4.9

- Personalised bonus offer

- Provably Fair Games

- Low House Edge

3.9

- Instant Deposits & Withdrawals

- Provably Fair Games

- Many cryptos available

- Live Casino Bonus

- Scratchcards

- Generous welcome bonus

- Crypto Casino

- Fast payouts

- Poker tournaments

4.7

- Good Bonuses

- Popular games

- Reputable Game Providers

Ranked: Our XMR Gambling Site Picks

- BC.Game – Best Overall Crypto Casino

- DuckDice – Best for Playing Dice

- 321 Crypto Casino – Best for Getting 3 Welcome Bonuses

- Betplay – Best for Gambling Anonymously

- MyStake Casino – Best for Accessing Over 6,500 Games

- Wolf.bet – Best for Gambling on a Decentralized Casino

Monero Casinos Sites Reviewed

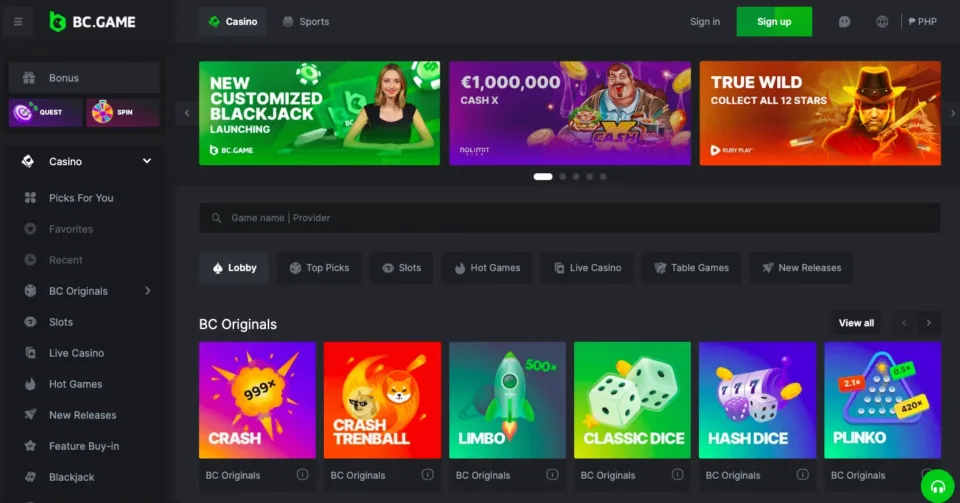

1. BC.Game – Best Overall Crypto Casino

As a first option, use Monero to deposit anonymously through a privacy coin, BC.Game is the best provider to do so since it offers a high overall welcome package, supports crypto-only payments, and allows partly anonymous betting on thousands of games. The welcome offer on BC.Game in addition, is something to brag about, as they have a welcome package of up to 1080% over four total deposits, while dappGambl users can claim a first deposit bonus of 270% up to 1 BTC for May. Other promotions are available on BC.Game which includes tournaments, cash prizes worth $10,000, free bonus rounds, or increased XP events. The operators also reward users’ loyalty through a referral of 25% and a rakeback worth 20%, which players can continue to use.

With over 10,000 games available, BC.Game offers jackpots, slots, megaways, table games like baccarat, blackjack, or roulette, provably fair games, a lottery, a live casino, or a sportsbook with traditional bets and eSports betting options. Players can make crypto deposits with Monero or other 66 tokens on multiple chains for deposits and withdrawals. The minimum deposit is $10, and near-instant withdrawals depend on the network address since launching in 2017, BC.Game has successfully obtained a gambling license while also creating a partnership with Cloud9 to increase its market status. For customer support, players can contact the casino using the live chat option, emailing, or reading the FAQ section regarding their issues.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 270% Deposit bonus up to 1 BTC | 500% – Unlocks with wagering | $10 | 66 tokens |

- Pros

- High welcome bonus

- 58 providers

- 24/7 support

- No wagering

- Cons

- Uses its own native token for bonuses

2. Duckdice – Best for Playing Dice

DuckDice is second on our list of Monero casinos, as the platform accepts multiple crypto tokens, has a distinct bonus structure, and includes on-chain financial transactions. There are several bonuses active on DuckDice, and the casino features a 100% deposit bonus of up to 2 BTC with unknown wagering requirements. Other prizes are also available, including a monthly event, a $50 daily sniper race, and dice progressive jackpots. A rakeback is also accessible with amounts up to 15%, staking offers, ticket lottery bonuses, an affiliate program, or playing a duck hunt interactive game.

For deposits, players can deposit using several tokens, including XMR, ZEC, or BTC, but DuckDice also includes other betting options in their FAQ section that feature more tokens. There’s a minimum deposit of 0.0001858 BTC and a minimum withdrawal for BTC of 0.00073266 BTC, with fees for slow, normal, or fast processing. In the games department, DuckDice only features the Dice game and also features a sportsbook with over 100 games. The casino held a valid gambling license in 2016, which includes an active casino faucet. Licensed in Curacao, DuckDice has a KYC set into place and holds a 5/5 review score – leading to increased customer gamer satisfaction. As such, the platform offers customer support through a FAQ section and live customer support.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 100% up to 2 BTC | N/A | 0.0001858 BTC | 30+ tokens |

- Pros

- Accepts different tokens

- On-chian withdrawals

- High reputation

- Cons

- Only dice and sports betting

3. 321 Crypto Casino – Best for Getting 3 Welcome Bonuses

321 Crypto Casino is a close favorite for betting and wagering with XRM tokens, as the casino offers two welcome bonuses, includes unique bonus codes and offers, and has a quick withdrawal period for casino wins. The welcome package on 321 Crypto Casino includes a first deposit bonus of 100% up to 0.005 BTC and 15 free spins, and a wagering of 35x the amount. A second bonus can be applied worth 120% up to 0.005 BTC with a similar wager and 25 free spins. The final bonus includes an 80% bonus up to 0.005 BTC with ten free spins. No other promotions are available on the platform, and the operator has a minimum deposit of 0.00025 BTC and maximum withdrawals and deposits of 0.1 BTC.

There is a gambling license, so verification might be required, and the casino offers casino games like slots, a live casino, table games, and megaways but no provably fair games. Still, deposits can be made using multiple tokens, including BNB, BTC, or XMR. For customer support, players can reach out to the casino through a contact form or check the FAQ section.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 100% up to 0.005 BTC and 15 Free Spins | 35x | 0.00025 BTC | BTC, BCH, ETH, LTC, USDT, LINK, DOGE, XRP, BNB, XMR, TRX |

- Pros

- Three welcome bonuses

- Fast withdrawals

- Free Spins

- Cons

- Low welcome bonus

- Weak game selection

4. Betplay – Best for Gambling Anonymously

Betplay is a lightning-fast crypto casino that accepts privacy tokens like Monero with instant deposits and provably fair games. The welcome package offered by Betplay includes a 100% bonus of up to 50 mBTC or 1,000 USDT with high wagering of 80x the deposited amount. Other promotions include Daily Rakeback with no specification and a weekly cashback of 10%, which becomes available only for Bronze VIP status players. Seasonal campaigns are also part of the promo section with Pragmatic Play’s Drop and Wins and a 92-day tournament with prizes. The casino doesn’t have a minimum deposit or withdrawals, and there is a maximum withdrawal limit of $10,000 per day.

Withdrawals occur instantly on Betplay since no KYC is required for players since the casino doesn’t have a valid gambling license, making anonymous gambling possible on the 2020 established casino. The game selection includes slots, table games, blackjack, craps, or baccarat, and a live casino with Evolution Gaming tables and game shows. A sportsbook is accessible with eSports betting, and there’s also the possibility of playing live poker. For customer support, Betplay offers just a live chat option and an FAQ section.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 100% bonus of up to 50 mBTC | 80x | N/A | BTC, DOGE, BNB, TRX, ETH, USDT, XMR, USDC, SHIB, SAND, XRP |

- Pros

- Anonymous gambling

- No minimum deposit

- Poker games

- Privacy focused

- Cons

- High wagering

- Low welcome bonus

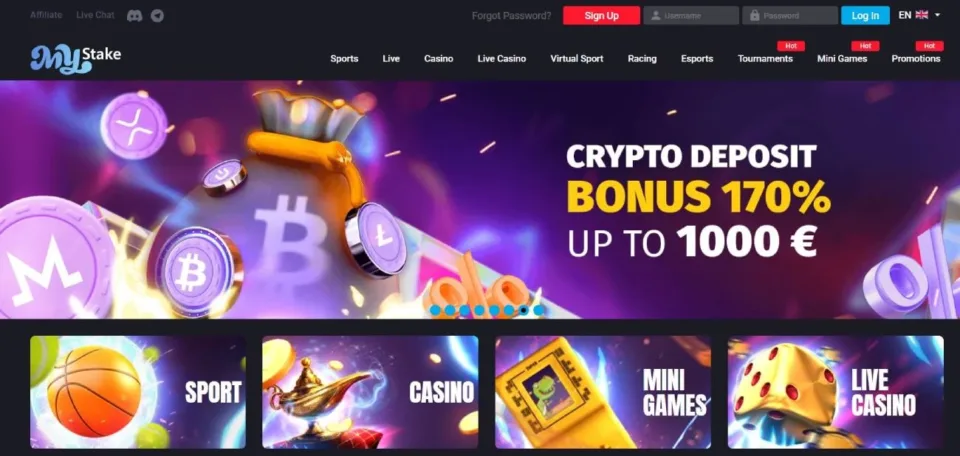

5. MyStake Casino – Best for Accessing Over 6,500 Games

MyStake Casino is part of the XMR-compatible casino list as it offers customer promotions, includes new game modes, and is a mobile-friendly casino operator. The welcome package offered by MyStake includes a special crypto bonus of 170% bonus up to $1,000 for new players, which can be claimed by also using XMR. A second reload bonus is available with 100% up to $500 and a similar wagering of 30x the amount. Other promotions include 10% cashback on bets, free game runs, an eSports bonus of up to $500, social media giveaways, casino tournaments, boosted odds on sports, or a sports welcome bonus + reload.

The casino accepts both crypto and fiat payments with a KYC set in place and accepts multiple tokens, including BTC, BCH, or XMR. Minimum deposits and withdrawals start at $20 with a cap of $7500 per week. The casino has over 6,500 game options, including a live casino, racing, sportsbook with eSports and regular sports, virtual sports, bonus buys, and mini and crypto games. In addition, the casino, launched in 2020, includes a Curacao gambling license without the possibility to gamble anonymously and provides customer support through live chat and email.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| 170% bonus up to $1,000 | 30x | $20 | BTC, ETH, XRP, BCH, USDT, XMR, DASH |

- Pros

- Unique welcome offer

- Long list of promotions

- Cons

- No VIP Program

- Limit on max withdrawals

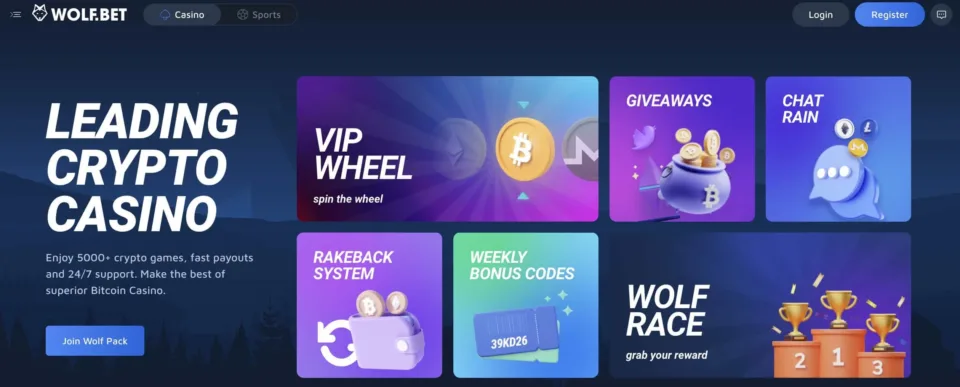

6. Wolf.bet – Best for Gambling on a Decentralized Casino

The last operator to accept Monero as a payment method is Wolf.bet, a decentralized crypto casino with 24/7 live support, access to thousands of games, and near-instant winning payouts. Wolf.bet doesn’t include a welcome offer and has a leveling rewards system where players get bonuses as they rank up. The rakeback available is 10%, and users can also join the race event, where they can earn by topping the leaderboard. However, none of the bonuses compare to the top casinos we listed above.

The casino has over 6500 games available that include provably fair games, a live casino option, table games, drops & wins, and they’re constantly adding new games from top casino providers. A sportsbook is also on the table without the possibility of betting on eSports. The platform has a verified casino license and doesn’t allow anonymous gambling, and players can start depositing using multiple tokens such as SHIB, BTC, or XMR with no minimum deposits and withdrawals starting at 0.001 BTC. Customer support is provided to players through a live chat or by contacting the operator through their email address.

| Crypto Bonus | Wagering Requirement | Minimum Deposit | Available Currencies |

|---|---|---|---|

| N/A | N/A | 0.0001 BTC | BTC, TRON, USDT, or ETH |

- Pros

- Great game selection

- Sportsbook

- Faucet system

- Cons

- No provably fair

- No welcome bonus

Top Monero Casinos Compared

| Monero Casino | Welcome Bonus | Available Games | Live Games (Yes or No) | Minimum Deposit | Withdrawal Time | Accepts US players? (Yes or No) |

| BC.GAME | 270% Deposit bonus up to 1 BTC | Slots, provably fair games, table games, jackpots, live casino, sportsbook | Yes | N/A | Instant | No |

| Duckdice | 100% up to 2 BTC | Dice, sportsbook | No | N/A | Instant | No |

| 321 Crypto Casino | 100% up to 0.005 BTC + 15 Free Spins | Slots, megaways, live casino, table games | Yes | 0.00025 BTC | 12 hours | No |

| Betplay | 100% bonus of up to 50 mBTC | Slots, live casino, sportsbook, table games | Yes | N/A | Instant | No |

| MyStake Casino | 170% bonus up to $1,000 | Slots, live casino, virtual sports, mini games, sportsbook, table games, crypto games | Yes | $20 | 1 day | No |

| Wolf.bet | N/A | Slots, provably fair games, live casino, table games | Yes | 0.0001 BTC | Instant | No |

What is Monero?

Monero is a cryptocurrency created by Nicolas van Saberhagen in 2014. With Monero, users will get privacy, fungibility, and secure cryptography in one digital asset. Due to its extensive privacy features, the Monero blockchain is opaque. As a result, participants’ addresses and transaction numbers are always anonymous. In this way, all user addresses on the blockchain remain anonymous.

To regulate the issuance of XMR on its network, Monero relies on a proof-of-work mining consensus. In exchange for adding blocks to the blockchain, Monero mining operators receive XMR tokens as a reward for their mining activities.

Introduction to Monero Gambling

On several gambling dApps, Monero is now accepted as a deposit and withdrawal method. Our recommended Monero gambling dApps offer a variety of betting options to gamblers. Among these options are sports betting, casino betting, and dice betting.

A variety of other cryptocurrencies are accepted as payment options by Monero gambling dApps. The list includes crypto-assets like Shiba Inu, Bitcoin Cash, Litecoin, Ethereum, and Tether.

The Monero dApps we recommend offer fast payment options and a wide selection of games for gamers. The best Monero gambling dApps can be found on our ranking of Monero gambling dApps.

Mobile Monero Casinos

Crypto casinos have developed mobile gambling apps to improve the quality of gameplay and general aesthetics on these sites. Users can download these apps from Google Play, Apple Store, or the casino’s website.

Generally, these mobile apps are compatible with iOS and Android devices.

Gamblers should install their chosen type of crypto wallet and casino app on the same mobile device to take full advantage of the mobile gaming experience. When you connect your wallet to the casino, you can easily fund your casino account.

Why Monero

Utilizing cryptocurrencies offers gamblers the possibility of anonymous deposits and withdrawals without interference from third parties. As a result, transactions involving crypto-assets like Bitcoin (BTC), Dogecoin (DOGE), Bitcoin Cash (BCH), Tether (USDT), Ethereum (ETH), and Litecoin (LTC) are generally anonymous and private.

Cryptocurrencies generally offer users some form of anonymity, but some virtual currencies provide a greater level of privacy. A prime example is the Monero token. Due to the privacy features it offers, many online gambling platforms now offer Monero as a payment option to users on their sites.

This article will consider the benefits of using Monero as a payment option on any of our listed online casinos and gambling dApps. Additionally, we will provide a comprehensive guide on how to use Monero to wager on any of our listed best Monero casinos.

We have included a section in this guide explaining how to buy and store XMR tokens so that you can gamble on any of our listed Best Monero Casinos. We also have a section that reviews the best Monero Casino Apps and Monero Gambling dApps.

How to Buy Monero?

There are several casino games offered at the Monero gambling sites featured on our website. These casino games include games like online slots, table games, bingo, lotteries, live dealer games, and other excellent casino games.

However, for gamblers to get a taste of live gameplay, they have to make deposits using one of the payment methods offered by these gambling sites. This section of our guide will learn how to buy Monero and how to bet using this crypto asset as a payment method in this part of our guide.

Step 1: Open A Crypto Wallet

If you want to store your XMR tokens in crypto wallets rather than exchange wallets, you must create your own crypto wallet. A gambler can sometimes buy XMR tokens directly into their crypto wallet. To prevent losing funds, cryptocurrency traders wishing to use this method to purchase their Monero tokens must ensure they fully understand the wallet purchase process.

Step 2: Open An Account with A Crypto Exchange

The best way to purchase Monero tokens is through reputable crypto exchanges. In this regard, we recommend that our readers open an account with a reputable crypto exchange to buy Monero.

Before opening an account with a crypto exchange, gamblers may need to create a crypto wallet. Additionally, they can store their XMR in a crypto wallet associated with their preferred crypto exchange. Crypto traders, however, are typically advised to keep their crypto assets in a secure crypto wallet.

If you decide to purchase the XMR token on a centralised crypto exchange, be sure to complete the KYC (Know Your Customer) process. Users of DEX platforms are not required to provide their personal information. Ensure you provide the right wallet address during the transaction process to prevent the loss of your XMR tokens.

Step 3: Buy Monero

A user who sets up a crypto wallet and account can then purchase XMR and store it in the wallet or exchange. To buy XMR, go to the purchase section of the crypto exchange, and select Monero.

After entering your wallet address, enter the amount of XMR you wish to purchase and click buy. You will then be asked to choose a payment method. Pick a payment method and complete your purchase.

To verify receipt of your XMR coins, check your crypto wallet after the transaction is complete. XMR is available on several cryptocurrency exchanges, including Binance, Huobi Global, Mandala, ZBG, and Coinbase.

How to Play With Monero?

Step 1: Set up an account with a Monero Casino

Gamblers who wish to use the XMR token must first choose a Monero casino and register. To help new players find the best XMR casinos accessible today, we’ve compiled a list of the best XMR casinos available. For gamblers to start playing in any of these Monero casinos, they must make a deposit first.

Step 2: Deposit Monero into Your Gambling Account

As soon as you create your gambling account at your preferred Monero casino, you will be required to deposit funds. A player must navigate to the cashier section of their gambling site to deposit Monero for gameplay.

If you prefer, you can deposit with Monero. Players typically receive a Monero wallet address from the casino for depositing funds. To begin gambling, players must transfer XMR tokens to the casino’s Monero wallet address.

As soon as casinos confirm your deposit, they credit your Monero account. You can also withdraw winnings through XMR. It’s usually faster to withdraw through XMR than through most traditional payment methods.

Step 3: Begin Gameplay

New players usually receive welcome bonuses at our listed online casinos and gambling apps. Often, these offers include deposit and no-deposit bonuses, as well as free spins. These gambling platforms also offer VIP programs and special tournaments for existing players.

After claiming your bonus offer, you can select the casino game of your choice and start playing. There are a number of casino games available at our recommended Monero casinos, including Baccarat, Poker, Roulette, and Blackjack. We also endorse Monero casinos that deliver the best live dealers games, esports, lotteries, Sportsbooks, bingo and video slots.

How to Withdraw Funds from Monero Gambling Sites?

With the growing popularity of Monero gambling sites, it is essential to know the process of withdrawing funds. Here’s a step-by-step guide on withdrawing Monero from a casino site.

Step 1: Have a Monero Wallet

Before even thinking of withdrawing funds, you need to get a crypto wallet that accepts Monero. Use known wallets like MyMonero to store, send, and receive XMR tokens to keep your transaction privacy high.

Step 2: Choose The Token

Once you enter the casino, click on the Cashier section, select withdrawals, and look for the XMR token. Once you click the token, make sure to locate the wallet address

Step 3: Withdrawal Amount

After selecting the token and copying the wallet address, type the number of tokens you want to withdraw and choose the right network. Then add your personal wallet address by copying and pasting it into the designated field. Finally, press ok or finalize, and make sure to double-check all the data.

Step 4: Verify Account

Some accounts, even if you are withdrawing a privacy coin, will require you to verify your account by providing personal information. Verification is a security measure that prevents any fraudulent activity on the website.

Step 5: Wait For Approval

After submitting the withdrawal request, wait for the casino’s approval. Then, depending on the casino, transactions can be processed within a few minutes or 24 hours.

Step 6: Funds Transfer

Once approval is granted, the funds will be transferred to your Monero wallet.

Key Factors to Keep in Mind Before Choosing Any Monero Online Casinos

Monero online casinos are becoming increasingly popular due to their anonymous and secure transactions through the use of cryptocurrency. However, you do need to check out these features before making your deposit.

GEO Restrictions

Before signing up, it’s crucial to verify if the casino is available in your geographic location. Certain casinos may have restrictions for players in specific countries, especially those that dabble with privacy coins, so make sure to check the terms and conditions and the legal regulations around XMR tokens in your country. Otherwise, you’re running the risk of having your account banned and losing your deposit.

Crypto Reputation

Another essential factor is the online casino’s reputation within the cryptocurrency community. With crypto casinos having odd registrations, it’s essential to double-check a casino’s online reputation before making a deposit. Check their social media to see if they’re active, read customer reviews on third-party websites, and how quickly they respond to customer queries. The more reputable the casino, the more comfortable you can feel about making financial transactions with them.

Deposit & Withdrawal Speed

The speed of deposit and withdrawal is also critical when choosing your casino, as you don’t want the platform to keep hold of your assets. Similarly, you want to avoid limitations when depositing crypto and being unable to gamble immediately. Therefore, always check that the casino processes transactions immediately and has instant deposits with a low minimum deposit.

Deposit Bonuses & Promotions

Bonuses and promotions are the most important feature to look for, especially when depositing crypto or wanting to make a large deposit. As a way to attract new players, Monero casinos frequently offer promotions to new and existing players as a way to improve gameplay. Thus, always check that the casino has a welcome bonus, they have a reasonable wagering requirement, and doesn’t require extra hoops. Even more important are other promotions running once you’re in the casino.

Customer Support

Effective and prompt customer support is an essential aspect of any online casino. The ideal casino should offer an active support team that’s available 24/7, regardless if it’s through a live chat, email, or phone. The effectiveness of customer support can significantly influence your gambling experience, so choose a casino with a customer support team that is always reliable and responsive.

Game Selection

The final element is to check the game selection on the casino. Even though you might not be playing all the games, you want the operator to include popular games from known providers, have crypto games with provably fair, traditional games, a live casino, and a sportsbook. This prevents you from creating multiple accounts, so choose a casino with a diverse selection of games.

Security

It is possible to store and send the XMR token using a cryptocurrency wallet. A Monero crypto wallet not only holds XMR tokens but also ensures the privacy of cryptocurrency holders. Traders of digital assets can safely store Monero in many different crypto wallets.

Since hardware wallets offer the highest level of security, they are your best option for storing your digital assets. Online and web wallets are more popular because of their ease of use and speed of implementation. To prevent token theft, protect your private keys regardless of which crypto wallet you use.

For cryptocurrency gamblers to protect their winnings and assets, they can take the following steps:

- Securely store your passwords and make sure they’re strong

- Use a web wallet or hardware wallet only if you are familiar with their security features.

- Your internet connection and device must be secure.

- Make sure the casino’s website is encrypted using powerful SSL encryption software.

Conclusion

As you might have already guessed, Monero is accessible as a crypto gambling token, but not without some limitations. You can still access a decent number of casinos, with some offering rewarding gambling experiences. However, it would help if you analyzed every casino to understand whether they’re ideal for your needs. Withdrawing XMR tokens is extremely easy, but getting access to them might prove more difficult than others. If you’re looking to gamble with Monero, we strongly recommend BC.GAME for its high welcome bonuses, a large number of games, and VIP program, as it offers the best of all worlds for any player. Finally, XMR gambling has changed how crypto is used for privacy as it provides additional anonymity layers even when users have to verify their accounts. At the end of the day, it helps keep players’ financial information more private!

How do I choose the top Monero casinos?

You can check our list of Monero casinos and read the reviews to find out which of the casinos is best suited for your gambling style.

Are Monero casinos safe?

Yes, casinos are safe as long as they have a good reputation, have a valid license and include great customer support.

Can you gamble with Monero?

Yes, Monero is accepted on a few crypto casinos.

Other Cryptocurrency Casinos

Facts Checked by Josip Putarek, Senior Author

julien@contentbydesign.ca

julien@contentbydesign.ca