Uniswap?

![]()

Hayden Adams is the founder and CEO of Uniswap. He graduated from Stony Brook University with a bachelor’s in engineering in 2016. Hayden has worked as a mechanical engineer at Siemens since he was laid off on July 6, 2017. He then decided to design an AMM, and that’s when the Uniswap crypto exchange idea was born. He and a team of fewer than ten people created the crypto exchange with a $100 000 grant from the Ethereum foundation.

The exchange was launched on November 2, 2018, with its headquarters in New York, US. In April 2019, the crypto exchange closed a $1M seed round led by paradigm. It also received additional funds from more venture capital firms, including Andreessen Horowitz, Union Square Ventures LLC, and ParaFi.

Uniswap Market Share

![]()

Uniswap has a $1.1T+ trade volume, 110M+ time trades, 300+ integrations, and 4,400+ community delegates as of this writing. It had registered V3 has a 24-hour trading volume of $352.65 million and ranked 14 while we were conducting this Uniswap exchange review. It has over 482 markets and a market share of 0.75%. It has about 3.4 million total visits and annual revenue of between $2.0 and $5.0 million.

Uniswap Exchange License and Insurance

![]()

As a decentralized marketplace Uniswap isn’t licensed or controlled by any government body. It is governed by UNI holders who vote for crucial decisions that determine the exchange’s future. It has a “GNU General Public License v3″, a free, copyleft license for software. We did not find information about any other operations license duri9ng this Uniswap exchange review.

Since it’s non-custodial, it doesn’t hold users’ funds and hence doesn’t need an insurance. DeFi users who need insurance can pay for their own cover on the platform. The amount varies due to the type, duration, and provider. For instance, you would pay 0.02559 ETH to cover 1 ETH for one year against a hack on Uniswap. This helps protect your funds locked on the Defi platform.

Reputation and Security

![]()

Uniswap exchange is no doubt the leading DEX on Ethereum because it has a good reputation. The marketplace is high safe as it enjoys the same security standard as that of the Ethereum network that hosts it. Unlike in central exchanges where all servers are concentrated, DEX’s services are usually spread out. This minimizes servers’ downtime and makes them more immune to attacks. The reason is simple; taking out one of the servers will have little impact on the full network of servers. Also, the fact that users keep their own funds mean hackers can’t access funds like they did with Mt. Gox, if they manage to breach server security. That is why Uniswap exchange is inherently safe.

Additionally, the UNI governance token secures the crypto exchange’s future development by creating a decentralized voting system that ensures bad actors don’t propose and implement development upgrades that may damage Uniswap’s reputation and security.

Complaints Received

Uniswap is rated 1.4/5 on Trustpilot based on 108 customer reviews. Most customers complain of fake calls from Uniswap, poor design of the platform, and fake tokens. While these complaints are critical, we noted that majority of them were not directly related to the platform. It goes without saying that as a leading DEX, scammers will target the platform. Account holders have a responsibility to remain cautious and avoid falling for traps. Uniswap exchangr will never ask for your seed phrase, so anyone asking you for that is a fraud. We also noted that in July 2020, many Uniswap users lamented about fake tokens on the platform. It isn’t clear how much the scammers stole. However, several crypto projects have made several announcements about not being associated with fake token projects. That’s a real challenge because the decentralized nature of the site means it lacks a proper review channel where users can check the reputation of different products before committing their hard-earned funds. Since anyone can list a product, fraudsters sometime take advantage to clone existing tokens and trick users into buying them. That said’ it’s important to research about new tokens before investing your funds. If you’re new to this, take some time and learn how to find the right DeFi project. In August 20202, Uniswap mitigated the issue via the introduction of lists. The introduction lists establish the legitimacy of tokens based on how many lists are included and how reputable those lists are. While this measure doesn’t sound robust enough, it is a noble attempt to manage the issue while remaining decentralized by allowing legitimate projects to add their tokens conveniently.

How Secure is the Uniswap Exchange?

Our Uniswap review establishes that the platform is secure, thanks to its decentralized nature and liquidity pool operation. Also, since it is based on the Ethereum blockchain, it has the same security measures as the Ethereum blockchain, as earlier mentioned. Liquidity pool funds are locked by a smart contract and, therefore, can’t be removed by any account but your own or anyone else without respecting the terms of contract. So, a hacker would need your personal information to access your funds in the liquidity pool. Therefore, it is best to keep your wallet safe all the time.

Once in a while you may experience lagging or get error codes while using the Uniswap exchange platform. When that happen, report the issue. The developers will most likely take note and resolve it in the next update. Such errors do not impose any security risk to you. They are just simple bugs. We established during this review that the platform’s code is regularly audited and tested for user safety. That said, there are other ways hackers can steal from you. Clients have lost considerable amount of money to phishing scams in the past. In 2020, over $25 million was lost to scammers in the same fashion. You can avoid being a victim by alwayc confirming the site’s URL before sharing your details.

Since Uniswap is permissionless, it is more prone to attackers. While these are crucial reminders, they should be published for more traditional sources of well-known sources. This way, it may sound more genuine as it will aid in differentiating good and bad platform users, and users will take the necessary measures.

Uniswap Available Tokens

Uniswap supports hundreds of RC-20 tokens. Some of the available tokens are:

Uniswap supports hundreds of RC-20 tokens. Some of the available tokens are:

- Ethereum (ETH)

- Basic Attention Token (BAT)

- Enjin Coin (ENJ)

- Chainlink (LINK

- finance (YFI)

- Tether (USDT)

- USD Coin (USDC)

- Dai (DAI)

- Synthetix (SNX)

- Uniswap (UNI)

- Wrapped Ether (WETH

- Wrapped Bitcoin (WBTC)

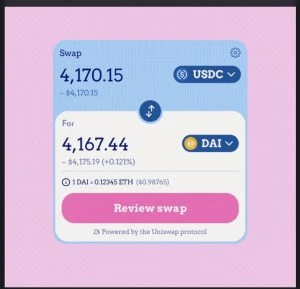

Uniswap Payments

- Deposits & Withdrawals Methods: Uniswap doesn’t accept any deposits of fiat currency. New crypto investors (those without previous crypto holdings) can’t trade here. To purchase your first cryptos, you need an entry-level exchange, which is an exchange accepting deposits of fiat currency. You may also consider creating a wallet where you can buy crypto with fiat, before using them on the Uniswap exchange site. All withdrawals are also through digital currencies. Payment times vary depending on network congestion, but usually take an average of five minutes.

- Limits: While compiling this detailed Uniswap crypto exchange review, we didn’t find any limits associated with the exchange. There are no trading, deposit, or withdrawal limits. This is common for decentralized marketplaces.

Uniswap Fees

All the fees for UniSwap V1 were flat at 0.3%, and all the fees were allocated to LP providers. Its V2 fee was 0.005%, and the fee was reserved for platform development. Uniswap V3 has a three-tiered fee structure.

- Swapping 0.01% (v3 governance)

- 05% (stable/stable pairs like USDC/USDT)

- 3% (stable/blue-chip pairs like USDC/ETH);

- 1% (foreign pairs such as ETH/DOGE).

All UniSwap fees (0.3%) go to liquidity providers. Turned off by default, one can turn on the protocol fee for particular pools through governance, and the cost can be set between 10% and 25% of LP fees.

Uniswap gas fees have been quite high, as the platform is based on the Ethereum blockchain. There is was no way Uniswap can minimize the high gas fees. However, we hope that the Ethereum merge will have a positive impact on the fees.

Uniswap Withdrawal Fees: When it comes to withdrawal fees, this platform has a competitive structure. Charges are based on the global industry BTC withdrawal, which is 0.00053 BTC per withdrawal. Although the fee varies daily, Uniswap exchange charges roughly 15-20% of the global industry average BTC-withdrawal rate.

Step 1: Visit app.uniswap.org

Step 2: Tap on Connect to a Wallet in the upper right corner.

Step 3: Choose your preferred wallet.

Step 4: Sign in to your wallet if you haven’t.

Step 5: Confirm you want to link your wallet to the Uniswap exchange. You’ve now connected your wallet and can start enjoying the Uniswap exchange features.

Step 6: Click on “swap” or any other function like staking to start using the platform.

Uniswap User Experience

Desktop

Unlike competitors like Trader Joe DEX, Uniswap exchange has a bit of a learning curve, even if you have prior experience with decentralized marketplaces. Platform features are not openly displayed, meaning you must comb through different tabs to search for them. It, however, takes a short time to get the hang of it. Like most crypto sites, the platform comes with a default dark background and a minimalistic design making it easy to read. You simply need to connect your wallet to get started since there is no registration requirement. Only afterward can you access their Uniswap features via their desktop app. You can swap and become a liquidity provider through the simple interface that allows easy navigation. No personal info is required during account setup, making it the perfect choice for privacy-conscious investors. However, fiat is not accepted, making it a little cumbersome, especially for first timers.

Mobile App

The platform allows users to deposit funds from their Ethereum wallets but doesn’t currently offer a mobile app. This is because designing a mobile app would go against the principles of the decentralized Uniswap project.

Uniswap Customer Service

Uniswap’s major drawback is the lack of well-established customer service. It only has FAQs where customers will find answers to common questions like how to get started with the platform. The platform doesn’t have a live chat option or a phone number for urgent issues. Although we found a live chat feature on the site, it was bot-based, meaning there were no humans to chat with us. The bot is pre-formatted to ask you specific questions and doesn’t answer solve most problems. Instead, it will ask you to leave your email address to get answers sent to your emails if the problem is complex. Being a community-based platform, we recommend taking advantage of social media sites and community groups to find easy and quick fixes.

Uniswap vs. Other Crypto Exchanges

Uniswap vs. Sushiswap

SushiSwap is an AMM DEx like Uniswap. Both are similar in some ways. For example, you can become a liquidity provider on both sites and earn from swaps passively. Besides, since they both offer exchange services, users can trade and swap different coins by simply tapping into respective liquidly pools.

Fees-wise, Uniswap has a three-tier fee structure. The fee tiers are 0.05%, 0.3%, and 1% based on the risk taken by liquidity providers concerning expected volatility in the pools. SushiSwap, on the other hand, charges 0.3% on all trading pairs. The liquidity providers earn 0.25% of the swap fees, while SUSHI token holders get the remaining 0.3% of the fees.

Uniswap supports concentrated liquidity where liquidity providers can concentrate the tokens in custom price ranges. Through this feature, the DEX allows lending and borrowing through smart contracts. SushiSwap has no such features. However, Sushiswap offers yield farming, where you can stake ETH to earn as high as 96% return. This feature is not available on its competitor.

In terms of TVL, Uniswap had about $10.44b, while its competitor had a TVL of $ 789.729M as of writing this. Uniswap lacks specific opportunities for lending and margin trading as it aims to maintain a strict emphasis on serving as a decentralized exchange, thereby introducing relevant features. However, SushiSwap has a “BentoBox” feature on the decentralized exchange, which acts as a token vault. The “BentoBox” also works as an “App Store” for dApps or decentralized applications. Presently, you can find only one dApp known as Kashi in BentoBox. The Kashi app utilizes the tokens in BentoBox for lending, borrowing, and margin trading.

Uniswap vs Pancakeswap

Uniswap and Pancakeswap are both popular decentralized exchanges. The former is older, having been established in November 2018, two years before its counterpart. While it was founded by an anonymous person, its competitor was established by well-known engineer, Hyden Adams.

Uniswap exchange had a TVL of $10.44B, while PancakeSwap’s was $3.782B as of writing this. Pancake’s market cap was only $3,194,518,068, about a third of its counterpart’s $11,431,572,754, and has a circulating supply of 252,043,050.50 CAKE compared to 628,516,329.95 UNI. The former supports only 200 crypto assets, a significant difference with its competitor, which has 1,600+ coins. We also found out that Pancake runs on the Binance smart chain (BSC), unlike its competition that is native to the Ethereum blockchain. In terms of consensus mechanism, Pancakeswap uses Delegated PoS (proof-of-stake) and PoA(proof-of-authority), while its counterpart only works with PoS.

The biggest advantage that PancakeSwap has over Uniswap is lower gas fees. It charges a flat fee of 0.25% per trade, slightly better than Uniswap, whose transaction costs start from 0.3% and go beyond 3%. There are just minor differences as you can tell, but the apps are highly similar.

Is the Uniswap Exchange Right For You?

While Uniswap aims to attract all types of crypto investors, not everyone will benefit fully from its services. For that reason, Uniswap is the best DEX AMM for you if:

- You need a simple, no-frills DEX to swap crypto assets.

- You want to earn high-interest rates on your assets by becoming a liquidity provider.

- Investors who wish to be part of a community governed by crypto exchanges

Final Verdict

Throughout this Uniswap review, it is clear that the crypto exchange’s only shortcoming is high gas fees. Otherwise, it offers an impressive set of features while remaining fully decentralized. Its high liquidity is a major advantage, as users can execute their trades quickly and easily.

If Ethereum 2.0 leads to reduced gas fees, what could hold you back from joining the UniSwap community? Besides having poor customer service, we haven’t seen many users complaining about it, which means most users’ issues are covered on the help page.

However, this doesn’t mean Uniswap should be reluctant to add customer service options. For a trader who is looking for a truly decentralized platform that supports hundreds of crypto assets and is available globally, Uniswap is a brilliant choice.

Remember to invest only funds you can afford to lose, as crypto trading comes with several risks, including impermanent loss in the case of Def. Connect your wallet now and start trading with Uniswap.

What are the benefits of using the Uniswap Exchange?

What are the benefits of using the Uniswap Exchange?

Uniswap exchange users enjoy prime benefits by becoming liquidity providers, easily swapping ERC tokens, high liquidity, fast transactions, and governance rights for holding UNI tokens.

What are the fees associated with using the Uniswap Exchange?

What are the fees associated with using the Uniswap Exchange?

As a Uniswap user, you will be responsible for paying a withdrawal fee of 15-20% of the global industry average BTC-withdrawal rate, and varied transaction fees depending on the type of activity you’re performing.

What are the key features of the Uniswap Exchange?

What are the key features of the Uniswap Exchange?

Uniswap features include UNI tokens, swap features, and liquidity mining. With these, you can perform exchange functions, earn passive income, and take part in community development and governance.

How easy is it to use the Uniswap Exchange?

How easy is it to use the Uniswap Exchange?

Compared to other AMMs, it is very easy to use the Uniswap exchange. After connecting your wallet, you can access all its features with a simple click. Of course, it has a slight learning curve, but you will get the hang of things within no time.

How secure is the Uniswap Exchange?

How secure is the Uniswap Exchange?

Uniswap is a non-custodial decentralized exchange, meaning it has distributed servers, and doesn’t directly store user funds. Any hacking attempt will be futile since it’s impossible to steal client money by accessing any of the firm’s servers. We, however, urge you to be wary of phishing attacks.

What payment methods does Uniswap support?

What payment methods does Uniswap support?

Uniswap exchange only supports crypto payment. That means methods like bank wire transfer, ewallets and credit/debit cards won’t work. Make sure you have a DeFi wallet like Metamask or any from WalletConnect to transact on the site.

How liquid is Uniswap?

How liquid is Uniswap?

As the largest DEX on the Ethereum platform, Uniswap boasts over 4 million active users and at least $1 trillion volume since inceptions. It has deep liquidity, and you can be sure your positions will always get filled.

Are there any restrictions on who can use the Uniswap Exchange?

Are there any restrictions on who can use the Uniswap Exchange?

Decentralized exchanges are meant to eliminate traditional banking limits. Anyone with internet access can use the platform regardless of where they are. We recommend making sure you’re of legal age before engaging though.

Facts Checked by Josip Putarek, Senior Author