Best No KYC Crypto Exchanges Sites – February 2026

- Pancakeswap – Best for low transaction fees

- Uniswap – Best for decentralized exchange on the Ethereum blockchain

- xExchange – Best for multiple revenue streams

- Trader Joe – Best for fast processing time

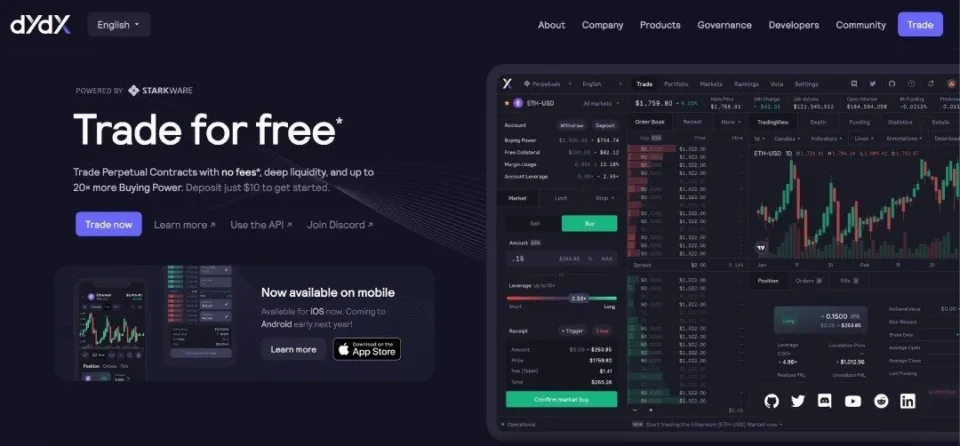

- dYdX – Best for free trading

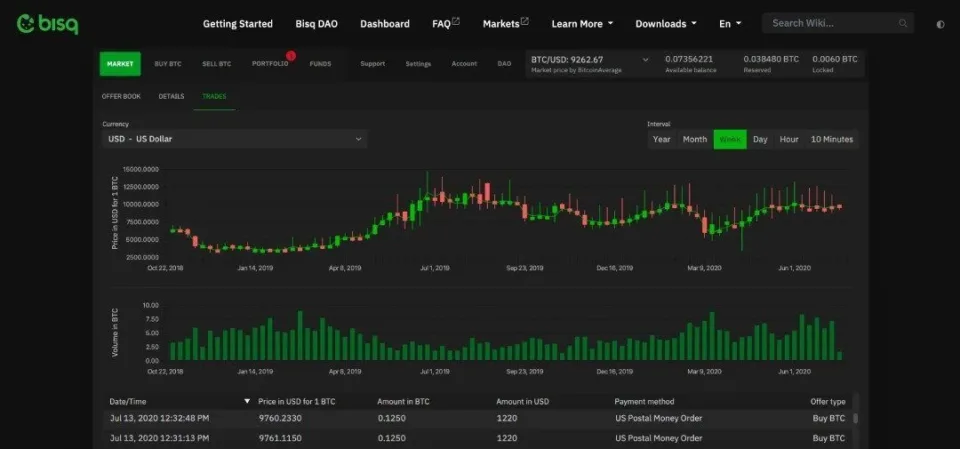

- Bisq – Best for decentralized Bitcoin exchange

No KYC Crypto Exchanges Sites Reviewed

Want to know more about what makes the top No KYC exchanges stand out? Our reviews cover everything you need to know about these exchanges’ features, security, user experience, and more. Explore each operator’s unique selling points to find the best fit for your trading needs and preferences. By prioritizing privacy and convenience, these exchanges offer a gateway to the world of cryptocurrencies without the hassle of KYC verification.

1. Pancakeswap – Best for Low Transaction Fees

Pancakeswap is a popular decentralized exchange (DEX) built on the Binance Smart Chain (BSC). With its user-friendly interface and low transaction fees, Pancakeswap has gained significant traction in the world of cryptocurrencies. The platform offers a seamless trading experience and supports a wide range of tokens without the need for extensive identity verification.

Pancakeswap’s user-friendly interface has contributed to its rapid adoption among both experienced traders and newcomers to the crypto space. Its intuitive design allows users to navigate the platform effortlessly, executing trades quickly and efficiently. This accessibility has made Pancakeswap a favored choice among crypto enthusiasts.

One of Pancakeswap’s key advantages is its low transaction fees. Operating on the Binance Smart Chain, the platform takes advantage of the network’s scalability and low-cost transactions. This cost-effectiveness appeals to traders seeking to maximize their profits while minimizing transaction costs, distinguishing Pancakeswap from other decentralized exchanges.

Another notable feature of Pancakeswap is its diverse selection of liquidity pools. Liquidity pools are crucial for decentralized exchanges as they provide the necessary liquidity for trading. Pancakeswap offers a wide array of liquidity pools, allowing users to earn passive income by providing liquidity to the platform. This feature has attracted yield farmers and liquidity providers, contributing to Pancakeswap’s popularity.

Pancakeswap also introduces its native token, CAKE, which offers various incentives to holders. CAKE holders can earn a share of the transaction fees generated on the platform, fostering an active ecosystem of yield farming, staking, and other activities centered around the token.

When trading on PancakeSwap, users incur a fixed fee of 0.25% for each transaction. This fee applies to each swap made in the Exchange V2 liquidity pool. Of this fee, 0.17% is added back to the liquidity pool as trading fees. This redistribution rewards liquidity providers who contribute to the pool, ensuring its continuous funding. By incentivizing liquidity provision, Pancakeswap maintains a robust liquidity environment, facilitating smooth and efficient trading for its users.

- Pros

- Low transaction fees

- Wide range of tokens

- User-friendly interface

- Cons

- Limited interoperability

- User responsibility for security

2. Uniswap – Best for Decentralized Exchange on Ethereum Blockchain

Uniswap is a decentralized exchange (DEX) that has gained significant popularity in the world of cryptocurrencies. It was built to enable users to trade ERC-20 tokens directly on the Ethereum blockchain. However, it has now expanded to include Ethereum-compatible networks such as Optimism and Polygon, providing users with more options for trading.

One of the unique features of Uniswap is its decentralized governance model. Users govern the platform by holding UNI tokens, which grants them voting rights on proposed changes and updates to Uniswap. This approach gives the community a say in the platform’s development and ensures a more democratic decision-making process.

Uniswap’s primary function is to facilitate token swaps. Users can trade ERC-20 tokens directly on the platform without the need for intermediaries. This decentralized nature eliminates the need for traditional order books and allows users to swap tokens instantly, providing them with a seamless trading experience.

While Uniswap itself does not require KYC verification, it’s worth noting that if users choose to use Moonpay for token purchases on Uniswap, KYC verification may be necessary. Moonpay is a popular payment service integrated with Uniswap that enables users to buy tokens using fiat currencies. In such cases, Moonpay’s KYC requirements apply.

When using Uniswap, there is a fixed fee of 0.3% for each token swap. This fee is distributed among liquidity providers who contribute to the platform’s liquidity reserves. The distribution is proportional to their respective contributions, incentivizing liquidity providers to add tokens to the liquidity pools.

It’s important to mention that if users opt to purchase tokens through Moonpay, they will incur additional fees. For card purchases, the fee is 4.5%, while for bank transfers, it is 1%. There is also a minimum fee of $3.99 for Moonpay purchases, ensuring that smaller transactions are subject to a reasonable fee.

Uniswap’s decentralized and community-driven approach, combined with its user-friendly interface and support for various networks, has made it a go-to platform for decentralized token swaps within the cryptocurrency ecosystem. Its ability to provide instant liquidity and its commitment to decentralized governance make it a significant player in the world of decentralized finance (DeFi).

- Pros

- Low transaction fees

- User-friendly interface

- Liquidity

- User governance

- Cons

- Limited customer support

- Regulatory uncertainty

3. xExchange – Best for Multiple Revenue Streams

xExchange is a prominent platform for trading and engaging with decentralized finance (DeFi) that operates on the MultiversX Network. At the heart of xExchange is the MEX token, which serves as the platform’s native currency and empowers users within the ecosystem.

One notable feature of xExchange is its governance system, which enables the community to actively participate in shaping the platform’s future. Through xExchange Governance, users can propose xExchange Improvement Proposals (xEIPs) and vote on them. This democratic approach ensures that the platform evolves based on the consensus and input of its users.

For liquidity providers, xExchange offers various opportunities to earn yield. One avenue is through farming, where liquidity providers stake their LP tokens to generate additional rewards. These farms create income streams for participants, incentivizing them to contribute liquidity to the platform.

Metastaking is another innovative feature offered by xExchange. This mechanism allows liquidity providers to earn from three revenue streams simultaneously. By staking LP tokens, participants can earn trading fees, stake their tokens, and also benefit from their farm positions. This comprehensive approach maximizes the earning potential for liquidity providers.

When it comes to token swapping on xExchange, a 0.3% fee is applied. However, what sets xExchange apart is the distribution of this fee. Out of the 0.3% fee, 0.2% is allocated to liquidity providers in proportion to their contribution to the liquidity reserves. This encourages liquidity provision on the platform, as providers are rewarded for their role in maintaining the ecosystem’s liquidity.

- Pros

- Robust governance

- Multiple revenue streams

- Fair fee distribution

- Cons

- Relatively new platform

- Limited adoption

4. Trader Joe’s Crypto – Best for Fast Processing Time

Trader Joe is a decentralized exchange (DEX) operating on the Avalanche blockchain. It provides users with a range of services, including a launchpad, an NFT marketplace, an exchange, and staking and lending capabilities. As a decentralized platform, Trader Joe allows users to trade assets in a peer-to-peer manner without relying on intermediaries.

One notable feature of Trader Joe is its community governance system. Each JOE token held by a user represents one vote, allowing the community to actively participate in decision-making processes. This democratic approach empowers token holders to contribute to the platform’s future improvements and development.

Staking JOE tokens on Trader Joe allows users to earn staking rewards. This incentivizes token holders to lock their JOE tokens in the platform, contributing to its liquidity and stability. Additionally, Trader Joe incorporates the Compound Protocol for lending, enabling users to lend their assets and earn interest on their holdings.

Trader Joe’s Joepegs is the largest NFT marketplace on the Avalanche blockchain. NFTs, or non-fungible tokens, have gained significant popularity in the digital art and collectibles space. The Joepegs marketplace provides a platform for users to buy, sell, and trade NFTs, allowing artists and collectors to showcase their creations and engage with a vibrant community.

In terms of fees, Trader Joe charges a 0.3% trading fee. Out of this fee, 0.25% is distributed among liquidity providers based on their proportional contribution to the liquidity reserves. This incentivizes users to provide liquidity, ensuring ample liquidity for traders. The remaining 0.05% of the fee is allocated to the JOE token farm, further benefiting JOE token holders.

Trader Joe’s support for the BNB Chain and Arbitrum expands its compatibility and accessibility for users, offering them flexibility in choosing their preferred blockchain for trading and transactions.

- Pros

- Fast processing times

- NFT marketplace

- Staking rewards

- Community governance

- Cons

- Limited customer support

- Regulatory uncertainty

5. dYdX – Best for Free Trading

dYdX is a decentralized exchange (DEX) that operates on the Ethereum blockchain, offering users the ability to engage in perpetual trading. This platform is known for its support of perpetual trading with leverage of up to 20x. By leveraging smart contracts, dYdX provides users with a secure and transparent trading environment.

One notable feature of dYdX is its maker-taker fee model. When users place maker orders, these orders are not immediately filled but instead, rest on the order book. This adds depth and liquidity to the platform, benefiting other traders. On the other hand, taker orders are executed immediately, crossing existing maker orders. Taker orders remove liquidity from the order book, allowing users to quickly enter or exit positions.

To improve scalability and enhance the trading experience, dYdX has collaborated with StarkWare to develop a Layer 2 protocol for cross-margined perpetual. This Layer 2 solution aims to address the scalability limitations of the Ethereum network, allowing for faster and more cost-effective transactions while maintaining the security and decentralization of the blockchain.

In terms of fees, dYdX offers free trading on the first $100,000 of trading volume every month. This incentivizes users to actively participate in trading without incurring additional costs, especially for those who engage in smaller-scale trading activities.

dYdX’s focus on perpetual trading and leverage makes it an attractive platform for traders who seek to profit from price movements in the cryptocurrency market. The availability of leverage allows users to amplify their potential gains or losses, but it also increases the risk involved in trading. Traders should exercise caution and have a good understanding of the risks associated with leverage before engaging in trading on dYdX.

- Pros

- Free trading

- Perpetual trading

- Leverage options

- Scalability

- Cons

- Regulatory concerns

- Limited asset selection

6. Bisq – Best for Decentralized Bitcoin Exchange

Bisq, also known as Bisq Network, is a decentralized Bitcoin exchange network that operates on a fully peer-to-peer basis. It is built on the principles of privacy, security, and freedom. Bisq is open-source software released under version 3 of the GNU Affero General Public License, ensuring that it is free and libre for anyone to use and contribute to.

One of the key features of Bisq is its focus on security. To prevent fraud, trades on Bisq involve security deposits from both the buyer and the seller. The bitcoin for sale and the bitcoin security deposits are locked in a 2-of-2 multi-sig escrow, ensuring that both parties have a stake in the transaction. In the case of disputes, Bisq employs a decentralized human dispute resolution system, where arbitrators help resolve issues fairly and impartially.

Privacy is another core aspect of Bisq. Every Bisq application operates as a Tor hidden service, adding an extra layer of anonymity to the trading process. Unlike traditional exchanges, Bisq does not rely on central servers or databases to record data. The trade details are encrypted and readable only by the counterparties involved, ensuring that sensitive information remains confidential.

When it comes to fees, Bisq has a transparent and competitive fee structure. The combined BTC trading fee rate is 1.3%, with 0.15% charged by the maker and 1.15% by the taker. The absolute minimum fee to avoid dust is set at 0.00005 BTC. For the native BSQ token, the combined trading fee rate is targeted at 0.65%, with 0.075% charged by the maker and 0.575% by the taker. The minimum fee to avoid dust for BSQ is set at 0.03 BSQ.

- Pros

- Privacy and anonymity

- Open-source and community-driven

- Security

- Low transaction fees

- Cons

- Potential regulatory concerns

- Market availability of trading pairs and cryptos

- Dispute resolution process may take time

- Limited liquidity

What is Know Your Customer (KYC)?

Know Your Customer (KYC) refers to a process that financial institutions and businesses implement to verify the identity of their customers. It involves collecting and verifying certain personal information and documents from customers to ensure compliance with regulatory requirements and mitigate risks associated with fraud, money laundering, and other illicit activities.

The purpose of KYC is to establish the true identity of customers and assess their suitability to engage in financial transactions or access certain services. By implementing KYC procedures, organizations can enhance their due diligence efforts, promote transparency, and prevent the misuse of their products or services for illegal purposes.

KYC is crucial for several reasons. Firstly, it helps financial institutions and businesses comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations imposed by governmental authorities. By accurately identifying customers, organizations can detect and report suspicious activities, contributing to global efforts to combat financial crimes.

Secondly, KYC plays a significant role in customer protection and risk management. By verifying the identities of customers, organizations can reduce the risk of fraud, identity theft, and unauthorized access to sensitive information. This not only safeguards the organization but also protects the customers themselves from potential harm.

The application of KYC is prevalent across various industries. In the banking sector, for example, banks are required to perform KYC procedures when opening new accounts, conducting high-value transactions, or providing certain financial services. Similarly, investment firms, insurance companies, and cryptocurrency exchanges implement KYC to ensure compliance with regulations and safeguard their operations.

KYC is also utilized in non-financial sectors. Online platforms, such as e-commerce websites, social media platforms, and online marketplaces, may employ KYC measures to authenticate the identities of their users and maintain a secure environment for transactions.

Online casinos also implement such procedures, unless they are No KYC Casinos, in which case they may only require certain information in a sporadic manner if they have a good enough reason to request it.

What is a No KYC Crypto Exchange?

A no KYC crypto exchange is a platform that allows users to trade cryptocurrencies without the requirement of mandatory identity verification, commonly known as Know Your Customer (KYC) procedures. Unlike traditional exchanges or financial institutions, these platforms do not ask users to provide personal information or go through the process of verifying their identities.

A no KYC crypto exchange is a platform that allows users to trade cryptocurrencies without the requirement of mandatory identity verification, commonly known as Know Your Customer (KYC) procedures. Unlike traditional exchanges or financial institutions, these platforms do not ask users to provide personal information or go through the process of verifying their identities.

The primary benefit of using a no KYC crypto exchange is the preservation of privacy. Users can trade cryptocurrencies without disclosing their details, such as their name, address, or identification documents. This can be particularly appealing to individuals who value anonymity and wish to maintain confidentiality in their financial transactions.

Another advantage is the convenience and speed of transactions. By eliminating the KYC process, users can quickly create accounts and start trading without having to go through lengthy identity verification procedures. This allows for faster access to the cryptocurrency markets, enabling users to take advantage of time-sensitive opportunities.

However, it is essential to consider the drawbacks of using a no KYC crypto exchange. The absence of identity verification raises concerns regarding the platform’s security and regulatory compliance. Without KYC procedures, it becomes easier for bad actors to engage in illicit activities, such as money laundering or terrorist financing, as their identities remain undisclosed.

Additionally, the lack of KYC can also pose risks to users themselves. In case of any security breaches or fraudulent activities on the exchange, it may be challenging to trace and recover funds without proper identity verification measures in place. Users should exercise caution and conduct thorough research to ensure the reputation and credibility of a no KYC crypto exchange before using it.

We’ve reviewed some popular examples of no KYC crypto exchanges already, with the features that make them stand out. It is important to note that while no KYC crypto exchanges provide privacy and convenience, users should be aware of the associated risks and exercise due diligence when choosing a platform.

Pros & Cons

Offering a balanced perspective, using a no KYC crypto exchange can provide privacy, faster onboarding, and accessibility to cryptocurrency markets.

Pros of using a no KYC crypto exchange:

Pros of using a no KYC crypto exchange:

- Privacy: One of the main advantages is the preservation of privacy. Users can trade cryptocurrencies without disclosing their personal information, providing a higher level of anonymity compared to exchanges with KYC requirements.

- Faster Onboarding: No KYC crypto exchanges typically have a simplified registration process, allowing users to quickly create accounts and start trading without the need for time-consuming identity verification procedures. This enables faster access to the cryptocurrency markets.

- Accessibility: No KYC exchanges often have fewer geographic restrictions, making them accessible to users from various regions. This can be beneficial for individuals in countries with limited access to traditional financial services or strict KYC requirements.

Cons of using a no KYC crypto exchange:

Cons of using a no KYC crypto exchange:

- Increased Risks of Fraud: The absence of identity verification can attract bad actors who may engage in fraudulent activities, such as money laundering or scams. Users should exercise caution and conduct thorough research to ensure the credibility and security of the chosen no KYC exchange.

- Limited Customer Support: Some no KYC exchanges may have limited customer support due to the decentralized nature of the platforms. Users may face challenges in receiving prompt assistance or resolving issues compared to exchanges with dedicated customer support teams.

- Potential Regulatory Concerns: No KYC exchanges may operate in a regulatory gray area. Depending on the jurisdiction, there may be uncertainties or risks associated with the legality and compliance of these platforms. Users should be aware of the potential regulatory implications and consider the legality of engaging in cryptocurrency trading without KYC.

- Pros

- Privacy

- Faster Onboarding

- Accessibility

- Cons

- Increased Risks of Fraud

- Limited Customer Support

- Potential Regulatory Concerns

What are the Reasons to Avoid KYC?

Privacy Concerns

One significant reason individuals may choose to avoid KYC (Know Your Customer) procedures is to protect their privacy. KYC requires the submission of personal information such as name, address, identification documents, and sometimes even financial details. This data can be vulnerable to security breaches or unauthorized access, increasing the risk of identity theft, hacking, or misuse of personal information. By avoiding KYC, individuals can maintain a higher level of control over their data and minimize the chances of their information falling into the wrong hands.

Anonymity

KYC processes often require individuals to reveal their identities, which contradicts the principles of anonymity that cryptocurrencies were designed to uphold. For users who prioritize privacy, avoiding KYC allows them to transact with cryptocurrencies without linking their real-world identities to their digital assets. This can be particularly appealing for those who wish to separate their financial activities from their personal lives or political and social associations.

Time and Effort

Undergoing the KYC process can be time-consuming and cumbersome. It typically involves submitting various documents, completing forms, and waiting for verification. For individuals who value convenience and efficiency, avoiding KYC can be an attractive option. By using platforms that don’t require KYC, users can skip the lengthy onboarding procedures and gain immediate access to cryptocurrency services, enabling faster transactions and seizing time-sensitive opportunities.

Security Concerns

While KYC is often seen as a security measure, it can also introduce risks. The storage of personal information by centralized platforms poses the potential for data breaches. Additionally, the requirement to share sensitive documents online may make users vulnerable to phishing attacks or identity fraud. By avoiding KYC, individuals can minimize their exposure to such risks and maintain greater control over the security of their personal information.

Limited Access

Some individuals may find themselves restricted from using financial services or cryptocurrency platforms due to KYC requirements. This can be the case for people living in countries with restrictive regulations or lacking proper identification documents. No KYC platforms provide an alternative for these individuals, allowing them to access and participate in cryptocurrency ecosystems and associated financial services, thereby promoting financial inclusivity.

Regulation and Compliance

The regulatory landscape surrounding no KYC crypto exchanges is dynamic and varies across jurisdictions. While these platforms offer privacy and anonymity, they must still navigate legal requirements and guidelines to ensure compliance. Understanding the regulatory landscape and implementing best practices is crucial for the sustainable operation of no KYC crypto exchanges.

In many countries, financial regulators have increased their focus on cryptocurrencies and digital asset exchanges. Some jurisdictions have implemented specific regulations that govern cryptocurrency-related activities, including KYC and anti-money laundering (AML) measures. No KYC exchanges need to be aware of these requirements and assess whether they can operate within the legal framework.

Challenges and risks arise for no KYC crypto exchanges when it comes to compliance with regulations. Firstly, they may encounter difficulties in identifying and preventing illicit activities, such as money laundering and terrorist financing. The absence of KYC procedures can make it harder to detect and report suspicious transactions, increasing the risk of regulatory non-compliance.

Additionally, no KYC exchanges may face reputational risks due to the perception that they facilitate illegal activities. This can result in regulatory scrutiny and potential sanctions. Therefore, these platforms need to develop robust internal compliance programs and risk management frameworks to mitigate such risks.

To ensure regulatory compliance while maintaining the privacy-focused nature of a no KYC crypto exchange, the following best practices and strategies can be employed:

- Implement a Risk-Based Approach: Adopt a risk-based approach to identify and mitigate potential risks associated with money laundering, fraud, and other illicit activities. Develop comprehensive AML and counter-terrorism financing (CTF) policies and procedures tailored to the specific risk profile of the exchange.

- Monitor and Report Suspicious Activities: Implement robust transaction monitoring systems to identify suspicious patterns and behaviors. Establish procedures for reporting suspicious transactions to relevant authorities as required by applicable regulations.

- Cooperate with Regulatory Authorities: Foster a cooperative relationship with regulatory authorities by engaging in open dialogue and staying informed about evolving regulatory requirements. Proactively seek guidance and clarification to ensure compliance with local laws.

- Enhance Security Measures: Implement stringent security protocols and measures to safeguard user funds and data. This includes employing strong encryption, multi-factor authentication, cold storage for cryptocurrencies, and regular security audits.

- Transparent Communication: Maintain clear and transparent communication with users by disclosing the platform’s privacy policies, terms of service, and any limitations or risks associated with using a no KYC exchange. Educate users about the importance of complying with local regulations and promote responsible cryptocurrency usage.

- Stay Abreast of Regulatory Changes: Continuously monitor and stay updated on regulatory developments in relevant jurisdictions. Adapt policies and procedures accordingly to ensure ongoing compliance with evolving regulatory requirements.

Security and Privacy Considerations

Ensuring robust security measures and protecting user privacy is of utmost importance in a no KYC crypto exchange environment. Users entrust these platforms with their funds and personal information, necessitating the implementation of effective security practices and privacy-enhancing technologies.

To safeguard user funds and personal information, no KYC crypto exchanges should prioritize the following security measures:

- Strong Encryption: Utilize robust encryption techniques to protect user data and communication channels. This includes encrypting sensitive user information, such as account credentials and private keys, to prevent unauthorized access.

- Multi-Factor Authentication (MFA): Implement MFA to provide an additional layer of security. This authentication method requires users to provide multiple pieces of evidence, such as a password, SMS code, or fingerprint, to access their accounts, reducing the risk of unauthorized access.

- Cold Storage: Employ cold storage solutions for storing the majority of user funds. Cold storage keeps cryptocurrencies offline, making them less susceptible to hacking attempts or theft. By keeping only a portion of the funds in hot wallets for immediate trading purposes, the overall security of user funds is enhanced.

- Regular Security Audits: Conduct periodic security audits by third-party professionals to identify and address potential vulnerabilities. These audits help ensure that the platform’s infrastructure, codebase, and security protocols are up-to-date and resilient against emerging threats.

In terms of privacy, no KYC crypto exchanges can employ various techniques and practices:

In terms of privacy, no KYC crypto exchanges can employ various techniques and practices:

- Privacy-Enhancing Cryptocurrencies: Explore privacy-focused cryptocurrencies that offer built-in privacy features, such as Monero (XMR) or Zcash (ZEC). These cryptocurrencies utilize advanced cryptographic techniques to enhance transaction privacy, making it harder to trace funds and link them to real-world identities.

- Privacy-Preserving Protocols: Implement privacy-enhancing protocols, such as zero-knowledge proofs or ring signatures, that obfuscate transaction details and protect user privacy without compromising the integrity of the underlying blockchain.

- Transparent Privacy Policies: Communicate the platform’s privacy policies to users, outlining how their personal information is collected, stored, and used. This includes providing transparency regarding data-sharing practices and adhering to data protection regulations.

To assess the security and privacy features of a no KYC crypto exchange, users should consider the following:

- Reputation and Track Record: Research the platform’s reputation and track record within the cryptocurrency community. Look for user reviews, feedback, and any reported security incidents or breaches.

- Security Practices: Evaluate the platform’s security practices, including encryption standards, use of cold storage, and regular security audits. Look for indicators of a robust security framework to ensure the protection of user funds.

- Privacy Policies and Transparency: Review the platform’s privacy policies to understand how user data is handled. Look for transparency regarding data collection, storage, and sharing practices. Ensure that the platform aligns with your privacy expectations.

- Community Engagement: Assess the platform’s engagement with the cryptocurrency community. Active participation, open communication, and responsiveness to user concerns indicate a commitment to security and privacy.

How do No KYC Crypto Exchanges Work?

No KYC crypto exchanges operate on the principle of allowing users to transact cryptocurrencies without the need for mandatory Know Your Customer (KYC) verification. These platforms prioritize privacy and user autonomy, providing an alternative to traditional exchanges that require extensive identity verification.

The general process of using a no KYC crypto exchange involves the following steps:

- Account Setup: Users start by creating an account on the platform. Typically, this involves providing an email address or creating a username and password. Some platforms may require additional information, such as a phone number, for security purposes.

- Depositing Cryptocurrencies: To begin trading, users need to deposit cryptocurrencies into their exchange wallet. They generate a unique deposit address for each supported cryptocurrency. Users can transfer their funds from external wallets or other exchanges to the provided address.

- Trading Cryptocurrencies: Once the funds are deposited, users can start trading cryptocurrencies on the platform. No KYC exchanges offer a variety of trading pairs and order types, enabling users to buy, sell, and exchange different cryptocurrencies based on market conditions and their investment strategies.

- Privacy Mechanisms: No KYC crypto exchanges employ different mechanisms to allow users to transact without undergoing KYC verification. This may include utilizing decentralized platforms that operate on blockchain technology, leveraging privacy-focused protocols, or utilizing anonymous accounts that don’t require personal identification.

- Case Studies: To illustrate the effective utilization of no KYC crypto exchanges, let’s consider two examples. In one case, Alice wants to exchange her Bitcoin for Ethereum. She registers on a no KYC exchange, deposits her Bitcoin into the provided wallet address, and then proceeds to execute a trade to convert it into Ethereum. In another case, Bob values privacy and wants to trade cryptocurrencies without revealing his identity. He joins a privacy-focused decentralized exchange, where he can transact anonymously and enjoy enhanced privacy features.

How to Proceed with Withdrawals and Deposits?

Making deposits and withdrawals on a crypto exchange involves specific steps and considerations. Here’s a guide on how to proceed:

- Wallet Selection: Before depositing funds, users must choose a compatible wallet for the cryptocurrencies they wish to deposit. Different cryptocurrencies may require different wallet types, such as software wallets, hardware wallets, or online wallets. It is important to select a wallet that offers a balance between security and accessibility.

- Providing Necessary Information: When making a deposit, users need to provide the exchange’s deposit address associated with their account. They can find this address within the exchange’s interface or by accessing their account settings. To ensure accuracy, users should copy and paste the address rather than manually typing it.

- Transaction Fees and Processing Times: Users should be aware of any transaction fees associated with deposits and withdrawals on the exchange. These fees can vary depending on the cryptocurrency and network congestion. It is advisable to check the exchange’s fee schedule and ensure that the chosen cryptocurrency’s network is not experiencing high congestion, which could result in longer processing times.

- Security Measures: Users should prioritize security when conducting deposits and withdrawals. This includes enabling two-factor authentication (2FA) on their exchange account, utilizing strong and unique passwords, and regularly updating their software and wallets to the latest versions. Additionally, users should be cautious of phishing attempts and ensure they are accessing the official exchange website or application.

By following these steps and considering important factors such as transaction fees, processing times, and security measures, users can navigate deposits and withdrawals on a crypto exchange with confidence. It is advisable to refer to the exchange’s support documentation or reach out to customer support for any specific instructions or best practices related to the platform they are using.

Key Factors for Finding the Best No KYC Crypto Exchanges

When searching for the best no KYC crypto exchanges, several key factors should be considered to ensure a reliable and user-friendly experience. These factors include:

Reliability

Look for exchanges with a proven track record of reliability and trustworthiness. Consider factors such as the exchange’s longevity, user reviews, and overall reputation within the crypto community.

User Experience

A user-friendly interface and intuitive navigation are essential for a smooth trading experience. Look for exchanges that offer a seamless and responsive platform, making it easy to execute trades and access account information.

Payout Frequency

Different exchanges have varying payout frequencies. Some offer instant or frequent withdrawals, while others have specific payout thresholds or time frames. Consider your preferences and trading strategy to choose an exchange that aligns with your needs.

Faucet Reputation

Assess the reputation of the exchange’s faucet, if applicable. Look for faucets that have a history of reliable payouts and a transparent distribution system. User feedback and reviews can provide insights into the faucet’s performance.

Security Measures

Prioritize exchanges that implement robust security measures to protect user funds and personal information. Features such as two-factor authentication (2FA), cold storage of funds, and encryption protocols can enhance the security of your assets.

Earning Opportunities

Some no KYC crypto exchanges offer additional earning opportunities beyond trading. These may include staking, lending, or participating in decentralized finance (DeFi) protocols. Consider the available earning opportunities and whether they align with your investment goals.

No KYC Crypto Exchange Vs. Traditional Exchanges

No KYC crypto exchanges and traditional exchanges differ in several important aspects. Understanding these differences can help you decide which type of exchange suits your needs best:

No KYC crypto exchanges and traditional exchanges differ in several important aspects. Understanding these differences can help you decide which type of exchange suits your needs best:

- User Privacy: No KYC crypto exchanges prioritize user privacy by not requiring extensive identity verification. Traditional exchanges, on the other hand, often mandate KYC procedures, which involve submitting personal information. If privacy is a priority, a no KYC exchange may be preferable.

- Verification Requirements: Traditional exchanges require users to go through a verification process, submitting identification documents and proof of address. No KYC exchanges allow users to trade without undergoing this verification, enabling quick onboarding and immediate access to cryptocurrency markets.

- Transaction Limits: Traditional exchanges may impose transaction limits based on the level of verification completed. No KYC exchanges often have higher transaction limits or no limits at all, allowing users to trade larger volumes without constraints.

- Ease of Use: No KYC exchanges typically have a simplified account setup process, making them more accessible to beginners. Traditional exchanges may have more complex interfaces and trading features, catering to advanced traders with diverse needs.

- Regulatory Compliance: Traditional exchanges operate within the regulatory frameworks of the jurisdictions they are based in, ensuring compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations. No KYC exchanges may have different regulatory considerations and may operate in jurisdictions with more relaxed regulations.

Expert Conclusion

No KYC crypto exchanges have benefits and drawbacks. Advantages include enhanced privacy, faster onboarding, and accessibility. However, using them may increase the risk of fraud, limit customer support, and raise regulatory concerns. Users should weigh the pros and cons, considering privacy, security, compliance, and available features. Thorough research is crucial to understand the risks involved. Staying informed about regulations is important. Users must make informed decisions based on their preferences and requirements when using no KYC crypto exchanges.

Is there a crypto exchange without KYC?

Is there a crypto exchange without KYC?

Yes, there are crypto exchanges that operate without mandatory KYC verification.

What is the safest crypto exchange without KYC?

What is the safest crypto exchange without KYC?

Determining this depends on various factors, including security measures, reputation, and user reviews. It is recommended to research and compare different exchanges to assess their security practices and choose a reputable platform.

Can I buy crypto with no KYC?

Can I buy crypto with no KYC?

Yes, you can buy cryptocurrencies on no KYC exchanges without undergoing the traditional KYC verification process.

Facts Checked by Josip Putarek, Senior Author