Lunu Review

3.6

Main Selling Points

Free for buyers

Free for buyers  Instant transaction confirmation

Instant transaction confirmation  Omnichannel solution

Omnichannel solution Lunu Basic Information

Crypto payments are the future of retail transactions. Explore how having an account with Lunu virtual currency exchange operator will open up a world of possibilities in crypto-funded retail transactions thanks to its zero-fee feature for buyers. With retailers now being able to charge crypto but receive the payment in fiat, this omnichannel service has started to catch on - and for good reason. Do however keep in mind that this is not investment advice, but common knowledge from our experts in cryptocurrency trends.About Lunu

The payment gateway was launched in 2018 and registered as UAB Lunu, a virtual currency exchange operator and virtual currency wallet operator. The company is duly registered in Lithuania and has its headquarters in Berlin, Germany.

Being a visionary brand, it projected that crypto payments would be crucial in the retail sector in the coming years. They created a virtual currency exchange service and wallet to ease transactions in the crypto retail space. It facilitates processing and exchanges for people using crypto to shop at regular e-commerce sites.Registering for the widget or getting the physical terminal for your retail business helps you connect with forward-thinking customers already using crypto in their transactions.

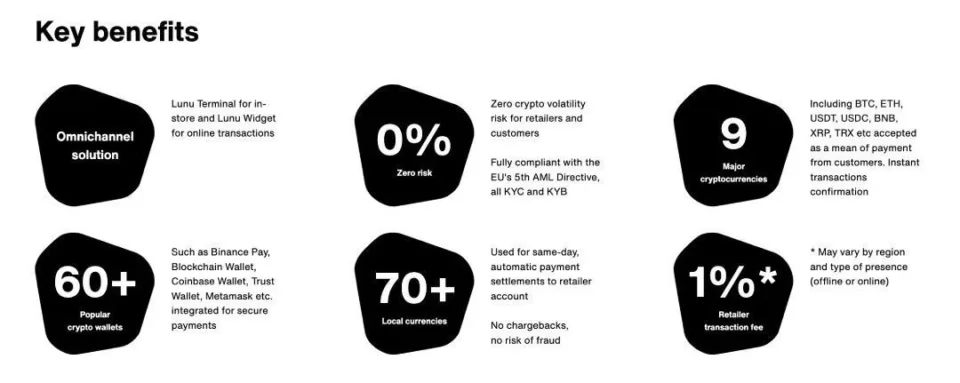

Key Features

Here are the key features of the software:

- Versatile: It allows retailers to accept settlement in 7 major cryptocurrencies: Bitcoin, Ethereum, Tether, Binance Coin, USDC coin Ripple, and Tron.

- Secure: Every Business has to follow KYB and consumers KYC protocols when registering-which keeps everyone safe during transactions.

- Omnichannel: You can choose to install the online widget for e-commerce purchases, or the terminal for in-store purchases.

- Multi-currency: Works with more than 70 local currencies

- Stable: Zero percent coins volatility for both the buyers and sellers.

- Integrated: The crypto payment gateway works with more than 60 popular crypto wallets including the Blockchain wallet, Trust, CoinBase, MetaMask and many others.

- Low Cost: They charge retailers a 1% transaction fee for all transactions.

- Safe: The system is set up in a way that eliminates chargebacks and fraud risks.

How Does Lunu Work?

Lunu is a payment gateway that makes it possible for merchants to receive crypto from their customers. The deposit is typically made in coins or tokens by the buyer, and the API converts it into fiat money for the merchant.

How to Proceed with a Deposit & Withdrawal Using Lunu

This exchange facilitates crypto for shoppers in stores that accept the digital currencies. Therefore, the buyer deposits coins, and the seller withdraws fiat. Here’s the checkout flow:

- First, the merchant has to create an account and either get the widget or terminal. Customers will only pay you in crypto when you have finished the KYB verification.

- A customer buys an item from the physical store or online e-commerce site.

- The website initiates the checkout process, which involves choosing the cryptocurrency they want to use to pay. Lunu terminal also initiates the same process for in-store purchases.

- They’re prompted to choose a wallet to pay from and scan the QR code for the address.

- They send their cryptocurrency or stable coin to the scanned address.

- It processes the deposit on behalf of the merchant.

- The merchant receives fiat money in their local currency.

Pros & Cons

- Pros

- Simplifies the use of cryptocurrency in retail

- Verifies transactions to avoid fraud and chargebacks

- Available in over 70 local fiat currencies

- Easy checkout process for beginners in digital currency transactions

- Free for the buyers and affordable fee for the merchant

- Cons

- Only supports 7 cryptocurrencies

- Is still very new to the market

Why Choose Lunu as a Payment Method?

- It offers solutions both for online and physical transactions via the widget and the terminal respectively.

- Allows you to pay from more than 60 popular crypto wallets.

- It is compliant with the European Union’s 5th AML directive, which protects both the buyer from exposing their business to money laundering or other types of financial fraud.

- The storekeeper does not have to struggle to convert the stablecoins or other tokens into fiat money once a purchase is made as the system makes the conversion.

- The transactions are confirmed instantly, and settlements made to the retailer’s account in their local currency on the same day.

- They have top notch security and data encryption, minimizing the possibility that someone could hack into the apis and interfere with the information.

- A business without a website can still get a system using their ‘pay by link’ feature. They only have to create a link which the service provider hosts and collects money on their behalf.

What are the Risks of Choosing Lunu as a Payment Method?

- The buyers only have a choice of seven cryptos to choose from to make purchases, and this still limits their shopping experience.

- While the business registration process is meant to ensure every business complies with anti-money laundering laws, it can be complicated for the first time user.

Supported Countries

This service is available in the United Kingdom, Austria, Belgium, Germany, Greece, Hungary, Ireland, Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Italy, Latvia, Lithuania, Luxembourg, Bulgaria, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain Croatia, Malta, and Sweden, Australia, Brazil, Saudi Arabia, South Africa, Taiwan, UAE, New Zealand, Mexico, South Korea, Malaysia, Singapore, Japan, Canada and the US.

Restricted Countries

The crypto payment gateway is restricted in the following countries: Afghanistan, Armenia, Bangladesh, Egypt, Eritrea, Gabon, Georgia, Ghana, Guinea, Guinea-Bissau, Guyana, Haiti, Indonesia, Crimea Region, Cuba, Dominican Republic, Ecuador, Kazakhstan, Kosovo, Republic, Tajikistan, Tanzania, Togo, Tunisia, Turkey, Pakistan, Iran (Islamic Republic of), Iraq, Libya, Belarus, Benin, Bolivia, Bosnia and Herzegovina, Palau, Palestinian Territories, Senegal Somalia, South Sudan, Sudan (the), Syrian Arab Nigeria, Russia, Burkina Faso, Burundi, Cameroon, Côte d’Ivoire, Central African Republic (the), China, Congo (the Democratic Republic of the), Maldives, Mali, Moldova, Morocco, Myanmar, Namibia, Nepal, Nicaragua, Niger, Kuwait, Lebanon, Lesotho, North Macedonia, North Korea, Oman, Turkmenistan, Vanuatu, Venezuela (Bolivarian Republic of), Vietnam, Yemen and Zimbabwe.

| Zone | Country | Online Charge | In-Store Charge |

|---|---|---|---|

| 1 | European Union, United States, United Kingdom | 1.0% | 1.20% |

| 2 | Czech Republic, Denmark, Poland, Norway, Hungary, Sweden, Switzerland, Australia, Canada, China, HongKong,India, Japan, Mexico, New Zealand, Singapore, UAE, Saudi Arabia, El Salvador | 1.20% | 1.40% |

| 3 | Malaysia, Indonesia, South Africa, Israel, Taiwan, South Korea, Taiwan, Thailand, Ukraine, Turkey, Bahrain, Philippines, Vietnam | 1.30% | 1.50% |

| 4 | Argentina, Central African Republic, Chile, Colombia, Costa Rica, Democratic Republic of the Congo, Georgia, Sudan, Tanzania, Angola, Anguilla, Antigua and Barbuda, Armenia, Aruba, Azerbaijan, Bahamas, Barbados, Belize, Benin, Bermuda, Bhutan, Botswana, Brazil, British Virgin Islands, Burkina Faso, Burundi, Cameroon, Cape Verde, Cayman Islands, Chad, Christmas Island. Cocos Islands, Comoros, Curaçao, Djibouti, Dominica, Dominican Republic, Ecuador, Ethiopia, French Guiana, French Polynesia. French Southern Territories, Fiji, Gabon, Gambia, Ghana, Guernsey, Greenland, Grenada, Guadeloupe, Guatemala, Guinea, Guinea-Bissau, Guyana, Haiti, Holy See (Vatican City State), Honduras, Isle of Man, Ivory Coast, Jamaica, Jersey, Jordan, Kazakhstan, Kenya, Kiribati, Kosovo, Kuwait, Kyrgyzstan, Laos, Lesotho, Liberia, Lebanon, Malta, Macau, Madagascar, Malawi, Maldives, Marshall Islands, Martinique, Mauritania, Mauritius, Micronesia, Mongolia, Montenegro, Morocco, Mozambique, Moldova, Montserrat, Namibia, Nauru, Nepal, Niger, Nigeria, Niue, Norfolk Island, Northern Mariana Island, Tajikistan, Oman, Palau, Panama, Papua New Guinea, Paraguay, Peru, Puerto Rico, Republic of the Congo, Rwanda, Saba, Samoa, Saint Kitts and Nevis, Saint Lucia, Saint Martin, Saint Vincent and the Grenadines, San Marino, São Tomé and Príncipe, Senegal, Sierra Leone, Serbia, Seychelles, Sint Eustatius, Solomon Islands, Sri Lanka, Suriname, St Maarten, Swaziland, Timor-Leste, Togo, Tokelau, Tonga, Tunisia, Tuvalu, Trinidad and Tobago, Turks and Caicos Islands, Turkmenistan, Uruguay, Uganda, U.S. Virgin Islands, Uzbekistan, Vanuatu, Western Sahara, Zambia | 1.50% | 2.00% |

Trading Fees

The platform does not charge any trading fees to the customers.

Deposit Fees

The system does not charge deposit fees, which means the buyer will not be charged to deposit tokens and pay for goods. However, some currencies like Ethereum might charge gas fees, while others will charge miner, and network fees independent from the service provider.

Withdrawal Fees

The provider charges between 1.00% and 2.0% for withdrawal, depending on their local region and whether the transaction is conducted in-store or online.

Limits

The software settles to the retailer’s bank account’s general ledger balance once per day. However, you can write to the company to have them remove the limit beforehand.

Supported Payment Methods

The software allow users to pay from the following wallets: Binance, Paxful, Blockchain, CoinBase, Trust, MetaMask, ImToken, Bitcoin.com, Luno, Exodus, Enjin, Bitpay, Abra, Status, Mycellum, Atomic, BTC.com, Kucoin, Electrum, TokenPoket, FreeWallet, SafePal, Ledger, Eidoo, Edge, Guarda, Lumi, ShapeShift, Samurai, Wallet of Satoshi, Trustee, CLV, Blue Wallet, BLW, BitNovo, Particl Copay, Eclair, WallEth, Coinomi Wallet, Lunu Wallet, Polkadot, Ledger Live, Huobi, Jaxx Liberty, Polker Wallet.

Safety and Security

UAB Lunu is registered as a virtual currency exchange operator by the State Enterprise Centre of registers of Lithuania with the registration number 305774629. The software company has incorporated all the safety measures to ensure only legitimate businesses and customers engaging in legal activities use their terminal, pay by link and widget. Here’s a breakdown of its safety and security measures:

- Users aren’t allowed to sub-license or transfer the license they give for transactions.

- Users aren’t allowed to act on behalf of anyone else when receiving money through the gateway.

- The retailer must set a secure username and password when signing up.

- Users are allowed to inform support immediately if they suspect someone might have compromised their account.

- The service provider has a list of 20 businesses they prohibit from using their service. These include sale of drugs, weapons, prostitution, sale of lottery tickets, and DarkWeb/TOR market purchases among others that pose a risk to users.

- It also encrypts all transactions to protect both the customer and retail merchant from phishing attacks.

User Experience

The exchange software is straightforward and user-friendly for both merchants and customers. The service provider will guide you throughout the registration process through their console. You can get the Lunu terminal for in-store purchases, a widget, or a hosted pay by link if you don’t have a merchant website. You can also access it on Android, desktop and iOS. Additionally, it has a widget that works with existing self-hosted Ecommerce shops like Woocommerce, Shopify, Magento, Virtue Mat and others. You’ll follow these steps when registering:

The exchange software is straightforward and user-friendly for both merchants and customers. The service provider will guide you throughout the registration process through their console. You can get the Lunu terminal for in-store purchases, a widget, or a hosted pay by link if you don’t have a merchant website. You can also access it on Android, desktop and iOS. Additionally, it has a widget that works with existing self-hosted Ecommerce shops like Woocommerce, Shopify, Magento, Virtue Mat and others. You’ll follow these steps when registering:

- Click on the ‘sign-up link at the top left hand side of the website.

- The website will redirect you to the software console where you fill in your preferred username, email address and password. The site will send a code to verify your email address.

- Click the link and enter the verification code. The second page with full registration details will open up. The details it needs to register your business include:

-

- Your name as a contractual partner, or the name of your company.

- Your legal form

- Your office’s registered address or principal place of business.

- Your name and email address.

- Your Business Registration Number and Tax Identification Number.

- Mobile number and fiat account number.

- The console will expect you to read the terms and conditions and accept them before they register your account.

- You must prove you’re over 18 to be allowed to transact on the gateway.

- Once you’ve completed the registration and the system has performed KYC verification, your retailer account will be ready for use.

Customer Support

The exchanger has a support page with 24 hour response to sellers, buyers and all other types of queries. The page redirects to frequently asked questions. If you can’t find answers in the FAQs, you can contact the team by filling out your name and email address and sharing your question. You can also email them directly using the address. They also have Twitter, LinkedIn and Instagram communities where they make important announcements to their users. Due to the volume of messages they receive, they could take more than 24 hours to respond to your email. The provider doesn’t have a phone number or live chat on the site.

1. CoinRemitter

CoinRemitter prides itself in being the digital currency exchanger with the lowest processing fee. It was founded in 2017 and has headquarters in Singapore. The company charges 0.23% per transaction, and works with major currencies like Bitcoin and Ethereum. It has a simple registration process for sellers who wish to start receiving money. Here are the pros and cons of using CoinRemitter pay.

Pros

- Their software has an easier signup process and also faster integration with the retailer’s e-commerce store.

- CoinRemitter has top grade encryption which keeps your data safe throughout the transactions.

- It has a simple user-interface that allows beginners to set it up and either send or receive.

- It supports Bitcoin, Tether, Bitcoin Gold, Litecoin, Ethereum, Ripple, Dash and Dogecoin.

Cons

- CoinRemitter does not have a terminal retailers can use in their physical stores. It mainly works with digital shops.

- The transaction fee increases with the amount of money being spent by the customer, and can be quite high for large transactions.

2. CoinsPaid

CoinsPaid is among the oldest cryptocurrency payment gateways in the world. It was launched in 2014 and has its headquarters in Estonia. The best thing about CoinsPaid is that they don’t charge anything to make or receive settlement in coins. Here is how it compares to Lunu in terms of pros and cons:

Pros

- CoinsPaid is easy to install and pay or receive coins, which makes it user-friendly.

- You can track your assets and monitor your digital transactions, making their process transparent.

- They do not charge any fees for transactions, while the latter charges up to 2.0 percent for transactions.

- CoinsPaid also acts as a wallet, which simplifies transactions for buyers.

Cons

- CoinsPaid only allows Bitcoin transactions, which is a huge limitation, considering that Lunu offers 7 major coin options.

3. BitPay

Bitpay started in 2011 when Bitcoin and blockchain technology was still new. The software company has its headquarters in Atlanta, Georgia. It supports more than 100 of the most popular crypto wallets and also works with these popular crypto: Bitcoin, Bitcoin Cash, Ethereum, Wrapped Bitcoin, ApeCoin, Litecoin, Dogecoin, Shiba Inu, Euro Coin, Gemini Dollar, USD coin, Tether, DAI, and Binance USD. Here are the pros and cons of Bitpay.

Pros

- It has a simple and friendly interface, and a way to carry out invoicing. It is easier to set up than others as it needs fewer documents and KYC or KYB.

- It has favorable settlement options with the highest rate being 1 percent. There’s also a free plan, which is better than other payments that go up to 5 percent depending on the region.

- Both platforms have API access which makes transactions easier for customers.

Cons

- While it allows more major coins than the former, there are still a lot of coins that aren’t on their transaction list.

Expert Conclusion

Lunu is an excellent crypto exchange operator for a business that wants to adopt digital currency. It is more tightly regulated than many other alternatives in the market, which makes it safe for both the digital community and retailers. Our overall rating is 4.4 out of five, based on safety, versatility, and user experience.

Is Lunu a safe and secure platform for online transactions?

Is Lunu a safe and secure platform for online transactions?

Yes, it is duly registered and regulated by the Lithuanian State Enterprise Center. It also follows Europe’s AML laws, and has a list of prohibited and restricted businesses to minimize risk buyers and sellers.

How do I contact customer support on Lunu?

How do I contact customer support on Lunu?

You can reach them through their customer support page. Their support email address is support@lunu.io. You can also connect with them on Instagram, Twitter and LinkedIn.

What is the minimum and maximum amount I can deposit or withdraw via Lunu?

What is the minimum and maximum amount I can deposit or withdraw via Lunu?

There’s no minimum amount you can transact. The platform automatically clears merchant payments to their account daily as long as they reach the $200 withdrawal threshold.

What are Lunu restricted countries?

What are Lunu restricted countries?

It’s restricted in the following countries: Afghanistan, , Cameroon, Côte d’Ivoire, Palestinian Territories, Pakistan, Russia, Senegal Somalia, South Sudan, Sudan (the), Kazakhstan, Kosovo, Kuwait, Lebanon, Lesotho, Libya, Maldives, Mali, Moldova, Central African Republic (the), China, Congo (the Democratic Republic of the), Crimea Region, Cuba, Dominican Republic, Ecuador, Egypt, Eritrea, Gabon, Georgia, Ghana, Guinea, Guinea-Bissau, Guyana, Haiti, Indonesia, Iran, Iraq, Namibia, Nepal, Nicaragua, Niger, Nigeria, North Macedonia, North Korea, Oman, Palau, Morocco, Myanmar, Syrian Arab Republic, Tajikistan, Tanzania, Togo, Tunisia, Turkey, Turkmenistan, Vanuatu, Venezuela, Vietnam, Yemen and Zimbabwe.

Does Lunu have a mobile app?

Does Lunu have a mobile app?

Currently, it doesn’t have a mobile application.

Does Lunu have an API?

Does Lunu have an API?

Yes, it has an API making it easier to connect it with e-commerce sites.

What kind of support options does Lunu offer?

What kind of support options does Lunu offer?

Email, FAQs and Social Media Communities.

What languages does Lunu support?

What languages does Lunu support?

It only supports English at the moment.