Since the launch of Bitcoin in 2009, cryptocurrency has become a prominent fixture in modern investments and has been making waves in the financial world. Soon entered the “crypto whales” – individuals and entities holding large amounts of a cryptocurrency, making them highly influential in the market.

These whales have captivated the industry as their every move has the potential to sway prices and alter current markets. As well as this, the mystery surrounding these majestic financial beasts adds a layer of fascination as to who they are and where in the world they could be.

So to answer this question, we at dappGambl have taken it upon ourselves to locate the countries and cities where you will most likely come across a crypto whale in the wild. So you know where best to reside if you are an eager crypto investor yourself.

To undercover what areas would be the most enticing for so-called ‘crypto whales’, we’ve created an index analysing five key factors:

Laws governing cryptocurrency: considering legal status, taxation, AML/CFT, consumer protection and licensing.

- The number of crypto ATMs

- The number of known ‘crypto whales’ residing in the area

- The number of crypto events

- The number of online interest around “crypto” in the area

By combining these data points, dappGambl can reveal where you should head if you want to go (crypto) whale-watching or are searching for a like-minded pod.

Who Are Crypto Whales?

Cryptocurrency has grown rapidly in recent years, resulting in the development of affluent individuals dubbed as “whales” in the market. Crypto whales are individuals or entities that own large quantities of cryptocurrency, such as Bitcoin, Ethereum, and other digital assets. These entities are recognized for their excessive possession of these digital currencies, which they use to exert market influence through their trading activities. Other market participants constantly monitor the trades of whales, given their capacity for significant transactions capable of reshaping liquidity dynamics. Notably, according to BitInfoCharts data, 107 wallets own over 19% of the world’s Bitcoin, earning them the moniker “whale.” It is critical to understand that the classification of “whale” is subjective and differs among different crypto asset “oceans.”

Who Is The Biggest Crypto Whale in the World?

In the world of cryptocurrency, it can be difficult to identify the biggest players due to the anonymous nature of transactions. However, there are some notable individuals who are widely recognized as major players in the field. Let’s explore who they are.

Satoshi Nakamoto

Satoshi Nakamoto, the anonymous founder of Bitcoin, is one of the most notable crypto wells, possessing roughly 1 million BTC. This accounts for more than 4.5% of the overall supply. Since the introduction of BTC in 2009, these coins have largely remained unaltered.

Bitfinex

In 2022, iFinex Inc, Bitfinex’s parent business, made some of its wallets public. At the time, the company had about 192,000 BTC and over 1,225,000 ETH.

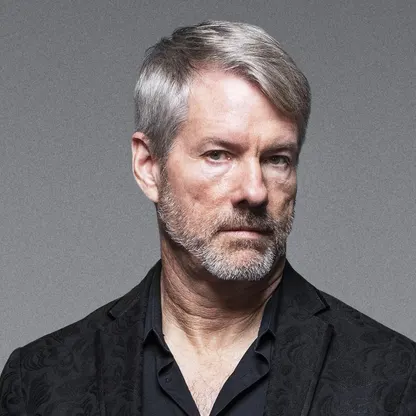

Michael Saylor

Saylor is the CEO of MicroStrategy, a publicly traded business that has amassed large quantities of Bitcoin as a treasury reserve asset. He personally possessed 17,732 BTC at the time of writing, while MicroStrategy held 152,333 BTC.

Tyler and Cameron Winklevoss

The duo famous for their $65 million historic 2008 settlement with Mark Zuckerberg, made headlines after revealing their purchase of approximately $11 million in bitcoin. According to current estimates, the Winklevoss twins purchased a significant portfolio of around 70,000 BTC and have amassed more than 150,000 BTC under their hands.

Vitalik Buterin

It’s no secret that there are a lot of Ethereum millionaires out there, but competing with the network’s founder is a bit tough. Vitalik Buterin, the co-founder and creator of the Ethereum network, is claimed to have gathered over 240,000 ETH in his VB 3 account, which is just one of many ETH addresses he controls. That’s a massive amount of Ethereum, worth well over $400 million USD, making Buterin a crypto whale.

The Top 10 Countries For Crypto Whale Watching

| (out of 35) | (out of 10) | (out of 100) | ||||||||

| Country | Law Index Score | ATMs Per Capita | ATMs Index Score | Number of Whales | Whales Index Score | Number of Events | Events Index Score | Crypto Searches Per Month | Searches Index Score | Overall Index Score |

| United States | 30 | 12,424 | 10 | 63 | 10 | 14 | 10 | 673,000 | 10 | 93 |

| Canada | 30 | 13,513 | 10 | 3 | 2 | 2 | 2 | 90,500 | 7 | 68 |

| Australia | 30 | 37,609 | 10 | 1 | 1 | 3 | 3 | 74,000 | 7 | 68 |

| United Kingdom | 30 | 67,736,802 | 2 | – | – | 5 | 5 | 165,000 | 8 | 60 |

| France | 30 | 3,809,211 | 6 | – | – | 1 | 1 | 110,000 | 8 | 60 |

| South Africa | 30 | 3,020,725 | 6 | – | – | 2 | 2 | 14,800 | 5 | 57 |

| Philippines | 30 | 4,345,828 | 6 | – | – | 1 | 1 | 40,500 | 6 | 57 |

| Malaysia | 35 | – | – | – | – | – | – | 18,100 | 5 | 53 |

| Brazil | 30 | 24,046,938 | 4 | – | – | – | – | 40,500 | 6 | 53 |

| Japan | 30 | 41,098,171 | 3 | 2 | 2 | – | – | 14,800 | 5 | 53 |

*Law index score combines five factors with a max of 35 points. Legal status was awarded (10), Consumer Protection (10), No taxation (5), AML/CFT (5), and Licensing (5). *Number of ATMs per capita represents how many people in that country would have to share one ATM (the lower, the better)

#1: United States

The United States reigns supreme on the index, scoring an astounding 93 out of 100. In fact, the US scored perfect marks in every category except for laws – as the government can tax crypto earnings. The US sets the standard for ATMs, boasting 27,366 of them at a rate of one machine per 12,424 people. It is home to 63 known crypto whales, while every year, 14 major crypto events take place in the States, giving investors a chance to stay ahead of developing trends in the industry. On top of all this, 673,000 crypto-related searches per month are recorded in the country. Basically, if you are interested in crypto whale-watching, the United States is the place to head.

#2: Canada

In second place with a score of 68, Canada’s crypto climate is only inferior up against its bigger, more populated neighbour to the south. A nearly perfect legal framework with crypto being legal, have consumer protection, , a huge 2,870 ATMs (or one for every 13,513 people), and an active, if a little smaller, pod of 3 known crypto whales make it a safe harbour for investors looking for steady waters. It’s clear that as far as cryptocurrency is concerned, the North American continent is at the forefront of innovation.

#3: Australia

Australia is hot on the heels of Canada, just missing out on a runners-up spot with a score of 65. The country offers a cryptocurrency environment as welcoming as the sandy beaches of Bondi. The fact it has 703 ATMs (which is one ATM for every 37,609 people), as well as a high score in the legal category and a healthy cryptocurrency search volume, solidifies it in the top 3. Though whales may be small in number, there seems to be a growing Australian interest in crypto.

The best crypto countries for laws, accessibility and community

Laws and taxation can have a huge financial impact when investing in crypto. Therefore, when analysing the countries with the best laws for crypto investors we measured them against five key things and scored them out for 35 accordingly.

- The legal status – legal (10 points), partial ban (5 points), general ban (0 points)

- No taxation on income, corporate or capital gains (5 points)

- If there are regulations which aim to eliminate illicit financial activity (anti-money laundering and combating the financing of terrorism) (5 points)

- Does the country have consumer protection (eg. cyber-security, advertising regulations, transfer rules) (10 points)

- Do businesses and investors have licensing, disclosure and reporting requirements (5 points)

Malaysia was the only country to score maximum points in the legal category, achieving the perfect score of 35 due to all necessary protections without any tax on crypto. This could see Malaysia becoming a hub for investors in the coming years. Meanwhile, 12 countries came second with 30 points, all missing out on top place due to taxation such as South Africa, the United States, Brazil, and the UK.

In third place, if Malaysia isn’t your ideal living location but you don’t want to be taxed, Thailand and South Korea have no taxation on crypto; however there are partial bans.

The Best Countries with Favourable Crypto Laws

| Country | Status | Taxation | AML/CFT | Consumer Protection | Licensing | Overall Score |

| Malaysia | Legal | No | Yes | Yes | Yes | 35 |

| South Africa | Legal | Yes | Yes | Yes | Yes | 30 |

| United States | Legal | Yes | Yes | Yes | Yes | 30 |

| Brazil | Legal | Yes | Yes | Yes | Yes | 30 |

| United Kingdom | Legal | Yes | Yes | Yes | Yes | 30 |

| Chile | Legal | Yes | Yes | Yes | Yes | 30 |

| Canada | Legal | Yes | Yes | Yes | Yes | 30 |

| Philippines | Legal | Yes | Yes | Yes | Yes | 30 |

| Japan | Legal | Yes | Yes | Yes | Yes | 30 |

| Australia | Legal | Yes | Yes | Yes | Yes | 30 |

| Ireland | Legal | Yes | Yes | Yes | Yes | 30 |

| Singapore | Legal | Yes | Yes | Yes | Yes | 30 |

| France | Legal | Yes | Yes | Yes | Yes | 30 |

| Belarus | Legal | No | Yes | No | Yes | 25 |

| Kenya | Legal | Yes | No | Yes | Yes | 25 |

| South Korea | Partial Ban | Yes | Yes | Yes | Yes | 25 |

| Thailand | Partial Ban | Yes | Yes | Yes | Yes | 25 |

However, if you’re looking for accessibility and easy liquidity, there are a surprising number of ATMs:

- Spain (297, or one for every 159,999 people)

- Poland (272, or one for every 150,831 people)

Despite neither appearing in the top ten. Both of these rank way higher than the top ten countries like the United Kingdom (only 1 crypto ATM in a population of over 67 million) and France (17 ATMs, or one per every 3.9 million people ).

Regarding being around like-minded people, Hong Kong is a hot spot for crypto whales. 6 known whales currently reside in this Asian country, while neighboring China is home to 5. Singapore (3) has also attracted its fair share, showing Asia is a welcoming home for big-time crypto investors. Meanwhile, many people in India and the United Kingdom are keenly interested in crypto, seeing over 165,000 monthly searches recorded in each country. At the same time, France has plenty of monthly searches (110,000), so you could bond over crypto with a croissant.

If you’re an investor looking to engulf yourself fully in the crypto community, the United Kingdom hosts 5 prominent crypto events yearly, such as the Crypto and Digital Assets Summit, Zebu Live, and the Modern Investor Summit, reflecting its stature as a fintech innovator. Portugal and Turkey each host 4 events, offering crypto knowledge alongside a healthy dose of sunshine, while the UAE and India also have 3 annual events each.

Best Crypto Cities For Whales And Bidding Investors Worldwide

It’s not just countries we looked at – we wanted to hone in on the best cities in the world for crypto investors. While the majority of the best cities in our index are in the United States, other crypto capitals worldwide stand out due to high scores in one other category.

| Rank | City | Country | Index Score (out of 100) |

| 1 | San Francisco | United States | 90 |

| 2 | Toronto | Canada | 71 |

| 3 | London | United Kingdom | 68 |

| 4 | Sydney | Australia | 69 |

| 5 | Paris | France | 63 |

| 6 | Singapore | Singapore | 63 |

| 7 | Manila | Philippines | 60 |

| 8 | Cape Town | South Africa | 60 |

| 9 | Barcelona | Spain | 44 |

| 10 | Bucharest | Romania | 44 |

At the forefront is San Francisco, scoring a near-perfect 90 out of 100- no surprise given its status as the tech capital of the world. The city’s affinity for innovation and a high concentration of tech firms make it an ideal landscape for crypto startups and investors.

Head north to Toronto, Canada, and you’ll find a thriving scene. 995 ATMs (one per every 5,676 people), three whales, and a high monthly search volume mark Toronto as a place to be as a crypto investor.

Sydney is the heart of the crypto scene in Australia, with six ATMs (one for every 24,878 people) giving investors high liquidity and two annual events dedicated to crypto, meaning there are plenty of opportunities to network.

But suppose you want to increase your chances of seeing a whale or want to set down roots in the best crypto cities in the world (which isn’t San Francisco). In that case, these are the best cities in the USA that you need to live in…

Most Likely US Cities to Spot a Crypto Whale in the Wild

L.A. and Miami take silver and bronze positions for the best crypto cities for investors overall. One of the key differences that stopped them from gaining the top position was the number of known whales in the area.

San Francisco is currently home to whales like Olaf Carlson-Wee, Robert Leshner, and seven others, whilst L.A. is only home to two, and Miami one. Also, San Francisco has two key events, BuildETH Patterns and NFT San Francisco, while L.A. isn’t home to any.

Also, one state which has stood out among the rest in the USA was Texas. Three cities, including Austin, Dallas, and Houston, rank in the top 15 crypto cities worldwide. If easy liquidity suits you, Houston boasts 1,092 ATMs (one per every 2,150). Meanwhile, Dallas hosts events like BitBlockBoom The Halving Edition in 2024 if the community is more of your thing.

| (out of 35) | (out of 10) | (out of 100) | |||||||||

| City | State | Law Index Score | ATMs Per Capita | ATMs Index Score | Number of Whales | Whales Index Score | Number of Events | Events Index Score | Crypto Searches Per Month | Searches Index Score | Overall Index Score |

| San Francisco | California | 30 | 2001 | 7 | 9 | 7 | 2 | 2 | 28,090 | 10 | 90 |

| Miami | Florida | 30 | 565 | 10 | 1 | 1 | 2 | 2 | 46,370 | 10 | 85 |

| Atlanta | Georgia | 30 | 633 | 10 | – | – | 1 | 1 | 35,130 | 10 | 82 |

| Boston | Massachusetts | 30 | 1194 | 9 | 2 | 2 | – | – | 21,420 | 10 | 82 |

| Austin | Texas | 30 | 1618 | 7 | 2 | 2 | 1 | 1 | 25,070 | 10 | 81 |

| Baltimore | Maryland | 30 | 1322 | 9 | 1 | 1 | – | – | 17,380 | 10 | 81 |

| Dallas | Texas | 30 | 1618 | 8 | 1 | 1 | 1 | 1 | 35,770 | 10 | 81 |

| Detroit | Michigan | 30 | 893 | 10 | – | – | – | – | 35,770 | 10 | 81 |

| Tampa | Florida | 30 | 714 | 10 | – | – | – | – | 18,170 | 10 | 81 |

| Las Vegas | Nevada | 30 | 2352 | 7 | 1 | 1 | 1 | 1 | 33,660 | 10 | 79 |

| Los Angeles | California | 30 | 2118 | 7 | 2 | 2 | – | – | 22,200 | 10 | 79 |

| Chicago | Illinois | 30 | 2563 | 6 | 2 | 2 | – | – | 53,140 | 10 | 77 |

| Houston | Texas | 30 | 2150 | 7 | – | – | – | – | 42,070 | 10 | 76 |

| Nashville | Tennesse | 30 | 2523 | 6 | – | – | 1 | 1 | 15,040 | 10 | 76 |

| Phoenix | Arizona | 30 | 3250 | 5 | – | – | – | – | 25,510 | 10 | 73 |

The index judged the moving currents of law, technology, and culture to crown the best spots for crypto whale-watching. These scores are more than numbers; they’re the X marks on a treasure map, which dappGambl hopes can help lead savvy investors to the promised land of crypto freedom.

How Much Money Do You Need To Be Considered A Whale?

The term “crypto whale” isn’t solely based on a fixed amount of cryptocurrency but rather influenced by numerous factors, such as the proportion of the total supply of a specific cryptocurrency, rather than the mere monetary value. Let’s delve into the different benchmarks and variables that determine the amount of money an individual needs to be classified as a crypto whale.

Determining Thresholds

Small Whale

A person who has a significant but relatively tiny quantity of cryptocurrency holdings in comparison to larger whales. The threshold for a crypto like Bitcoin includes investors whose cryptocurrency holdings vary from $1 million to $10 million.

Medium Whale

These are institutions of individuals that have big cryptocurrency holdings but are not huge enough to be labeled as top-tier whales. Medium whales often hoard cryptocurrencies worth about $11 million to $100 million.

Large Whale

Lastly, large whales are crypto wallets with a vast quantity of virtual coin holdings, huge enough to have a significant influence on the market. In the case of Bitcoin, large whales generally own over $100 million in crypto.

Factors Affecting Whale Status

Cryptocurrency Type

The market sizes, valuations, and adoption rates of various cryptocurrencies differ, influencing the whale criteria for each. While having $1 million in Bitcoin may qualify an individual as a small whale, the same amount invested in a less popular cryptocurrency may qualify an individual as a medium whale.

Market Conditions

The volatile nature of the cryptocurrency market plays a crucial role in defining whale status. A market with high price swings can produce large changes in crypto valuation, potentially raising or demoting investors’ whale status.

Evolving Industry Standards

As the cryptocurrency industry changes, whale classifications may be revised to reflect market movements and total market value. The industry, including investors and participants, might revise whale thresholds based on continuously changing perceptions.

Is It Good When Whales Buy Crypto?

The influence of whale buying on cryptocurrency markets can be favorable or detrimental, depending on market conditions, whale strategies, and the specific coin involved. Whales’ large transactions can cause price volatility, affecting upward or downward movements that give opportunities for other traders. Whales’ accumulation of cryptocurrencies may signal a bullish market attitude, supporting a more stable market environment. Notably, whales’ efforts increase the liquidity of a specific cryptocurrency, making it more accessible to a wider spectrum of investors.

Large whale transactions, on the other hand, have the potential to manipulate prices, causing market volatility and lowering the value of the cryptocurrency. If whales keep large amounts of a cryptocurrency without trading or transferring it, the cryptocurrency’s liquidity suffers, making it difficult for other investors to acquire or sell. Some whales may engage in market manipulation by utilizing their large transactions to manipulate the cryptocurrency’s price, producing artificial inflation or deflation.

While the amount of crypto he owns is not known, billionaire Elon Musk, the founder of SpaceX, has had a significant impact on the cryptocurrency market through his tweets, particularly on Bitcoin and Dogecoin. In January 2021, when he changed his Twitter bio to #bitcoin, BTC’s price surged from about $32,000 to over $38,000 within hours. The coin’s price, on the other hand, was seen to slide from $56,800 to $49,500 when he announced that Tesla would no longer accept BTC for its vehicles. Musk’s influence is not limited to BTC. He has expressed support for Dogecoin, and his tweets have caused significant price fluctuations of more than 800% in DOGE. Investors and traders must keep a close eye on whale activity and assess the potential consequences of whale buying based on the specific cryptocurrency and market conditions.

Methodology

Data was collected from the following sources:

- Crypto law – Atlantic Council – scored out of 35.

- Crypto ATMs (per capita) – Coin ATM Radar – scored out of 10.

- Crypto Whales – Investing.com – scored out of 10.

- Crypto Events – Crypto Events – scored out of 10.

- Crypto Searches – taken from keywordtool.io for country-wide searches on Google related to ‘crypto’ – scored out of 10.

The maximum score was 75, results were then multiplied to give a number out of 100. For example, the United States scored 70 across all categories, so it was given a total score of 93.

jputarek22@gmail.com

jputarek22@gmail.com