Introduction to Haasbot

Haasbot is a crypto trading bot enabling users to automate their digital asset trading strategies. Using HaasScript programming language, the platform provides users with advanced trading strategies, customizable settings like arbitrage opportunities, and technical indicators to help enrich their trading and help minimize their risks.

The bot is catered to experienced traders but can also be suitable for beginners that want to get a foothold on automated trading. Professional traders with a good knowledge base can update their trading model to match a series of theories by which they trade. Where Hassbot strives is its customizable feature where users can implement ‘Conditional’ orders and ‘Strategy Builder’ functions using multiple accounts and multiple access points to more exchanges. Beginners can also play with pre-set bots that provide basic theory implementation, such as MACD or RSI data.

Where Haasbot shines is the ease through which professional traders can translate their trading strategies into code with little technical knowledge and receive near-instant exchange feedback to help maximize their trading reaction speed. The secure interface makes it easy to trust but sometimes challenging to understand if you haven’t used trading bots. But you can get used to it quickly.

Platform and User Interface

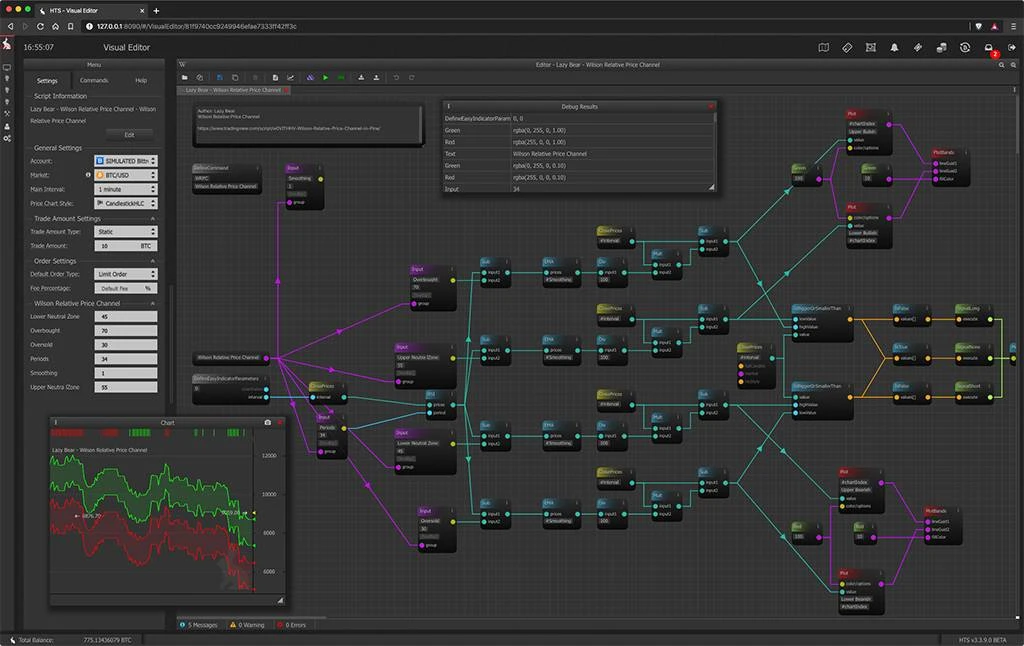

Haasbot is owned and operates under the HaasOnline web platform and requires anyone who wants to run a crypto bot to connect to the local server and then link to the trading exchange. As a web-based platform, Haasbot’s user interface could be more visually appealing; however, it is effective because it has similarities to cryptocurrency exchanges, such as their graphs and tool positioning.

Even though the bot might seem that it’s launched on the terminal, its ease of use is unprecedented. Traders only need to implement buying and selling parameters without having to code, and they can connect to over 20 exchange integrations through API. The core of Haasbot is its customizable indicators, helping traders create more accurate trades.

Novice traders can use the left-sided menu to add triggers, such as buy and sell orders, based on a series of indicators. HaasOnline has a YouTube channel with video resources such as walk-thoughts, setting up a Haasbot trade, or using the visual designer to create a bot. Most of the resources on their Youtube channel focus on bot creation using HaasScript.

We showed above how beginners can start using HaasBot; however, traders that want to create complex trading systems need to use HaasScript and assemble a number of conditions using the visual editor.

Haasbot is for those that have a deep understanding of trading, and to access its full features, you do need time to get accustomed to all the functions. It’s just like learning a new software with little guidance.

Arbitrage

This method is designed to take advantage of price discrepancies between different exchanges or markets. This strategy allows traders to buy low on one exchange and sell high on another, thereby profiting from the price differences. Another type of strategy is ‘Accumulation.’ This involves slowly accumulating coins over a period at varying intervals, allowing traders to purchase coins while they are still relatively cheap to make a profit later when the price increases.

‘Ping Pong’

This automated approach uses predetermined buy and sell points for buying/selling assets at specific prices. Traders who use this strategy will set their own buy and sell points throughout the day to take advantage of any fluctuations in price. A more advanced version of this strategy is ‘Scalping,’ which incorporates both ping pong and market-making techniques to allow you to make small trades quickly, taking advantage of minor fluctuations in price with minimal risk exposure due to its short-term nature.

Trend Trading

Trend trading works by identifying trends in the market using technical indicators such as moving averages and then following these trends accordingly with either buy or sell orders.

Breakout Trading

Breakout trading also uses technical indicators but focuses more on sudden bursts of volatility rather than long-term trends. It enables you to capitalize quickly on opportunities created by sudden shifts in market direction.

There are a wide variety of trading strategies you can customize. Arbitrage, accumulation, ping pong, scalping, trend trading, and breakout trading offer different advantages for experienced cryptocurrency traders. But, of course, the profit margins depend on the amount of money invested and the risk factor of each trade.

Security and Safety

Haasbot doesn’t have any clear certification or regulatory compliance. None of the information is featured on their website yet; however, there is transparency regarding who the team members and the CEO are. While that doesn’t guarantee fund security, the platform’s longevity adds a trust layer. Another trust factor of Haasbot is its partnership with some of the biggest cryptocurrency exchanges on the market, such as Binance.

The fact that Haasbot only accepts crypto as a payment method should not be discouraging. The trading bot platform uses SSL certificates to keep users’ data safe and uses the HaasOnline Cloud to back every user’s data. If you want to make the platform safer, you can enable Two Factor Authentication (2FA) as an additional security layer.

In terms of asset security, Haasbot doesn’t directly handle your digital assets, so they’re not put in a situation where they have to store assets on cold or hot wallets. Instead, all the platform does is send buy-sell orders to the exchange through the API, so the security of the assets is more related to the security of your exchange.

Pricing and Support

Haasbot has been in the business since 2014, and its prices have changed to account for Bitcoin price fluctuations. The main thing about Haasbot’s pricing is that it’s featured in BTC, and they offer a variety of pricing plans for every budget. You can sign up to Haasbot for a contract length ranging from 3 months to six months and 12 months.

The Beginner plan starts at 0.006 BTC per 3 months or 0.013 BTC per year and includes ten trading bots, access to 22 exchanges, only 20 indicators, and ten safeties. What’s missing at the beginner level is the restriction to Visual Editor or HaasScript, and grants $100 worth of VPS Credits for Vultr or Digital Ocean.

The Simple plan starts at 0.008 BTC per 3 months or 0.023 BTC per year and includes twenty trading bots, the same amount of exchanges, and access to 40 indicators. On top of that, it has 13 insurances compared to the 11 provided in the Beginner plan and 20 safeties. What’s more, you can start using the Visual Editor or HaasScript in the Simple plan version but with some restrictions to the Core Features.

The Advanced plan starts at 0.014 BTC per 3 months or 0.038 BTC per year and gives you unlimited access to every feature on Haasbot. In addition, you’re getting access to all exchanges through HaasBot, and the platform grants you a Free Developer license, which also means an unlimited number of bots per account.

There’s also the possibility of a free 14-day trial, but this one is paid compared to other platforms. For 0.001 BTC, you get full access to all platform features for 14 days. You’re also entitled to an up to 40% discount on a renewed license if orders are made consecutively.

Regarding support, you can only reach out to Haasbot for questions through email or live chat. However, the same support level applies to any license, and Haasbot also grants you access to their FAQ section.

Comparison with Competitors

Every trading bot platform has its perks and downfalls, and that also applies to Haasbot. Our research and testing gave us a good sense of where Haasbot excels compared to other platforms and which other trading bot is more suited for beginner or on-the-go traders.

3Commas is a trading bot focusing on traders without much experience in crypto trading, giving them the possibility to enable a bot by plug-and-play. Haasbot has a large pool of cryptocurrency exchanges it can connect to compared to the 18 offered by 3Commas. However, the latter is focused on inexperienced traders and offers an easy-to-start platform that doesn’t bear the risks of causing faulty trades due to misuse. Contrary to belief, Haasbot must be installed locally, and bots must be manually set. In 3Commas, users can select pre-built bots without much freedom to modulate them. What’s more, Haasbot needs to be installed on the computer, whereas 3Commas is a cloud-based platform with app access.

Bitsgap is an algorithmic crypto bot that allows users to trade on the future market automatically. Compared to Haasbot, the platform has some limitations in terms of arbitrage possibilities as Bitsgap only offers 10 crypto exchanges compared to Haasbot’s 20+. Bitsgap’s differentiating factor is its access to the futures market; however, it does lack in terms of being modular enough to attract experienced traders. By comparison, Haasbot is geared towards professionals who also want to set up their own rules through HaasScript. Price-wise, Bitsgap is much cheaper but offers fewer possibilities.

When analyzing the entire bot trading market, we can see that most demand is for easy-to-use automation, focusing on beginner to advanced traders. Haasbot is the only bot with a HaasScript and Trading Editor function which helps professionals create complex trading conditions and use over 20+ indicators to match their trades. Where Haasbot is lacking is their futures interoperability and a visually pleasing platform for traders to work with. When looking at the pricing, the cheapest option with limited modular functions exceeds $100, whereas most competitors start their licenses at $20-$30.

What We Think?

When you’re serious about trading crypto, and you just want a program that gives you access to a building bot feature, then Haasbot is the way to go. We’re saying that for the current price, Haasbot is not ideal for beginner traders since they can get cheaper, more reliable software from their competitors. That’s because Haasbot can be challenging to set up at first and cloud-based platforms give novice traders easier access.

Haasbot has skin in the game, and it will continue to be an in-demand bot for traders who want to apply complex crypto strategies without knowing how to code. Sure, you can do arbitrage trading and use MACD and RSI indicators, but the power of Haabot’s platform is in their trading builder strategy. So we wouldn’t recommend it if you’re just starting simply because it will get too complicated too quickly for you.

FAQs

How does Haasbot protect my funds and ensure the safety of my investments?

How does Haasbot protect my funds and ensure the safety of my investments?

Haasbot does not store digital assets on the platform. Any assets you’re trading with have to be deposited on the cryptocurrency exchange you connect your trading bot to.

How much does Haasbot cost, and what are the pricing options available?

How much does Haasbot cost, and what are the pricing options available?

The Beginner license costs 0.006 BTC for three months, 0.008 for six months, or 0.013 for one year.

The Simple license costs 0.008 BTC for three months, 0.016 BTC for six months, and 0.023 BTC for one year.

The Advanced license costs 0.014 BTC for three months, 0.026 BTC for six months, and 0.038 BTC for one year.

Can I customize my Haasbot settings to fit my specific trading needs?

Can I customize my Haasbot settings to fit my specific trading needs?

The bot has pre-set settings; however, you can customize your parameters based on the strategy you want to implement.

How can I get support and assistance if I have questions or issues with Haasbot?

How can I get support and assistance if I have questions or issues with Haasbot?

You can either submit a support ticket or you can access the chat pop-up button on the website.

Can I use Haasbot on multiple exchanges or only on specific ones?

Can I use Haasbot on multiple exchanges or only on specific ones?

Yes, you can use Haasbot on the exchanges that allow the bot to link to them through the API. You can select which exchange you want to trade on from within the software.

How does Haasbot compare to other crypto trading bots on the market?

How does Haasbot compare to other crypto trading bots on the market?

Haasbot is developed for advanced cryptocurrency traders, and it can be more powerful if traders use it to create modular strategies based on their liking. Also, Haasbot must be installed locally, which is not as easy as running cloud-based software.

Can I use Haasbot with multiple accounts, and how to switch between them?

Can I use Haasbot with multiple accounts, and how to switch between them?

You can trade using Haasbot on multiple exchanges using multi-account arbitrage.

Is Haasbot suitable for beginners, or it’s more advanced for professional traders?

Is Haasbot suitable for beginners, or it’s more advanced for professional traders?

The platform is designed with professional traders in mind, but it can also be used by beginners using pre-set trading bots.